VA Forbearance Guidelines: What You Need to Know

Many homeowners have been facing hardship over the last few years related to the pandemic, which has caused severe impacts on their finances, particularly in making mortgage payments. To aid them, the CARES Act was introduced, extending relief to a broad spectrum of homeowners, even those possessing VA loans.

Below, we’ll delve into the guidelines concerning VA loan forbearance and what you need to bear in mind while contemplating this choice.

For those who have served in the military and are currently experiencing financial difficulties as a result of the pandemic or unforeseen events, VA loan forbearance is an extremely beneficial choice. Temporarily ceasing mortgage payments, forbearance enables borrowers to concentrate on attaining financial equilibrium without additional concerns.

Familiarizing yourself with VA loan forbearance guidelines, conditions for eligibility, and potential effects on your loan, can direct you in determining whether this alternative is suitable for you.

Delving deep into the world of VA loan forbearance, we present an all-encompassing guide that covers essential points like the benefits of VA loans, limitations, how to apply, eligibility requisites, and noteworthy aspects. Our aim is to equip you with the crucial information that you need to make an informed decision that aligns with your financial standing.

KEY TAKEAWAYS

- VA loan forbearance is a temporary pause in mortgage payments for those experiencing financial hardship.

- The deadline for CARES Act forbearance has been extended to July 30th, 2023.

- VA loan borrowers experiencing financial difficulties due to COVID-19 or other reasons may be eligible for forbearance.

- Missed payments during forbearance are not forgiven but paused, and borrowers must work with their lenders to develop a repayment plan.

- VA loan borrowers can refinance their loans even while in forbearance.

- VA forbearance rules should not impact credit or borrower standing as long as repayment agreements are followed.

What Is VA Loan Forbearance?

VA loan forbearance is an opportunity for homeowners with VA loans facing financial hardship to ease some pressure on themselves. It provides you with the ability to take a break from making monthly mortgage payments without penalty or repercussions.

This also gives borrowers who have experienced job loss, reduced income, or other economic struggles the chance to refinance–with a VA streamline refinance or cash-out refinance–while still in forbearance, unlike conventional, FHA, and USDA loans.

However, it’s important to note that there are some VA forbearance refinance guidelines that need to be followed, and we can help with that.

When Is the Deadline for CARES Act Forbearance?

The original deadline set by the CARES Act was December 31st, 2020 but has since been extended multiple times due to prolonged economic challenges caused by COVID-19.

Currently, eligible borrowers can apply up until July 30th, 2023 giving them plenty of time to find relief through temporary mortgage payment suspension and explore long-term strategies for stabilizing their finances.

Who Is Eligible for Forbearance?

If you’re a veteran experiencing financial hardship due to job loss, reduced income, or any other circumstance, you may be eligible for relief under the VA forbearance refinance guidelines.

The purpose of this program is to provide assistance and support during difficult times so that veterans can maintain their home ownership without having to worry about making payments they might not be able to afford right now.

How to Request Forbearance for a VA Loan

The first step in requesting a forbearance on your VA loan is getting in touch with your lender and explaining why you need help. Your lender will work with you directly on creating an agreement that outlines the terms of the forbearance period, such as:

- How long it will last

- If there are options for extensions available

- What plan needs to be implemented when it comes time for repayment of missed payments down the road

To ensure everything runs smoothly throughout this process, communication between both parties should remain open at all times.

Forbearance Period

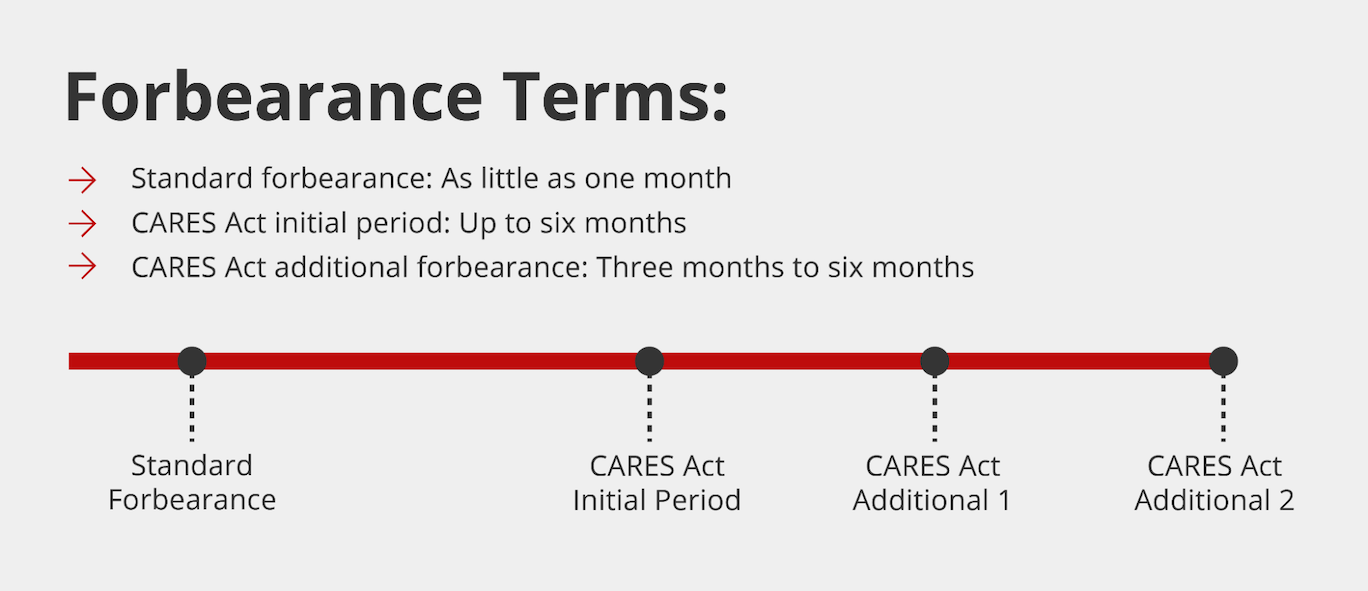

Have you been struggling to make mortgage payments? VA loans offer a valuable source of temporary financial relief in the form of forbearance. For up to 180 days, your monthly mortgage payments are put on pause, giving you some much-needed breathing room.

Plus, if needed, you can request an extension for another 180 days from your lender. Just keep in mind that interest will still accrue during this period, which could increase the overall cost of your loan down the line.

Missed Payments

But what about all those missed payments during forbearance? Don’t panic. You won’t be expected to pay it back immediately after the timeframe is over; instead, talk to your lender about setting up a repayment plan that works best for both parties involved, like spreading out or deferring costs until later on down the road when finances may have improved significantly.

Resuming Payments

You will work with your lender to come up with a repayment plan that considers your financial situation. The terms of repayment and when they are resumed will vary by lender, but generally, it should be favorable for both parties.

Refinancing VA Loans

VA loan holders who are currently in forbearance may also be able to refinance, including a cash-out refinance, if they made six consecutive payments before entering forbearance status. Refinancing is an excellent way for borrowers to possibly lower interest rates or change the terms of their loans.

Both of these are key aspects that could help them manage financially during this difficult period. It’s essential for borrowers considering this option to understand the guidelines related to VA forbearance and seek out expert advice from knowledgeable lenders.

Impact of Forbearance

While taking advantage of this option can provide much-needed financial relief during tough times, there are certain steps you must take in order to ensure that everything goes smoothly throughout the process. Be sure to talk with your lender about how this might impact your credit score.

Pros & Cons of VA Loan Forbearance

When considering whether or not entering into VA loan forbearance is right for you, it’s essential to weigh up both the pros and cons.

On the one hand, taking advantage of this avenue could give you some breathing space with regard to your mortgage payments. But, on the other hand, there may be consequences down the line if all terms aren’t adhered to.

Pros:

- It allows borrowers an opportunity for a temporary financial reprieve from mortgage payments without penalty.

- It can help keep defaulting off your record by avoiding foreclosure.

- Easy access is provided through lenders who work with Veterans Affairs (VA) loans.

Cons:

- Any missed payments will need to be paid back eventually, which could lead to further debt after the forbearance period ends.

- Interest continues accruing even while in forbearance, increasing the overall loan balance.

- Potentially extends the length of the loan depending on the repayment plan agreed upon between lender & borrower.

- Could potentially negatively impact your credit score and ability to use credit

Your Options Once the VA Loan Forbearance Deadline Passes

While the application deadline for CARES Act forbearance has been extended until the end of July 2023, this isn’t the only option if you’re struggling to keep up with your mortgage. Beyond the deadline for CARES Act forbearance, there are steps you can take to find financial relief. Some options for VA loan borrowers include:

- VA streamline refinance loan (IRRRL): A VA IRRRL allows those with an existing VA loan to refinance their mortgage relatively quickly. Using a VA IRRRL, you can potentially lower your rate, modify the terms of your loan, or even switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage.

- Work with a VA loan technician: If you’re experiencing difficulties with a VA loan, consider connecting with a VA loan technician. The VA can connect servicemembers with loan technicians who will walk you through various options based on your unique situation. From sorting out a repayment plan to arranging a short sale, a VA loan technician can provide much-needed support.

- Repayment plan: If you’ve missed some mortgage payments, contact your lender to see whether you can work out a repayment plan. Typically, a repayment plan will require you to continue making monthly mortgage payments with an additional amount added on each month to gradually repay the payments you missed.

- Loan modification: You can work with your lender to get a loan modification, which lets you add missed mortgage payments and related fees to your loan balance. The term of your loan is then extended and a new payment schedule is drafted to adjust for the missed payments.

Contact Griffin Funding for More About VA Loan Forbearance

VA loan forbearance could be a lifeline for borrowers experiencing financial difficulties. However, it’s crucial to understand the terms and conditions and develop a realistic repayment plan with your lender.

If you have further questions or need assistance navigating VA loan forbearance, consider reaching out to Griffin Funding for expert advice and support. Or, if you need to refinance, we can help you get approved for a VA loan. Call 855-698-1230 to get started.

Interested in learning more?

Get StartedFrequently Asked Questions

Does forbearance affect the maturity date of your VA loan?

However, it’s important that you talk through all possible scenarios with your lender and understand how they will impact both short-term and long-term goals related to paying off the debt.

What other circumstances qualify you for forbearance?

It's essential to discuss your situation with your lender in order to determine if forbearance is right for you since they will have their own criteria when it comes to granting assistance. Make sure to have all documentation ready before going into this meeting so they can assess the best option possible.

Will forbearance help you avoid foreclosure?

Working out a repayment plan with the lender and sticking to it will help avoid foreclosure down the line. Proactivity in addressing financial issues is key. By reaching out quickly and knowing exactly what kind of help might work best in these circumstances, you could avoid the worst circumstances of missing mortgage payments.

Recent Posts

Bonus Depreciation for Real Estate: What It Is & How It Works

Understanding the concept of bonus depreciation and its practical application can help you capitalize on this ...

No Doc Business Loans: What You Need to Know

While “no doc” is short for “no documentation,” there are actually no true no doc loans. Instead, they...

BRRRR Method: Buy, Rehab, Rent, Refinance, & Repeat

Read on to learn more about BRRRR loans and explore how this approach can open doors to lucrative opportunitie...