VA Home Loans

If you are a current service member or veteran, you can use a VA loan to purchase or refinance a home with no down payment. Partner with an experienced VA lender like Griffin Funding to get the most out of your VA home loan.

- No down payment required

- Government-backed financing

- Low interest rates

- No PMI requirement and limited closing costs

- Refinance and cash-out options available

Featured In

Benefits

VA Loan Benefits

No down payment:

Get a mortgage with a 0% down payment.

Low interest rates:

Access highly competitive interest rates. Often ~0.5% lower than conventional rates.

No mortgage insurance:

No private mortgage insurance (PMI) is required on VA loans.

Flexible credit and income requirements:

Qualify with lower income or less-than-perfect credit.

Convenient refinance options:

Adjust your rate with a streamlined refinance option or access up to 100% of your home’s appraised value with a VA cash-out refinance.

Limited closing costs:

Some closing costs are capped and certain fees are not allowed.

Assumable mortgage:

A VA loan is assumable, making it easier to sell your home to a qualified buyer.

No prepayment penalties:

Don’t get penalized for paying off your mortgage early.

How it Works

What Are VA Loans & How Do They Work?

A VA loan is a mortgage that is backed by the Department of Veteran Affairs. VA loans are available to qualifying veterans, service members, and surviving spouses. This type of financing lowers the upfront costs of buying a home and allows borrowers to get a government-backed loan at a competitive rate.

VA guaranteed loans are made by approved private lenders, such as banks or mortgage companies, to eligible veterans for the purchase of a home. The Department of Veteran Affairs guarantees a portion of the home loan.

This guarantee — also known as VA entitlement — acts as an alternative to the traditional down payment, which is typically required to help protect the lender if a borrower defaults on the loan.

Key Features of VA Loans

- No down payment required

- Highly competitive rates

- Government-backed financing

- Available to service members, veterans, and surviving spouses

- Flexible qualification requirements

Requirements

VA Loan Eligibility Requirements

Minimum service requirements:

Must meet the VA’s minimum active-duty service requirements to qualify.

Certificate of Eligibility (COE):

Obtain a COE from the VA to prove eligibility and verify entitlement.

Credit score:

Qualify with a FICO score as low as 550.

Meet income qualifications:

Prove you earn sufficient income to repay the loan.

VA Loan Rates Today

VA Loan Types

Use a VA purchase loan to buy a home with no down payment required and competitive interest rates.

A VA IRRRL allows you to refinance an existing VA loan to lower your rate or switch from an adjustable-rate to a fixed-rate loan. No appraisal, income qualification, pest inspection, or new COE required. Fast closing timeline and minimal out-of-pocket costs.

Use a VA cash-out refinance to replace your current mortgage with a larger VA loan and access up to 100% of your home’s appraised value. Access your equity, alter your interest rate, and get cash to use for any purpose, all with one loan.

VA Loan Calculator

Use our free VA loan calculators to see what this type of financing could look like for you and how much home you might be able to afford using a VA loan.

Where We Lend

Griffin Funding offers VA loans in several states to help service members and veterans find a home in their ideal location.

Frequently Asked Questions

Determining whether a VA home loan is worthwhile depends on your individual circumstances. As with all home-buying decisions, committing to a mortgage is a personal decision.

That said, both the short-term and long-term VA home loan benefits cannot be understated. From having more available income to afford current expenses, to being able to pay off debt and increase savings over the course of the loan, you are likely to be in a much better financial position if you secure a VA home loan or VA refinance loan with Griffin Funding.

Some of the cons of VA loans include:

- You must meet service requirements in order to qualify

- You have to pay the VA funding fee (unless you have a service-related injury and are exempt)

- You must adhere to occupancy requirements

- VA loans generally cannot be used for investment properties, unless you are purchasing a duplex, triplex, or fourplex and are going to live in one of the units.

- You don’t have the option to waive a VA home inspection or appraisal

For most borrowers, the benefits of VA loans tend to outweigh the drawbacks. Since VA home loans do not require monthly mortgage insurance (MI) and offer more favorable terms, they are usually more affordable. As such, borrowers can potentially buy a house with low income while focusing on paying off debt and other financial obligations.

VA loan entitlement is the amount that the VA agrees to guarantee on a loan. There are two parts to the VA entitlement:

- Basic Entitlement: The VA will insure up to 25% of loan amounts up to $144,000 or $36,000, whichever amount is less. Unless you live in a fairly affordable part of the country, you will likely need to use both your basic entitlement and your bonus entitlement.

- Bonus Entitlement: The VA will insure up to 25% of loan amounts between $144,000 to the current conforming loan limit in your county which is established by the Federal Housing Finance Agency. Bonus entitlements are used when the cost of a home is over $144,000. They also serve as a secondary layer of protection should you default on your mortgage.

The VA does not limit the maximum amount you can borrow for a VA home loan. However, there may be a limit on how high of a loan you can qualify for without a down payment. These limits are based on your entitlement.

Typically, you can borrow up to four times your entitlement amount. When both the basic entitlement and bonus entitlement are utilized, you can qualify for a loan of $484,350 (or, in some cases, more).

While these amounts are standardized, the loan limit and entitlements may be greater in high-cost areas. To determine the maximum amount you can use a VA loan for, you need to look at the loan limit for the county you plan to purchase in, while considering the above factors.

There is also the Blue Water Navy Vietnam Veterans Act of 2019 to consider, which has authorized changes to VA home loans as of January 1, 2020. Under the Act, qualifying veterans can now purchase a home valued up to $1,500,000 with zero down payment.

For all qualifying VA home loan applications moving forward, the following will apply:

- Maximum $3,000,000 loan amount

- Minimum 700 FICO for loan amounts greater than $1,000,000

- Full 25% guarantee from entitlement required

- Manual underwriting not allowed for loan amounts exceed FHFA conforming loan limit

To learn more about this legislation and how it can impact your VA loan, review the VA’s page that covers the changes to benefits.

There is no limit to the number of times you can use a VA loan entitlement. If you qualify for the VA loan program, it is a life-long benefit that you will be able to enjoy.

That said, there are some stipulations for using your VA loan. After using your VA loan benefit, you typically need to restore your entitlement before you can use it for another VA home loan—meaning you pay off the remaining balance of your mortgage.

Getting a VA loan is relatively straightforward as long as you meet the minimum VA loan requirements. If you meet the basic service requirements, you’ll be able to obtain a Certificate of Eligibility from the Department of Veterans Affairs, which confirms your eligibility for the VA loan program, specifies your available VA loan entitlement, and states whether or not you qualify for a VA funding fee exemption.

Once you confirm your eligibility for the VA loan program, the next step is choosing the right VA lender for your needs. Working with the right lender can make a big difference in how difficult the VA loan process is, from the very first step to the last.

At Griffin Funding, we’re proud to be an experienced VA lender that offers a streamlined process and excellent customer support at every step of the way. In addition to providing borrowers with competitive VA loan rates, we have a dedicated and experienced team that will work as hard as possible to ensure the VA loan process goes smoothly for you and your family.

The VA loan process can seem intimidating to sellers because they just don’t know enough about it. Sellers may reject a VA loan borrower because they believe it’s harder to close on these mortgages, even though that’s not true.

VA loans can take longer to close than traditional loans, but only by a few days. Since sellers prefer fast sales and closings, the best thing you can do is educate the seller to help them learn more about the process.

When a VA loan exceeds the loan limit in a given county, it’s referred to as a VA jumbo loan. You can get a VA jumbo loan to purchase a home that’s situated in a high-cost area, broadening your housing options and giving you access to homes that may be situated near big cities or large metro areas.

At Griffin Funding, we offer VA jumbo loan amounts of up to $3,000,000. Reach out today to see if you qualify for a VA jumbo loan and discuss the competitive VA home loan rates we can offer you.

In addition to VA home loans that help you purchase a house, you can also refinance your current VA loan or another mortgage loan. VA loans can also be used to build, repair, and adapt your home.

A home refinance loan can not only improve your current rate and terms, but can give you a chance to change the type of loan you are in, increasing your loan payoff time.

Refinancing your home loan enables you to replace your existing home loan with a new home loan that features better terms while giving you the opportunity to get cash back from the equity you have built in your home. Using the equity in your home is a powerful way to help you improve your overall financial well-being and pay off high-interest loans, debts, and credit cards.

VA loans are assumable, which means they can be transferred to someone else who will take over the existing terms of the loan. In these cases, the buyer will have the same mortgage payment even though they may not traditionally qualify for a VA loan.

However, for a VA loan to be transferred, the borrower must meet specific requirements, and lenders must evaluate their ability to repay the loan. You can’t transfer the loan to someone else without your lender’s permission.

Any type of borrower, whether they qualify for VA benefits or not, can assume a VA loan, but they’ll still need to prove their creditworthiness to the lender. Each lender has their own standards, so if you’re considering transferring your VA loan to someone else, work with your lender to find the best possible solution.

- Secure your COE from the VA or have Griffin Funding do it for you.

- Contact Griffin Funding so that one of our loan officers can evaluate your eligibility and provide you with a quote.

- Submit your application, sign disclosures, and provide any necessary documentation.

- Schedule a VA appraisal and ensure a pest inspection is performed.

- Review your final loan documents and have them notarized.

- Receive funding for your loan. VA purchase loans receive same-day funding but a VA refinance loan will be subject to a three-day waiting period.

- ID: All lenders must verify your identity using a state-issued ID like a driver’s license or government-issued ID.

- Certificate of Eligibility (COE): The Certificate of Eligibility is unique to the VA loan and proves you’re eligible for the home loan benefit. Not everyone who serves in the military is eligible since there are minimum service requirements you’ll need to meet. You can request your COE online from the VA, or your lender can do it for you by searching their database.

- Income documentation: Your lender must ensure you can repay your loan, so they’ll need income documentation, which may be pay stubs, tax returns, bank statements, and W-2s. Bank statements can also help your lender understand your savings to ensure you can pay closing costs. To qualify for a VA loan, lenders like to see at least two years of employment history.

The Certificate of Eligibility is provided by the VA and verifies that a borrower meets the minimum service requirements to qualify for the VA loan for a home. The COE also provides the lender with information about how much of your entitlement you have remaining.

You can request your COE via the following methods:

- Use the VA’s eBenefits portal

- Mail a request form

- Work directly with your lender

When applying for your COE, you’ll need to provide the VA or your lender with several types of documentation, such as:

- Your discharge or separation proof, also known as form DD-214.

- Statement of service signed by commander, adjutant, or personnel officer (for active service members only).

How fast closing on a loan is depends on a variety of factors, including whether or not you respond to your lender’s request for more information.

While VA loans can take longer to close than other types of loans because there are additional steps like obtaining a COE and having a VA appraisal before the VA will approve the loan, it’s possible to close on a VA loan in as little as 30 days.

All home loans require an appraisal, which determines the true market value of the home and ensures the borrower is paying a fair price, and the lender isn’t spending more than they should on their investment.

However, the VA appraisal differs from a regular appraisal and instead is more of a combination between an appraisal and a home inspection.

For a property to qualify for a VA loan, it must meet the VA’s Minimum Property Requirements (MPRs) to ensure the property is safe, sanitary, and structurally sound. The appraiser will look for things like roofing issues, lead-based paint, working appliances, access to the property, and so forth.

It’s important to note that while a VA appraisal has some aspects of a home inspection, an appraiser is not qualified to perform a full home inspection to ensure every aspect of the property is up to standards.

The VA appraisal is required, but a home inspection is not. However, it’s generally recommended to have a home inspection to help you find any potentially major issues with the home before closing.

Understanding VA loan closing costs can be challenging because the VA sets rules for lenders. There are two types of fees associated with the VA loan: non-allowable and allowable fees.

Non-allowable fees are those the lender can’t require you to pay, such as prepayment penalties, attorney fees, and so forth. Additionally, lenders are required to use the 1% rule, which dictates that your origination fee can’t be more than 1% of the total loan amount.

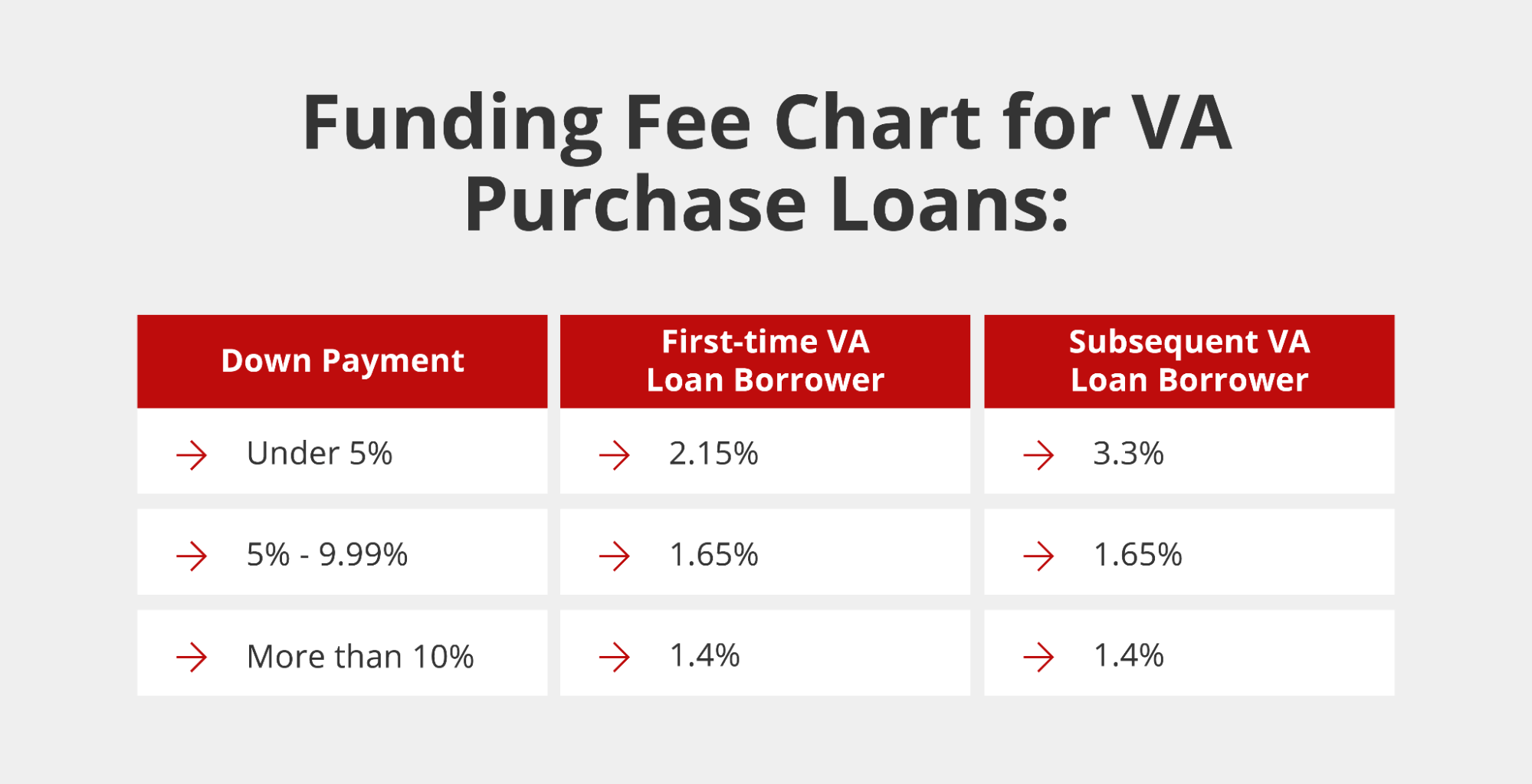

These limited fees can help you save thousands of dollars on your VA loan for a home. However, there’s one fee you should be aware of: the VA funding fee. The VA funding fee is a one-time cost due at closing that’s completely unique to the VA home loan. This fee is paid directly to the VA to help support the VA loan program.

The cost of the fee ranges depending on whether you’ve made a down payment or used your entitlement in the past. If you haven’t used a VA loan before, you can expect a funding fee of 2.15% of the loan amount.

Other fees you’re required to pay include the following:

- VA appraisal fee

- Credit report fee

- Origination fee

- Title insurance

- Recording fee

- Discount points

- VA loan points

It’s important that you have a thorough understanding of VA home loans before moving forward with your application. For more info on Griffin Funding VA loans, speak with one of our loan specialists who will be happy to provide clarity, or you can use the following resources:

If you default on your loan, you risk foreclosure. However, the VA offers financial counseling to help avoid foreclosure, which allows them to contact your lender on your behalf to find the best solution before the lender forecloses on your home.

Additionally, you can contact your lender directly to discuss your unique situation and find the best solution, which may be a payment plan, forbearance, or deferment.

- VA Disability 0% Funding Fee = VA (in almost all cases)

- Interest rate that is .5% to 1.5% less than CONV = VA

- Short Sale, Foreclosure, Bankruptcy without enough seasoning = VA

- VA FF Recoup / Breakeven is less than the time they will be in the property = VA

- Less than a 620 FICO = VA

- 0% Down = VA

- 80% + LTV = VA

- DTI of 45 or 49%+ = VA

- True Jumbo above the high balance limit with strict DTI, FICO and reserve requirements that they cannot meet = VA

- Get in the VA’s system for future IRRRL opportunities if rates drop = VA

- VA FF, consider CONV or HELOAN

- High FICO, consider CONV or HELOAN

- Low LTV, consider CONV or HELOAN

- Plans to sell or Refi before the VA FF breakeven timeline, consider CONV or HELOAN