How to Calculate ROI on a Rental Property

KEY TAKEAWAYS

- Calculating rental property return on investment can help you determine whether it’s the right investment for you while comparing it to other investment opportunities.

- Your ROI will depend on several factors, including whether you’ve paid in cash or taken out a mortgage.

- Mortgage loan amount, length, and interest rate can affect your ROI.

- There are several ways to calculate ROI on rental properties, but the most effective is to factor in your debt obligations and compare them to your net operating income.

Investing in rental property can help you grow your wealth, but it also comes with a different set of responsibilities than any other type of real estate investment. When you invest in rental properties, you’re responsible for everything from handling tenant issues and maintenance requests to calculating your return on investment (ROI) to ensure you make a profit.

Knowing how to calculate your ROI on a rental property can help you determine whether you need to increase your rental rates, decrease expenses, or both to help you grow your wealth over time. In addition, measuring ROI on a rental property will help you determine when it will become profitable.

So how do you calculate rental property ROI? There are several ways to measure your ROI for a rental property, so it’s crucial to determine which makes the most sense based on your needs. Keep reading to learn more about the common ways to measure rental property ROI.

KEY TAKEAWAYS

Return on Investment (ROI) Definition

Return on investment (ROI) is a percentage that tells you how profitable your rental property is based on its generated income through rent payments versus expenses like maintenance and your mortgage. Calculating your ROI can help you determine whether you should invest in a property in the first place or if a property you already own is generating enough income. Unfortunately, calculating ROI on a rental property can be challenging because there are so many financial factors you have to take into account, especially if you’re taking out a mortgage.

ROI Formula

The simplest way to calculate rental property ROI is to subtract your original investment cost from the total return on your investment. The formula looks like this:

This formula is how you’ll calculate your return on just about any investment, including stocks, rental properties, and even your primary residence after selling it. You can even use it to calculate ROI on homes you’ve purchased with conventional or VA loans. For example, if you purchase a house for $200,000 and sell it for $350,000, your net profit is $150,000 (350,000 – 200,000). Your ROI, calculated using the formula above, is 75% (net profit of 150,000 ÷ 200,000, then multiplied by 100 to give you a percentage).

When you purchase a rental property, there are more variables involved because you’re not reselling the property. Instead, you’re earning revenue by renting it to tenants, so your investment gains and costs may change monthly or over time. Some factors that can impact your rental property ROI include the following:

- Loan terms: Shorter loan terms and lower interest rates can increase your ROI.

- Vacancy rate: Vacancies cost money because they’re not generating income. The lower your vacancy rate, the higher your ROI.

- Repairs: Major repairs cost more than minor ones and lower your ROI.

Why Calculate ROI on a Rental Property?

Your ROI tells you how profitable your investments are, so calculating ROI on a rental property can help you determine whether you need to reduce costs or increase rent to help you reach your financial goals. Calculating your ROI is crucial if you already own investment property because it can determine your rental property’s profitability, helping you make crucial decisions that impact your financial health.

Additionally, you should calculate ROI on a rental property before purchasing one to ensure the property will be profitable for you. If you’re interested in purchasing a rental property, whether an apartment complex or a single-family home, you must determine whether it’s worth it. Your ROI is a figure that can help you decide whether you should purchase a particular property.

Calculating ROI on a rental property primarily helps the investor make an investment decision based on potential income and costs. Most lenders don’t require these financial figures to determine whether you qualify for an investment property loan. However, some types of loans may require other financial figures to determine your eligibility. For instance, debt service coverage ratio (DSCR) loans only consider your rental income and debt obligations, which can help decide whether or not you can afford the loan without factoring in other expenses.

With DSCR loans for rental properties, lenders don’t factor in your personal or operating income. Instead, they ensure your rental property can generate enough income — cash flow — to pay back your mortgage. While the DSCR calculation is not the same as the ROI calculation, it can help you ensure that there will be a good return on your investment. You can use our DSCR calculator to help you determine whether your rental property generates enough cash flow to repay your mortgage debt.

Metrics Needed to Calculate ROI on a Rental Property

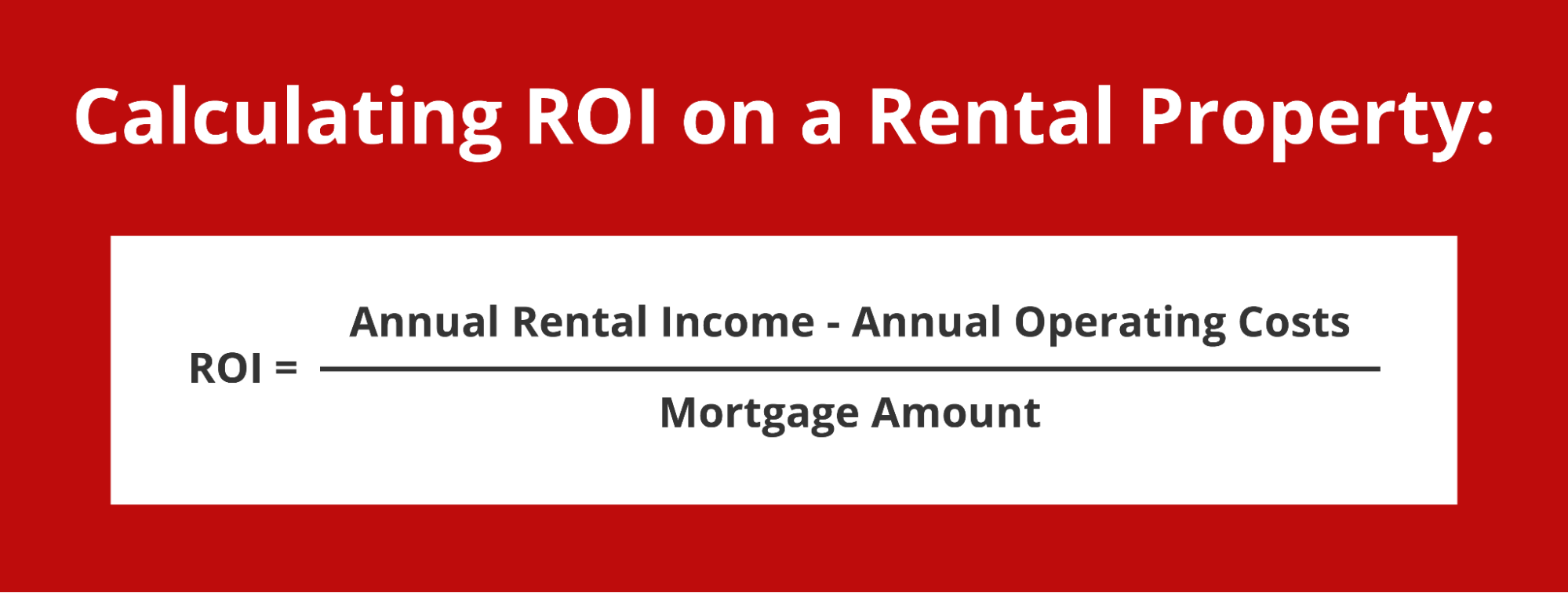

The simplest formula for calculating ROI on a rental property requires you to know your annual rental income, operating costs, and mortgage amount.

ROI on a rental property is more challenging to calculate than ROI on stocks or sellable investments because there are more variables involved, such as rental rates, vacancies, and maintenance costs. To accurately calculate your ROI on a rental property, you’ll need to gather the following metrics:

Cash flow (monthly/annual)

Cash flow is your investment property’s income after paying all operating expenses. For instance, let’s say your rental property is a single-family home generating $2,500 per month in rent. Your operating expenses may include maintenance costs, mortgage payments, property taxes, and various reserves, totaling around $750 per month. Your monthly cash flow would be $1,750 (2,500 – 750).

Purchase price

The purchase price is how much the investment property costs without factoring in your mortgage interest. You’ll need to know the purchase price for any real estate investment so lenders can determine whether you qualify for a particular loan amount based on factors like your down payment and credit score.

Knowing the purchase price can help you calculate your capitalization rate, also known as the cap rate, which is the estimated ROI of a rental property, which we’ll discuss in more detail later.

Operating expenses

Your operating expenses are the costs of maintaining the rental property. They can include everything from advertising to fill vacancies to the costs of vacancies themselves, working with a property management company, employees, maintenance, insurance, and property taxes. Your operating expenses don’t include the cost of your mortgage but may include any expenses related to your business of owning a rental property.

Rental income

Your net operating income (NOI) measures your rental income versus various expenses. However, unlike cash flow, it doesn’t factor in your mortgage debt but instead measures your revenue after various expenses.

If you’re currently vetting various properties, you probably don’t have an accurate rental income figure. However, you can review comparable properties in the neighborhood to help you determine a competitive and realistic rent price.

Estimating your rental income is crucial because it helps determine how much revenue a profit generates without factoring in debt obligations. You’ll also need to know this number if you apply for investment property loans to help lenders determine whether the rental property you want to purchase can generate enough income to repay your mortgage.

Initial investment

Before calculating ROI on a rental property, you must know how much the rental property will cost you initially. Your initial rental property investment includes items like down payment and closing costs, preparing for tenants, initial repairs, and any other costs associated with purchasing or readying the property before you start generating income.

How to Calculate ROI on a Rental Property: 4 Methods

The easiest way to calculate ROI on a rental property when you have a mortgage is to subtract your operating costs from your income to give your net profit. Then, you’ll divide your net profit by the mortgage amount to determine your true ROI. The formula looks like this:

However, since rental properties have so many financial variables, calculating ROI over time can be difficult. For instance, you might have considerably more repair costs in one month, reducing your ROI for that month.

Everything from your monthly operating expenses to the length of your mortgage can impact your ROI on a rental property, so it may be necessary to calculate your ROI in a few different ways to ensure you have the most accurate figures when comparing multiple rental properties. If you’re taking out a mortgage, you can also use a rental property ROI calculator to estimate cash flow, cash-on-cash yield, and internal rate of return.

Let’s take a look at the few most common ways to calculate ROI on a rental property.

Cash Flow

As mentioned, cash flow is your generated income after subtracting all your expenses. Cash flow ROI is calculated with the following formula.

Your operating expenses are any costs you pay to maintain the property, including property taxes and insurance, employee payroll, management companies, maintenance, and so forth. This rental property ROI calculation is typically used to help you determine whether to invest in a property before applying for a mortgage because it tells you how much you’ll earn before factoring in debt.

Of course, because it doesn’t factor in your mortgage, it’s not the most accurate and will only give you an accurate figure if you’ve invested using cash only. However, since most investors pay for rental properties with a mortgage, you may want a more accurate figure that accounts for your monthly mortgage premium.

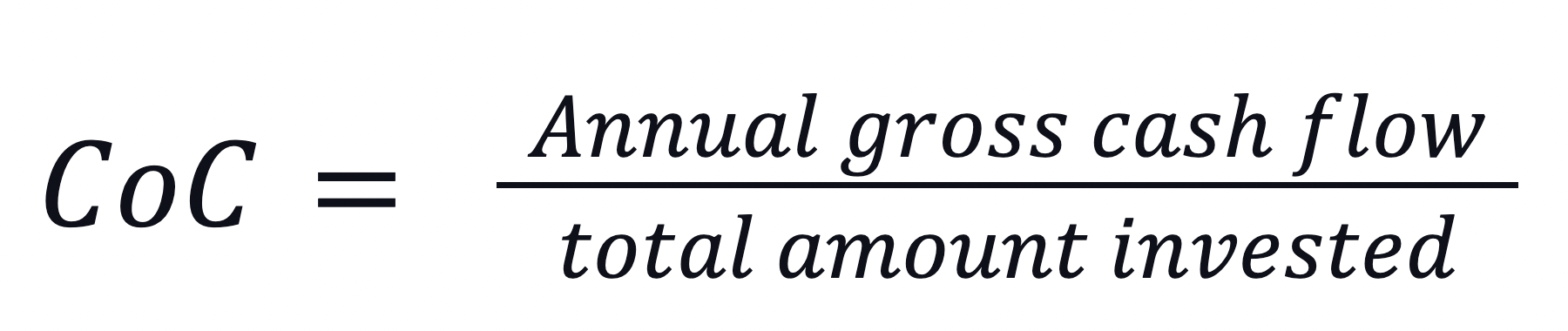

Cash-on-Cash Return

Cash-on-cash return (CoC) calculates the rental property’s annual cash flow based on the total amount invested in the property, comparing the amount generated to the cash invested during the same period. The formula looks like this:

Cash-on-cash return is not technically the same as ROI when considering debt because the cash return on the investment differs from the standard ROI. ROI calculates the total return, including the mortgage, while cash-on-cash return only measures the return of the invested cash rather than the total rate of return on the property.

Ultimately, cash-on-cash return doesn’t calculate the ROI as it relates to the property’s mortgage, so if you have a mortgage, it only considers your down payment and closing costs (cash out of pocket). As a result, the cash-on-cash return can be misleading without factoring in your annual mortgage payments because it doesn’t give you an accurate account of all your financial data.

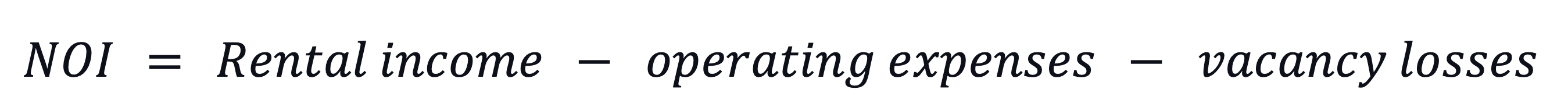

Net Operating Income

Net operating income (NOI) is calculated by subtracting operating expenses and vacancy losses from your rental income.

This method measures profitability based on operating expenses and vacancy; it doesn’t factor in your mortgage expenses if you’ve taken out a loan. NOI is typically used to compare multiple rental properties to determine the best investment, allowing you to choose the right option based on your potential return.

The most important metrics required to calculate NOI are your rental income and operating expenses. Your rental income may include rent, parking fees, laundry services, vending machines, application fees, etc.

Net operating income is not the same as gross operating income. The main difference is that your gross operating income doesn’t subtract operating costs or vacancy losses.

Cap Rate

Cap rate estimates your ROI by dividing your net operating income (rental income) by the purchase price. The formula for the cap rate is:

Cap rate gives you a percentage that reflects your estimated rate of return. The lower your percentage, the lower the overall investment risk but, the lower your return. Meanwhile, a higher cap rate means the potential for a higher return, but it carries more risk.

In addition, the cap rate doesn’t factor in your mortgage loan and looks only at the property’s purchase price, so it doesn’t consider any of the money you invested in fixing it up or renovating it.

Typically, cap rates are used to compare return rates when considering multiple rental properties to help you learn more about their potential performance. This measurement doesn’t provide a total return on your investment, but it can estimate how long it will take for a property to become profitable.

What Is a Good ROI for a Rental Property?

A good ROI for a rental property depends on various factors like location, property type, loan amount, rental income, vacancy rates, and the individual investor’s business goals. An ROI of 10% or more is generally considered good. However, it’s important to note that it may take time for an investment property to become profitable.

For instance, you might purchase a property and spend a year or more fixing it up in order to charge higher rent. Unfortunately, you don’t have any tenants during that year, so you’ll lose money. However, since fixing up your property enables you to increase rental rates when you have tenants, you’ll increase your potential ROI.

You should always calculate your potential ROI before purchasing an investment property to help you determine whether it’s worth it. Then, you should continue calculating your actual ROI on already-owned investment properties to ensure you’re generating the profit you’d like.

How to Improve Rental Property ROI

ROI is a measurement used to determine the profitability of your property investments; most lenders don’t require these calculations before approving you for a loan. So whether you apply for a bank statement loan or a DSCR loan, lenders will determine your ability to repay your debt obligations in various ways, but they won’t calculate your ROI.

Instead, you can use this figure to ensure you’re making the right choice to reach your financial goals and avoid purchasing a property that won’t generate a profit.

After purchasing a rental property, you should re-calculate your ROI regularly to ensure profitability. Remember, your ROI may change on a month-to-month basis because of various expenses and vacancies. Still, you can use your annual ROIs to determine when to sell the property and how much to keep investing in it.

After purchasing a rental property, the main goal should be to improve your ROI, which will increase your profits. Here are a few tips to increase your rental property ROI:

Set reasonable rental rates

You might think the best way to increase your rental property ROI is to increase rental rates. However, your rental rates should be reasonable and comparable to similar properties in the area. For instance, if the rent for comparable single-family homes in your area is $1,500 and you haven’t renovated to increase the home’s value, raising rental rates too high could deter potential tenants, leaving you with high vacancy rates that reduce your ROI or even cost you.

Keep up with maintenance

Maintenance on a rental is crucial because tenants have certain expectations and rights to live in a safe, habitable home. If your rental home is dangerous because you haven’t kept up with maintenance and repairs, tenants may have a legal right to back out of their lease agreement. Additionally, not keeping up with maintenance can deter prospective tenants, increasing your vacancy rates and lowering how much you can charge for rent.

Screen potential tenants

Screening potential tenants is crucial regardless of the type of rental property. Your tenants are responsible for your income; without their rent payments, your investment property will lose money. You want your tenants to pay rent on time and in full, follow the lease terms, and care for the rental property.

Screening tenants can help you ensure they earn enough income to pay rent every month and have a history of paying their bills and debts while allowing you to learn more about them by contacting previous landlords.

For instance, certain tenants might look great on paper but have a history of damaging apartments, paying rent late, or other things that don’t appear on a credit check or during income verification. Damage to your rental means spending more on fixing it, reducing your ROI. Meanwhile, a tenant that doesn’t pay rent means you’re losing money.

Start Expanding Your Real Intestate Investment Portfolio

Learning how to calculate ROI on a rental property can help you compare your investment options to find the right opportunity based on your financial goals. Using the various rental property ROI calculations discussed in this article can help you learn more about a property and how much you stand to profit from it.

Ready to expand your investment portfolio? Griffin Funding can help you find the right opportunity based on your financial goals and needs. Whether you’re interested in purchasing a single-family home, apartment complex, or commercial building, we have mortgage options for all types of investors. Talk to Griffin Funding today or apply for our investment property loans online.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

Conventional Loan Limits in 2025

If you plan to purchase or refinance a home in the coming year, understanding the conventional loan limits in ...

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...

Mortgage Refinance Limits

Your Refinancing Options Most owners have several refinancing pathways depending on their financial goals and ...