VA Loan Debt-to-Income Ratio Guidelines

KEY TAKEAWAYS

- VA loan debt-to-income (DTI) ratio requirements vary by lender, but most like to see a DTI of 41% or lower.

- Your DTI ratio can affect VA loan eligibility, making it crucial to understand your debt versus income.

- If you have a high DTI ratio, you may still qualify for a VA loan, but eligibility requirements vary by lender, so you may want to focus on paying off debt before applying.

In the last several decades, VA loans have helped military members, veterans, and their families achieve their dreams of homeownership. VA loans are backed by the US Department of Veterans Affairs and offered by private lenders, allowing eligible borrowers to take advantage of benefits like no down payment and lower credit score requirements.

Eligible veterans, service members, and surviving spouses must meet VA and lender requirements to take advantage of the VA loan benefit. With all types of home loans, two important factors lenders use to determine your loan eligibility are your income and debts.

Lenders compare how much of your income goes toward paying debts each month, also known as your debt-to-income (DTI) ratio, to determine whether you qualify for any type of home loan, including VA loans. The VA loan debt-to-income ratio requirement is comparable to conventional loans and is just one financial figure lenders use to determine your eligibility.

Keep reading to learn more about the ideal debt-to-income ratio for VA loans to help you determine whether you might qualify for a home loan.

KEY TAKEAWAYS

- VA loan debt-to-income (DTI) ratio requirements vary by lender, but most like to see a DTI of 41% or lower.

- Your DTI ratio can affect VA loan eligibility, making it crucial to understand your debt versus income.

- If you have a high DTI ratio, you may still qualify for a VA loan, but eligibility requirements vary by lender, so you may want to focus on paying off debt before applying.

What Does Debt-to-Income Ratio Mean?

The debt-to-income ratio for VA loans and other types of home loans is a percentage of your gross monthly income used to pay your debt obligations. The debt-to-income ratio for VA loans is just one of the many lending requirements you must meet to qualify for a loan.

The lender, not the VA, sets debt-to-income ratios for VA home loans. The VA has other qualifying criteria, but the borrower’s DTI ratio isn’t one of them. Since VA loans are offered by private lenders, they’re free to set their own criteria.

There are two types of debt-to-income ratios for VA loans; a lender might look at front-end and back-end DTI.

- Front-end DTI only considers your housing expenses like mortgage payments, insurance, property taxes, and so forth.

- Back-end DTI measures your minimum monthly debt payments, including items like student loans, personal loans, alimony, child support, and credit cards, reviewing all your outstanding debt to ensure you can repay your loan.

Since the back-end DTI takes into account all of your debt obligations, lenders typically use it during the loan approval process to get a full picture of your financial situation.

Why Does Debt-to-Income Ratio Matter for VA Loans?

A borrower’s debt-to-income ratio is used to determine if you qualify for a loan. Of course, it’s not the only lending criteria, but it tells lenders whether you earn enough income to add a mortgage loan to your debt obligations. When lenders compare your gross monthly income to your debt obligations, they determine if you have enough left to pay your mortgage premium.

Your DTI ratio isn’t the only factor lenders look at when approving your loan application. Other factors like employment history, income, and credit score will factor into their decision.

However, looking at your debt-to-income ratio for a VA loan can give lenders a clearer picture of your financial situation by telling them how much of your income goes toward paying your debts to ensure you can afford a mortgage on top of your existing debt.

What Is the Required Debt-to-Income Ratio for VA Loans?

Typically, lenders like to see a debt-to-income ratio for VA loans that’s as low as possible because it indicates that you don’t take on too much debt and makes you a lower-risk borrower. Most lenders like to see a debt-to-income ratio for VA home loans around 41%. However, you may be able to find lenders that allow for higher DTIs, depending on various factors.

While the VA guarantees VA loans, they don’t set DTI limits for lenders, allowing them to determine what ratio they’re comfortable with when loaning to veterans and service members. Since the VA doesn’t make home loans, lenders typically have their own caps that vary on factors like the borrower’s credit score.

Even if your DTI is above 41%, you may still be eligible for a VA loan, so it’s crucial to discuss your lender’s eligibility criteria to understand whether factors like higher credit scores and incomes will help you qualify even with a high DTI.

How Do You Calculate Debt-to-Income Ratio?

If you’re wondering what your debt-to-income ratio is, the equation is quite simple. All you need to do is add up your debt obligations, such as personal loans, car loans, student loans, and credit card payments, and divide them by your monthly income. The formula looks like this:

![]()

This formula will give you a decimal, which you can multiply by 100 to get your DTI ratio.

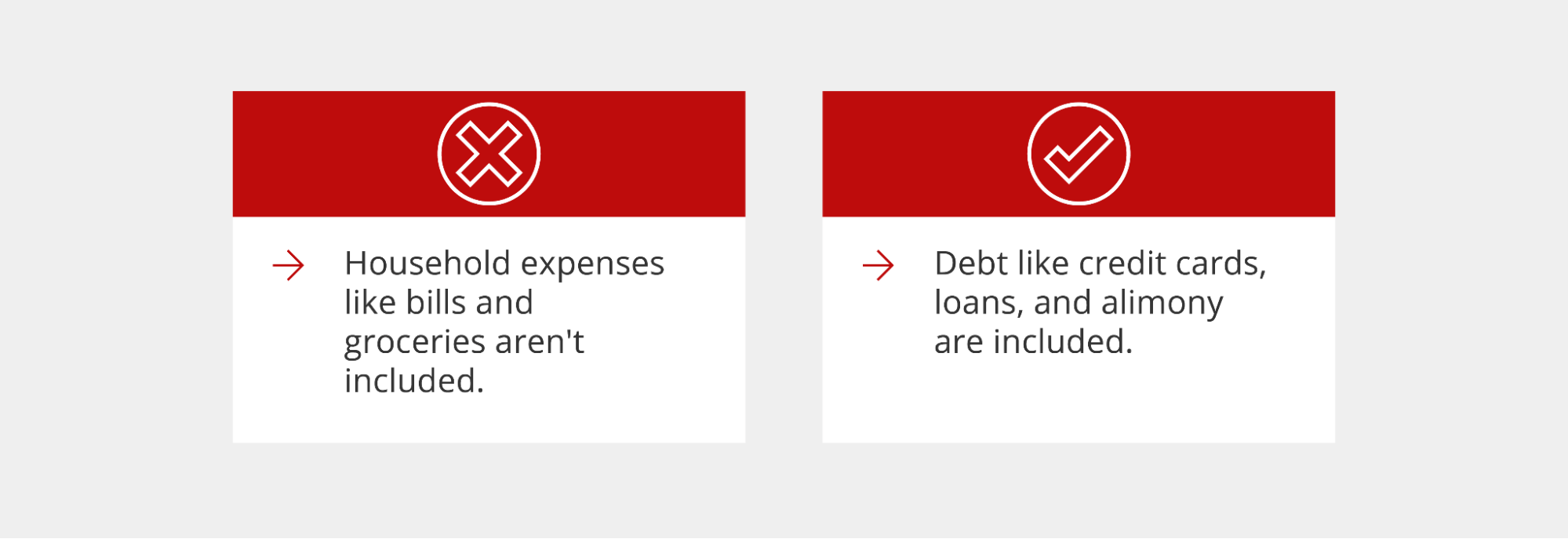

Before adding up your debt obligations, you should understand that not all debt and income count toward your VA loan debt-to-income ratio. Lenders consider the more obvious forms of debt that would appear on your credit reports, such as:

- Mortgages

- Car loans

- Student loans

- Credit cards

However, they may also factor in other types of monthly payments that don’t appear on your credit report, such as alimony and child support.

Other monthly expenses, like health insurance, groceries, internet bills, and so forth, aren’t factored into your DTI.

What If Your DTI Ratio Is Too High?

If your VA loan debt-to-income ratio is too high, you may not qualify for a home loan. However, since every borrower is different, there may be some exceptions even if you have a DTI higher than 41%. You can talk to your lender about your options if you have a high DTI to determine how it affects your VA loan eligibility.

If you have a high DTI ratio, you may still be eligible for a VA loan or another type of loan, depending on your needs and financial situation. Some lenders allow VA loan debt-to-income ratios up to 50%, depending on other factors like your credit score.

4 Ways to Lower Your Debt-to-Income Ratio for a VA Loan

Since a high DTI may disqualify you from securing a home loan, the best thing you can do before applying for one is to lower your DTI as much as possible. The best way to avoid getting your application denied is to strive to reduce your DTI by addressing some of your debt or increasing income.

- Pay off debts: When you pay off debts, you effectively reduce how much of your income goes towards paying them, resulting in more money to spend on your mortgage. For instance, let’s say your total monthly debts are $1,600, and you earn $40,000 per year. In this case, your DTI ratio is around 48%. By reducing your debt to $1,200, you’ll have a new DTI ratio of 36%.

- Increase income: Your other option is to increase your income, which also reduces how much of your monthly income goes toward paying debts. Let’s say you have the same amount of debt of $1,600 and increase your annual salary to $50,000. Your new DTI ratio is 38%.

- Add a co-borrower: Applying for a VA loan with a co-borrower like your spouse can help you qualify for a mortgage because lenders typically average the two debt-to-income ratios. Therefore, if your co-borrower has a low DTI, it can effectively reduce your average DTI. However, the opposite is also true; if your co-borrower has a high DTI, it can increase your DTI.

- Apply later: As mentioned, paying off your debts can significantly reduce your DTI ratio. Unfortunately, most borrowers can’t afford to pay their debts in a single lump sum. However, since your debts are paid down on a monthly basis, you could wait to apply for a VA loan until you’ve reduced your debt enough over time to decrease your DTI.

Apply for a VA Loan with Griffin Funding

Knowing your DTI can help determine the right time to apply for a VA loan. Your VA loan debt-to-income ratio will help lenders determine how much of your monthly income you can afford to pay towards your mortgage, giving them a clearer picture of your financial situation.

Ready to apply for a VA loan? Apply online or call 855-698-1230 to speak to one of our mortgage specialists. We can help you determine your VA loan eligibility and help you begin the pre-approval process so you can start looking for your dream home.

Griffin Funding takes pride in helping service members on their journey to homeownership.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What are the Other Requirements for VA Loans?

In general, to qualify for a VA loan, you must have received an honorable discharge and served 90 consecutive days during wartime or 181 days during peacetime.

Additionally, the property you wish to purchase must meet the VA's minimum property requirements, so they'll order a home inspection to ensure that the home is safe and meets their guidelines.

You may also be subject to VA loan limits. First-time buyers haven't used their VA loans yet and have their full entitlements, so they are not subject to loan limits. However, if you've already used your VA loan, you’ll either need to restore your entitlement or be subject to loan limits.

Besides the VA's requirements, you'll also have to meet the lender's requirements, which include criteria such as minimum credit score, proof of income, appraisal, and home inspection.

Can I Get a VA Loan with over 50% DTI?

Is the DTI Requirement the same for a VA refinance loan?

Recent Posts

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...

Mortgage Refinance Limits

Your Refinancing Options Most owners have several refinancing pathways depending on their financial goals and ...

Pros and Cons of FHA Loans

What Is an FHA Loan? An FHA loan is a mortgage insured by the Federal Housing Administration, a division of th...