Are VA Loans Assumable? A Guide to VA Loan Assumption

KEY TAKEAWAYS

- An assumable loan can be transferred to another borrower.

- VA loans are assumable by those who have VA benefits as well as civilians.

- Assuming a VA loan can allow the borrower to enjoy savings and more flexibility in their mortgage.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformVA loans can be assumed by other buyers, including civilians. This guide explains how VA loan assumption works, who is eligible, and the steps to assume a VA loan. Whether you’re a veteran or a potential buyer, you’ll find the information you need about assumable VA loans.

A VA loan, or a Veterans Affairs loan, is a loan that is guaranteed by the US Department of Veterans Affairs for those who have or are currently serving in the US military.

In the past, VA loans were only available to those who had served in the military, making them non-assumable by any other purchaser or borrower. However, the flexibility of VA loans has expanded, now making loans from the Veterans Affairs office assumable by others who meet broader specifications.

Keep reading to find out whether you can assume a VA loan.

What Is an Assumable Loan?

An assumable VA loan means that the loan itself can be transferred to another buyer or purchaser, even if that borrower is not originally qualified for a VA loan themselves.

Whenever someone is qualified for a VA loan, they are typically required to maintain that loan over an extended period of time. With a VA assumable loan, individuals are able to take over the existing terms of a VA loan, including rates and the overall nature of the loan itself.

Are VA Loans Assumable?

Yes, VA loans are assumable by qualified buyers. However, buyers must still meet minimum requirements set by the lender and the VA to qualify.

It’s important to keep in mind that borrowers who are interested in assuming a loan from those in the military do not require any military experience or service themselves.

Who Can Assume a VA Loan?

Anyone who successfully meets lender criteria — whether or not they’re a veteran — is eligible to assume a VA loan.

Before you apply for a VA loan, keep in mind that the original borrower of a VA loan will need to confirm their military service and commitment. However, those who are interested in assuming a VA loan do not require any particular military experience in order to qualify.

In fact, those who are interested in assuming a VA loan will typically only need to provide their financial documentation and prove their ability to pay back the loan based on the individual lender’s qualifications. They won’t have to jump through many of the hoops associated with non-assumable loans, like getting VA loan pre-approval. This works out in favor of those who wish to eliminate their VA loans as well as buyers who are seeking top-notch interest rates that are locked in.

What are the requirements to assume a VA loan?

Again, you don’t need to be a veteran or get a VA loan to assume one. Anyone can assume a VA loan. However, you’ll need to meet the lender’s VA loan requirements for assumption, which typically include:

- Credit score: Typically, lenders like to see a credit score of at least 620 when you assume a VA loan.

- Income stability: You must prove to the lender that you have a steady income to be able to afford the mortgage payments.

- Debt-to-income ratio: Your DTI should generally be 41% or lower.

- Property appraisal: The VA will appraise the property to make sure it still meets their standards.

- Cash reserves: You may need to show that you have enough money to cover a few months of mortgage payments.

- Assumption approval: Both the current lender and the VA must approve the loan assumption.

Remember, while military service isn’t required to assume a VA loan, meeting these financial and property-related criteria is crucial for approval. Wondering if you might be able to assume a VA loan? Try our VA loan calculator to see what your monthly payments will be or use our VA loan affordability calculator to estimate how much house you can afford.

Is Assuming a VA Loan a Good Idea?

It depends on your particular circumstances. Whether you should assume a VA loan is a highly personal decision, but we’ve outlined some of the pros and cons to consider before doing so.

Pros of Assuming a VA Loan

Some of the most notable pros of an assumable VA loan include:

- Assumption flexibility: One of the most appealing aspects of a VA loan that is assumable is that it can be assumed by someone who does not have military experience or is a veteran. This means as long as an individual qualifies financially, they are typically capable of assuming a VA loan in most situations.

- Save on closing costs: In many cases where a VA loan is present, it is possible for the borrower or individual who is assuming the loan to receive appraisals for free. Additionally, buyers who are assuming VA loans also have the ability to save potentially thousands of dollars on closing costs, as these are also often covered. Who pays fees will usually be determined between the buyer and the seller, you may still have to pay certain fees including lender’s fees.

- Gain access to VA benefits: Whenever a seller relinquishes their VA loan to another buyer, the new buyer assumes all of the VA loan benefits, even if they are not active military or veterans themselves.

- Lowered funding fee: Most VA loans have a lower funding fee if they are assumption loans over traditional VA loans. At 0.5% of the loan amount, this makes VA assumable loans extremely appealing.

- Inherited interest rates: One reason so many flock to assume a VA loan is their ability to inherit set interest rates. If an interest rate is low and locked in with a VA loan, it is much easier for the new buyer/borrower to assume the same loan interest rates and terms and conditions without a hassle. This is often a much better deal than seeking out a traditional mortgage.

Cons of Assuming a VA Loan

A few potential drawbacks of an assumable VA loan include:

- Not required to approve: Although you may have found yourself the best deal possible on the market, lenders are not required to approve any or all assumption loans. In some cases, you may need to seek out a lender who is open to working with you and willing to approve a VA loan, so long as you are qualified otherwise.

- Lending requirements still exist: While the lending options are often more flexible when it comes to assuming a VA loan, it’s important to recognize that lending requirements still exist. Whenever you are thinking of investing in a new home or property that is available with an assumable VA loan, keep in mind that you will need to meet the income and credit requirements in place in order to qualify for the loan itself.

- Lengthy process: While you may have the ability to place a down payment on a home and move in as quickly as a few weeks, a VA assumable loan may require a bit more time. In some cases, the loan must also be approved by the VA office itself, which can require weeks or up to months to complete. If you’re working with a lender who has not previously handled assumable VA loans, this can further complicate the process.

For sellers, it’s important to note that the VA entitlement in use remains with the property unless another VA-qualified buyer takes over the loan. This is non-negotiable and cannot be removed or remedied at a later time. You’ll need to decide whether it’s worthwhile to lose out on this portion of your benefits.

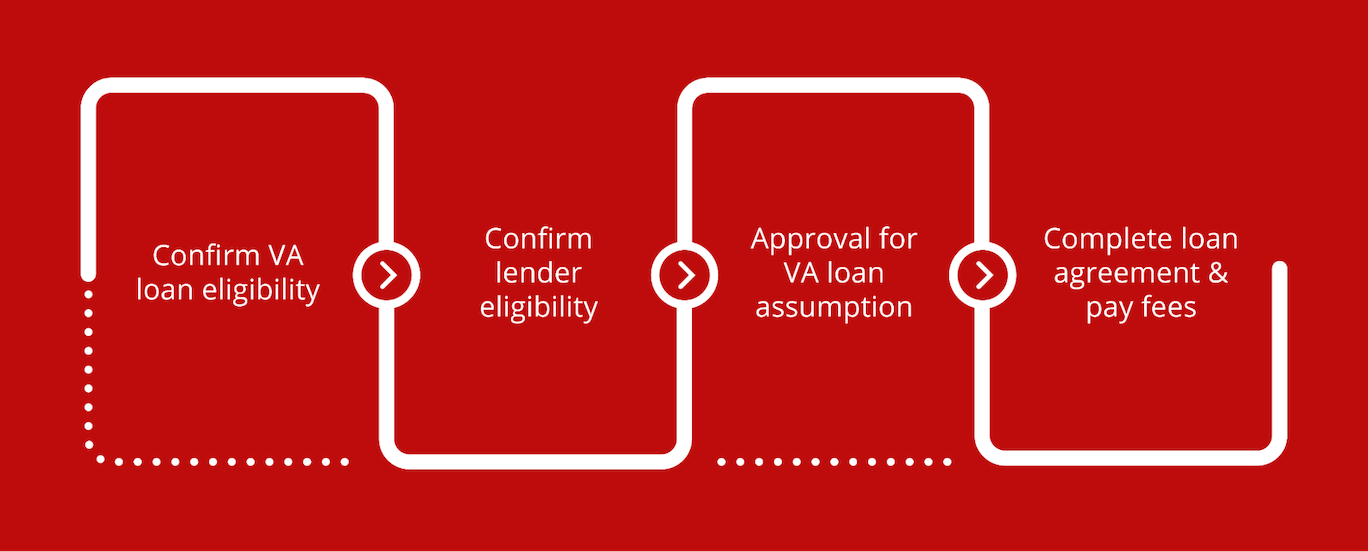

How to Assume a VA Loan: Step-by-Step

Whether you’re a veteran or civilian, the process requires you to work with the current VA loan lender to assume the loan. Here’s typically how that process works:

- Determine your eligibility: Verify if you meet the financial and residency requirements for assuming a VA loan.

- Find an assumable VA loan: Locate a property with an existing VA loan that the current owner is willing to transfer.

- Contact the current lender: Reach out to the lender servicing the existing VA loan to express your interest in assuming it.

- Submit an application: Complete and submit the required paperwork, including financial documentation.

- Undergo credit and income verification: The lender will review your credit history and income to ensure you qualify.

- Get VA approval: If you’re not a veteran, the VA must approve the loan assumption.

- Obtain a property appraisal: Ensure the property meets VA standards and is valued appropriately.

- Review and sign assumption documents: Carefully review and sign all necessary paperwork to complete the process.

- Finalize the assumption: Once approved, take over the responsibility for the loan payments and officially become the new borrower.

Our VA Loan Experts Can Help

At Griffin Funding, we are VA loan experts and are able to walk you through the process of assuming a VA loan so it’s as efficient as possible. We have a streamlined qualification and approval process that will make assuming a VA loan a pleasant experience.

Whether you’re interested in a VA purchase loan, a VA streamline refinance, or a VA cash-out refinance, we can help. Get started online today or contact us today at 855-698-1230 to speak with one of our loan specialists today. We are proud to serve military members and look forward to helping you purchase your home.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Are VA loans assumable by non-veterans?

Can an ex partner assume a VA loan?

How old do you need to be to assume a VA loan?

Is entitlement always forfeited with a VA loan assumption?

How long does it take to assume a VA loan?

The VA loan timeline for assuming these loans has significantly improved in recent years. While the process could take several months in the past, it's now much quicker. The VA has recently mandated that lenders and servicers must process VA loan assumptions within a 45-day timeline to remain in compliance. This new requirement aims to streamline the assumption process and reduce waiting times for borrowers.

How can I find a VA loan to assume?

In some cases, sellers may promote the VA loan assumption opportunity directly through real estate listings, social platforms, or local community networks, especially in areas with a strong military presence. If you're serious about pursuing a VA loan assumption, it's important to ask the right questions early in the process and request details about the existing loan terms.

Once you find a potential opportunity, the loan servicer must approve the assumption, and you'll need to meet the lender’s eligibility requirements.

How much does it cost to assume a VA loan?

- Assumption processing fee: The VA loan assumption processing fee—paid to the lender to cover some administrative costs associated with transferring the mortgage—is usually capped at $300.

- VA funding fee: A one-time funding fee of 0.5% of the loan balance, unless the buyer qualifies for a VA funding fee exemption.

- Title and escrow fees: Standard closing costs for title insurance, escrow services, and document preparation.

- Recording fees: Charged by the local government to officially record the change in ownership and loan responsibility.

- Escrow account deposits: Funds to establish or replenish the escrow account for property taxes and homeowners insurance.

Recent Posts

How to Get the Lowest Mortgage Rate: 7 Strategies

How Mortgage Rates Are Set Before we teach you how to get the lowest mortgage rate, it helps to understand wha...

What Is an Escalation Clause in Real Estate?

A real estate escalation clause is an addendum to a purchase offer that authorizes your bid to increase automa...

Mid-Term Rentals: Guide for Real Estate Investors

Mid-term rentals are furnished properties leased for 30 days to 12 months, targeting traveling professionals, ...