What Is the Minimum Credit Score for VA Loans?

KEY TAKEAWAYS

- The VA does not set a minimum credit score requirement, but most lenders look for a score of at least 580. At Griffin Funding, you can qualify for a VA loan with a credit score as low as 500.

- A higher credit score can help you secure a better VA loan interest rate and easier approval.

- It’s possible to qualify for a VA loan without a traditional credit score through manual underwriting using alternative credit sources.

- Maintaining healthy credit habits, like paying bills on time and managing credit utilization, can strengthen your chances of VA loan approval.

If you’re thinking about using a VA loan to buy a home, you might be wondering what kind of credit score you’ll need to qualify. While VA loans offer flexible requirements, lenders still look at your credit to determine eligibility.

The United States Department of Veterans Affairs provides a valuable home loan benefit to current service members, veterans, and eligible surviving spouses. VA loans are often easier to secure because the approval criteria and lending qualifications tend to be less restrictive than other available types of mortgage loans.

One of the most important things to consider before applying for a VA loan is your credit score. A high credit score can lead to a low interest rate, while a poor credit score can lead to higher interest rates or even the rejection of your application. Read on to learn what the minimum credit score is for a VA loan and explore other VA loan qualification requirements.

KEY TAKEAWAYS

- The VA does not set a minimum credit score requirement, but most lenders look for a score of at least 580. At Griffin Funding, you can qualify for a VA loan with a credit score as low as 500.

- A higher credit score can help you secure a better VA loan interest rate and easier approval.

- It’s possible to qualify for a VA loan without a traditional credit score through manual underwriting using alternative credit sources.

- Maintaining healthy credit habits, like paying bills on time and managing credit utilization, can strengthen your chances of VA loan approval.

What Is the Minimum Credit Score You Need for a VA Loan?

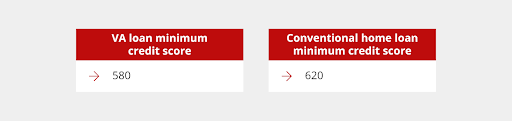

Because each mortgage lender approved by the VA has the authority to set a minimum VA loan credit score for its VA mortgages, the minimum credit score for VA loan options will vary.

Griffin Funding’s minimum credit score for VA loan borrowers is generally 580. However, under certain circumstances, there may be instances where Griffin Funding accepts a minimum credit score for a VA loan as low as 500.

Can You Qualify for a VA Home Loan With Bad Credit?

As noted above, approved VA lenders have the authority to set their own credit score and underwriting benchmarks for VA mortgage loan approvals. In fact, because of this flexibility, eligible VA home loan borrowers can secure financing where there was once no other option. This is because the VA home financing program is designed to accommodate as many potential military buyers as possible.

At the same time, if you’re eligible for VA financing and have a higher credit score, you will likely be eligible to secure a mortgage with improved rates and terms. When seeking specific financial guidance regarding VA home loans, it is best to speak with a mortgage specialist who can evaluate your loan scenario.

How to Improve Your Credit Score for a VA Loan

Your credit score is a numerical value that represents your creditworthiness—or, in other words, the likelihood that you will pay back your debts. Your credit score is calculated by analyzing a variety of factors, such as how often you pay back debts on time and how many lines of credit you have open.

But, because the information on a credit report is updated regularly, your corresponding score will change, usually as a function of changing patterns over time. As a result, you should view your credit score as something that is dynamic or fluid, with the potential to change based on your behavior and finances.

Before applying for a VA home loan—or any type of mortgage—you should try to get your credit score as high as possible. Raising your credit score may take time, but it’s worth it in the end. A higher credit score will allow you to access better VA loan rates, higher loan amounts, and more advantageous loan terms.

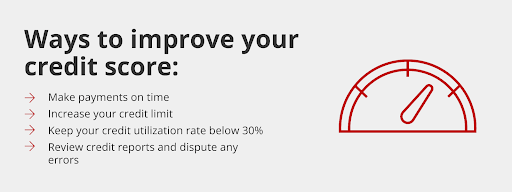

Consider these proven techniques to improve your credit score:

- Manage open credit lines carefully: Keep balances below 30% of your credit limit to optimize your credit utilization rate, which plays a major role in maintaining a healthy credit score.

- Always make payments on time: Consistently paying bills when they are due helps build a strong credit history and protects your credit score from avoidable damage.

- Avoid cosigning loans: Even if your intentions are good, cosigning a loan puts your credit at risk. You lose control over payments, and if the borrower falls behind, your credit profile—and future financial opportunities—could suffer.

- Limit new credit applications and inquiries: Each hard inquiry can temporarily lower your credit score. If you’re applying for a mortgage, it’s best to wait until your loan closes before opening any new credit accounts.

- Stay proactive with your credit management: Review your credit report annually. The Consumer Financial Protection Bureau recommends requesting your free reports from all three major credit bureaus once a year. If you spot any errors, challenge them promptly to prevent unnecessary damage to your score.

As you prepare to apply for financing, try using the above methods to raise your credit score for a VA loan. A credit score of 740 and above can have a significant impact on the interest rate and loan terms you qualify for.

Who Qualifies for a VA Loan?

There are a few requirements one needs to meet in order to qualify for a VA loan. Some of the main requirements are as follows:

- A borrower must meet minimum service requirements for the VA loan program.

- A borrower must live in the property as an owner-occupied property. Investment properties are not eligible.

- A borrower must meet the VA-approved lender’s underwriting requirements.

The Certificate of Eligibility (COE)

Potential borrowers must obtain a Certificate Of Eligibility (COE) from the VA to qualify for a VA-backed loan. While there are several VA-backed loan eligibility requirements, the biggest hurdle is the minimum service requirement that must be met. To obtain a COE, you must meet the following service requirements:

- A borrower has completed a minimum of 90 days of active-duty service.

- A borrower has at least six years of service in the Reserves or National Guard.

- A borrower has served at least 181 days of active-duty service during peacetime.

- A borrower has 90 days of service accumulated under Title 10 or Title 32. With regard to Title 32 service, a minimum of the 30 required days must be consecutive.

In 2020, the Department of Veterans Affairs no longer imposed loan caps or limits for those borrowers who otherwise qualified for a mortgage. This was the first time VA-qualified borrowers had the option to apply for any size loan with zero down. Of course, borrowers must meet the VA’s typical underwriting qualifications with regard to affordability.

Why Apply for a VA Loan?

VA loans are an excellent option for veterans and other eligible borrowers, especially those with low credit scores. In fact, when compared to other loan types, VA loans tend to have the lowest minimum credit score criteria, along with a variety of other benefits for borrowers.

The main benefits of a VA loan include the following:

- No down payment required: VA loans typically do not require a down payment, making homeownership more accessible. However, keep in mind that those with partial entitlement or a poor financial profile may be required to provide a down payment.

- Competitive mortgage interest rates: VA loans often offer lower interest rates compared to conventional loans, helping borrowers save significantly over the life of the loan.

- Reduced closing costs: Closing costs are generally lower with VA loans, and lenders, sellers, or third parties can cover some or all of these fees, reducing the upfront cost for the buyer.

- No need for private mortgage insurance (PMI): Unlike many conventional loans, VA loans eliminate the requirement for PMI, helping borrowers save on monthly expenses.

- VA loan benefits are reusable: Eligible borrowers can use their VA loan benefit multiple times throughout their life, as long as they meet the qualification requirements each time.

- No loan limits with full entitlement: If you have full VA loan entitlement, there are no loan lending limits, giving you more flexibility when purchasing a home.

- No prepayment penalty: You can pay off your VA loan early without facing any prepayment penalties or fees, providing more freedom to manage your finances.

VA loans also offer flexibility in how they can be used. If you are eligible for a VA home loan, this potential funding can be used to:

- Buy a single-family home or townhouse.

- Buy a multi-family home with up to 4 units.

- Buy a condo in a VA-approved condominium project.

- Buy a home and improve or renovate the property.

- Buy a manufactured home and the lot on which it sits.

- Build a new home.

- Make changes or add new features to make the home more energy efficient.

See if You Qualify for a VA Home Loan

If eligible, a VA loan is an excellent option for any home buyer who may want to purchase a home without a down payment. Also, buyers can meet VA loan requirements with a credit score that’s less than perfect. To learn more about your VA home loan options based on your credit score, reach out to a mortgage expert at Griffin Funding online or call us at 855-698-1230.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Will having a higher credit score get me a better VA loan rate?

What is the minimum credit score required to assume a VA loan?

At Griffin Funding, we can work with VA loan borrowers with credit scores as low as 500, but keep in mind that a higher credit score will lead to better rates and terms.

Can I get a VA loan with no credit score?

Recent Posts

How Does a Recession Affect the Housing Market?

What Happens to the Housing Market During a Recession? A recession sends shockwaves through the economy. Compa...

Conventional Loan Limits in 2025

If you plan to purchase or refinance a home in the coming year, understanding the conventional loan limits in ...

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...