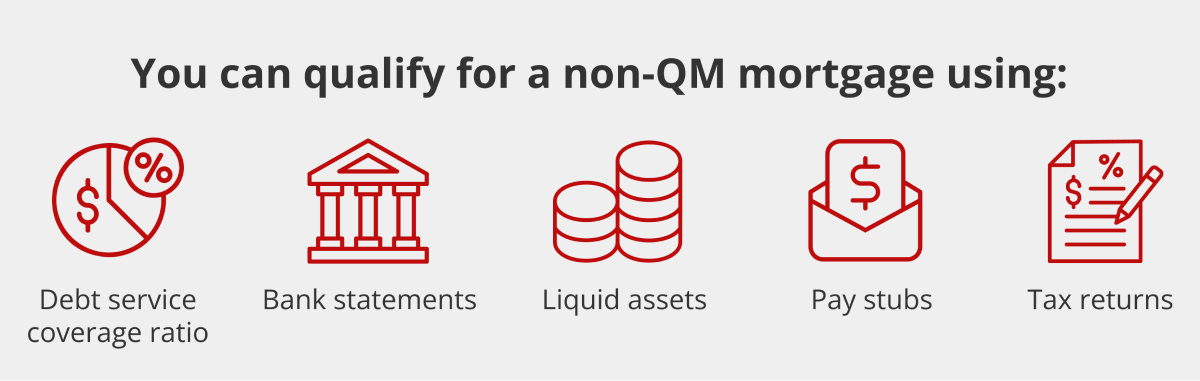

Griffin Funding offers a diverse range of Non-QM mortgage products that allow you to qualify using better representations of your reliability as a borrower. Such representations may include bank statements, rental income, your liquid assets, or your credit history.

Whether you are a new or experienced real estate investor or a hopeful first-time homebuyer, Non-QM mortgage products can help you finance your purchase, without having to jump through unnecessary hoops.

Non-QM Mortgage Products

What Is a Non-QM Loan?

A Non-QM loan, or a non-qualified mortgage, is a type of mortgage loan that allows you to qualify based on alternative methods, instead of the traditional income verification required for most loans. Common examples include bank statements or using your assets as income. Because of the more flexible qualification requirements, Non-QM loans open up real estate investment opportunities to a broader group of individuals.

Non-QM vs. Qualified Mortgage

Non-QM loans are an alternative to qualified mortgage (QM) loans. More specifically, a Non-QM loan is one that is not required to meet the federal government and Consumer Financial Protection Bureau’s (CFPB) guidelines for qualified mortgages.

Qualified Mortgage Requirements

The CFPB has established a set of rules for QM loans to provide more stable borrowing requirements. These are meant to protect borrowers from entering loan agreements that they cannot afford to repay. These stricter regulations were established in 2014 in response to the Great Recession that lasted from 2007 to 2009, during which many borrowers defaulted on their subprime mortgages and were forced into foreclosure. This not only had a long-lasting effect on the economy but damaged many individuals’ credit.

Highlights of Updated QM Requirements

Some of the key takeaways of the updates made to QM requirements are:

- Points and fees that are 3% or less than the total loan amount

- Maximum loan terms of 30 years or less

- No negative amortization, interest-only, or balloon loans

These restrictive requirements have made it more difficult to qualify for a mortgage. If you do not meet the conditions required to prove your ability to repay, you will likely miss out on the investment opportunity or house of your dreams.

Since many first-time borrowers are only aware of QM loans, it can seem like investing or becoming a first-time buyer is an impossible feat. However, that isn’t the case. Non-QM loans are a credible and viable option for many borrowers.

Pros and Cons of Non-QM Loans

Pros |

|---|

Flexible underwriting Flexible underwriting |

No personal income required No personal income required |

Job history isn’t always required Job history isn’t always required |

Qualify with as little as 10% down Qualify with as little as 10% down |

No reserves required (in some cases) No reserves required (in some cases) |

Credit scores as low as 580 considered Credit scores as low as 580 considered |

Low or negative DSCR can be considered Low or negative DSCR can be considered |

Cons |

|---|

Less safeguards in place for borrowers Less safeguards in place for borrowers |

Potential for higher interest rates Potential for higher interest rates |

Higher down payment requirements Higher down payment requirements |

Not offered by every lender Not offered by every lender |

|

|

|

Benefits & Risks of Non-QM Loans

While Non-QM mortgage are not held to these same restrictions, it does not mean that borrowers are putting themselves in an, especially risky position. There are checks and balances in place to protect both the buyer and the lender.

As with any loan, there are both Non-QM lending opportunities and risks.

Non-QM Mortgage Benefits

Non-QM loans are favorable to borrowers for many reasons, including:

- Greater underwriting flexibility

- No personal income calculations are required

- No job history is required (in some cases)

- As little as 10% down required

- No reserves required (in some cases)

- Credit scores as low as 620 allowed (580 w/ compensating factors)

- Low debt-service-coverage ratio (DSCR) on investment properties

- Counting rental income (including Airbnb & VRBO)

For many potential homeowners and real estate investors, Non-QM loans are the only way to make investment opportunities plausible. As you well know, real estate opportunities don’t always linger on the market for long. A Non-QM mortgage can make it possible to make a timely purchase.

Non-QM Mortgage Risks

The primary risk of a Non-QM mortgage is not being able to pay back the loan should your financial circumstances drastically change. This is particularly of concern if there is another economic recession. However, defaulting on any loan is always a risk.

However, by maintaining reasonable lending standards while preserving flexibility, Non-QM loans offer a middle ground for borrowers who would otherwise have no options or be saddled with unreasonably high-interest rates that drastically increase the expense of the loan.

Types of Non-QM Mortgage Products We Offer

To meet the needs of diverse borrowers, we offer a broad spectrum of Non-QM loan products:

Non-QM Mortgage Products We Offer

Bank Statement Loans

Only bank statements are required for this type of Non-QM loan. Borrowers can qualify with as little as twelve month’s bank statements. This loan is often a good solution for self-employed borrowers, business owners, realtors, consultants, and entrepreneurs. P&L loans are also an option for certain borrowers.

Jumbo Loans with 10% Down

While traditional jumbo loans still often require 20% down, we offer near-miss jumbo loans up to $3 million with as little as 10% down, up to a 55% debt-to-income ratio, and credit scores as low as 660. Jumbo loans with 10% down are often the ideal solution for first-time buyers who might still have large student loans and other types of “good credit debt”. 10% down jumbo loans are also good for high-income earners who are looking to invest their cash in other assets.

No Income Investment Loans

Private and hard money loans often have high rates and take a while to get approved for, which is not ideal for most real estate investors. Alternatively, both new and experienced real estate investors can benefit from the expanded criteria offered by no-income investment loans which allow you to build your real estate portfolio with fewer setbacks. The Debt-Service-Coverage-Ratio loan uses the rental income of the property to qualify and does not take into account your personal income.

Asset-Based Loans

Asset-based loans allow you to leverage assets you already have, including checking and savings accounts, investment accounts, or money market accounts, to secure a loan. This type of Non-QM mortgage is ideal for individuals with substantial liquid assets available. Although asset-based loans are typically associated with high-interest rates, we have access to wholesale rates and favorable borrowing terms. Griffin Funding does not require you to pledge your assets.

Foreign National Loans (ITIN)

If you do not have a valid Social Security number, U.S. FICO score, or Individual Tax Identification Number (ITIN) you can still qualify for this type of Non-QM loan. To qualify, you will need to provide a VISA or VISA waiver as well as three active and open trade lines with a two-year history.

Interest-Only Home Loans

We offer interest-only home loans on 40-year fixed loans, 30-year fixed loans, 7/1 arms, and 5/1 arms. During the first 10 years of the loan, you will only pay the interest. This provides significant savings over the life of the loan. However, it’s important to keep in mind that you will not be paying down the principal balance during the interest-only period.

Recent Credit Event Loans

Recent credit events can make it challenging to secure a loan because many lenders view them as a red flag. However, we offer loan programs for borrowers with recent credit events including foreclosure, short sale, and bankruptcy. While we do offer options for as little as one day out from the credit event, loan terms typically improve the longer it has been, even in just a year or two.

Commercial Rental Property Loans

We offer a variety of loans specifically tailored to the needs of real estate investors who want to expand their portfolio to include single-family homes, 2 to 4 unit properties, condos, townhomes, multi-use, and multi-family 5 to 20 unit properties. Our loans are designed to make the process easier for buy-and-hold investors.

Read more about each of these mortgage products or review your circumstances with a loan specialist to determine which type of loan will work best for your needs. We provide Non-QM mortgage loans to borrowers in Arizona, California, Colorado, Connecticut, Florida, Georgia, Hawaii, Idaho, Illinois, Maine, Maryland, Michigan, Montana, Nevada, New Mexico, New Hampshire, North Carolina, Ohio, Oregon, South Carolina, Tennessee, Texas, Virginia, and Washington.

Who Should Consider a Non-QM Mortgage?

Purchasing property is already a complex and often drawn-out process. If you’re then ineligible for a traditional mortgage, the situation quickly becomes frustrating. However, QM loans are not your only option.

If you have been denied for a traditional QM loan, a Non-QM loan may be your next step. You might also want to consider a Non-QM loan if you have good reason to believe you will not qualify for a QM loan solely based on your credit, income, or other factors. For those who are still unsure whether this might be the right financing solution, let’s further break down the most common types of Non-QM loan borrowers.

Non-QM mortgages are typically recommended for:

- Self-employed individuals

- Real estate investors

- Retirees interested in purchasing a second home that will not be their primary residence

- Small to midsize business owners

- Borrowers looking for interest-only payments or more flexible DSCR requirements

- “Subprime” or “Non-Prime” borrowers who just barely miss the requirements for a QM loan and don’t want to postpone

- Those who have had a recent credit event (bankruptcy, short sale, or foreclosure)

If you fall into one of these categories, you should consult one of our knowledgeable loan officers who can help you determine if a Non-QM mortgage is the right solution for you.

What Should You Look for in a Non-QM Loan?

As a borrower, you want to find the best possible terms, including the lowest possible interest rates. It might seem obvious to choose the loan option that provides you with the lowest rate, but that is not always the best option in the long run. You want to inquire about the associated fees with the loan and ensure that mortgage product is the best fit for your circumstances.

Educating yourself about your loan options is the first step to finding a Non-QM loan that meets your needs.

Securing Your Non-QM Loan

The process for securing your loan is fairly straightforward and can be completed in 10 easy steps:

Process for Securing Your Non-QM Loan

Step 1: First, the loan officer will assess your situation and propose the loan options (and the rates) that are available for your circumstances.

Step 2: Complete the loan application over the phone or through our secure online platform.

Step 3: Lock in your rate over the phone based on the agreed-upon terms.

Step 4: We will send the initial application and disclosures which you will need to then review and e-sign.

Step 5: Return the requested documentation.

Step 6: Your paperwork will be submitted to underwriting.

Step 7: The appraisal of the property and a termite inspection (if applicable) need to be performed.

Step 8: Once the loan is approved, we will request any additional information to finalize the documentation.

Step 9: You will review your Closing Disclosure/settlement statement with your loan officer and then you can have it signed by a notary.

Step 10: Once everything is complete, your loan will be funded and you’re ready to move forward with purchasing or refinancing your property.

We understand that you are likely on a tight deadline and we are dedicated to providing a swift loan approval process. Our experienced loan officers will help you move through the process as smoothly as possible.

Selecting a Trusted Lender

Not all Non-QM mortgage lenders are the same. In fact, some offer much better terms than others. When you’re making such a large investment and entering a legal agreement for significant money borrowed, you do not want to take your decision lightly.

To enter into a Non-QM loan with confidence, choosing a lender that has your best interests in mind is important. Not only that, but you need a lender who is easy to work with and will be mindful of the time-sensitive nature of real estate loans.

Griffin Funding is that lender. We take pride in being able to offer our clients flexible loans that work in favor of your interests, not against them. In addition to our favorable loan terms, we utilize the most advanced technology to streamline the process, offer highly competitive mortgage rates, and prioritize our customers’ experience above all else.

Apply for Your Non-QM Loan

With Griffin Funding, we make it possible to secure the loan you need to buy a house or property you have your eye on without all the stress, frustration, and red tape. Speak with a Griffin Funding loan officer today to begin the application process for your Non-QM loan.

Frequently Asked Questions

What types of documentation is accepted for Non-QM loans?

Non-QM loans don’t require traditional underwriting requirements like W2s and pay stubs to verify your income. While there’s no longer a no-doc mortgage program available for homeowners, Non-QM loans are relatively low-doc.

A few basic types of documentation you may need to get approved for a home loan include the following:

- Bank statements: Bank statements are crucial documents for Non-QM mortgage loans because they help underwriters verify your income and determine whether you have the ability to repay the loan. Lenders may ask for these documents with conventional loans as well, but they’re most important for Non-QM loans like bank statements and asset-based loans.

- Tax returns: Non-QM mortgage lenders understand that not everyone has a regular 9-5 job, so they may not have pay stubs or tax returns that accurately reflect their financial situation. For instance, self-employed individuals and business owners take tax deductions that reduce their taxable income. In some cases, lenders may still ask to see your tax returns to help them understand your financial situation.

- Proof of assets: Asset-based loans allow you to use liquid assets as income to qualify for a mortgage loan, so you’ll need to provide proof of those assets, including retirement, investment, and bank accounts.

The exact type of documentation you’ll need depends on the loan. For instance, one of the key differences between DSCR vs. conventional loans is the type of documentation required to determine a borrower’s ability to repay. DSCR loans are for investment properties and determine whether the rental income can cover the total cost of the mortgage, so there’s no income verification, but you’ll have to provide information regarding the rental income of a particular property.

Are Non-QM mortgages more expensive?

Non-QM mortgage products may be more expensive than other types of home loans. Since they’re not backed by Fannie Mae or Freddie Mac and can’t be sold on the secondary mortgage lender, they’re riskier investments for Non-QM mortgage lenders.

To mitigate this risk, lenders typically require higher minimum down payment amounts and interest rates that can make these loans more expensive than traditional home loans.

Still, because of their more flexible lending criteria, Non-QM loans may still be more attractive for self-employed first-time buyers.

How are Non-QM mortgage payments calculated?

Non-QM mortgage payments are calculated the exact same way as regular mortgages. The only difference is the underwriting process which determines a borrower’s ability to repay using alternative documentation like bank statements instead of pay stubs.

Like all home loans, Non-QM mortgage payments are calculated based on principal, interest, taxes, and insurance (PITI).

- Principal: The principal is the amount of the payment that’s dedicated to repaying the principal balance.

- Interest: Interest is the mortgage rate you receive when you apply for the loan. Bad credit can result in higher interest rates, which typically results in higher monthly payments and a greater cost over the life of the loan.

- Taxes: Taxes refer to real estate and property taxes assessed by local government agencies. They’re calculated each year and can be paid as part of your mortgage.

- Insurance: Property insurance payments are rolled into your mortgage payment. Non-QM loans do not require PMI.

Is a Non-QM loan the same thing as a hard money loan?

Hard money loans are designed for investment properties, while Non-QM loans are for residential and investment properties. Hard money loans typically require much higher down payments.

Is PMI required for Non-QM mortgages?

Private mortgage insurance (PMI) is only required for conventional mortgages backed by Fannie Mae and Freddie Mac. Instead, for Non-QM loans, your lender will have their own requirements in place to help them reduce their risk when borrowers make low down payments.

What type of property can you purchase with a Non-QM loan?

You can purchase a residential or investment property with Non-QM loans, including:

- Primary and secondary residences

- Vacation homes

- Investment properties

- Single-family homes

- Multi-family homes

- Townhomes & condos

- Manufactured homes