DSCR Loan vs Conventional Loan

Choosing the right type of loan is a critical step in achieving your real estate goals. Whether you’re an investor seeking flexible financing or a home buyer looking for a traditional mortgage, understanding the differences between DSCR loans and conventional loans can help you make an informed decision. Let’s break down how these two loan options compare.

If you are a new or seasoned real estate investor, it can be difficult to qualify for traditional forms of financing, such as conventional loans for first-time buyers. Fortunately, investors can use alternative financing options if a potential investment doesn’t qualify for a conventional home loan.

One such option is the debt service coverage ratio (DSCR) loan, which is a type of financing that allows borrowers to qualify based on their DSCR ratio rather than traditional income verification methods. This type of loan is very popular among real estate investors, as it allows them to qualify for financing based on the projected income of a property.

So, when it comes down to it, you may be wondering about the differences between a DSCR loan vs conventional loan. Oftentimes, the better financing option depends on your specific needs. In this article, we compare the strengths and weaknesses of each loan type so that you can decide which is best for you.

What Is a DSCR Loan?

DSCR loans are a type of financing that offers approvals based on the income from a rental property’s ability to cover the expenses of one or more investment property loans.

DSCR loans, because their approval is based on the property’s operational data, have no income requirements, and often guidance is less restrictive and more flexible than conventional fixed-rate mortgage loans.

What Is a Debt Service Coverage Ratio?

To understand how to use a DSCR loan, it is essential to know what a debt service coverage ratio is. Traditionally, the DSCR offered insight into a company’s financial health, measuring its ability to meet current debt obligations by comparing those debt obligations to current cash flow. When it comes to real estate investing, DSCR can be used to determine how likely a borrower is to pay back their loan by evaluating the amount of debt they have and comparing that to gross rental income.

How to Calculate DSCR

There are two main components used to calculate the DSCR:

- Gross Rental Income

- Total Debt Service or Total Monthly Mortgage Related Expenses

To calculate the debt service coverage ratio, substitute the income and expenses for your particular rental property’s situation. You can also use a DSCR calculator to make the process quicker and more accurate. The equation for DSCR is as follows:

DSCR = Gross Rental Income / Total Debt Service

What Is a Good Debt Service Coverage Ratio?

While there are no formalized industry standards, most lending institutions consider a good DSCR at or above 1.25 to be strong. In most cases, lenders want to see a DSCR of at least 1 unless there are extenuating and extraordinary circumstances that may offer large compensating factors. A DSCR of 1 means that the income generated by the rental property only covers the costs of maintaining the property. If the DSCR ratio is at least 1.25, the borrower will have more of a financial cushion.

Is a DSCR Loan Conventional?

No, a DSCR loan is a specialty type of mortgage that would not be considered a traditional home loan. Rather, a DSCR loan falls under the umbrella of Non-QM loans, which offer borrowers alternative financing methods. Oftentimes, Non-QM loans such as DSCR loans allow borrowers to secure financing without having to go through typical income verification methods.

DSCR Loan Requirements

The DSCR loan is designed for real estate investors. And while these loans offer an alternative and more flexible path to rental property ownership, there are still some fundamental loan qualifications for these unique loans. The following requirements apply when taking out a DSCR loan at Griffin Funding:

- Minimum credit score of 620.

- A minimum loan requirement of $100,000

- Appraisal to determine property’s market value and rental income

- 12 months of cash reserves for DSCR ratios less than 1

- Property type must be an investment property, not a primary residence

Reach out to the team at Griffin Funding for a full list of DSCR loan requirements.

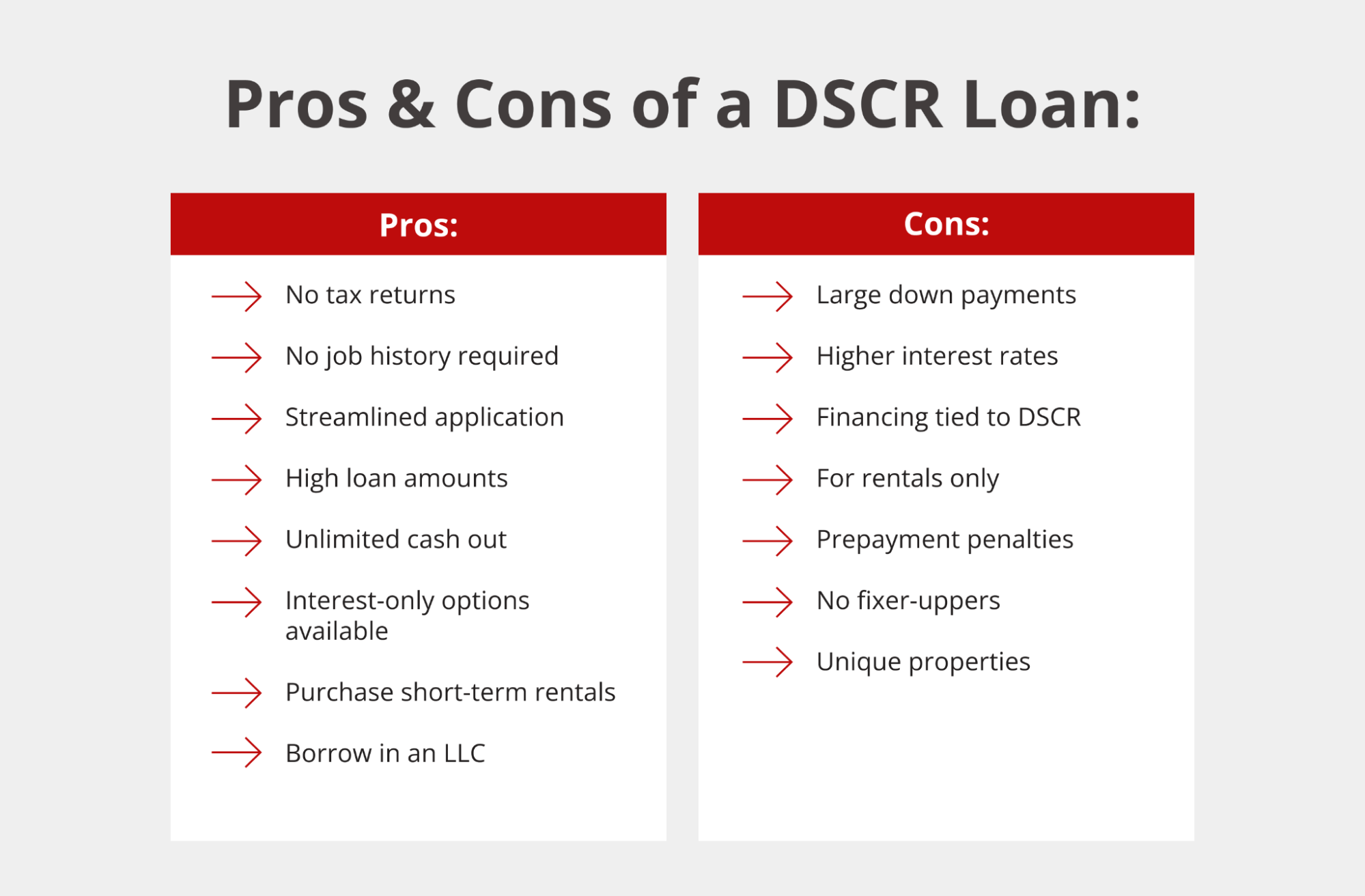

Benefits of a DSCR Loan

DSCR loans are designed for individual real estate investors or investment companies. Using a DSCR loan comes with several benefits, such as:

- No tax returns: No income verification is required in order to qualify.

- No job history required: Borrowers don’t need to prove employment in order to get a DSCR loan.

- Streamlined application: Closing times tend to be quicker for DSCR loans than conventional loans.

- High loan amounts: Access loan amounts up to $20 million.

- Unlimited cash out: Take money out whenever you need it to cover repairs and upgrades.

- Interest-only options available: Save money during the beginning of the mortgage with an option that allows you to make only interest payments.

- Purchase short-term rentals: DSCR loans can be used for both short- and long-term rentals. You can use a property purchased with a DSCR loan as an Airbnb or vacation rental.

- Borrow in an LLC: Close DSCR loans in the name of your LLC and protect your personal assets.

Borrowers find DSCR loans advantageous as these loans allow them to buy a rental property when they previously could not secure conventional financing. The DSCR loan is also hassle-free and has no income verification requirements, which means no W-2s, pay stubs, or tax returns are required for approval. An added benefit is that DSCR loans have no limit on the number of properties an investor may choose to finance. Essentially, this opens an opportunity for certain investors to expand their portfolios.

Drawbacks of a DSCR Loan

While DSCR loans can be a great option for real estate investors, there are several drawbacks to consider before committing. Here are some of the potential challenges:

- Large down payments: DSCR loans typically require a higher down payment compared to conventional loans, which can be a significant barrier for some investors.

- Higher interest rates: These loans often come with higher interest rates, increasing the overall cost of financing.

- Financing tied to DSCR: Lenders may offer a limited loan amount based on the property’s cash flow, restricting how much you can borrow.

- For rentals only: DSCR loans are typically only available for rental properties, meaning you can’t use them for owner-occupied homes.

- Prepayment penalties: Some DSCR loans may have prepayment penalties if you pay off the loan early, limiting flexibility.

- No fixer-uppers: Lenders often won’t approve DSCR loans for fixer-upper properties, as they prefer well-maintained, cash-flowing assets.

- Unique properties: DSCR loans might not be available for unique or unconventional properties that don’t fit standard lending criteria.

What Is a Conventional Loan?

Conventional home loans are what most people refer to when they discuss home loans. The conventional loan is what many individual borrowers use to purchase their home and the loan terms for conventional loans typically range from 10 to 30 years. This type of loan can be configured as a fixed-rate or adjustable mortgage, depending on whether the borrower wants a fixed or fluctuating interest rate.

In order to secure a conventional home loan, a borrower must qualify by meeting the criteria set by the lender. Generally, potential borrowers must prove consistent income by providing relevant tax documents and demonstrate employment by providing job history. It can be difficult to qualify for a conventional loan if you don’t work a traditional job or don’t rely on a conventional income stream.

Benefits of a Conventional Loan

Conventional loans offer several advantages for home buyers, making them a popular choice for many. Here are some of the key benefits:

- Choose from several types of mortgages: Conventional loans come in a variety of options, allowing borrowers to select the mortgage type that best suits their needs.

- Lower down payment: Many conventional loans offer the option of a lower down payment, making homeownership more accessible.

- Relatively low interest rate: Conventional loans often come with competitive interest rates, helping borrowers save on long-term financing costs.

- No Private Mortgage Insurance (PMI) with 20% down: If you can make a down payment of at least 20%, you can avoid the added cost of private mortgage insurance (PMI).

- More flexible property use: Conventional loans can be used for a wider range of property types, including primary homes, second homes, and investment properties.

- No prepayment penalties: Unlike some other loan types, conventional loans typically don’t have prepayment penalties, giving borrowers flexibility to pay off their mortgage early without extra fees.

Drawbacks of a Conventional Loan

While conventional loans offer many benefits, there are also some drawbacks that potential borrowers should consider. Here are some of the key disadvantages:

- Higher credit score requirements: Conventional loans generally require a higher credit score compared to other loan types, which may be a challenge for some borrowers.

- Larger down payment for best terms: To secure the most favorable terms, a larger down payment (typically 20% or more) is often necessary.

- Private mortgage insurance (PMI) with less than 20% down: If your down payment is less than 20%, you’ll likely need to pay for private mortgage insurance (PMI), increasing your monthly costs.

- Stricter income and debt-to-income ratio requirements: Conventional loans typically have more stringent requirements when it comes to your income and debt-to-income (DTI) ratio, which may limit your eligibility.

- Longer approval process: The approval process for conventional loans can sometimes take longer due to stricter documentation and underwriting standards.

- Higher costs for investment properties due to Loan-Level Price Adjustments (LLPAs): When financing an investment property with a conventional loan, Fannie Mae and Freddie Mac impose Loan-Level Price Adjustments (LLPAs), which can significantly increase interest rates and upfront costs.

DSCR vs. Conventional Loan: Which Is Better?

It is impossible to say whether a DSCR loan or conventional loan is better, as the right loan will depend on your unique needs and goals. Like most things in life, the loan that will be most suitable will be highly personal and depend on the borrower, their goals, and the property in question.

In general, conventional loans tend to be best if you’re an individual with a traditional job who is seeking to purchase your own home to live in. On the other hand, DSCR loans can be better suited for real estate investors who want to access a significant loan amount, but don’t have the income to qualify for the loan amount they want through traditional means.

Find the Right Loan for You

When it comes to investing in real estate, there are several different routes you can take when it comes to financing. Two of the most popular ways to finance investment properties are with DSCR loans and conventional loans.

When comparing conventional vs DSCR loans, it’s crucial to consider your own goals and your financial situation. Choosing the right investment property loan can optimize your return on investment and make the entire investing experience easier.

At Griffin Funding, we can work with you and consider your unique financial situation when comparing DSCR vs conventional loans. We can advise you on which may be better given your situation and goals, and walk you through the mortgage process.

We also offer free tools to help you make informed financing decisions. Download the Griffin Gold app to easily compare mortgage options, access smart calculators, and manage your finances.

Ready to make your next real estate investment? Reach out to us today!

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Is it harder to get a DSCR loan or a conventional loan?

Can I use a conventional loan to buy an investment property?

What are my other investment property loan options?

Some other investment property loan options include:

- Hard money loans: These are short-term loans that can be funded quickly. They’re commonly used by inventors to finance real estate deals or bridge the gap between financing.

- Home equity loans: In addition to traditional HELOANs and HELOCs, we offer self-employed home equity loans and DSCR home equity loans.

- Bank statement loans: Qualify for a mortgage using bank statements instead of tax returns. Get up to $20 million with as little as 10% down.

- Asset-based loans: Leverage liquid assets like bank accounts and investment portfolios to secure home financing.

Recent Posts

Conventional Loan Limits in 2025

If you plan to purchase or refinance a home in the coming year, understanding the conventional loan limits in ...

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...

Mortgage Refinance Limits

Your Refinancing Options Most owners have several refinancing pathways depending on their financial goals and ...