A Step-by-Step Guide to the Mortgage Underwriting Process

KEY TAKEAWAYS

- The mortgage underwriting process determines a lender’s level of risk when deciding whether to give you a loan.

- Underwriters verify your income, assets, and debts and review information about the property to determine if you qualify for a home loan.

- You can speed up the underwriting process by providing all the necessary documentation during the application phase and communicating with your lender.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage Platform

Applying for a mortgage can be confusing for a first-time home buyers, but once you’ve gone through it once, you’ll be an expert. There are several steps to getting financing for your dream home, but one of the most important is the mortgage underwriting process.

The mortgage underwriting process determines your eligibility and dictates whether you’ll be approved for the loan by assessing a lender’s risk. For the most part, the underwriting process occurs behind the scenes, but there are several ways to streamline the process to ensure you get approved for the loan quickly.

But what is underwriting, and how does it affect you? Keep reading to learn about underwriting, including what underwriters do and why it’s important.

KEY TAKEAWAYS

- The mortgage underwriting process determines a lender’s level of risk when deciding whether to give you a loan.

- Underwriters verify your income, assets, and debts and review information about the property to determine if you qualify for a home loan.

- You can speed up the underwriting process by providing all the necessary documentation during the application phase and communicating with your lender.

What Is Underwriting?

The mortgage underwriting process occurs after applying for a home loan and before approval. During this step of the mortgage process, the lender verifies the financial information you’ve shared with them, such as your income, assets, and property information, to determine your home affordability and whether to approve your application.

Your mortgage lender will take care of the entire underwriting process, but you’ll be involved because you must provide accurate documentation of your income and other financial information.

Even after submitting your mortgage application with the requested documents, your lender may ask for more information or documentation about your financial situation. For example, they may want more proof of assets or to ask about specific deposits in your bank account.

What Does an Underwriter Do?

Mortgage underwriters are the individuals who perform the duties required to determine approval on loan. They’re the people who work for a lender and assess your finances and the level of risk for the lender. Underwriters review your income, assets, credit history, and home appraisal to determine your approval, so they’re an important part of the mortgage loan underwriting process.

These individuals also work directly with your Loan Officer to ensure they have all the necessary paperwork and information to assess how much risk a lender takes by approving you for a loan. Additionally, your Loan Officer will ensure you submit all the necessary documentation for a smoother process.

A few of the main duties of an underwriter include the following:

- Reviewing the appraisal: An appraisal tells the lender how much the home you’re interested in purchasing is worth compared to the seller’s asking price to ensure you’re not overpaying for the home. The underwriter reviews the appraisal to ensure the home’s actual value matches the loan amount to reduce a lender’s risk while protecting the buyer from purchasing an overvalued home.

- Reviewing your credit history: Your credit history is one of the most important factors lenders use to determine your loan eligibility and approval. While they’ll review your credit score, they’ll also look at your current open accounts, late payments, bankruptcies, and credit usage to determine whether you have good spending habits and a history of paying your debts on time.

- Verify income and employment: Most lenders like to see that you’ve stayed in the same position or field for at least two years before applying for a home loan. This ensures that you have a steady source of income that will help you pay your monthly mortgage premium. In addition to verifying your employment, they’ll ensure you earn as much as you stated on your application to ensure you can repay the loan.

- Review down payment and savings: Before you can be approved for the loan, an underwriter must ensure you have enough for the down payment on the property. They’ll also review your savings to ensure you have enough to pay for additional costs associated with the loan, such as closing costs and other fees. Of course, some loans, such as VA loans and USDA loans, don’t have down payments.

Ultimately, the underwriter decides whether you’ll be approved for the loan, so it’s crucial to make this process as easy as possible for them. Timeliness is crucial after you’ve made an offer on a home, and ensuring your underwriter has all the necessary documentation to verify your information can help streamline the process.

Why Is the Underwriting Process Important?

Why Underwriting Is Important for the Lender

The underwriting process for a mortgage benefits the lender by telling them whether or not to give you a loan. For example, if your debt-to-income (DTI) ratio is too high, an underwriter can deny your loan application because you may have too much debt compared to income to afford the loan. On the other hand, if you can’t afford your loan and end up defaulting, the lender can’t make any money.

Why Underwriting Is Important for the Borrower

The underwriting process for mortgage loans benefits borrowers because it can prevent them from purchasing a house they can’t afford. In addition, if you simply don’t earn enough to pay back the loan, the underwriter will deny your application, which can protect you from defaulting or going bankrupt when you can no longer afford your mortgage.

What Is Evaluated During the Underwriting Process?

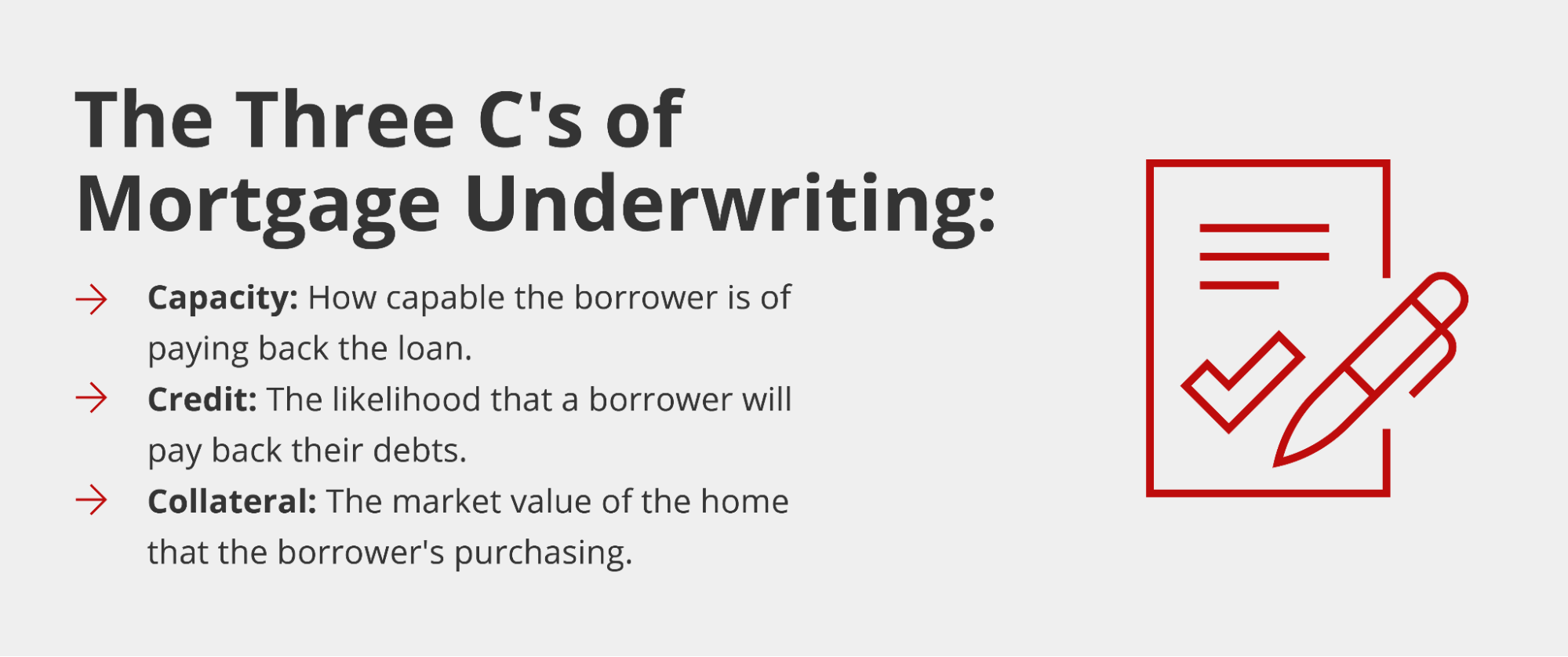

As we’ve mentioned, underwriters evaluate your finances, credit history, and the property you wish to purchase to determine the lender’s risk level to decide whether to approve your loan application. During the underwriting process, underwriters review three critical areas, called the 3 C’s of underwriting. These include:

Capacity

Capacity refers to your ability to pay off the loan by reviewing your employment history, income, debt, and assets like savings accounts and investments. Your income is one of the most important factors because it tells lenders how much you earn monthly and whether your income is reliable with every borrower needing enough income to cover their monthly mortgage payments. Most financial experts recommend following guidelines about how much income going to your mortgage is appropriate to ensure you can afford your payments.

The type of income documentation required depends on your loan type. For a conventional loan, lenders typically ask for pay stubs, W2s, and tax returns, while requires only bank statements for verification. Self-employed individuals may need to provide alternative documentation such as profit and loss statements, business tax returns, and business licenses. Ultimately, underwriters verify that your reported income matches your actual earnings and confirm employment stability, typically requiring at least two years in the same job or field.

Credit

Credit is one of the most important factors in the loan approval process because it determines whether a borrower can be trusted to repay the loan. Underwriters review credit reports to:

- Ensure you make payments on time

- Have paid off debts

- See how many lines of credit you currently have open

Credit scores are important because they give underwriters an idea of your creditworthiness, with a good credit score demonstrating that you pay back your debts on time.

The credit report also gives underwriters access to your debts to calculate your DTI ratio by comparing it to your pre-tax income. Most lenders prefer a DTI below 50%, but the requirement varies by lender and loan type. A high DTI can be a red flag to lenders because it means you already have high debt, so paying back your mortgage loan will be more challenging. You can use a DTI ratio calculator to determine where you stand before applying.

Collateral

The collateral on a home loan is the property itself. Underwriters ensure that the home value matches the loan’s value so it can be used as collateral if you stop making your monthly mortgage payments. The appraisal is crucial because lenders must be able to recover unpaid balances if you default on your loan.

Therefore, the underwriter will review an appraisal to assess the home’s true value and compare it to the price you’re paying for it. You could be denied the loan if those values don’t match up.

For example, if a home is valued at $250,000 and the asking price is $350,000, it means you’re paying more than you should, and the home itself wouldn’t make good collateral because it’s worth much less than the appraised value.

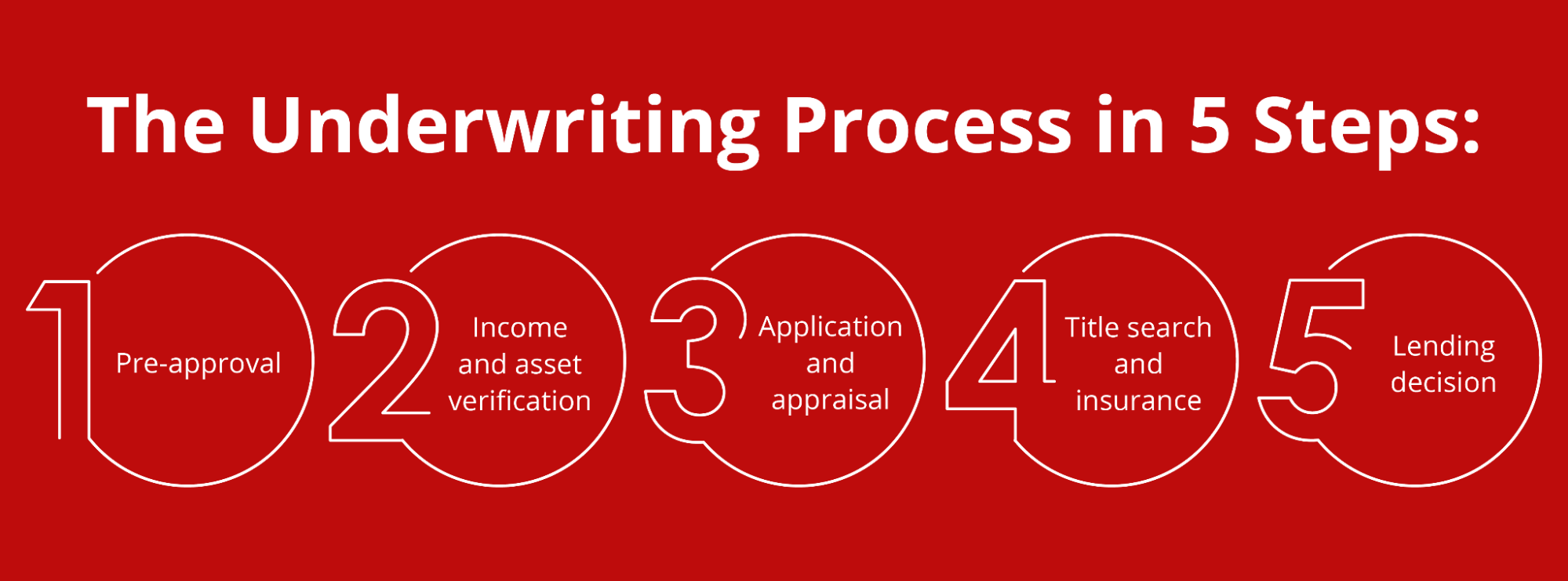

The Steps of the Underwriting Process

To give you more insight into the mortgage approval process, here are the steps of the underwriting process for mortgage loans:

1. Pre-approval

Mortgage pre-approval is the first step of the process because it tells you the likelihood of getting approved for a home loan. It can give you buying power and help you stand out from other buyers in a competitive market.

When you get pre-approved for a mortgage, the lender reviews your income, debts, and credit. Pre-approvals typically require some documentation, but the process isn’t as comprehensive as the actual loan application. With pre-approval, lenders want to ensure you earn enough to repay the loan.

2. Income and Asset Verification

To pre-approve you for a loan, lenders must verify your income and assets via documentation such as:

- Pay stubs

- Tax returns and W-2s

- Bank statements

- Proof of assets

- Profit and loss (P&L) statements

They’ll review your liquid assets to ensure that if, for some reason, your income doesn’t cover the cost of your mortgage loan, you have money tucked away that you can use to pay it. Once your lender has determined whether you’re qualified for a loan, they’ll give you a pre-approval letter stating that you’ve been pre-approved for up to a certain amount.

3. Application & Appraisal

Once you’ve found your dream home, you’ll complete a mortgage application for that property. The information you provide will determine whether you’re eligible for a loan for that property based on income, debt, credit history, and the home’s appraised value. This is where the underwriting process starts, and you’ll need to provide several financial documents to prove your ability to repay the loan.

Once your underwriter has reviewed your documents, they’ll review the appraisal on the home to confirm its true value and compare it to the purchase price. Your lender’s main goal is to ensure that the loan doesn’t exceed the appraised value in case you default because they’ll need to sell the property to recoup the money lost on their investment. The appraisal also ensures borrowers that they’re not overpaying for a home that’s worth much less.

4. Title Search and Insurance

The title search and insurance ensure lenders are not loaning borrowers the money for a home legally owned by someone else. Ultimately, they must ensure the property can be transferred to the borrower.

A mortgage underwriter or title company researches the property to look for existing mortgages, claims, liens, zoning ordinances, legal action, unpaid taxes, or other issues that can prevent the title from being transferred to a new owner.

Once the title search is complete, the title company issues an insurance policy to guarantee its results and protect the lender and the property owner.

5. Lending Decision

Once the underwriter has all the information they need, they’ll determine the lender’s risk level and decide on whether to approve the loan for a particular property. Additionally, they can help determine the type of loan that’s best for the borrower, such as adjustable- or fixed-rate mortgage loans, conventional or Non-QM loans, and so forth. Be sure to understand the current mortgage rates to help you make the best decision about your loan terms.

Several things can happen at this point. Your loan can be approved, denied, put on hold, or have conditional approval based on additional requirements. Let’s take a closer look at what these mean:

- Approved: Getting approved for a mortgage loan is the best possible outcome. Once you’re approved for the loan, you can close on the property and become a homeowner. At this point, you don’t need to provide the lender with any additional information, and you can schedule an appointment for closing. You’ll receive a mortgage commitment letter confirming your approval.

- Denied: Your mortgage application can be outright denied by the lender for a number of reasons. In most cases, it’s simply because the borrower or the property doesn’t meet their specific requirements for the loan. For example, your lender can deny the application if you have bad credit or don’t earn enough for the loan. In most cases, you’ll receive a specific reason for your denial to help you determine the next steps. For example, if the lender says you were denied because of poor credit, you’ll have to work towards increasing your credit score before applying again. If this happens, you might have options, such as applying again at a later date, trying to secure a lower loan amount, or putting down more money.

- Suspended or pending: In some cases, your mortgage loan application might be suspended or pending because you haven’t provided the underwriter with enough information or documentation for them to accurately verify some of the information on your application. Ultimately, your application can be suspended whenever an underwriter can’t evaluate your financial situation. You should be able to reactivate your application by providing the underwriter with the documentation they need to decide.

- Approved with conditions: Some approvals come with conditions. In these instances, you’re technically approved but can’t move forward with closing until you provide the underwriter with additional information or documentation. Approved with conditions typically means they need more information from you to approve the application. Ultimately, in these cases, you’re approved, but the lender is doing their due diligence to confirm the information they have in front of them.

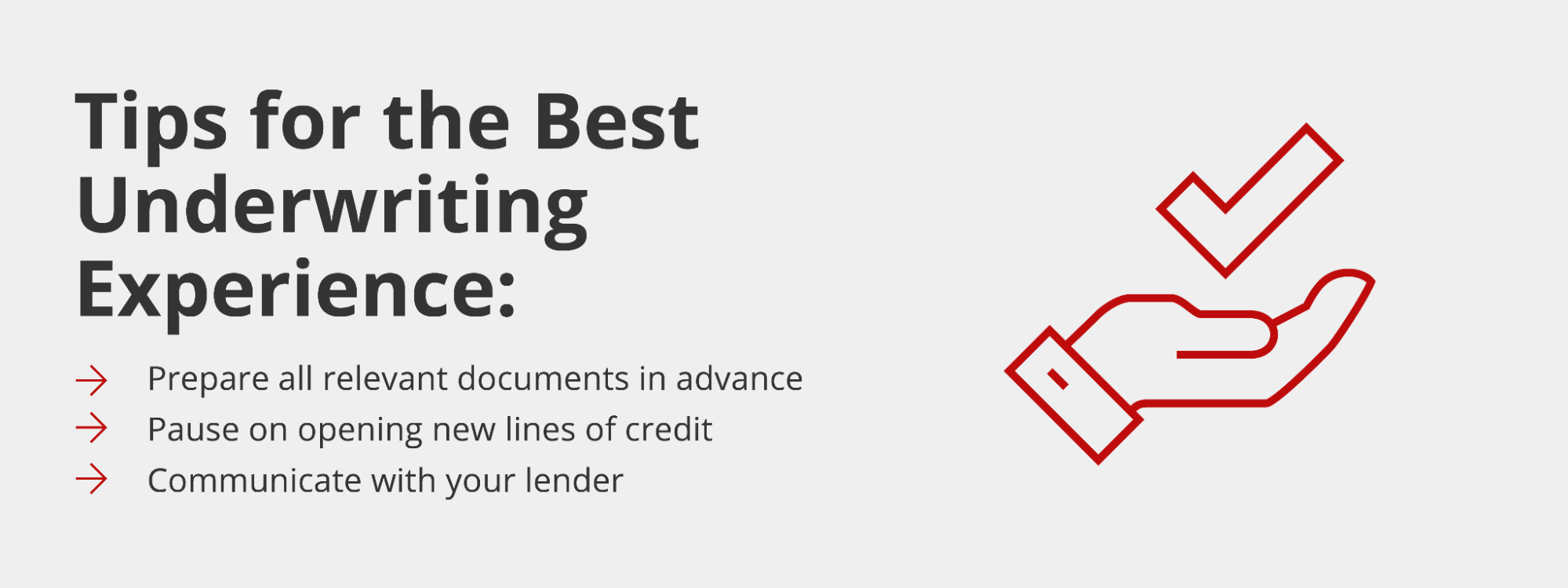

Tips for a Better Underwriting Experience

There are several ways you can streamline the process to ensure the underwriter has everything they need to approve your loan application. Follow these tips to ensure a smooth underwriting experience:

1. Prepare documentation in advance

Knowing the types of documentation you’ll need in advance can ensure that there’s less back and forth between you and the underwriter. You can contact your lender to ask about the specific types of documentation you’ll need to provide when applying to ensure they have everything they need to make a decision.

2. Avoid opening new lines of credit

Opening new lines of credit can complicate the underwriting process because it can hurt your credit score or add to your debt. If an underwriter has already reviewed your income and debts, a financial change could make them have to go back and re-review them. Any new lines of debt effectively increase your DTI, which could be a red flag to lenders. Instead, if you have to open a new line of credit, wait until after your decision.

3. Be an effective communicator

Underwriters must ensure that you can afford to repay the loan, so they need various types of financial documents to verify income and debts. Getting a mortgage is time-sensitive because if you don’t get approved in time, the house you put an offer on could go back on the market or be sold from under you.

The underwriting process can’t move along if you don’t provide the necessary information and documentation in a timely manner. For example, even if you’ve submitted W2s and pay stubs, your lender will still want to verify information using tax returns. Failing to provide all the necessary information can pause your mortgage application.

Being an effective communicator and responding to inquiries from your lender as soon as possible is crucial for a streamlined approval process that ensures you can purchase your dream home.

How Long Does the Underwriting Process Take?

How long the underwriting process takes for a mortgage varies by lender. Underwriting can take days or weeks, depending on the complexity of the loan and your finances. You can speed up the process by ensuring the underwriter has everything they need when they begin and answer their questions and inquiries as fast as possible to keep the process moving smoothly.

In most cases, the underwriting process timeline varies by case. However, Griffin Funding aims to complete the home loan process in 30 days or less to help you secure home financing.

How Griffin Funding Is Revolutionizing the Mortgage Underwriting Process

Griffin Funding launched LIA (Loan Intelligence Assistant), an AI-powered underwriting platform that speeds up mortgage processing in July 2025. Partnering with AI engineering firm, Cadre, LIA provides source citations that link answers directly to investor guidelines.

This AI platform helps Griffin Funding better serve self-employed borrowers and real estate investors who need non-QM loans. The technology analyzes complex financial situations faster than traditional methods while maintaining accuracy and compliance standards.

Work With a Qualified Lender to Undergo a Streamlined Underwriting Process

Underwriting is the process whereby the lender verifies a borrower’s income, assets, debt, and property information to determine whether to approve the loan application. This process is crucial for lenders and borrowers because it ensures borrowers can repay their debt on time.

The best way to streamline the underwriting process is to ensure your lender has all the necessary information to verify your financial information. Want to learn more about the mortgage approval process? Talk to a Griffin Funding mortgage specialist today to learn about the different requirements and documents we need to help you get approved for a mortgage loan faster.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Can I switch lenders during the underwriting process?

What happens if I get a different job during underwriting?

What would cause a mortgage to get denied during underwriting?

Is underwriting required for every loan type?

What should I avoid doing during the underwriting process?

Recent Posts

Net Operating Income: Definition, Formula, & Examples

What Is Net Operating Income (NOI)? Net operating income measures how much money your investment property gene...

Best DSCR Lenders: Griffin Funding vs Angel Oak vs Kiavi vs Visio vs Lima One vs Easy Street

What to Look for in a DSCR Lender Choosing the best DSCR lender for your unique situation means evaluating sev...

Cash on Cash Return in Real Estate: Definition, Formula, & Examples

What Is Cash on Cash Return? Cash on cash return (CoC) is a metric that measures the annual income you generat...