A Guide to NINA Loans

KEY TAKEAWAYS

- A no-income, no-asset (NINA) loan is a type of mortgage loan that doesn’t require borrowers to share their personal financial information.

- NINA loans are no longer available for owner-occupied properties.

- NINA loans might be the right choice for investors who take deductions on their tax returns and want to qualify for a loan using the investment property’s rental income instead of personal income or assets.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage Platform

Investing in real estate can help you passively build wealth over time — whether you purchase a primary residence or an investment property. If you’re like most buyers, you need a mortgage loan to help you purchase a home, but there are so many options available that finding the right one can be challenging.

Conventional mortgage loans have strict lending criteria and income verification methods that aren’t right for every borrower. For instance, some borrowers don’t have W-2s or pay stubs because they’re entrepreneurs or investors. Luckily, those types of borrowers can still get a mortgage, but they may qualify for a different type of mortgage.

If you don’t meet the stringent lending requirements of a conventional loan, you may qualify for a no-income, no-asset (NINA) loan. Current NINA loans are only available for investors and not for owner-occupied properties like primary residences. Wondering if a no-income, no-asset loan is right for you? Keep reading to learn more about NINA loans.

KEY TAKEAWAYS

What Is a NINA Loan?

No income, no asset loans are a type of no doc loan in which the lender doesn’t verify income or assets. However, they do verify other information like rental income and credit history. These loans are currently only available for real estate investors purchasing rental property. Instead of verifying assets and income, NINA loan lenders will review the rental income to determine a borrower’s ability to repay the mortgage loan.

NINA loans were once available for primary residences and made a good option for business owners, self-employed individuals, and gig workers who couldn’t use traditional income verification methods because they don’t have W-2s or pay stubs. NINA loans are just one type of loan with no income verification required. They made it easier for individuals to qualify for loans if they couldn’t prove their income using traditional underwriting methods.

However, NINA loans became dangerous because lenders didn’t verify important information like income or assets, so they didn’t actually know whether a borrower could repay their debt. Many people foreclosed on their homes because the lender didn’t do their due diligence.

NINA and stated-income loans were popular around the same time and contributed to the housing crash, after which the federal government passed laws requiring lenders to verify that borrowers could afford to repay their mortgage loans. These new laws were designed to protect borrowers and prevent them from securing a loan they couldn’t afford.

The only exceptions to the new laws are investment properties, which allow lenders to determine their loan qualifications. However, NINA loan lenders must still verify that a borrower can repay their mortgage loan in some way. While NINA loans don’t require the lender to verify income or assets, the lender instead verifies that the property generates enough rental income to pay for the mortgage.

As such, NINA loans have more flexible lending criteria and could be a good option for both new and veteran investors. Unfortunately, most financial institutions don’t offer these types of loans because they can’t be sold on the secondary mortgage market. However, private lenders might.

NINA Loans vs. NINJA Loans

While NINA loans have some of the most flexible lending requirements available, they’re often confused with NINJA loans, which are even more flexible. NINJA stands for “no income, no job, no assets,” meaning a lender doesn’t verify income, employment, or assets and is primarily based on the borrower’s credit score.

These types of loans are even rarer than NINA loans, but they still allow investors to qualify for an investment property loan based on cash flow rather than personal income, assets, or employment.

Who Are NINA Loans for?

NINA loans were once designed for retirees, business owners, and freelancers because they didn’t verify income or assets. Instead, the lender took the borrower’s word for it when it came to these factors, which allowed borrowers to lie to obtain a home loan without realizing the significant consequences of taking out a loan they couldn’t afford.

Of course, anyone who lied on their mortgage application and couldn’t afford their monthly payments defaulted on their loan. These loans no longer exist for owner-occupied homes because NINA loan lenders must verify a borrower’s ability to repay using income and/or assets, regardless of the verification method. For instance, they can use W-2s, tax returns, bank statements, and pay stubs as long as they verify that a borrower can repay their debt.

Now, NINA loans are only available for investment properties, not owner-occupied primary residences. However, there are several no-income loans available for borrowers today, including asset-based and bank statement loans. Investors can also choose DSCR loans, which are similar to NINA loans in that they can qualify based on the rental property’s income instead of personal financial information.

How Do NINA Loans Work?

With true NINA loans, lenders don’t require you to share your income or assets on the loan application. However, you’ll still need to meet various other requirements to qualify for the loan. With NINA loans, you can only finance investment properties, so they’re only available for individuals who wish to purchase rental properties or fix and flip homes. Otherwise, you won’t qualify for a NINA since they’re not an option for owner-occupied homes.

Additionally, since NINA loans don’t require you to share your income or asset information with lenders, they’re riskier for both lenders and borrowers. In some cases, they may be more challenging to qualify for than another type of investment property loan. For instance, NINA loan lenders typically require higher credit scores or charge higher interest rates.

At the same time, NINA loans typically come with significant down payment requirements. You’ll need to put down at least 20% on the property, and if you have a low credit score, the lender may require an even larger down payment.

So how exactly do NINA loans work? Instead of qualifying for the loan based on your personal income or assets, you’ll qualify based on the rental property’s performance. Lenders must determine your ability to repay by reviewing rental rates to ensure they’ll cover your mortgage payment.

While you don’t need to provide your lender with information regarding your personal income or assets, there are several other requirements you must meet for a NINA loan, such as:

- Credit score: Credit score is one of the main qualifying criteria for this loan because it’s the only figure lenders have available that tells them how creditworthy you are as a borrower. Lenders must ensure you have a track record of paying your debts on time.

- Employment type: Unlike NINJA loans, NINA loan lenders may require you to have at least two years of employment history.

- Underwriting and approval: Lenders must perform underwriting to ensure the information you have provided them is accurate and reliable. While they don’t need to determine if you have a reliable source of income, they still need to ensure the information they do require is true.

- Down payment: As we’ve mentioned, down payments are a requirement of this loan, but the exact amount you’ll need to pay will vary depending on your lender and factors like your credit score. Because NINA loans are riskier investments for lenders, the down payment acts as a type of protection because it means they won’t have to lend you as much to purchase the property. A larger down payment will also reduce your mortgage interest rates to help you pay less over the life of the loan.

- Reserves: Some lenders may require a few months’ worth of reserves to ensure you can make your mortgage payments. Since your property may not generate rental income immediately, having reserves can assure lenders that they’ll receive their payments.

NINA Loans: Pros & Cons

Investors looking to purchase rental properties can benefit from NINA loans because lenders determine eligibility without verifying income and assets. However, like all mortgage loans, NINA mortgages have their pros and cons.

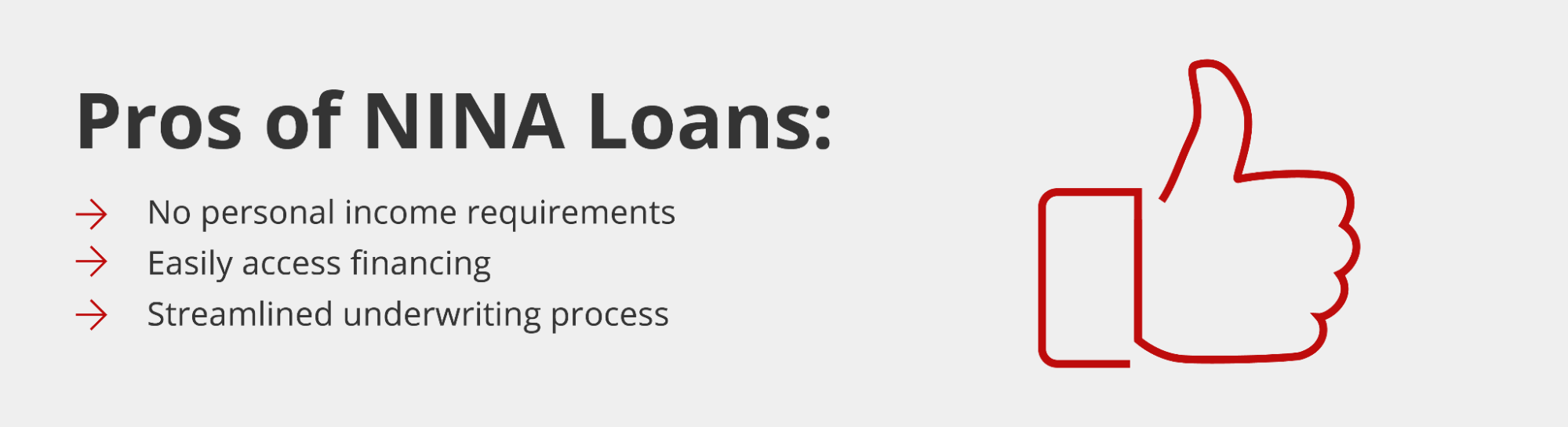

Pros of NINA loans

NINA loans can help investors secure financing with more flexibility in terms of the information they can use to demonstrate their ability to repay the loan. Other benefits of this loan program include the following:

- No personal income requirements: Traditional mortgage loans require you to share personal income information in the form of tax returns, bank statements, and W-2s, depending on your employment situation. However, with a NINA mortgage, you can qualify for a loan based on the rental income of the property you wish to purchase. That said, being able to provide your lender with as much financial information as possible can make you a more appealing borrower.

- Easy access to financing: Since most investors take significant deductions from their tax returns, these documents don’t accurately represent their income. With NINA loans, your tax returns, bank statements, and other personal financial information is less important because you can qualify for the loan based on rental income.

- Streamlined underwriting process: Since NINA loans don’t require an underwriter to verify your personal financial information, getting approved for a mortgage is often much faster. With these loans, you can close on a property and start generating rental income faster.

Cons of NINA loans

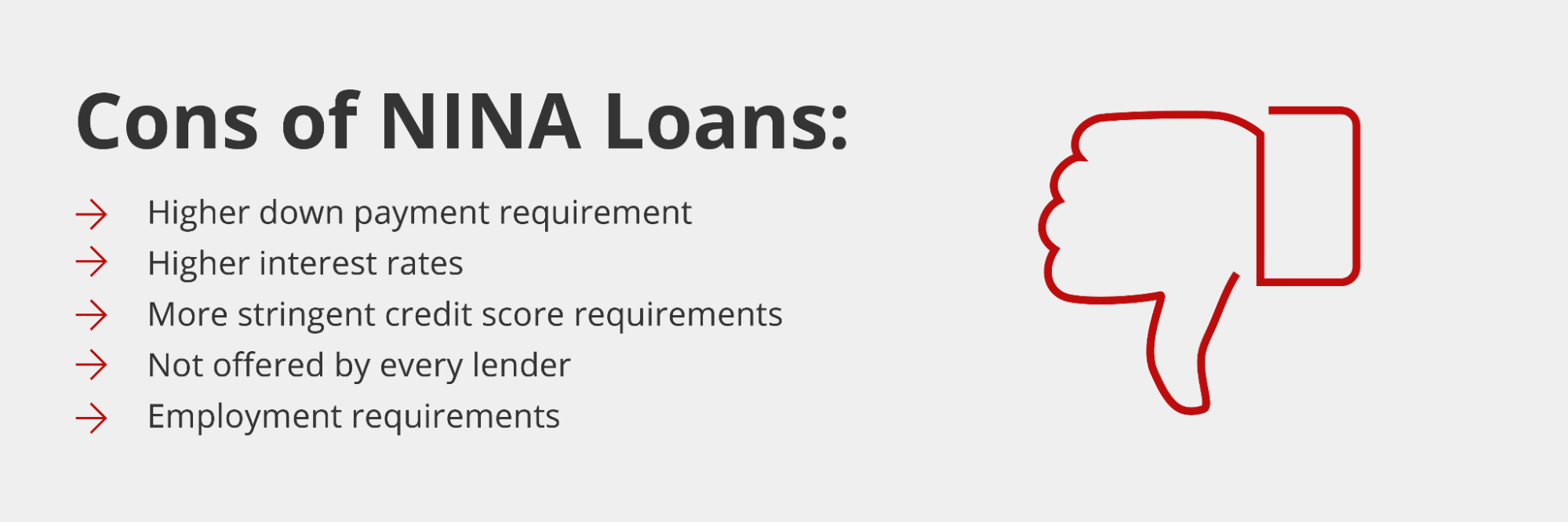

The main benefit of a NINA mortgage loan is that you can qualify based on rental income instead of personal income. However, these loans are riskier investments for the lender, so they come with various disadvantages, such as:

- Higher down payments: NINA mortgage loans are no-doc loans, which means they’re a higher risk for the lender. To mitigate their risk, lenders typically require higher down payments. The minimum down payment for a NINA loan is usually 20% of the purchase price, but some lenders may charge even more depending on various factors like your credit score. If you can make a higher down payment, you can reduce how much you need to borrow and save more money on the life of the loan.

- Higher interest rates: Typically, NINA loans have higher interest rates and less favorable terms because they’re riskier for the lender. Some lenders may only offer adjustable-rate NINA loans, which can cost you even more over the life of the loan, especially if mortgage rates increase.

- Higher credit score requirements: NINA mortgage loans have much more flexible lending requirements. However, because the lender primarily determines your eligibility based on your potential rental income, they may look at your credit score with more scrutiny. Therefore, you typically need a higher credit score for NINA loans than conventional loans to ensure the lender you have a history of paying your debts on time.

- Not offered by every lender: Many lenders don’t offer NINA loans because they’re riskier investments. However, many lenders offer loans similar to NINA loans that allow you to qualify for a mortgage based on rental property income. Lenders also offer Non-QM loans that allow you to qualify for a mortgage using alternate income verification methods like bank statements and assets.

- Job requirement: Most home loans have a job history requirement to ensure you have a steady source of income. However, investors may be self-employed. As long as you can demonstrate that you’ve been employed or self-employed for at least two years, you should still qualify for a NINA loan if you meet the other loan criteria. Most lenders require at least two years of work history, so you’ll have to provide ample evidence that you’ve been an investor for at least two years or have had a steady job for at least two years. NINJA loans don’t require you to submit employment history information, but these loans no longer exist today.

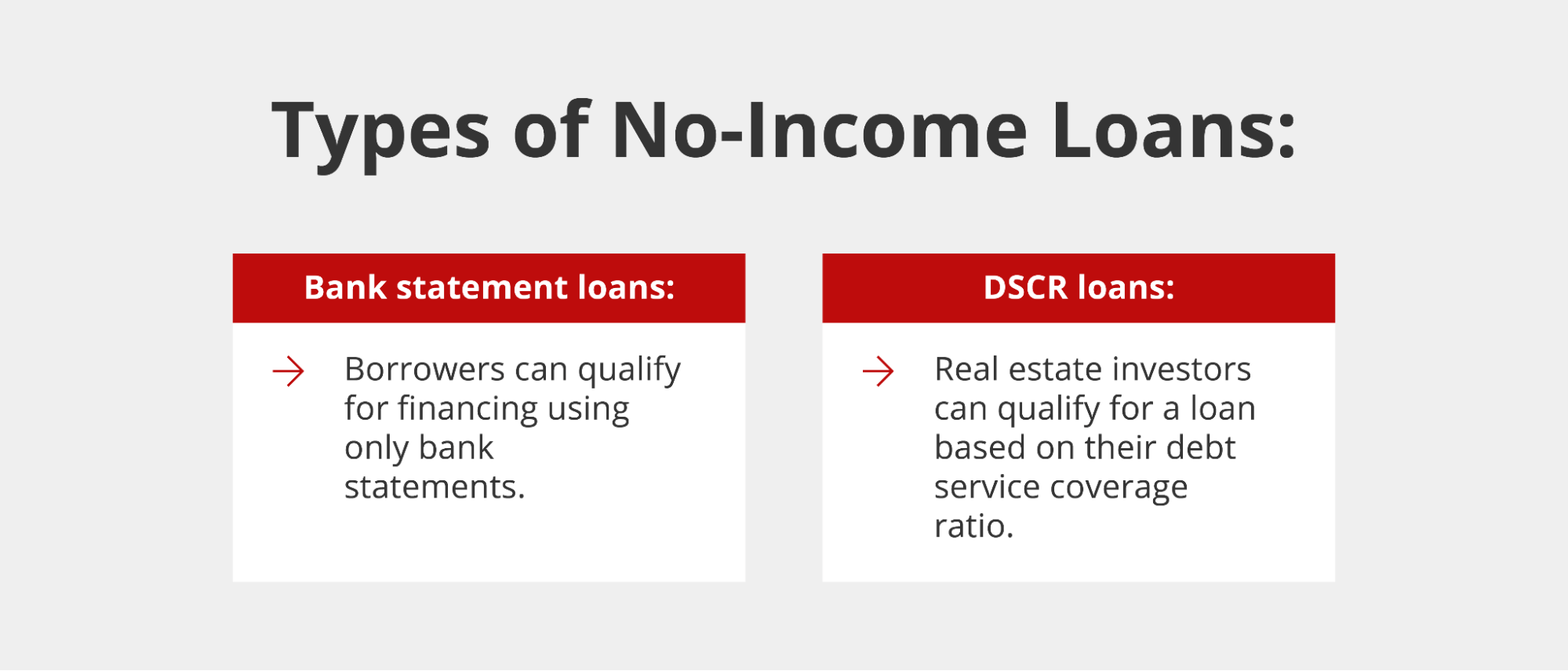

Types of No-Income Loans

True NINA loans are only available for non-owner-occupied investment properties. Therefore, if you’re looking for a loan for a primary residence, you won’t qualify for a NINA mortgage. However, there are several other no-income loan options available for owner-occupied properties. These types of loans are best suited for freelancers, self-employed individuals, retirees, and business owners who can’t prove their income using traditional methods. A few of the most popular no-income loans today include the following:

Bank Statement Loans

Bank statement loans are technically not no-income loans. However, they allow lenders to verify your income using alternative underwriting methods. Instead of providing your lender with W-2s, pay stubs, and tax returns, you can give them 12 to 24 months’ worth of bank statements to help them determine whether the deposits in your account are enough to pay your mortgage.

Lenders will not use your tax returns to determine your loan eligibility or amounts when you apply for a bank statement loan. However, since many self-employed borrowers and investors take tax deductions, lenders recognize that your tax returns don’t accurately reflect how much you earn.

In addition to having sufficient income to repay your mortgage, bank statement loans typically require a minimum credit score and a down payment of at least 10%. Exact requirements vary by lender, but you’ll have to prove that you’ve been self-employed for at least two years. Additionally, these loans may come with higher interest rates and down payment requirements than some other types of home loans.

DSCR Loans

Think of debt service coverage (DSCR) loans as the modern version of the NINA loan for investors. These mortgages make it possible for you to qualify for a loan with no income verification. Instead of qualifying for an investment property loan based on your income or assets, lenders will determine your eligibility based on the property’s projected cash flow — or rental income.

DSCR mortgages are another type of Non-QM loan that helps lenders easily determine a borrower’s ability to repay. The debt service coverage ratio tells lenders whether a property generates enough rental income to allow the borrower to repay the loan. Most lenders like to see a DSCR of at least 1.25 to ensure the borrower can repay their debt and still have some rental income left over for other expenses. However, Griffin Funding allows DSCRs as low as 0.75.

The debt service coverage ratio formula compares the property’s gross rental income to its mortgage debt, including principal, interest, taxes, and insurance. Lenders use this figure to determine if the property’s generated income can support the loan without taking into account other factors like management, maintenance, and utility costs.

DSCR loans are only available for real estate investors; they can’t be used to purchase a primary residence. However, they can be used for both long-term and short-term rentals and various types of properties, from condos to single-family homes and apartment complexes.

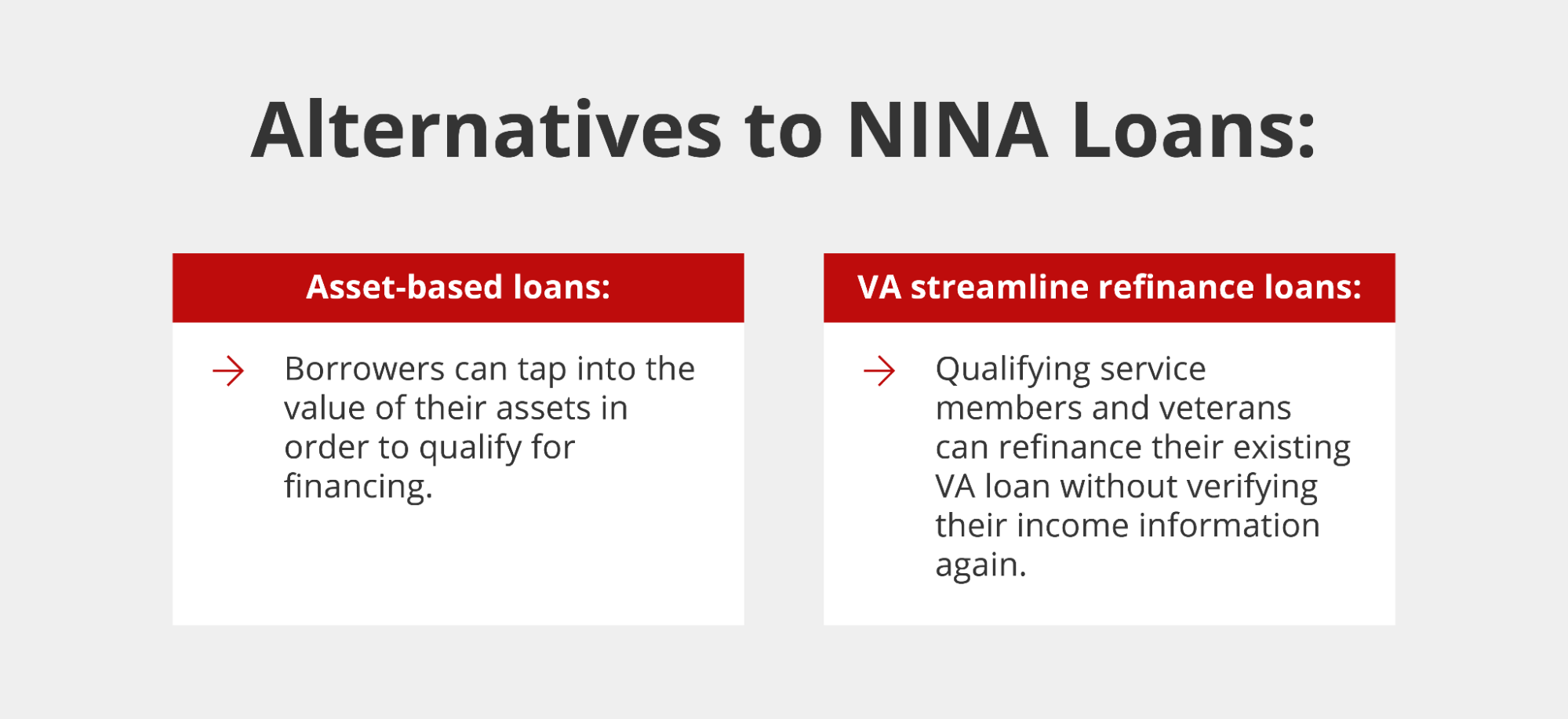

NINA Mortgage Alternatives

NINA loans no longer exist for homebuyers, but there are several alternative loan programs available that allow you to qualify based on factors like assets rather than personal income. For instance, if you’re currently unemployed but have a high net worth, you may still qualify for other no-income loans, such as:

Asset-Based Loans

Asset-based loans are similar to NINA mortgage loans because they don’t require income verification. However, unlike NINA loans, they do require asset verification. With these loans, you use your assets as income which can then be used to qualify for a mortgage loan. Additionally, asset-based lending can be used to purchase primary residences, second homes, and investment properties.

Like bank statement loans, these mortgage programs are ideal for individuals who can’t provide the required income verification documents associated with conventional loans. By qualifying based on assets, borrowers don’t have to provide proof of employment or income since their ability to repay the loan is determined solely by liquid assets, such as:

- Bank accounts

- Certificates of deposit

- Investment accounts

- Money market accounts

The borrower’s debt-to-income (DTI) ratio is usually not calculated, but the main drawback of these loans is that most lenders typically require a down payment of 20%.

VA Streamline Refinance Loan

If you purchased your home with a VA loan, your lender verified your income to ensure you could afford your mortgage. However, if you use a VA streamline refinance loan to reduce your interest rate and monthly payments, you won’t have to provide your income information again. Instead, your new loan will replace your old VA loan to give you better terms that reduce your monthly payments.

With a VA streamline refinance loan, you can choose to start over with a new 30-year fixed mortgage or customize your loan terms. However, to qualify for a VA refinance loan, your current loan must be a VA loan.

VA streamline refinance loans don’t require income verification because your income was already verified for the VA loan. Additionally, you won’t be required to have a second appraisal or provide us with your certificate of eligibility (COE) again.

Griffin Funding specializes in a variety of mortgage types to ensure you find the right option based on your needs and budget. If you’re an investor, you can inquire with us about the various investment property loans we offer. Meanwhile, if you’re looking for a loan for an owner-occupied property, you can review our website for our available loan offerings in your state.

See If You Qualify for a No-Income, No-Asset Loan

If you don’t qualify for a conventional loan with strict lending requirements, a no-income loan similar to a NINA loan might be right for you. While NINA loans are currently only available for investors, borrowers looking to purchase a primary residence still have many options, such as bank statements and asset-based loans.

Wondering which option is right for you? Talk to a Griffin Funding mortgage specialist today to learn about our mortgage programs and find one that aligns with your needs. Apply now.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

Net Operating Income: Definition, Formula, & Examples

What Is Net Operating Income (NOI)? Net operating income measures how much money your investment property gene...

Best DSCR Lenders: Griffin Funding vs Angel Oak vs Kiavi vs Visio vs Lima One vs Easy Street

What to Look for in a DSCR Lender Choosing the best DSCR lender for your unique situation means evaluating sev...

Cash on Cash Return in Real Estate: Definition, Formula, & Examples

What Is Cash on Cash Return? Cash on cash return (CoC) is a metric that measures the annual income you generat...