VA Funding Fee

VA loans are available to active-duty members of the military and veterans. With a VA loan, you can secure a home loan with a relatively low interest rate without supplying a down payment or paying private mortgage insurance (PMI).

While these benefits are certainly nice, there is a price attached to them. That is where the VA loan funding fee enters the picture. A VA loan funding fee is a cost associated with virtually every VA loan. Borrowers are required to pay the funding fee in order to support the VA loan program and enable other veterans to take out loans as well.

In this post, we explain what the VA funding fee is, why the fee is required, and how much a VA funding fee is. Read on to learn about the VA funding fee or navigate the article using the links below.

- What Is a VA Funding Fee?

- Why Do VA Loans Include a Funding Fee?

- How Much Is the VA Funding Fee?

- Can I Get the VA Funding Fee Waived?

- VA Funding Fee vs Private Mortgage Insurance

- Explore VA Loans Available From Griffin Funding

What Is a VA Funding Fee?

While VA loans extend several significant benefits to borrowers, they also come with a unique cost known as the VA funding fee. The VA funding fee refers to a one-time fee that a borrower will pay to the Department of Veterans Affairs. The exact size of the funding fee will vary depending on a number of factors, but essentially everyone taking out a VA loan is required to pay it. Keep in mind, however, that in certain cases the VA funding fee can be waived—we’ll go into more detail about that in a later section.

Why Do VA Loans Include a Funding Fee?

The VA funding fee can be significant, so why do VA loans ask you to pay a funding fee? The biggest reason why you are required to pay a VA funding fee is that the program needs to remain sustainable. By paying the VA funding fee, you are supporting the VA loan program and giving other service members and veterans access to these government-backed home loans

Taking out a loan through the VA gives you access to numerous VA loan benefits that are not available to the traditional borrower. The funding for all of these benefits has to come from somewhere, and much of it comes from the government. That means that these benefits are also coming from various taxpayers.

While this is a generous piece of legislation, the program cannot survive on taxpayer dollars alone. Therefore, the government has created a funding fee as a way to keep the program sustainable and to continue offering benefits to borrowers who have served the country.

How Much Is the VA Funding Fee?

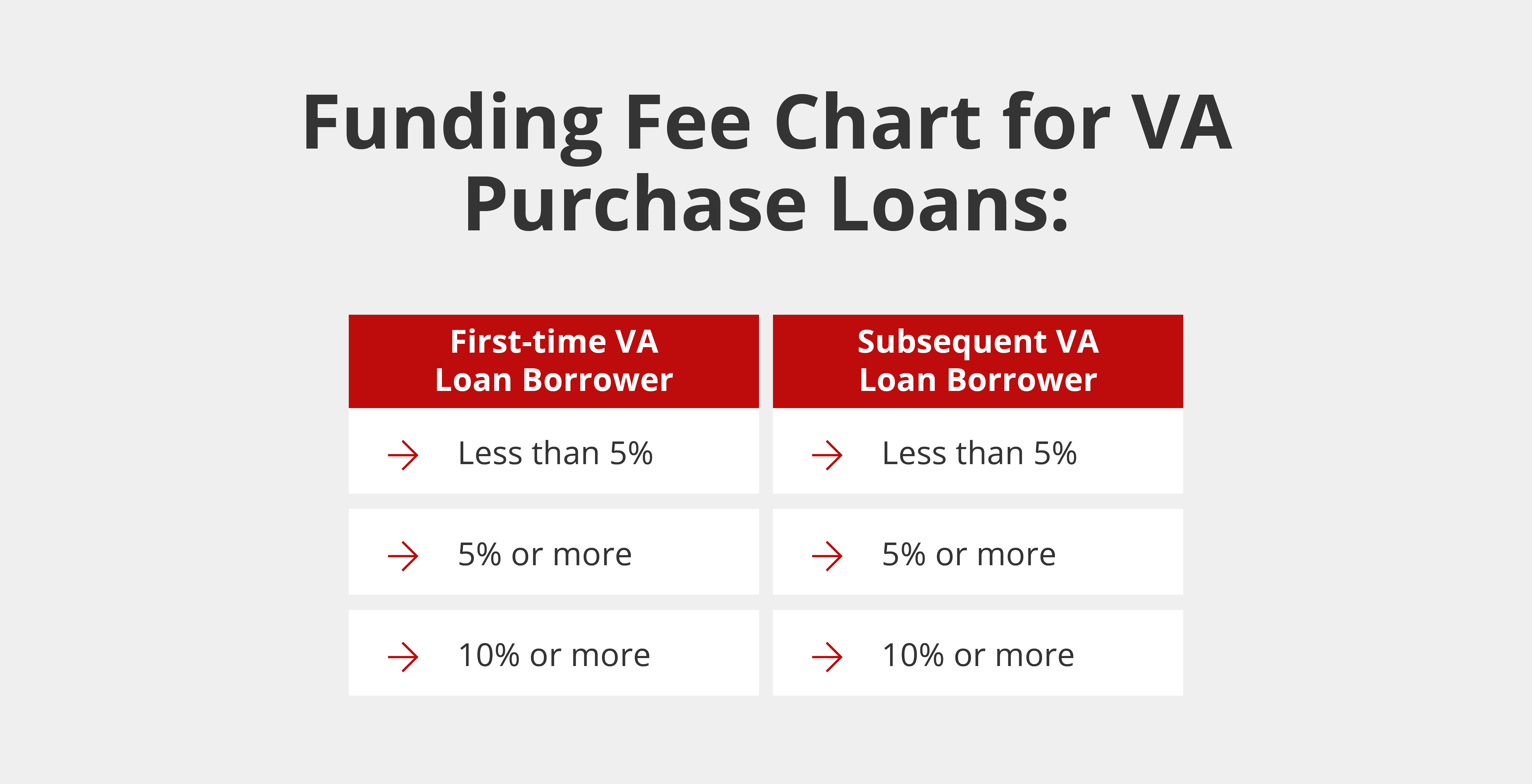

So how much is the VA funding fee? If you are purchasing a home for the first time, you will have to pay 2.15 percent of the loan amount when you close on your house. If you are taking out a subsequent VA loan to purchase a house, you will have to pay a funding fee of 3.3 percent.

For example, if you have to borrow $400,000 to purchase a house, you will have to pay a VA funding fee of $8,600 if you are buying a house for the first time. If you have already purchased a house using a VA loan and you are now purchasing a different home, the VA funding fee is going to be $13,200. That is why it might be a good idea to take a look at a VA funding fee chart before you decide which loan option is right for your needs. If you would like an easy chart that will explain the VA funding fee to you, take a look at the chart below:

Keep in mind that the funding fee can change from time to time, depending on the legislation that the government passes. You need to make sure you understand exactly how much money you might have to pay when you close on a house, so consider reaching out to a professional who can help you. It might be difficult to keep up with changes in funding fee legislation, but an expert can point you in the right direction.

Can I Get the VA Funding Fee Waived?

If you are interested in taking out a VA home loan to repair, improve, build, or purchase a house, you will typically be required to pay a VA funding fee. The VA funding fee will also apply to you if you are refinancing a mortgage.

On the other hand, there are a few specific situations in which you might be able to get your VA funding fee waived. Some of the most important examples include:

- Disability: If you can prove that you are receiving VA compensation for a disability that is related to your time serving in the armed forces, you may be eligible to have the funding fee waived.

- Active Pay: If you are eligible to receive VA compensation for a disability that you sustain during your time serving the military, but you are still receiving pay related to active duty service or retirement, you may be eligible to have the funding fee waived.

- Surviving Spouse: If you are receiving dependency and indemnity compensation as a surviving spouse, you might be eligible to have the funding fee waived.

- Pre-Discharge Claim: If you have received a proposed or memorandum rating before the closing date of your loan, and that memorandum says that you are eligible for compensation because of a claim prior to discharge, you might be able to get the funding fee waived.

- Purple Heart: If you have received a Purple Heart prior to the closing date of your loan, you may be able to get your funding fee waived.

If you have to pay the funding fee now but certain factors change going forward, you may be able to get a refund. There might be a way for you to apply for a funding fee refund down the road if your circumstances change. For example, you might be applying for compensation related to a disability you sustained while serving in the armed forces. If your disability claim has not been approved by the time you close on your loan, you might not be able to get the funding for you waived. However, if you can show proof that the claim was approved later, and you can show that the disability was sustained before you closed on your house, you might be able to get your funding fee refunded to you.

VA Funding Fee vs Private Mortgage Insurance

You may have heard that if you put less than 20 percent down on your house, you might be required to pay private mortgage insurance, also known as PMI. Some people believe that the VA funding fee is simply VA loan private mortgage insurance or VA loan mortgage insurance. But, in reality, that is not the case.

First, when you pay your VA funding fee, you have to pay it all at closing. With mortgage insurance, you typically pay a monthly premium, similar to other insurance policies. Even though the VA funding fee is designed to keep the mortgage program sustainable, which is also the purpose of traditional mortgage insurance, it is not identical to traditional mortgage insurance.

A few important differences to note include:

- With a conventional loan, you are required to pay monthly if your down payment is less than 20 percent.

- If you decide to take out an FHA loan, you are required to pay monthly mortgage insurance as well. This includes an upfront mortgage insurance payment and a monthly premium.

Therefore, you need to understand exactly what type of insurance you are paying, how often you have to pay it, and how much you need to pay. The process can be confusing, and that is why you need to reach out to a professional who has an in-depth understanding of VA loan rates and insurance premiums. We can help you with that.

Explore VA Loans Available From Griffin Funding

If you are interested in applying for a VA loan, consider working with a professional who can help you find the right loan to meet your needs. At Griffin Funding, we have plenty of loan options available, whether you’re looking for a VA loan, a traditional mortgage, or a Non-QM mortgage. We understand that everyone comes from a slightly different background, and it would be our pleasure to help you find the right loan package for your upcoming real estate purchase.

Apply for a VA loan with our team today. We can help you qualify for competitive interest rates, get to the closing table at a time that is convenient for you, and finance the home of your dreams. Reach out to us today to start the process.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

Conventional Loan Limits in 2025

If you plan to purchase or refinance a home in the coming year, understanding the conventional loan limits in ...

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...

Mortgage Refinance Limits

Your Refinancing Options Most owners have several refinancing pathways depending on their financial goals and ...