Debt Service Coverage Ratio (DSCR) Loan: Use Rental Income to Qualify for Investment Properties.

A DSCR loan allows real estate investors to secure financing based on the rental income of a property rather than their personal income. If you cannot qualify for a conventional loan, DSCR loans are a great option. Without having to submit tax returns and W-2s, you can secure capital to invest in rental properties with a DSCR loan. Answer a few quick questions to get started on your journey in investing in rental property with a DSCR loan today.

Table of Contents

Qualify for a home loan without using your tax returns with a DSCR loan program. As a real estate investor, you can avoid high rates and high points of private loans, lengthy approval processes, and strict lending criteria with a debt service coverage ratio loan, which is a type of no-income loan. Qualify for a loan based on your property’s cash flow, not your income.

Securing a debt service coverage ratio loan can help you expand your investment portfolio easier than ever before. Read on to learn more about what a DSCR loan is, how it works, and DSCR loan requirements.

KEY TAKEAWAYS

- The debt service coverage ratio (DSCR) is a number that measures a property’s current rental income compared to its debt obligations. A DSCR above 1.0 indicates positive cash flow, while a DSCR below 1.0 indicates negative cash flow.

- A DSCR loan allows a borrower to qualify for financing based on the projected rental income of a property rather than personal income.

- DSCR loans are designed for real estate investors and can only be used to purchase income-generating properties. DSCR loans can’t be used to buy a primary residence or a fixer-upper.

Think you qualify for a loan? Contact us today to find out!

Contact UsWhat Is the Debt Service Coverage Ratio (DSCR)?

The debt service coverage ratio measures a property’s annual gross rental income against its annual mortgage debt, including principal, interest, taxes, insurance, and HOA (if applicable). Lenders use DSCR to analyze how much of a loan can be supported by the income coming from the property and to determine how much income coverage there will be at a specific loan amount. When calculating DSCR, lenders do not take into account expenses such as:

- Management

- Maintenance

- Utilities

- Vacancy rate

- Repairs

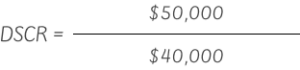

DSCR Formula Calculation

The debt service coverage ratio measures a property’s annual gross rental income against its annual mortgage debt, including principal, interest, taxes, insurance, and HOA (if applicable). Lenders use DSCR to analyze how much of a loan can be supported by the income coming from the property and to determine how much income coverage there will be at a specific loan amount.

How to Calculate DSCR

To calculate your debt service coverage ratio, follow the steps below:

Step 1

To find your gross rental income, we take your annual rental income based on your lease agreement and the appraiser’s comparable rent schedule (form 1007) and use the lesser of the two. In some cases, if you can prove a twelve-month history of LTR or STR rental income, you can qualify off that rather than the appraiser’s market rent.

Step 2

Next, you’ll need to find your annual debt. Your annual debt for loan qualification purposes equals the total annual principal, interest, taxes, insurance, and HOA (if applicable) payments. Annual Debt = Total Annual PITI payments.

Step 3

Next, you’ll divide your annual gross rental income by your annual debt for your ratio. DSCR = Annual gross rental income/Annual debt.

Example of Debt Service Coverage Ratio Calculation

A real estate investor might be looking at a property with a gross rental income of $50,000 and an annual debt of $40,000. When you divide $50,000 by $40,000, you get a DSCR of 1.25, which means that the property generates 25% more income than what is necessary to repay the loan. This also means that there is a positive cash flow in the lender’s eye.

How to Improve Your DSCR

Improving your DSCR before applying for a loan can increase your chances of approval and the amount you qualify for. Here’s how you can optimize your DSCR to make yourself more qualified when applying:

Increase rental income:

Boost your rental income by optimizing your property’s occupancy rates, increasing rental rates in line with market trends, or offering additional services or amenities to attract more tenants. Minimize vacancies by implementing effective marketing strategies, maintaining properties in good condition to attract and retain tenants, and quickly addressing tenant concerns or issues.

Refinance existing loans:

Explore opportunities to refinance existing loans at lower interest rates with longer repayment terms and consider adding an interest-only feature. Refinancing your existing mortgage reduces your monthly debt service obligations and improves your DSCR.

Increase property value:

Invest in property upgrades or renovations to increase its market value, allowing you to command higher rental rates and improve your overall financial position. Upgrades can also help attract tenants, helping you increase your rental income by reducing vacancies.

Manage your expenses:

Implement cost-saving measures like energy-efficient upgrades, outsourcing maintenance services, or renegotiating vendor contracts to reduce operating expenses. The lender does not consider expenses when calculating your DSCR but this will help you improve your overall cash flow.

“If they want to increase their DSCR ratio, investors should consider looking into two to four unit properties. With single family residences, especially if you’re looking at purchase prices over $400,000, meeting the 1:1 ratio can be difficult with 20% down. From my experience, if we’re looking at two, three, and especially four unit properties, those multiple unit properties will DSCR and cash flow a lot better than single family residences. So, if you’re looking at purchase prices over $400,000 and you want to keep your down payment lower, look at the multi-family units.”

Ryles Murray, a Senior Loan Officer at Griffin Funding with 5 years of experience in financial services.

Think you qualify for a loan? Contact us today to find out!

Get StartedWhat Are DSCR Loans?

DSCR loans can serve as a great tool for real estate investors who are looking for a no-income verification mortgage loan. Below, we go into more detail about what a DSCR mortgage is, how it works, and how you can qualify for this type of financing.

What Is a DSCR Loan?

A DSCR loan is one of several types of home loans referred to as Non-QM loans. Non-QM loans provide potential borrowers with an alternative route to financing, which doesn’t require traditional income verification methods. A DSCR loan, in particular, makes it easier to show rental income that might not show up on your taxes due to deductions for legitimate business expenses.

A DSCR loan is a strong Non-QM loan for real estate investors. Lenders can use a DSCR to help qualify real estate investors for a loan because it can easily determine the borrower’s ability to repay without verifying personal income.

When it comes to Non-QM mortgages, DSCR loans are one of the most popular options among all borrowers. In fact, between 2018 and February 2023, DSCR loans accounted for approximately half of the 201,000 Non-QM loans rated by S&P Global.

A DSCR loan enables real estate investors to get a loan because it takes into account cash flow from investment properties rather than pay stubs or W-2s, which many investors do not typically have. Lenders use DSCR to evaluate a borrower’s ability to make monthly loan payments.

Deductions from properties may lower taxable income, making it hard for investors to prove their true income. Lenders use DSCR to determine whether someone can make loan repayments. Otherwise, many investors might struggle to meet the basic eligibility standards for real estate loans.

Since they don’t require pay stubs or tax returns showing minimum income levels, debt service coverage ratio loans are a great alternative for investors who claim many write-offs and business deductions.

Think you qualify for a loan? Contact us today to find out!

Get StartedHow Does a DSCR Loan Work?

Real estate investors are continuing to seize opportunities in the U.S. housing market. Investor purchases of U.S. homes accounted for 16% of the market in the third quarter of 2024. As 2025 unfolds, the outlook remains bright for those investing in the right markets, as emerging trends and strategic opportunities pave the way for growth and success. However, getting the right type of mortgage financing is not always easy as a real estate investor.

Because real estate investors write off expenses on their properties, some may not qualify for a conventional loan. The debt service coverage ratio loan allows these individuals to qualify more easily because they don’t require proof of income via tax returns or pay stubs, which investors either don’t have or don’t represent their true income due to write-offs and business deductions.

Real estate investors looking for home buying tips should consider a DSCR loan because it’s ideal for properties you intend to rent out or otherwise turn into income-generating properties. From renting to a long-term tenant or operating a short-term rental business on Airbnb, there are many situations where a DSCR loan is a good option, especially if you don’t have W-2 income.

Some of the property types you can use a DSCR loan for include:

- Single Family Residences (SFR), including single-family homes, condos, and townhomes.

- Multifamily properties (2-10 Units).

- Rural (acreage limitations apply, and the property’s income must be supported by comparable rents in the area).

Many real estate investors tend to use DSCR loans for rental income properties that allow them to open up new revenue streams. If you’re interested in purchasing or building a property and unsure about whether you can use a DSCR loan to do so, reach out to Griffin Funding. We can help you decide whether a DSCR loan is right for you.

Types of DSCR Loans

We offer the following types of DSCR loans:

- DSCR purchase loans: New and experienced real estate investors can use a DSCR purchase loan to buy a rental property with no proof of income needed. Start or expand your real estate portfolio by applying for a DSCR purchase loan, which allows you to qualify using a property’s rental income. We can fund DSCR loans for borrowers with a DSCR of less than 1.0 and a credit score as low as 620. Qualified borrowers can access up to $20,000,000 in financing.

- DSCR home equity loans: Tap into the equity of your investment property with a DSCR home equity loan (HELOAN). This investor-focused mortgage solution makes it possible for real estate investors to access their equity without touching their first mortgage. Access up to $500,000 in financing and qualify with a DSCR as low as 1.0.

- DSCR cash-out refinance loans: A DSCR cash-out refinance loan allows investors to leverage their equity to access large sums. Investors can qualify for a DSCR cash-out refinance with a DSCR of less than 1.0. Qualified borrowers can borrow up to 75% of the property’s appraised value and get a loan amount of up to $5,000,000 with a DSCR cash-out refinance.

Both a DSCR home equity loan and DSCR cash-out refinance allow investors to tap into their equity and get large upfront sums. You can use the cash from either to expand your investment portfolio, consolidate debt, fund upgrades and renovations, cover business expenses, and much more.

Keep in mind that while DSCR HELOANs allow you to avoid touching your first mortgage, DSCR cash-out refinance loans offer higher loan amounts, lower rates, and more flexible qualifying requirements.

Why Does DSCR Matter?

The debt service coverage ratio provides the lender with a metric that helps them gauge a borrower’s ability to pay off their DSCR mortgage. Lenders must forecast how much a real estate property can rent for so that they can predict a property’s rental value.

If you have a DSCR of less than 1.0, it means that a property has the potential for negative cash flow. DSCR loans can still be made on properties with a ratio below 1.0, however these are usually purchase loans with home improvements, upgrades, or remodeling to be made to increase the monthly rent or for homes with high equity and potential for higher rents in the future. You also can potentially get the property above a 1.0 ratio with a DSCR interest-only loan. Keep in mind that for DSCR loans that we fund, the average property has a DSCR of 1.05.

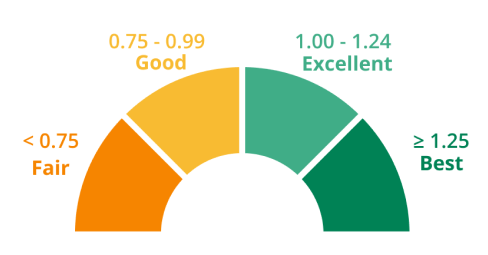

What Is a Good DSCR Ratio?

Many lenders will require a 1.25 DSCR to qualify for a DSCR mortgage loan. However, Griffin Funding allows real estate investors to qualify for a loan with a DSCR of less than .75.

Please note that borrowers with a good DSCR ratio can secure more beneficial rates and terms on their loans with fewer requirements. Interest rates are best on DSCR ratios of 1.25 or above, while a DSCR ratio of less than .75 requires more down payment/equity and more reserves to offset the negative cashflow. For example, a DSCR that is 1.00 or higher on a loan of $1,000,000 or less requires a 20% down payment, a 700 credit score, and 3 months of reserves. Whereas a DSCR that is less than 1.00 on a loan of $1,000,000 or less requires a 25-30% down payment, a 700 credit score, and 6-12 months of reserves. Real estate investors can increase the DSCR by choosing an interest-only loan and/or a 40-year term to maximize cash flow.

If you have a DSCR of less than 1.0, it means that a property has the potential for negative cash flow. DSCR loans can still be made on properties with a ratio below 1.0, however these are usually purchase loans with home improvements, upgrades, or remodeling to be made to increase the monthly rent or for homes with high equity and potential for higher rents in the future. You also can potentially get the property above a 1.0 ratio with a DSCR interest-only loan. Keep in mind that for DSCR loans that we fund, the average property has a DSCR of 1.05.

DSCR Loan Requirements

DSCR loans have specific requirements that borrowers must meet to secure this type of loan. The key DSCR loan requirements include:

- Minimum credit score of 620: Borrowers’ credit histories and financial stability are evaluated, although credit requirements can vary depending on the lender and specific loan terms. Borrowers who take out a DSCR loan with Griffin Funding have an average credit score of 732, but we can work with borrowers with credit scores as low as 620.

- Minimum loan amount of $100,000: DSCR loans offer loan amounts ranging from $100,000 to $20,000,000, providing a flexible financing option for properties that range in cost.

- Appraisal: An appraisal is conducted to determine the property’s current market value and rental income.

- Property type: DSCR loans can only be used for investment properties that generate rental income. The property you are purchasing or refinancing must be a non-owner-occupied, income-producing investment property used for business purposes. DSCR loans cannot be used on primary residences.

Think you qualify for a loan? Contact us today to find out!

Get StartedToday’s DSCR Loan Rates

Griffin Funding offers both fixed and adjustable-rate DSCR mortgages with no balloon payments. DSCR fixed rates are offered on 40-year, 30-year, and 15-year terms. DSCR adjustable rates are provided on 10-year, 7-year, 5-year, 1-year, and 6-month adjustment periods. All DSCR programs have the option for full amortization or interest-only payments upon approval.

Where We Offer DSCR Loans

Griffin Funding offers DSCR loans in 45 states (plus the District of Columbia) to help real estate investors find an investment property in their ideal location.

Regulations and terms related to DSCR loans can vary based on the region you’re buying in. Consulting with an experienced DSCR lender can help ensure that your transaction goes smoothly. Griffin Funding offers DSCR loans in all 50 states and DC.

![]()

Pros, Cons, and Other Considerations

When considering any type of financing options, it’s essential to weigh the benefits and drawbacks and take any special considerations into account. In the sections below, we go through the pros and cons of DSCR loans, lay out the situations when a DSCR loan may not be ideal, and discuss the unexpected elements that can arise from this type of financing.

Pros and Cons of DSCR Loans

As you determine whether a DSCR loan is right for you, it’s important to weigh the pros and cons. Below, we go into more detail about the benefits of DSCR loans, as well as some of the drawbacks.

Pros |

|---|

Accessibility Accessibility |

Streamlined approval process Streamlined approval process |

Unlimited cash-out Unlimited cash-out |

No limit on the number of properties No limit on the number of properties |

All types of rentals are eligible All types of rentals are eligible |

Borrower in an LLC Borrower in an LLC |

Jumbo DSCR loans Jumbo DSCR loans |

Flexible qualifying requirements Flexible qualifying requirements |

Cons |

|---|

Large down payments Large down payments |

Higher interest rates Higher interest rates |

Limited financing Limited financing |

For rentals only For rentals only |

Vacancies Vacancies |

Prepayment penalties Prepayment penalties |

No Fixer-Uppers No Fixer-Uppers |

Unique Properties Unique Properties |

Benefits of DSCR loans

DSCR loans are often easier to qualify for and offer a streamlined approval process because there’s no personal income or job history requirement. Advantages of DSCR loans include the following:

- Accessibility: Your eligibility for a DSCR loan is determined by a single figure: your DSCR. Since lenders don’t consider personal finances, they’re more accessible to all types of borrowers, including novice and veteran investors.

- Streamlined approval process: DSCR loans typically have a streamlined application and approval process, offering faster closing times than other types of investment loans. Since you don’t have to submit personal financial information, the application and underwriting process is straightforward, and approvals are typically much faster.

- Unlimited cash-out: DSCR loans offer unlimited cash-in-hand, which means you can continue taking out money when needed to cover expenses like repairs.

- No limit on the number of properties: DSCR loans allow investors to purchase multiple properties simultaneously. With traditional loans, borrowers are limited by the number of properties they finance. However, with DSCR loans, investors can purchase as many properties as they want to build their portfolios. DSCR loans can also have a multiplier effect. For instance, you can qualify for a loan with one property then once it gains enough equity you can refinance it and use the cash to purchase an additional rental property.

- All types of rentals are eligible: DSCR loans can be used for all types of rentals, such as short—and long-term rentals and various properties, including single—and multi-family homes. Rural properties with limited acres and supporting rental comps are permitted.

- Borrower in an LLC: A limited liability company (LLC) can be used to purchase investment properties for business purposes. Taking out the DSCR loan in the name of an LLC helps protect your personal assets, and if structured properly, the loan will not be reported to your personal credit report. There can be multiple members in the LLC, and not all members need to personally guarantee the loan. DSCR LLC mortgage loans are perfect for real estate syndications. Syndicators can raise money from investors, pool the funds for down payments, purchase investment properties, and use DSCR mortgage loans to finance them. In addition to its ability to be held by an LLC, a DSCR loan can also be held in a revocable trust.

- Jumbo DSCR loans: Jumbo DSCR loans are ideal for real estate investors who focus on investing in high-end luxury properties. At Griffin Funding, we offer jumbo DSCR loans of up to $20,000,000.

- Flexible qualifying requirements: DSCR loans aren’t subject to the strict requirements that conventional loan products must follow, and this allows for more flexibility when it comes to qualifying. Lenders may be able to look past a lower credit score or down payment if there are other compensating factors or if they are presented with a great loan opportunity.

“A DSCR loan is low doc. When you’re applying for a conventional loan, you’re going to be bombarded with a bunch of conditions and requests for income documentation, past employment history, verification of employment, and so on. The docs that are requested are just a lot heavier on a full doc loan, while a DSCR loan keeps the stress lighter on the client throughout the transaction.”

Ryles Murray, a Senior Loan Officer at Griffin Funding with 5 years of experience in financial services.

Think you qualify for a loan? Contact us today to find out!

Get StartedCons of DSCR loans

Unfortunately, like all types of loans, DSCR loans have some risks and drawbacks that may not make them suitable for every borrower. The cons of DSCR loans include the following:

- Large down payments: Most lenders require a large down payment of 20-40%, which may be higher than some conventional mortgages.

- Higher interest rates: DSCR rates are typically higher because these loans are riskier investments for the lender. Additionally, the lender can require you to pay higher fees; the higher your loan amount, the more those will cost.

- Limited financing: DSCR loans offer amounts from $100,000 minimum to $20,000,000 maximum. If you’re purchasing properties for under $100,000 or an expensive property in a luxury market for over $20,000,000, these loans might not be suitable for you.

- For rentals only: DSCR loans are for buy and hold rental properties only, so they can’t be used for a primary residence or to fix and flip a home. Instead, you can only use a DSCR loan for a property that generates cash flow. If you plan to flip a home, you’ll need another type of mortgage loan.

- Vacancies: It’s normal for rental properties to have vacancies every now and then. However, you’re not generating any cash flow if you have vacancies. Lenders don’t assess your ability to repay your mortgage if your property or units within the property are vacant, so you could end up getting deeper into debt if you’re not consistently generating cash flow. This does not mean that vacant properties do not qualify for DSCR financing; it means that there are additional restrictions and limitations on properties that are not occupied by a tenant.

- Prepayment penalties: Most DSCR loans come with a prepayment penalty ranging anywhere from one to five years. You will get a lower interest rate in most cases if you opt for a prepayment penalty, however there are many different kinds of prepayment penalties so make sure to discuss the details with your loan officer. DSCR loans are available without pre-payment penalties, and pre-payment penalties can be bought out.

- No Fixer-Uppers: The property must be move-in ready for tenants and not in need of major repairs, renovations, or construction. DSCR loans are not for properties that need to be rehabbed. The appraiser cannot mark the appraisal “subject to”.

- Unique Properties: Unique properties, such as rural properties and those that can’t be compared to other like properties around the area, can be difficult to finance using a DSCR loan.

When Not to Use a DSCR Loan

While DSCR loans can be a helpful financing option for many real estate investors, there are certain scenarios in which using a DSCR loan may not be ideal. Here are some cases where a DSCR loan may not be the best choice:

- When purchasing a primary residence: DSCR loans are designed for investment properties rather than primary residences because the DSCR is calculated based on the rental income of the property. If you’re buying a home to live in yourself, you’d likely be better served by exploring traditional mortgage options tailored to owner-occupied properties.

- When you want to purchase distressed property/fix and flip a home: DSCR loans may not be suitable for purchasing distressed properties or for fix-and-flip projects where the intention is to quickly renovate and resell the property for a profit. In these cases, short-term financing options like hard money loans or bridge loans may be more appropriate due to their flexibility and faster funding times.

- When purchasing a property worth less than $100,000: DSCR loans are often more suitable for financing larger real estate investments with higher property values. For properties valued at less than $100,000, the transaction costs and underwriting requirements associated with DSCR loans may outweigh the benefits. In such cases, alternative financing options may be more practical.

Managing DSCR Loan Surprises

When applying for a DSCR loan, several unexpected elements or surprises may arise that you should be aware of, such as:

Prepayment Penalties

Prepayment penalties are fees lenders charge if you pay off your loan earlier than the agreed-upon term by either selling the home or refinancing the loan. The penalties are outlined in the loan agreement and can vary in terms of calculation method and amount. Below are some examples of common ways that prepayment penalties are structured:

- 3-2-1 prepayment structure: The most common type of prepayment penalty structure is a 3-2-1, or step-down, meaning it goes down from 3% to 2% to 1%. With the 3-2-1 structure, if you pay off the loan in year one, you’ll have a 3% prepayment penalty. In year two, you’ll have a 2% penalty, and in year three, you’ll have a 1% penalty. After that, you’ll have no penalty.

- 5-4-3-2-1 prepayment structure: There’s also a 5-4-3-2-1 structure, so your penalty can be anywhere from 1% to 5%, depending on whether you pay your mortgage off in the 1st year or 5th year.

- 6 months of interest: Depending on the number of years the prepayment penalty is structured, typically 1 to 5 years, you’ll have a penalty equal to 6 months of the interest portion of your mortgage payment if paid off before the prepayment period.

“You need to make sure that you figure out what kind of prepayment penalty is being put on the loan because, in many cases, that’s not disclosed. DSCR loans don’t follow federal disclosure guidelines, so you technically don’t need to disclose anything at all until the end. We like to be transparent, so we actually send you a regular loan estimate that looks like what you’re getting on a conventional loan. This way, you know what your fees are and what your prepayment penalty is. You also know we vetted it out versus the rental income, so that the loan has a much higher chance of closing where it starts rather than changing along the way.”

Guy Troxler, a Senior Loan Officer at Griffin Funding with 7 years of experience in the mortgage industry.

Prepayment penalties vary by lender, so it’s important to understand the terms of the loan to help you determine the right time to pay it off. Most DSCR borrowers hold onto their properties for much longer than 3 to 5 years, so this prepayment penalty is unlikely to affect them.

Hidden Fees

Review the loan agreement to identify any hidden fees or charges that may not have been clearly disclosed upfront. These fees could include things like:

- Loan origination fees

- Underwriting fees

- Administrative fees

Lenders may present these fees to you on a “term sheet” or a “loan estimate.” Many lenders opt to use a term sheet rather than a loan estimate, which makes it harder in some cases to understand the fees. DSCR loans are not qualified mortgages (QM) and, therefore, are not held to the same disclosure requirements as loans that fall under federal TRID rules.

Appraisal Issues

The lender will require a property appraisal as part of the loan process to determine its value. Unexpected appraisal issues, like lower-than-expected valuations of either the property’s value or the rental income, could impact loan eligibility or require additional money upfront from the borrower.

An appraisal coming in lower than expected for either value or rent can cause the most fallout, but it doesn’t have to. It is important to discuss your options upfront and be prepared with a plan B, which, in most cases, requires a larger down payment.

Market Conditions

Economic and market conditions can influence lending criteria and interest rates. Be prepared for potential changes in market conditions that may affect DSCR loan terms or availability of financing.

Think you qualify for a loan? Contact us today to find out!

Get StartedAlternatives to DSCR loans

DSCR loans can serve as a great tool for investors who are interested in securing real estate financing — however, if you decide a DSCR loan isn’t right for you or you don’t qualify, you still have options. Griffin Funding offers a range of mortgage options for investors to help you build your portfolio. A few alternatives to DSCR loans include the following:

- Private money loans: Private money loans, also known as hard money loans, provide borrowers with quick access to capital and relatively short loan terms. Take advantage of streamlined approval and funding timelines and get a bridge loan, construction loan, rescue purchase loan, long-term purchase loan, or refinance loan.

- Bank statement loans: Bank statement loans allow you to qualify for a real estate loan using alternative underwriting methods. Instead of sending us your pay stubs and W2s, we’ll review your bank statements to determine your eligibility.

- Asset-based loans: Asset-based loans allow you to qualify for a mortgage by converting your assets into income instead of using them as collateral. With asset-based loans, you can qualify using bank, investment, and retirement accounts.

- Jumbo loans: Jumbo loans are ideal for investors that need a higher loan amount with more flexible down payment and DTI requirements. These loans are best suited for high-income earners.

Engaging With DSCR Lenders

If you’re interested in securing a DSCR mortgage, it’s crucial to work with the right lender. Not only that, but it’s important to effectively communicate with your lender and come up with a strategy that will help you achieve your investment goals. Take a look at our list of questions to ask your DSCR mortgage lender as well as one of our client success stories, which speaks to the power of DSCR loans.

Questions to Ask Your DSCR Mortgage Lender

When considering a DSCR mortgage loan, it’s crucial to ask your lender the right questions to ensure you understand the terms and make an informed decision. Here are some essential questions to ask your DSCR mortgage lender:

What are the interest rate, loan terms, and fees?

Understand the interest rate on the loan, whether it’s fixed or adjustable, and how it will impact your monthly payments and overall cost of borrowing. Additionally, you should inquire about the duration of the loan, repayment schedule, and any prepayment penalties or balloon payments that may apply.

Ask about origination fees, discount points, closing costs, and any other fees associated with the loan to determine the total cost of borrowing.

What property types qualify?

Eligible property types can vary between lenders. Ask your lender about any restrictions on the types of properties that qualify for the loan, such as residential, commercial, rural, or multi-family properties.

Are you experienced with DSCR loans and working with investors?

Working with lenders experienced in DSCR loans is crucial because they understand the unique aspects of investment properties. Key features of experienced DSCR lenders include:

- Understanding investors’ needs to offer financing solutions that align with their investment strategies.

- Expertise in property analysis to determine their income potential and accurately calculate DSCRs, evaluate property cash flow projections, and determine loan eligibility based on property performance.

- A streamlined approval process because the lender understands the documentation requirements, underwriting criteria, and due diligence process for investment properties to facilitate efficient loan approval and funding.

- There should be multiple money sources that have an appetite for all types of DSCR Non-QM loans. The lender should not have one money source with one set of guidelines. Not all investment properties are equal; if the lender has access to funding from private equity, securitization, and large insurance companies, then your loan has a better chance of closing.

“When it comes to DSCR loans, a big misconception is the financing requirement. There’s a lot of videos online that will advertise no income doc loans or DSCR loans at 100% loan to value financing, but a big question would be down payment. The minimum down payment for the product is 20% and that’s if the borrower has a year of experience owning an investment property. If they don’t have any investment property experience, that would require an extra 5% down, which will be a total of 25% down.”

Ryles Murray, a Senior Loan Officer at Griffin Funding with 5 years of experience in financial services.

DSCR Loan Success Story

DSCR loans can provide investors with a lucrative opportunity when used effectively. Don’t just take our word for it — take a look at some of the ways in which DSCR loans have benefitted other real estate investors:

Meet Seth, a savvy real estate investor based in the vibrant market of Texas. Seth had a vision to expand his investment portfolio and maximize his returns, but he faced a common challenge among investors: limited liquidity. However, Seth was determined to overcome this obstacle and unlock the full potential of his investments.

In pursuit of his goals, Seth decided to explore the world of DSCR loans. This unique financial tool caught Seth’s attention, offering him the opportunity to leverage his existing assets and propel his investment journey forward.

With a strategic plan in mind, Seth identified one of his investment properties that he owned free and clear. He swiftly applied for a DSCR loan in Texas, utilizing the property as collateral to secure financing for his next move.

With the proceeds from the DSCR refinance, Seth executed a bold strategy and leveraged the funds to make a significant impact on his portfolio. Seth allocated the cash-out proceeds as a 20% down payment on not one, but three promising investment properties within the same year.

By strategically diversifying his investments across multiple properties, Seth not only expanded his real estate portfolio but also mitigated risk and enhanced his potential for long-term profitability.

Fast forward a decade, and the results speak for themselves. Seth’s investment strategy, powered by DSCR loans, have catapulted his net worth by over $600,000. What began as a single property owned outright has evolved into a thriving portfolio of income-generating assets, providing Seth with financial stability and freedom for years to come.

Sara J.

Sara J.

“Great team to work with from application through closing and afterwards for follow up needs. Very fast turnaround on rental property cash out mortgage. Have used them twice for this product and will again if I need to. Highly recommend for rental real estate investors!”

Applying for a DSCR Loan

As an experienced DSCR mortgage lender, Griffin Funding offers a streamlined application and approval process. Additionally, you’ll receive excellent support and customer service from our team of loan officers as you navigate the DSCR application process. Whether you’re interested in purchasing an investment property to attract long-term renters or you want to set up a short-term vacation rental business, read on to learn more about the basic steps involved in applying for a DSCR loan.

How to Apply for a DSCR Loan

To apply for a DSCR loan, the first step is finding a bank or lender with a robust DSCR loan program. Griffin Funding offers DSCR loans and has a history of qualifying borrowers at various income levels for small and large investment property loans.

Here’s an overview of how to apply for a DSCR loan with Griffin Funding:

| How to get a DSCR Loan |

|---|

| 1 Fill out a loan application |

| 2 Calculate your DSCR |

| 3 Lock in your interest rate |

| 4 Get approved |

| 5 Loan is funded |

- Fill out a loan application: Once you’ve chosen a reputable lender, it’s time to fill out a loan application. You can quickly apply for a DSCR loan through Griffin Funding using our online application, or you can call our office and have one of our Sr. Loan Officers fill out the application with you over the phone.

- Calculate your DSCR: Calculate the DSCR and fill out a rent schedule. The rent schedule validates the property’s fair market value, showing whether you can cover additional mortgage payments on a new property. Your DSCR will impact the interest rate that you qualify for.

- Lock in your interest rate: After calculating your DSCR and reviewing your application, we will offer you an interest rate for your loan. You can lock in this interest rate as we proceed through the final steps of the loan approval process.

- Get approved: Close the loan. You don’t need to bring proof of personal income or other information about your financial history. DSCR loan requirements are less stringent than traditional loans, making the closing go much faster.

- Loan is funded: Once the loan is approved, we will quickly fund it and deposit the loan amount into your escrow account.

Upon approval for our DSCR loan program, you’ll receive an estimate of the interest rate, closing costs, and monthly mortgage payments. Prepare to pay for an appraisal and undergo the underwriting process prior to signing the closing documents. The underwriting process includes credit report review, appraisal, rental income verification, title search, and a final underwriting decision.

“It’s a common misconception that a DSCR loan is just an easier way to get a loan than Fannie Mae and Freddie Mac. While we don’t look at direct income, there are still several qualification hurdles that aren’t widely discussed when you do a simple search online. With a DSCR loan, since we’re not looking at an individual’s income, we ideally want to see that a borrower has a history of managing residential real estate. Many times people think that by going with a DSCR loan, they don’t have to divulge the history of other properties they’ve owned and the past payment history on those, but that really just isn’t the case. We want to show that you have experience with managing investment properties, because this is essentially buying into a business with the way these loans are perceived by underwriting. One of the biggest stumbling blocks when going through underwriting is finding properties that are not scheduled within the application.”

Charles Toll, a Senior Loan Officer at Griffin Funding with 7 years of experience in the mortgage industry.

How to Get a DSCR Loan on a Short-Term Rental

DSCR loans aren’t just used to finance long-term rentals like business offices and apartment complexes; they can be used for short-term rentals like those listed on Airbnb and VRBO. Short-term vacation rentals are a $64 billion market in America, with each listing taking in an average of $26,024 each year. This represents a huge financial opportunity for real estate investors, especially for those looking to buy in areas that are highly desirable for vacations and tourism.

Short-term rentals are income-producing properties, making DSCR loans a perfect solution for investors who want to use the property’s rental income to qualify for the loan. Additionally, by securing a DSCR loan with favorable terms, investors can potentially lower their borrowing costs and improve cash flow from their STR properties.

Investors who already own STR properties can also refinance with a DSCR loan to lower their interest rates or access equity through a cash-out refinance. This can provide additional capital for property improvements, expansion, and other investment opportunities.

To qualify for a DSCR loan on a short-term rental property, you typically need to meet certain criteria, such as:

How to get a DSCR Loan on a Short Term Rental |

|---|

Minimum credit score of 700 Minimum credit score of 700 |

Minimum DSCR of 1.00 Minimum DSCR of 1.00 |

Minimum down payment of 25% for borrowers with at least 1 year of experiencing STRs Minimum down payment of 25% for borrowers with at least 1 year of experiencing STRs |

Minimum down payment of 30% for borrowers with less than 1 year of experience Minimum down payment of 30% for borrowers with less than 1 year of experience |

Projected annual revenue divided by 12 months to demonstrate sufficient income to cover debts Projected annual revenue divided by 12 months to demonstrate sufficient income to cover debts |

Occupancy rate exceeding 60% Occupancy rate exceeding 60% |

- Minimum credit score of 700

- Minimum DSCR of 1.00

- Minimum down payment of 25% for borrowers with at least 1 year of experiencing STRs

- Minimum down payment of 30% for borrowers with less than 1 year of experience

- Projected annual revenue divided by 12 months to demonstrate sufficient income to cover debts

- Occupancy rate exceeding 60%

“Between the creative financing options we offer, our ability to make some exceptions, and the flexible solutions we provide, we demonstrate a deep expertise when it comes to non-QM loans while providing personalized service and a commitment to the client’s success. Our long-term relationships with clients are built on trust and the mutual success of them closing on a loan. This leads to our clients having a little bit more financial freedom or being able to move into their dream home, where their kids all get a bedroom. So we are always dedicated to helping these clients achieve those financial objectives.”

Colby Freer, a Senior Mortgage Consultant with 10 years of experience at Griffin Funding.

Apply for a Non-QM Investment Property Loan

Begin or continue building your real estate investment portfolio without the need for a hard money private loan. Our DSCR loans are an excellent mortgage option for new and seasoned investors to help you build your portfolio without mortgage challenges standing in your way. Whether you are a first-time investor or an experienced investor investing in a long-term rental property or a short-term vacation rental, our DSCR loans have you covered. Capitalize on current DSCR loan rates and start building your rental property portfolio.

Want to learn more about our non-QM loans before applying? Get started online, contact us, or online or call us at 855-698-1098 to speak to one of our experienced loan specialists.

Unique DSCR Loan Programs You Won’t Find Elsewhere

At Griffin Funding, we don’t just offer standard DSCR loans—we provide specialized DSCR loan solutions designed to serve real estate investors with unique financial profiles and investment strategies. These exclusive options are rarely available through traditional lenders or online mortgage providers, giving you a competitive edge in growing your real estate portfolio.

DSCR No Ratio Loans up to 75% LTV

Many lenders shy away from DSCR loans where the rental income doesn’t cover the mortgage payment, but Griffin Funding offers No Ratio DSCR loans up to 75% LTV with a 700+ FICO and up to $1 million loan amounts. This option is ideal for investors focused on long-term appreciation or high-end properties with value-add potential.

15% Down DSCR Loans with High Credit

For investors with excellent credit, we offer DSCR loans with only 15% down (85% LTV) for loan amounts up to $1 million when you have a 740+ credit score. Preserve capital for your next investment while still locking in competitive rates and favorable terms.

DSCR Qualification Using Rental Income Plus Assets

Our innovative DSCR calculation goes beyond rental income alone. You can now qualify using monthly qualifying income calculated from both rental income and eligible assets – DSCR/Asset hybrid loan. For example, $60,000 in eligible assets can count as $1,000/month in additional income—helping you meet DSCR requirements more easily. A DSCR/Asset hybrid loan is a game-changer for investors with significant liquid assets or those transitioning between income sources.

No Cash-Out Seasoning Requirements

Griffin Funding allows cash-out refinances with no seasoning period—even on recently purchased or recently listed properties.

You can cash out based on today’s appraised value, not the original purchase price—even if you acquired the property just a few months ago.

This feature is ideal for investors who purchase below market at foreclosure auctions, wholesale deals, or renovate properties and want to recycle their capital quickly to move onto the next investment.

Boost your buying power, qualify creatively, and scale faster with DSCR investor loans that go far beyond conventional offerings. Whether you’re buying, refinancing, or cashing out, Griffin Funding gives you more ways to qualify, more flexibility, and less red tape.

Ready to explore some creative options? Apply now or schedule a strategy call today.

Other Non-QM Mortgage Products

DSCR Loan Calculator

Use our DSCR loan calculator to quickly estimate your debt service coverage ratio:

Frequently Asked Questions

DSCR Loan Definition

A DSCR loan is a measure of the gross rental income against the current debt obligations of an investment property. These loans are alternative mortgages used by real estate investors to qualify for financing based on the property’s income, without personal income verification.

The DSCR loan makes it possible to buy income properties for either short-term or long-term rentals. You can even purchase a secondary residence if you can prove it will generate sufficient income.

For example, you can maximize rental income on a permanent residence through seasonal rentals and short-term stays. Listing the property on Airbnb, renting out rooms to long-term tenants, or renting out portions of the property for events are all ways to generate income to meet your debt service requirement.

The DSCR measures your ability to repay a mortgage loan at a given point in time. A higher ratio indicates more cash flow and a higher likelihood of repaying a new mortgage loan. However, if you take on new debt or the rental income on your existing properties increases or decreases, it can change your debt service coverage ratio for the better or worse.

As your real estate portfolio grows, you will have higher or lower cash flow at various times. This makes it important to time your application for a DSCR loan wisely.

Interest rates will also affect your ability to repay a new loan. Higher interest rates increase monthly expenses and lower DSCR. Alternatively, lower interest rates can increase the DSCR.

DSCR Loan Requirements

It is possible to get a DSCR loan with as low as a 20% down payment. However, if you want to minimize your total interest payments, consider making a higher down payment, resulting in a lower monthly payment.

Down payments of less than 20% are not available on DSCR loans. However, you can purchase an investment property with as little as 15% down under a full documentation or bank statement loan.

DSCR loans do require decent credit scores. However, you can get a debt service coverage ratio loan with a score of 620 and above. Naturally, the higher your credit score, the better your interest rate and loan terms are likely to be.

No, DSCR loans are designed for investors and income-producing properties, not for primary residences. These loans are specifically structured to evaluate the property’s ability to generate income that can cover the debt service, making them only suitable for investment properties. If you’re looking to finance a primary residence, other mortgage options, such as traditional home loans, are better suited for that purpose.

DSCR loans differ from hard money loans in several ways. DSCR loans tend to have lower down payment requirements, discount points, and interest rates and are available at some local lenders, including Griffin Funding. Additionally, the loan terms are usually more favorable, which is a bonus if you need a longer loan term. Overall, DSCR loans tend to make a more attractive alternative to hard money loans for real estate investors.

PITIA stands for principal, interest, taxes, insurance, and association dues. It represents the total monthly cost of owning a property. For DSCR loans, lenders compare a property’s rental income to its PITIA to determine if the income generated is sufficient to cover the expenses. A higher DSCR means the property is more financially stable, thus making it easier to qualify for the loan.

Most DSCR loan programs do not allow gift funds for the down payment, as lenders prefer borrowers to use their own money to show financial stability and reduce risk. In some instances, DSCR loan lenders may allow for limited use of gift funds, but it ultimately depends on the DSCR loan terms and borrower profile. Always check with your lender to confirm whether gift funds are allowed for DSCR loans.

You can make an appointment with one of our loan specialists today to discuss any questions you may have regarding our DSCR loan program or any of our other loan types, such as VA loans or bank statement loans. We’ll do everything we can to smooth the way and help you gather the necessary information to apply for a debt service coverage ratio loan. You can either call us at 855-698-1098 or reach out to our team via our website for more information about DSCR loans and Non-QM loans in general.

DSCR Loan Use Cases

A DSCR loan is a good option for both novice and veteran real estate investors because it allows them to qualify based on rental income instead of personal income. If you’re new to real estate investing, a DSCR loan can help you get the financing you need for your first property, and if you’re a seasoned investor, it can help you get faster financing to help you grow your portfolio.

You can use a DSCR loan if you don’t have proof of income via traditional documentation such as W-2s, pay stubs, and tax returns. Additionally, investors who buy and hold rental properties often use DSCR loans to obtain funding for new investments.

However, keep in mind that no financing option is perfect. Since DSCR loans come with higher down payment requirements and interest rates, they’re not the ideal financing option for every investor.

Absolutely, DSCR loans are accessible to first-time investors. These loans provide an excellent opportunity for individuals looking to enter the world of real estate investing. They offer a flexible financing solution, especially for those who may not have an extensive investment portfolio.

If you’re a first-time investor interested in exploring the benefits of DSCR loans, reach out to Griffin Funding. Our experienced professionals can provide guidance, answer your questions, and help you determine whether this type of financing aligns with your investment goals and property aspirations.

At Griffin Funding, we understand that every investor’s journey is unique, and our experts are dedicated to assisting you in making informed financial decisions. If you’re considering a DSCR loan as a first-time investor, don’t hesitate to connect with our team to learn more and discover how this financing option can help you kickstart your real estate investment venture.

Yes, DSCR loans are commonly used to build rental property portfolios, as there is no limit on the number of properties you can buy with this type of financing. Since DSCR rental loan programs focus on the property’s rental income rather than personal income, they’re ideal for investors looking to scale. As long as you and the properties you’re financing are able to meet minimum DSCR qualification requirements, you can use DSCR rental loans repeatedly to grow your rental investment property portfolio.

Getting a DSCR Loan

Not all financial institutions offer debt service coverage ratio loans. However, you can get a DSCR loan at numerous banks, private lenders, and credit unions. These lenders offer DSCR loans to buy investment homes and properties, construct new properties, or renovate properties you already own.

If you’re looking to secure a DSCR loan, Griffin Funding is your trusted partner for reliable and tailored financing solutions. Here’s why you should choose us:

- Proven track record: With over $2 billion in loans funded, we have a demonstrated track record of successfully helping borrowers secure financing for their investments.

- Specialization in DSCR loans: Griffin Funding is the #1 direct-to-consumer DSCR lender in the country. Our expertise in this niche market ensures investors receive customized loan options that meet their unique needs.

- Excellent reputation: We have a solid reputation as evidenced by our A+ rating on Better Business Bureau (BBB) and our 100’s of 5-star reviews on Yelp and Google, reflecting our commitment to customer satisfaction, transparency, and professionalism.

Griffin Funding has been in business since 2013 and is the leader in direct-to-consumer DSCR lending across the country, with an A+ BBB rating and an excellent online reputation (evidenced by Google and Yelp reviews). Griffin offers flexible, common-sense underwriting and competitive terms/rates.

We will take the time to get to know you during the discovery meeting, and our DSCR loan specialists will help you during every step of the application and approval process.

“We have provided DSCR loan financing to hundreds of real estate investors across the country. Our goal is to help real estate investors finance over $500 million worth of investment properties in 2025 using DSCR loan financing. We look forward to serving you.” – Bill Lyons, President & CEO.

Your DSCR directly impacts your loan terms. A higher DSCR generally leads to better terms, such as lower interest rates and higher loan amounts, because the property presents less risk for the lender. A lower DSCR may lead to less beneficial terms, higher rates, or even a denied application, as it suggests the rental income isn’t strong enough to cover the property’s expenses.

Most DSCR loan lenders look for a DSCR of at least 1.0, but higher ratios often result in more favorable financing options. At Griffin Funding, we can work with borrowers who have negative debt service coverage ratios. Contact us today to explore your investment property financing options.

Yes, you can use our temporary buydown calculator to determine your monthly payments on a 2-1 or a 1-0 buydown. Temporary buydowns are becoming increasingly popular among real estate investors acquiring investment properties; however, permanent buydowns are still the most common.