What Is a Hard Money Loan? A Guide to Hard Money Lending

KEY TAKEAWAYS

- Hard money loans are short-term loans used for real estate investments.

- Hard money lenders are often private individuals or companies, not traditional banks.

- These loans are typically faster to get than conventional mortgages but have higher rates.

- Hard money loans are based more on the property’s value than your credit score.

The real estate market moves quickly, and conventional loan processes sometimes can’t keep pace. Hard money loans may be an option for fast and flexible funding. For real estate investors, developers, and even some home buyers, hard money loans can be the difference between taking advantage of a lucrative investment opportunity and missing out.

But what is a hard money lender? Hard money lenders offer loans based primarily on the value of the property being purchased or used as collateral. This approach can help borrowers secure financing when traditional lenders hesitate or take too long.

Whether you’re a seasoned real estate investor or exploring property financing for the first time, this guide will help you understand hard money lending, its applications, and alternative mortgage options that may suit your unique situation.

KEY TAKEAWAYS

- Hard money loans are short-term loans used for real estate investments.

- Hard money lenders are often private individuals or companies, not traditional banks.

- These loans are typically faster to get than conventional mortgages but have higher rates.

- Hard money loans are based more on the property’s value than your credit score.

What Is a Hard Money Loan?

A hard money loan — or hard cash loan — is a short-term loan used mainly in real estate transactions. Unlike your typical mortgage that focuses on your credit score and income, hard money loan lenders care more about the property you’re using as collateral to invest in real estate. That’s why it’s called a “hard” money loan — it’s based on a hard asset (the property) rather than just your financial history.

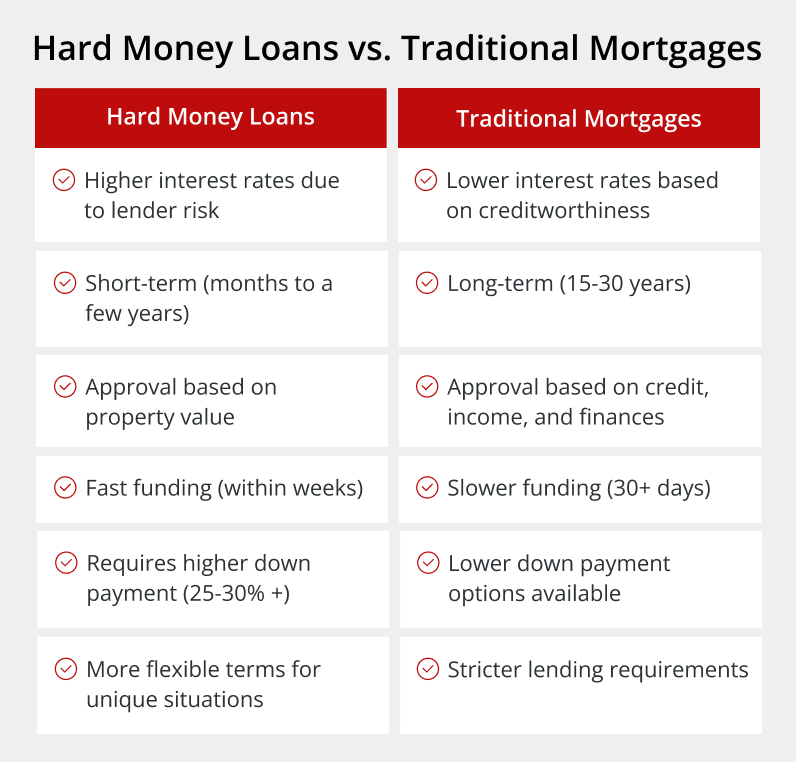

Hard Money Loans vs Traditional Mortgages

Now that you understand the definition of hard money and know what a hard money loan is in real estate, you might wonder how these loans are different from traditional financing options. Some investors might need to choose between a hard money loan and a traditional mortgage. There are some situations where one might make sense over the other. Let’s take a look at their differences:

- Interest rates: Because hard money loans are shorter-term and don’t rely on the borrower’s creditworthiness or income, lenders take on more risk with them. Because of this, interest rates are often higher.

- Loan term: Traditional mortgages are usually long-term commitments ranging from 15 to 30 years. On the other hand, hard money loans are much shorter, often lasting just a few months to a few years.

- Approval process: Getting approved for a hard money loan is usually faster because it focuses more on the property’s value than your personal finances.

- Speed: Need money fast? Hard money loans can often be funded within a week or two, while traditional mortgages can take up to 30 days or longer.

- Down payment: Be prepared to put down more money upfront with a hard money loan. They often require 25-30% or more of the property’s value as a down payment.

- Flexibility: Hard money lenders can often be more flexible with their terms, especially for unique situations that might not fit the strict rules of traditional banks.

What Are Hard Money Loans Used for?

So, who uses these loans and why? Here are some situations where a hard money loan makes sense:

- Fix-and-flip projects: Hard money loans are popular investment property loans. Because they offer fast funding, investors can quickly acquire and renovate properties for resale with a hard money loan. Plus, most flippers don’t need a long-term loan because they plan to sell quickly.

- Bridge loans: If you’re buying a new home but have yet to sell your existing house, you might consider a bridge loan. These loans provide short-term financing while awaiting long-term funding.

- Construction loans: Hard money loans allow you to finance new construction or major renovation projects.

- Foreclosure prevention: In some instances, homeowners facing foreclosure may use hard money loans as a last-resort option.

- Loan fallout: You attempted to finance the property with a conventional or DSCR loan but weren’t able to qualify for one reason or another.

It’s important to note that while hard money loans can be advantageous for investors, they are generally not recommended for typical home buyers due to higher costs and shorter terms.

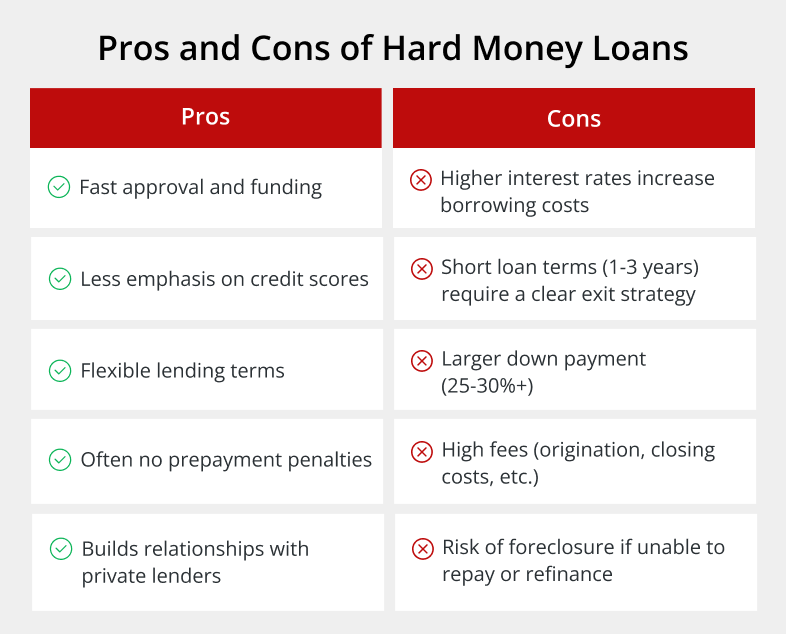

Pros and Cons of Hard Money Lending

Hard money loans can be beneficial for certain borrowers, particularly in time-sensitive real estate transactions or projects that don’t meet conventional lending criteria. However, you should always compare the advantages and disadvantages before deciding if a hard money loan is the right choice for your situation.

Advantages of hard money loans include:

- Rapid approval and funding: Hard money lenders typically offer faster approval times and quicker access to funds compared to traditional lenders. This speed can be especially beneficial in competitive real estate markets or for time-sensitive investment opportunities.

- Less emphasis on credit scores: Hard money lenders rely on the value of the property used as collateral to make a decision. This can help borrowers with less-than-perfect credit invest in real estate.

- Flexible lending terms: Hard money lenders can offer more flexibility in their terms. This can include customized repayment schedules or the ability to negotiate certain aspects of the loan to better suit the borrower’s needs.

- Often no prepayment penalties: Many lenders allow borrowers to repay the loan early without additional fees, which can provide flexibility for those who plan to quickly flip or refinance a property.

- Potential for building relationships with private lenders: Successful hard money loan transactions can lead to ongoing relationships with private lenders, potentially opening doors for future investment opportunities or more favorable terms on subsequent loans.

Despite the potential benefits of hard money loans, there are also some potential disadvantages to be aware of, such as:

- Higher interest rates: Higher interest rates increase the cost of borrowing and lead to borrowers paying more over the shorter life of the loan.

- Shorter loan terms: Most hard money loans have terms of 1 to 3 years. Borrowers should have a clear exit strategy, which means selling the property or refinancing with a traditional loan within a relatively short timeframe.

- Larger down payments or more equity required: Hard money lenders often require larger down payments or more equity in the property compared to traditional lenders. This can typically range from 25% to 30% or more of the property’s value.

- Potentially higher fees: Hard money loans may come with higher origination fees, closing costs, and other associated expenses.

- Risk of property loss: Because hard money loans are short-term loans, there’s an increased risk of default. If a borrower can’t repay the loan or refinance within the specified term, they may face foreclosure.

Alternatives to Hard Money Loans

While hard money loans can be effective in certain situations, it’s important to consider other financing options that may better suit your needs. Here are some alternatives to hard money loans:

- DSCR loans: Debt service coverage ratio (DSCR) loans are based on the property’s ability to generate income rather than the borrower’s personal income. DSCR loans are particularly useful for investment properties and can offer more favorable terms than hard money loans for long-term real estate investments.

- Home equity loan (HELOAN)/home equity line of credit (HELOC): These financial products enable homeowners to borrow against the equity in their homes. With a home equity loan or home equity line of credit, you can secure funds at interest rates that are generally more favorable than those of hard money loans.

- Cash-out refinance: This option involves refinancing your existing mortgage for more than you currently owe and taking the difference in cash. Cash-out refinances can offer lower interest rates compared to hard money loans.

- Bank statement loans: These loans use bank statements to verify income instead of traditional tax returns, making them useful for self-employed borrowers or those with non-traditional income sources. Bank statement loans typically look at 12-24 months of deposits to determine income and can offer more competitive rates than hard money loans for qualified borrowers.

- Asset-based loans: These loans consider your liquid assets, such as bank accounts, stocks, bonds, and other financial holdings, as a form of income. Asset-based loans can be particularly beneficial for retirees, self-employed individuals, or those with significant assets but limited regular income.

- RTL financing: Residential transition loans are for experienced real estate investors seeking short-term investment property loans that require quick, flexible financing for projects, such as bridge loans, flipping a house, or building from the ground up. RTL financing can have slightly longer terms than hard money with more consistent underwriting. At the end of the day, RTL financing is a better option for experienced investors seeking cost-effective financing for residential investments, while hard money lenders offer more flexibility but at a higher cost—perfect for first-time investors or unique property deals.

Work With a Trusted Hard Money Lender

When considering hard money lending, partnering with a reputable and experienced lender is crucial for a successful transaction. Griffin Funding is a trusted name in the industry for a reason. We offer a comprehensive range of mortgage loans, including hard money non-QM loans, DSCR loans, and other alternative financing options. Our team of experts specializes in non-QM lending, allowing us to provide tailored solutions for various real estate investment needs, from expanding your real estate portfolio to securing an investment property loan.

Ready to explore your options? Griffin Funding’s user-friendly Griffin Gold app streamlines the application process for hard money loans and other financing solutions. Don’t let traditional lending restrictions hold you back from achieving your real estate goals. Get started today and let our experienced team guide you toward the right financing solution for your unique situation.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What is a hard money bridge loan?

For example, a real estate investor might get a bridge loan if they want to capitalize on a time-sensitive opportunity but they have capital tied up in other ventures. Perhaps they plan to use the proceeds from selling one property to buy another, but their property hasn’t sold yet and they need to make an offer or risk losing out. In this case, a bridge loan provides a short-term solution that allows the investors to quickly get financing as they prepare to sell their current property and get a long-term mortgage.

How do I get a hard money loan?

How do I choose a hard money lender?

At Griffin Funding, we provide borrowers with a streamlined application process and deliver an excellent customer experience. Reach out today and one of our mortgage experts can help you compare your financing options and find a hard money lending solution that aligns with your goals.

Recent Posts

Conventional Loan Limits in 2025

If you plan to purchase or refinance a home in the coming year, understanding the conventional loan limits in ...

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...

Mortgage Refinance Limits

Your Refinancing Options Most owners have several refinancing pathways depending on their financial goals and ...