The VA Loan Process Timeline

KEY TAKEAWAYS

- Borrowers must complete all steps in the VA loan application process in order to get a decision on their application.

- Griffin Funding is typically able to complete the VA loan process in 30 days or less.

- Getting your COE, preparing your documentation, and staying in communication with your lender can streamline the VA loan process.

Veterans put their lives on the line to help us protect this country, and they deserve all of the assistance they can get when it comes to buying a house. Fortunately, they have access to an option called a VA loan. This is a loan that is backed by the Department of Veterans Affairs, which can make it much easier for veterans to secure financing for a house.

If you’re a veteran searching for a home, you may be eager to apply for a VA loan. But how long does the VA loan process take? The VA loan process timeline can vary depending on a number of factors, but if you can work with a professional who can streamline the VA home loan buying process, you may be able to close on your house much faster.

Learn more about the VA home loan process below, including what you must do to apply, how long it takes to get approved, and tips for streamlining the process.

KEY TAKEAWAYS

- Borrowers must complete all steps in the VA loan application process in order to get a decision on their application.

- Griffin Funding is typically able to complete the VA loan process in 30 days or less.

- Getting your COE, preparing your documentation, and staying in communication with your lender can streamline the VA loan process.

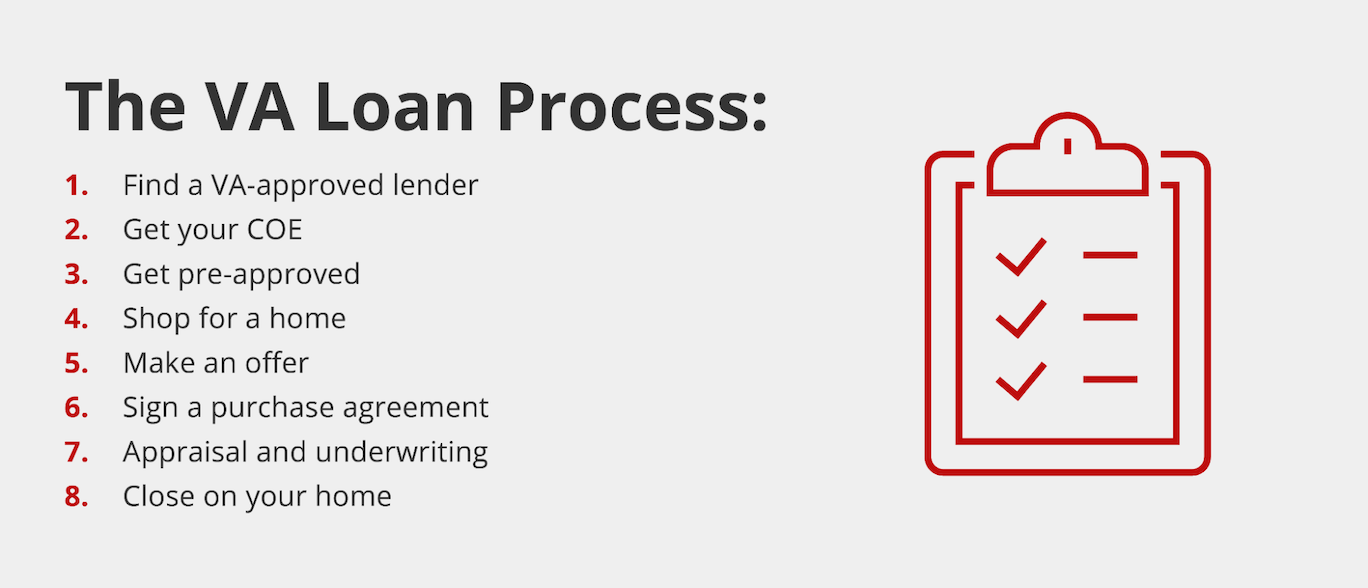

The VA Loan Process

There are several steps you need to follow to complete the VA home loan buying process. Below are the main steps that you’ll need to complete in order to buy a home with a VA loan.

1. Find a VA-approved lender

If you are interested in looking at VA loans, one of the first things you need to do is find a lender that has been approved by the VA. Unlike conventional loans, not every lender will be able to provide you with loans that have been backed by the Department of Veterans Affairs.

VA loans are unique, and you need to find a lender that has experience working with them. That way, you understand all of the options available to you, and your lender can help you find the perfect loan to meet your needs. Most lenders are going to be open and honest with you about whether they have been approved to offer VA home loans.

2. Obtain your Certificate of Eligibility (COE)

Before applying for a VA loan, you’ll need to confirm your VA loan eligibility by getting your Certificate of Eligibility (COE). In general, if you have served in the military and meet minimum eligibility requirements, you should be eligible for a VA loan. Keep in mind that service requirements can vary depending on your situation and your service history.

Another reason why it is important to work with a lender that has been approved by the VA is that they should be able to help you obtain your COE. Once you have this certificate, you should have an easier time finding the right loan to meet your needs.

3. Get pre-approved

The housing market remains exceptionally competitive, and you must make sure that your offer is seen as competitive. Getting pre-approved for a VA loan can help be seen as a competitive buyer and also provide you with a better understanding of what you can afford.

If you have a pre-approval letter from your lender, your offer will be more likely to be taken seriously, and you can increase your chances of the seller selecting your offer. Getting pre-approved is also important because it will give you a budget with which to work. You will know exactly how much money you have to spend on a house, and you can shorten the list of homes you decide to look at.

4. Shop for your home

Now that you have been approved for a VA loan, it is time for you to shop for your home. You may decide to do this on your own, or you may want to work with a real estate agent who can help you find the right house to meet your needs.

As you take a look at various housing options, there are several factors to consider. They include:

- You need to think about how long your commute will be to work or school.

- You need to think about the number of bedrooms and bathrooms you need.

- Consider how easy it is for you to access major highways and transportation hubs.

- Think about the level of crime in the area.

- Consider the quality of the school system, even if you do not have kids, as it will have an impact on your housing values.

- Take a closer look at how housing prices have shifted in the area in recent years.

You may also want to work with a real estate agent who can help you develop a “need” list and “want” list. This refers to the items your home has to have versus the items you want your home to have. This could make it easier for you to rank the options on your list.

5. Submit an offer

Once you find a house that you like, you need to submit a competitive offer. In general, you should only submit an offer on a house one at a time, no matter how competitive the housing market is. Once you submit an offer, you need to wait to decide whether the seller selects your offer. There are a lot of factors that the seller will probably consider when evaluating the offers. They include:

- The amount the buyer is offering.

- Whether the offer comes with a pre-approval letter.

- How much earnest money the buyer is willing to put down.

- Whether the buyer is able to submit a cash offer for the home.

If the seller decides to go with another offer, you will need to move on to another house. This is another area where a real estate professional can help you. They can take a look at what similar homes in the area have sold for recently, and they can help you put together a competitive offer sheet.

6. Sign a purchase agreement

Once you get an offer accepted, you will need to sign a purchase agreement. There are a lot of important elements that could be included in the purchase agreement. Just because you have an offer accepted doesn’t necessarily mean you need to move to the closing table right away.

For example, you will need to get your house appraised by the lender before your sale can be finalized and get an inspection to ensure the home meets the VA’s minimum property requirements. That way, you can figure out whether the house requires any repairs and whether you want to go through with the sale after the inspection report comes back.

There will be a lot of jargon in the purchase agreement, but you do not necessarily have to read the agreement on your own. Your real estate attorney should help you with the purchase agreement, and if you have questions about any of the language in the agreement, you need to talk with your attorney about any changes you might want to make. You may even want to have a real estate attorney take a look at your purchase agreement so that you understand exactly what you are agreeing to.

7. Home appraisal and loan underwriting

As your real estate agent helps you set up the home inspection, your lender will set up the home appraisal. A home appraisal is important because it will let you know what the house is actually worth. If you decide to spend more money on a house than the appraisal says it is worth, you may still be able to go through with the purchase process; however, the lender may ask for a larger down payment.

If you have your full VA entitlement, you do not necessarily have to put any money down, but this could change depending on what the home appraisal shows. This is another reason why you need to work with a lender who has experience with VA loans.

Your real estate agent should be able to help you predict what the home appraisal may look like. If you do not want to overpay for a house, as it could have an impact on the home appraisal and your lender, you should work closely with your real estate agent to make sure you put forth a fair offer.

8. Close on your new home and get funding

Finally, once the appraisal has gone through and the financing has been finalized, you can move to the closing table and purchase your new home. Your lender will complete the funding process, your sale should be finalized, and you should be familiar with the terms of your mortgage. Your lender will work with your real estate agent and the closing attorney to make sure all the paperwork is in order, and you will receive the keys to your new house.

How Long Does the VA Loan Process Take?

If you decide to apply for a VA loan, it can take many lenders between 40 and 50 days to go through the steps and finalize the process. However, at Griffin Funding, we strive to close on VA loans in 30 days or less. By streamlining the process, leveraging new technologies, and drawing on years of experience, we can speed up the VA loan process timeline and quickly get your loan approved.

So what happens between when you submit a VA loan application and when you get approved? There are a lot of reasons why the closing process may take some time. A few important factors include:

- There is a lot of paperwork that has to be submitted for a VA loan, and the lender has to make sure that they follow all necessary rules and regulations.

- It can take some time for the appraisal to come back, and the lender may not be able to move forward with the closing process until they know exactly how much the house is worth and how much money you will have to pay.

- The lender also has to do their due diligence to make sure that you can afford the house you want to purchase.

- You need to wait for the inspection to come back, as you need to make sure the house does not require any major unexpected repairs before you decide to move to the closing table.

Tips to Streamline the VA Home Loan Process

If you want to streamline the VA home loan process, you have a significant amount of control. There are a few steps you can take to get to the closing table more quickly. Some of the most important tips that can help you streamline the VA home loan process include:

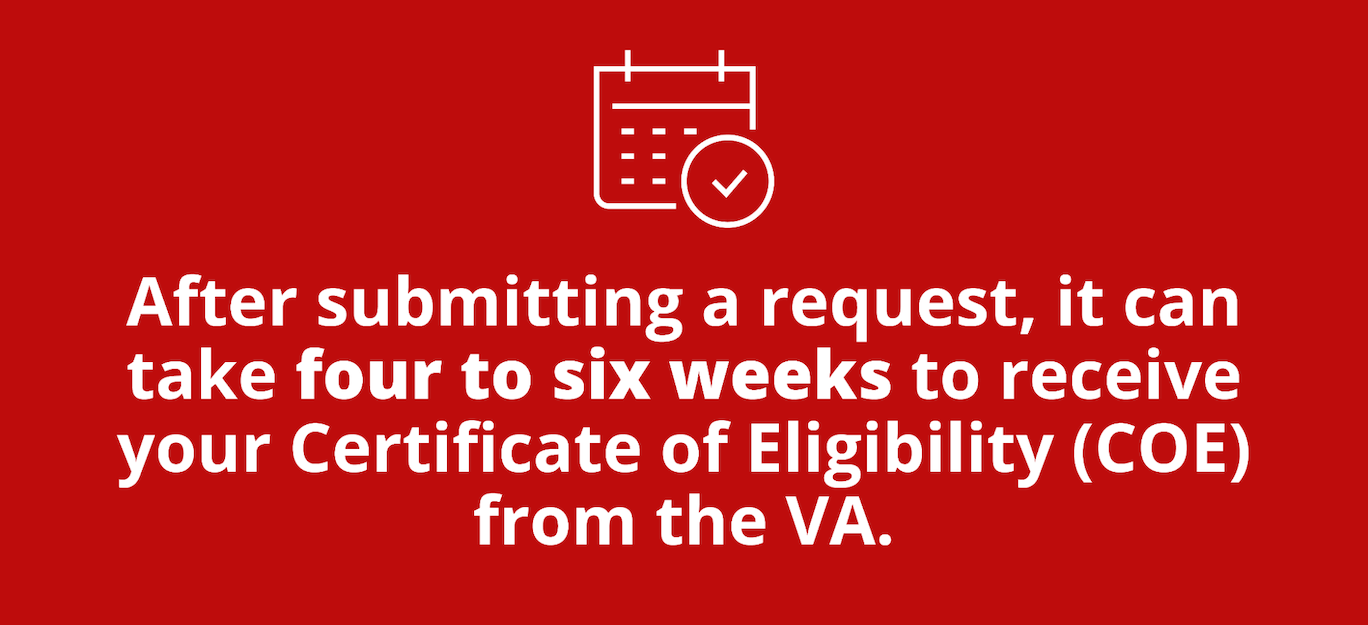

1. Get your COE

The housing market moves quickly, and if you don’t want to risk missing out on your dream house, you need to get your Certificate of Eligibility as quickly as possible. This is incredibly important to the VA home loan process, as you will not be able to get financing through the Department of Veterans Affairs without it.

Your COE can take a while to get, and even though you need to be patient with the VA, you need to start the process as early as possible. That way, you do not spend any longer waiting for your loan to get approved than you have to. The sooner you request your COE, the sooner you can start looking at homes.

If you are looking for a team that can help you expedite the process of getting your COE, work with Griffin Funding. We have a significant amount of experience working with the VA, and we can help you get your COE sooner rather than later. That way, you can move forward with the purchasing process, and you don’t have to worry about delaying your housing search.

2. Organize all relevant documents

There are a lot of documents that you will need to get in order if you would like to qualify for a VA home loan. Some of the most important documents you may want to request include:

- Your Credit Report: Your lender is going to request a copy of your credit report on their own, but you should also ask for a copy of your credit report. This will contain information not only about your credit score but also specific information related to your financial status. If there are mistakes on your credit report, you need to get them corrected before you move forward with the rest of the process.

- Pay Stubs and W2s: Your lender may ask you for proof of your income. Therefore, you might be asked for a series of your pay stubs or your W2s. If you are self-employed, your lender may ask for your 1099s or your tax return. You need to make sure you have these documents available, as it will shorten the document review process for your lender.

- Bank Statements: If you decide to apply for a home loan using your assets instead, then you may need to have a copy of your bank statements. This is important because it will provide your lender with proof of the assets you have, and it will help your lender figure out where these assets have come from.

- Investment Statements: If you have other financial accounts, such as investments, you may need to provide those statements as well. These assets could help you qualify for a more favorable home loan, but your lender will need to verify that you have these assets before moving forward with the rest of the process.

- Employment Verification: If you are trying to apply for a home loan using your employment as a source of income or assets, you need to provide verification of that employment. This could be something as simple as an employment contract or a statement of validity from your employer.

- Driver’s License: You need to have valid identification if you want to apply for a home loan as well. You will need to have your driver’s license or another source of identification, so make sure you are prepared to show it to your lender.

If you can organize all of these documents before you apply for a home loan, you can significantly shorten the process and make it easier for you to qualify for the home loan you need.

3. Effectively communicate with your lender

One of the most common reasons why the financing process doesn’t move forward is that the lender does not have the answer to a question. While you might be busy, you need to respond to your lender as quickly as possible if they have a question or concern.

For example, your lender may request additional documents or your lender may have a question about where certain sources of income or assets have come from. Until you answer these questions, the lender may not be able to move the process forward. Therefore, you need to respond to these questions and concerns as quickly as possible.

Likewise, if you have a question about something, reach out to your lender before you move forward. You do not want to spend your time moving in the wrong direction, so always wait for an answer to a question before you decide to submit additional paperwork or make an offer on a house that you aren’t certain you can afford.

As long as you keep these tips in mind, you should be able to maximize your chances of qualifying for a VA home loan and streamlining the VA loan process.

Work With Griffin Funding to Ensure the VA Loan Process Goes Smoothly

A VA home loan is a great option for veterans because it could allow them to purchase a house with zero percent down. At the same time, you need to work with a lender that has experience in this area, and that is where we can help you.

At Griffin Funding, we understand the sacrifice that veterans make when they serve our country, and we are here to make it as easy as possible for veterans to purchase their dream homes. We would be happy to provide you with a competitive VA home loan, and we can work with you to help you secure favorable loan terms.

Not sure if a VA loan is right for you? Reach out to us and we can determine your eligibility, explain the differences between FHA vs VA loans, and tell you about some of our other financing options.

If you would like to learn more about the options we have available, contact us today to speak to a member of our team! Let us help you get the process started. The sooner we get the process moving, the sooner we can get you into the perfect home for you and your family.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

Conventional Loan Limits in 2025

If you plan to purchase or refinance a home in the coming year, understanding the conventional loan limits in ...

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...

Mortgage Refinance Limits

Your Refinancing Options Most owners have several refinancing pathways depending on their financial goals and ...