What Is a VA Statement of Service?

KEY TAKEAWAYS

- The VA loan statement of service is a letter written by your commanding officer (CO), which lenders use to verify your employment with the military and income.

- Not every VA loan borrower needs to provide their lender with a statement of service, but you’ll likely need one if you’re currently employed by the military.

- Since the statement of service is completed by your CO, you should request it as soon as possible to streamline the VA loan application process.

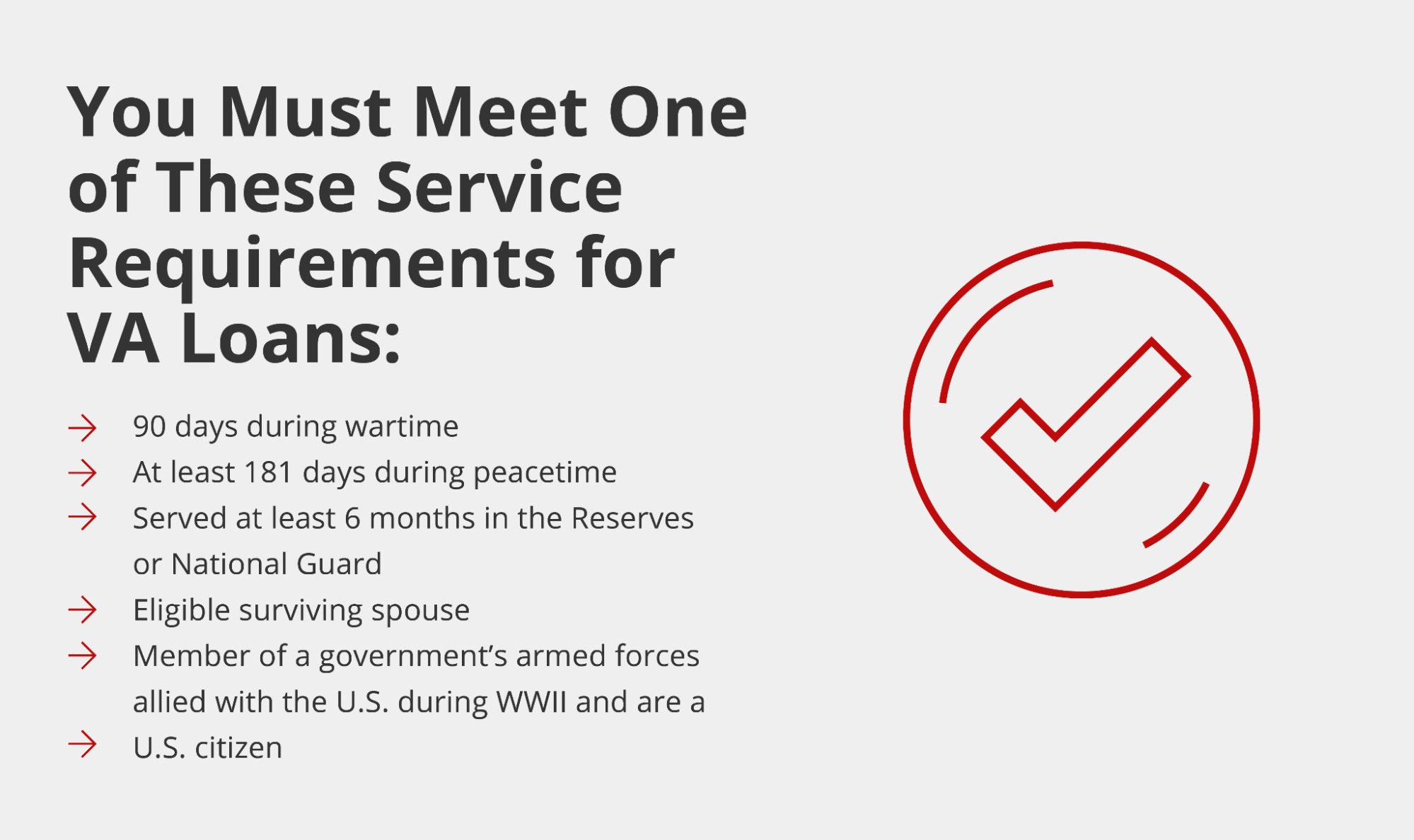

Eligible veterans, active duty service members, and surviving spouses may be eligible for a VA loan, with benefits like no down payment requirements, lower credit scores accepted, and less stringent lending criteria.

VA loans are guaranteed by the US Department of Veterans Affairs (VA), which reduces risk to lenders. In addition, since the VA guarantees 25% of the loan, the lender is free to create their own lending requirements, which are often more flexible than other loan programs. That said, there’s a lot of paperwork involved with VA loans.

To ensure you’re eligible and earn enough to cover the cost of your mortgage, you’ll need to provide your lender with a VA loan statement of service. But what is a statement of service for a VA loan, and how can you get one? Keep reading to learn more about this important document.

KEY TAKEAWAYS

- The VA loan statement of service is a letter written by your commanding officer (CO), which lenders use to verify your employment with the military and income.

- Not every VA loan borrower needs to provide their lender with a statement of service, but you’ll likely need one if you’re currently employed by the military.

- Since the statement of service is completed by your CO, you should request it as soon as possible to streamline the VA loan application process.

What Is a VA Statement of Service?

A VA loan statement of service is a letter that verifies your current or past employment in the military and acts as proof of income if you’re still in the military. This letter includes financial information about a borrower, such as the dates of service, pay rate, and discharge type, and is necessary for anyone applying for a VA loan.

The statement of service for a VA loan is used for income verification purposes. All home loans require the lender to verify your income to ensure you earn enough to afford to pay your monthly mortgage bill.

With other types of loans like conventional mortgages, lenders review W-2s, pay stubs, and tax returns to verify your income. However, with VA loans, they use a statement of service to fully understand your financial information and employment history.

If you’re retired from the military, you likely won’t need to submit a VA statement of service to the lender. Instead, your discharge paperwork may serve as sufficient evidence. Check with your lender to determine what’s needed from you.

A statement of service for a VA loan is required only in certain situations; not all borrowers applying for VA loans need them. Depending on your unique situation, your lender can help you determine if a statement of service is required.

If your lender requires a statement of service, you’ll have to request one from your commanding officer (CO).

Is the Statement of Service the Same as a COE?

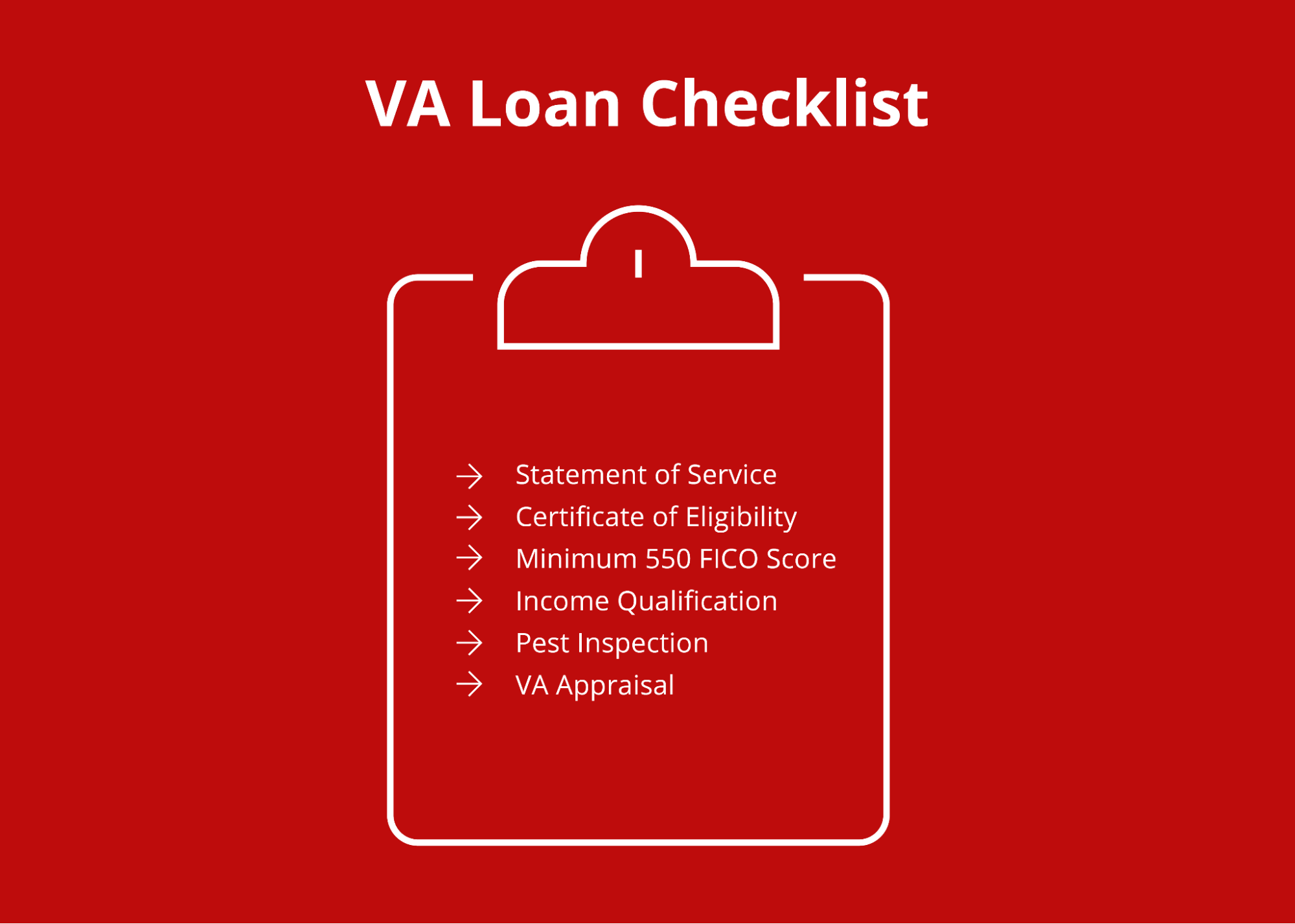

When you apply for a VA loan, your lender might request various documents from you, including your statement of service and Certificate of Eligibility (COE). These are two different documents, but they both help lenders determine if you’re eligible for the VA loan.

The COE tells lenders you’re eligible for a VA loan based on your service. Every VA loan borrower, whether on active duty or retired, will need to provide their lender with a COE.

On the other hand, the statement of service letter is meant to serve as income verification, telling lenders that you’re employed by the military. Therefore, it’s more of a supplemental document used with your COE to determine VA loan eligibility and ensure lenders that you have employment and a steady source of income.

Unlike the COE, the VA loan statement of service doesn’t state eligibility information. Therefore, this document is not a substitute for your COE because only your CEO can tell lenders that you’ve met the VA’s minimum service requirements.

What Should a Statement of Service Include?

The VA and lenders don’t set specific guidelines for formats you must use for the statement of service. However, it must be on official letterhead and signed by your CO. Additionally, the statement of service letter should include various types of information that verify your employment with the military, such as:

- Name

- Social Security Number

- Date of birth

- Branch you served/are serving

- Rank

- Active duty dates

- Time lost

- Pay rate

- Type of discharge, if applicable

- Return to service eligibility status

Is There a Standard Form for a VA Statement of Service?

Unfortunately, there is no standard form for a VA loan statement of service. Instead, it’s a document filled out by your commanding officer with information that verifies your employment. At the bare minimum, your statement of service letter for a VA loan should include any details pertaining to your service, such as dates of active duty, date of separation, current deployment details, and rank. However, it may also be helpful to lenders to see your pay rate.

You can also talk to your lender to find out what information they’re looking for on your statement of service to streamline the process. Since your CO is responsible for creating this document, you don’t want to leave any important information out because receiving your statement of service could take weeks or months.

Do You Always Need a VA Statement of Service?

Not every VA loan borrower needs a statement of service. In most cases, you’ll only need a statement of service if you’re still employed by the military.

As we’ve mentioned, the statement of service is supplemental for lenders and helps them understand your current employment situation and how much you earn from the military. As such, you likely don’t need this document if you’re no longer in the military and are employed elsewhere.

If you’ve been retired for many years and are just now taking advantage of your VA loan benefit, your lender will verify your new employment and income.

If you’re still in the military, lenders want to see guaranteed income for 12 months. However, if you’re retired from the military, they’ll look at the past two years of your employment. Therefore, if you retired from the military two years ago, your lender probably won’t request your statement of service because you’ve had other employment in the last two years.

Finally, it’s important to note that you need your VA loan statement of service any time you apply for a VA loan if you’re still employed by the military, including refinancing. Therefore, if you’re applying for a VA streamline refinance, or VA cash-out refinance, the lender will need to verify your employment and income again to determine if you qualify.

How to Get a VA Statement of Service

Unlike other VA loan documents like your COE, you can’t request your statement of service online; there’s no database for lenders to find it for you. Instead, you must go directly to your commanding officer, who will create the document on your behalf.

Since your commanding officer is likely very busy, you should contact them as soon as you decide you want to try using your VA home loan benefit. The earlier you ask your CO to complete the letter, the faster you can get it.

Unfortunately, there’s no way to make the process go faster because it depends on your CO and how much time they have to spend on it. However, now that you know the essential information required, you can create a template for your CO to help streamline the process for them.

If your CO doesn’t know how to create a statement of service, you can work directly with your lender to determine the information they need to provide in the letter.

Apply for a VA Loan with Griffin Funding

A statement of service is required for active duty service members looking to use their VA loan benefit. Unfortunately, this part of the process can take weeks or months, depending on your commanding officer’s available time. Therefore, it’s always best to request your statement of service from your CO as soon as you decide to purchase a home using your VA loan benefit, giving them as much time as possible to complete the letter.

If your CO has never completed a statement of service letter, we can help you ensure it contains all the information we need to verify your income and employment. Ready to begin the process of buying a home? Apply for a VA loan with Griffin Funding today.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Who Completes the VA Statement of Service?

You can discuss the required paperwork with your lender to determine whether you need a statement of service and ensure you give your CO enough time to complete it if necessary.

How Long Does It Take to Get a Statement of Service?

What Are the Other Eligibility Requirements for VA Loans?

Once your lender has determined that you're eligible for the VA loan, you'll have to meet their lending requirements, which include employment history, income, minimum credit score, and debt-to-income (DTI) ratio.

Recent Posts

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...

Mortgage Refinance Limits

Your Refinancing Options Most owners have several refinancing pathways depending on their financial goals and ...

Pros and Cons of FHA Loans

What Is an FHA Loan? An FHA loan is a mortgage insured by the Federal Housing Administration, a division of th...