VA Home Loan Rules on Selling: What You Need to Know

Are you a veteran or service member who used a VA loan to purchase your home? If so, you may be curious about how the VA mortgage will affect your home-selling process. Don’t worry, as it is not that much different from any other type of real estate transaction.

To help answer all your questions and provide some insight into what to expect when selling with VA loans, we will go through some of the most important points you need to keep in mind below.

KEY TAKEAWAYS

- If your house has a VA purchase loan attached to it, you’re still welcome to sell it at any time.

- The VA home loan rules on selling require you to use a specific VA loan appraiser if you decide to sell your house.

- You should try to recover enough money to pay off the balance of the loan, as you might run into some challenges if you want to complete a short sale.

VA Home Loan Rules on Selling

When it comes to VA-guaranteed mortgages, there’s no need to worry about how long you have to stay in the home before selling. And with no prepayment penalties attached, you can go ahead and list the house whenever it feels right.

However, there are some other rules that you should be aware of–particularly those concerning Minimum Property Requirements (MPR).

Meet Minimum Property Requirements

The US Department of Veterans Affairs sets out MPRs in order to guarantee a property’s safety, soundness, and sanitation, so here’s what you must know:

- Space Requirements: Every home must have adequate living space, sleeping areas, cooking, and dining areas. They also need to have enough bathrooms for everyone in the home.

- Access And Encroachments: The property should be accessible via public roads or an HOA-managed private street that has a permanent easement.

- Hazards: The home has to be free from potential hazards, such as lead, asbestos, and radon gas contamination.

- Water Supply, Sanitary Facilities, And Sewage Disposal: There should be consistent access to clean, potable drinking water, safe plumbing, and proper sewage drainage.

- Utilities: All You Need To Know: The house must have proper access to an HVAC system, electricity, and gas that are both safe and reliable. There has to be a reliable source of heat during the winter as well.

- Home Structure Matters: The roof must still have at least three years of life left on it. Not only should your roof be resilient enough against moisture, but it should also free from any immediate maintenance needs. The house must also be free from mold and mildew, which can be found anywhere but are frequently found in basements and crawl areas.

- Pest Control & Deterioration Checkup: The inspection team will also look for any potential deterioration due to termites or pests. This includes dry rot, which could lead to major structural issues within the home if not taken care of quickly.

This is just a brief overview of some of the minimum property requirements that have to be met before the house can be sold.

You may want to work with an expert who can help you identify and address these issues before you put your house on the market, as you do not want them to impact any potential sale that might be pending.

Pass VA Appraisal

When it comes to selling your house, you’ve got a lot on your plate with a VA appraisal vs. home inspection. One of the most important steps is getting a VA appraisal and understanding what it means for you.

A VA appraisal assesses the fair market value of your home and gives lenders an idea of how much collateral they have should something go wrong down the line. But there’s more than just money at stake; appraisers also make sure that all safety, sanitation, and property standards are met so that veterans won’t be put in harm’s way.

The VA appraiser will take a look at many of the factors listed above, but they also focus on the overall value of your house compared to a potential loan.

Keep in mind that a VA appraiser is not a home inspector. A home inspection is likely to be more thorough, as they will look at everything. A VA appraiser looks at the value of the home and some of the minimum criteria listed above.

Other Things to Know When Selling with a VA Home Loan

For veterans and service members, the VA entitlement offers a financial guarantee from the Department of Veterans Affairs that promises to cover part of your mortgage if you ever default on it. Your VA entitlement amount is determined by your specific situation and eligibility requirements.

If you’re applying for a VA loan benefit for the first time, then you may be eligible to borrow up to your full entitlement without a down payment required.

However, if you have already used this benefit in the past and now need another one, there may not be much of your original allotment left. In these cases, borrowers must apply for an increase or “restoration” of their entitlement before they can get approved again.

Re-Establishing Your VA Entitlement

If you’re a veteran and your entitlement is running low, don’t worry, as it’s possible to restore what you had before. Here are three steps that can help get the job done:

- Sell Your Original Property & Repay Your Current VA Loan: You can sell the original property and pay back any outstanding balance on your current VA loan in full. This will give you a fresh slate for restoring your entitlement.

- Invoke Qualifying Veteran Assumption: If another qualified Veteran wants to assume your existing loan and substitute their entitlement for yours, this could be an ideal solution for both of you involved. However, make sure all qualifications are met beforehand so there aren’t any surprises down the road.

- Refinance into Non-VA Product & Use “One-Time Restoration of Entitlement”: You could also refinance your existing loan into a loan package that is non-VA related while also invoking “one-time restoration of entitlement.” An expert can help you make this process happen.

The easiest option is to sell your existing home, pay off your mortgage, and restore your entitlement that way. We can work with you to make this happen.

Wait Time for Selling a Home with a VA Loan

If you want to sell your house with a VA loan, there is no required amount of time that you have to wait. You are welcome to sell your house whenever you want, but it is generally a good idea to make sure you can make enough money from the sale to pay off the remaining balance of your mortgage.

Don’t forget to consider VA loan closing costs as well.

What Is the Process of Selling a Home to a VA Loan Buyer?

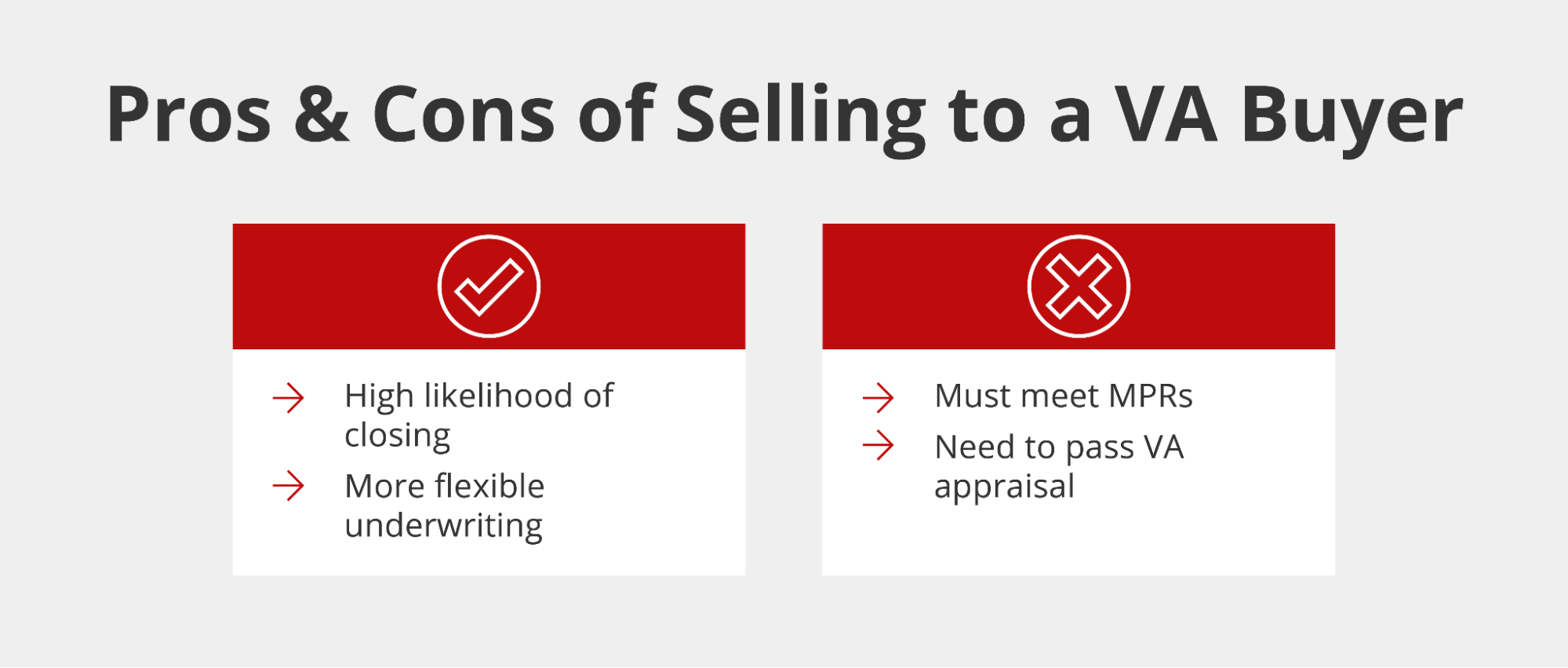

If you have a VA loan and you would like to sell your house, the process of selling it is generally the same as it is with a conventional mortgage, aside from the VA home loan requirements for sellers that we covered above.

You need to take a look at the local market to figure out how much your house is worth. Then, you need to put your house up for sale and wait for offers to come in.

It’s generally a good idea to work with a professional real estate agent who can help you review your offers and make sure you select the best one for your specific financial situation.

Talk to a Lender for Help with Buying & Selling with VA Loan

Are you thinking about selling your house? Do you still have a VA loan attached to it? If so, you need to work with a professional who can help you compare VA loans vs. conventional loans. At Griffin Funding, we pride ourselves on our extensive knowledge of VA home loans, and it would be our pleasure to work with you to help take the next step in buying a new home once you sell.

Request a quote online or contact us today at 855-698-1230 to speak to a loan specialist who can help you get approved for a home loan. We make home-buying for veterans the best experience possible.

Interested in learning more?

Get StartedFrequently Asked Questions

Does it take longer to sell to a buyer with a VA loan?

What are the benefits of selling to a VA loan buyer?

However, every situation is different and depends largely on the buyer.

Can I get another VA loan before I sell my house?

Recent Posts

Bonus Depreciation for Real Estate: What It Is & How It Works

Understanding the concept of bonus depreciation and its practical application can help you capitalize on this ...

No Doc Business Loans: What You Need to Know

While “no doc” is short for “no documentation,” there are actually no true no doc loans. Instead, they...

BRRRR Method: Buy, Rehab, Rent, Refinance, & Repeat

Read on to learn more about BRRRR loans and explore how this approach can open doors to lucrative opportunitie...