VA ARM Loans: What Are They & How Do They Work?

KEY TAKEAWAYS

- VA adjustable-rate mortgages may be a good option for individuals who want a lower interest rate for the first period of the loan.

- VA ARMs are typically available as 5/1 loans in which the introductory period interest rate is fixed for five years before adjusting every year after that.

- To qualify for a VA ARM loan, you’ll need to meet the VA’s and your lender’s requirements.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage Platform

VA loans allow eligible veterans, active duty service members, and surviving spouses to purchase or refinance a home with a zero percent down payment, competitive interest rates, and more flexible lending requirements.

When you apply for a VA loan, you have two options: adjustable-rate vs. fixed-rate mortgages. Each has its pros and cons and is better suited for some types of borrowers. When determining which type of VA loan is right for you, there are several things to consider, including your budget and whether you want your mortgage interest rate to be predictable throughout the life of the loan.

This article will discuss everything you need to know about VA adjustable-rate mortgages (ARMs) to help you make the right choice of home loan when using your military benefit.

KEY TAKEAWAYS

- VA adjustable-rate mortgages may be a good option for individuals who want a lower interest rate for the first period of the loan.

- VA ARMs are typically available as 5/1 loans in which the introductory period interest rate is fixed for five years before adjusting every year after that.

- To qualify for a VA ARM loan, you’ll need to meet the VA’s and your lender’s requirements.

What Is a VA ARM Loan?

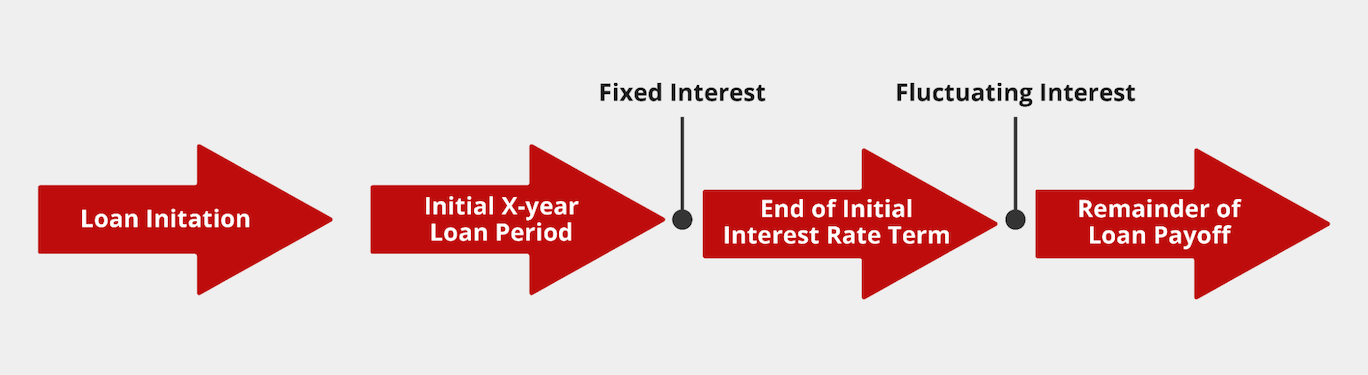

VA adjustable rate mortgages have interest rates that change—or adjust—throughout the mortgage. Typically, VA ARM loans are hybrid with rates that don’t change monthly. Hybrid VA ARMs have fixed interest rates at the beginning of the loan and adjust after a set fixed period, which is determined by the loan terms.

ARM VA loan rates typically change once per year after the fixed rate period. These loans allow veterans and other VA loan recipients to get a lower interest rate at the beginning of the loan, which can be beneficial for borrowers who want to save money during the first few years of the loan, allowing them to build their wealth.

However, it’s important to note that after the fixed-rate period changes, your mortgage rate will change every year afterward, which can make the loan more expensive. Interest rates are based on market conditions, so it’s possible to have a much higher interest rate than the average at points throughout your loan.

VA ARM Loans: How Do They Work?

To understand how VA ARM loans work, you should have a basic understanding of fixed-rate mortgages. With fixed-rate mortgages, the interest rate never changes, so you’ll pay the same amount every month for the life of the loan.

Conversely, with ARM VA loans, you’ll have a fixed-rate period determined by your loan terms, and after that period ends, your mortgage rate will adjust every year, so your monthly mortgage payment will change over time.

Loan Terms

There are several types of VA loan terms to choose from, but the most popular are 3 or 5 years with a fixed introductory rate before the loan interest rate changes every year after.

When researching these types of loans, you might see them explained as 3/1 ARM or 5/1 ARM. The first numbers are the number of years the loan is fixed before changing to an adjustable-rate mortgage every year after.

Interest Rates

After the introductory period ends, your interest rate will either increase or decrease depending on the index it’s tied to. Lenders calculate the interest rate using the index and margin.

The index is a benchmark that reflects market conditions, and the lender decides which index your loan is tied to when you apply.

The margin is the amount of interest (also known as percentage points) determined by the lender that you’ll pay on top of the index. Therefore, to find your interest rate, lenders add these two numbers together.

Every year, your VA ARM loan payments are recalculated based on the new rate and the number of years remaining on the loan. For example, if you have a 30-year 5/1 ARM loan, your new loan would be based on the 25 years you have left to repay the loan.

Rate adjustments are typically capped, so your interest rate can only adjust up or down so much each year. For example, at Griffin Funding, rate adjustments are capped at a total of 5% above your initial rate and typically won’t increase more than 1% each year.

VA ARM loans can be refinanced later in case you decide you want an unchanging mortgage rate.

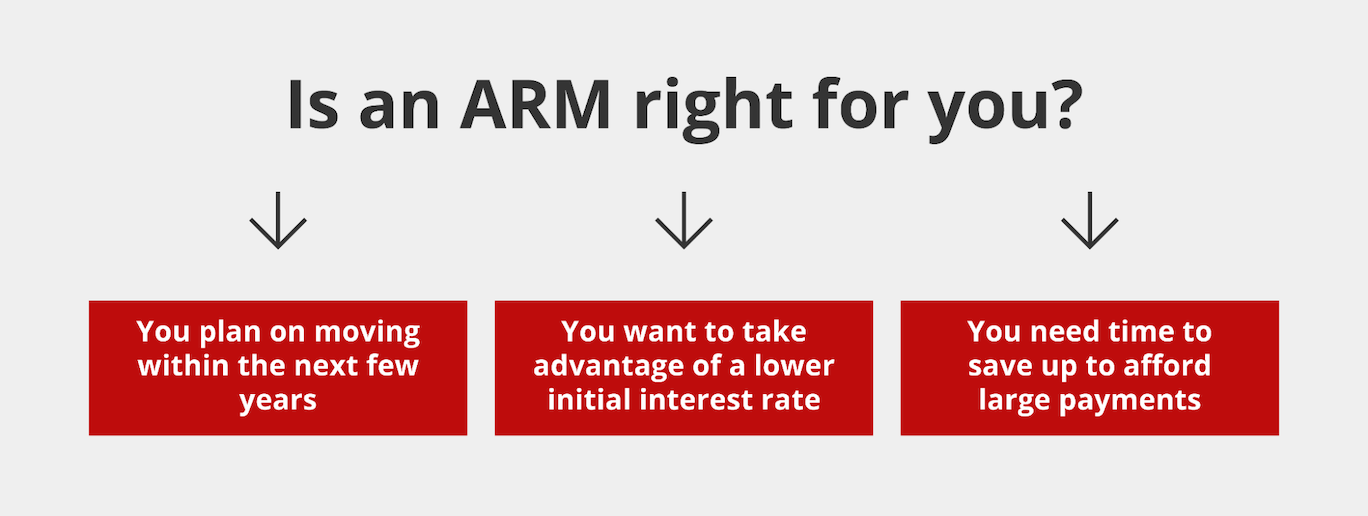

However, ARMs are ideal for situations when you want to pay less for the first few years of your loan because they typically have a lower introductory rate than fixed-rate mortgages. Ultimately, if you can pay off most of your loan during that period, you can save money over the life of the loan.

How Is VA ARM Eligibility Determined?

To qualify for a VA ARM loan, you must be eligible for a VA loan, which means meeting the US Department of Veterans Affairs (VA) minimum service requirements:

- Active duty service members must have served at least 90 days during wartime or 181 days during peacetime

- Veterans who served during wartime or peacetime

- Reserves and National Guard members who have completed a minimum of six years of service

- A surviving spouse if the veteran passed away due to service-related injuries or complications

- Spouses of members who have been listed missing in action (MIA) or a prisoner of war (POW) for at least 90 days.

Additionally, the property must meet the VA’s minimum property requirements (MPRs) to ensure the property is safe, sound, and livable.

Your lender will need your certificate of eligibility (COE) from the VA, which they can obtain through a database when you apply for the loan. You can also request your COE from the VA at any time. Then, you must meet the lender’s criteria.

VA loans aren’t offered by the VA; they’re guaranteed by it, so the VA will back a portion of the loan amount if you default, making lending to eligible borrowers less risky for the lender. Because of this, lenders can offer more flexible lending criteria, which typically include:

- Lower credit score requirements

- Zero percent down payment

- Competitive interest rates

That said, you’ll still need to demonstrate your ability to repay the loan by meeting a lender’s VA income requirements.

Typically, lenders like to see a credit score of at least 580, but Griffin Funding will accept credit scores as low as 500.

Advantages & Disadvantages Of VA ARM Loans

VA loans are one of the most significant benefits of serving in the military, and there’s no reason not to take advantage of them if you’re eligible. The VA ARM loan is one of the few loans available that offer zero down payment without the need for private mortgage insurance and flexible lending criteria that makes securing a home loan easy.

But, of course, no loan is a perfect solution for every person. Here are a few advantages and disadvantages of VA ARM loans to consider:

Advantages

VA ARM loans share the same advantages as fixed-rate VA loans, giving you a zero percent down payment option without purchasing PMI. Additionally, there are more flexible lending criteria with lower credit scores and higher debt-to-income (DTI) ratios accepted.

However, a few benefits of ARM VA loans, in particular, include:

- Ideal for starter homes: Starter homes are those you don’t plan to live in for the rest of your life. Instead, they’re usually small and allow you to start a family until you need more space. If you’re looking for a starter home, VA adjustable rate mortgages offer lower interest rates during the first period, and after 3 or 5 years (depending on your loan terms), you can move to a new home before the interest rate adjusts.

- Lower fixed rate: VA ARM loans typically have lower introductory fixed rates than fixed-rate mortgages, allowing you to save during the first portion of your loan. If you expect your income to grow over the next few years, these loans can help keep your costs low now while you build wealth.

- Capped increases: VA ARM rates are capped, so they can only increase so much. While it’s possible for your ARM rate to increase at times, there’s a limit on how much it can go up.

Disadvantages

Unfortunately, no loan product is perfect, even though VA loans come close. Some disadvantages of VA ARM loans include the following:

- Increased payments: ARM loan interest rates adjust yearly after the introductory period, so your payments could increase. If you might have difficulty paying more, a fixed-rate mortgage is a better option for you.

- Capped decreases: While capped VA rate increases can prevent you from paying more than you can afford on your loan, interest rate decreases are also capped. Therefore, your interest rate can only decrease so much.

Calculating VA ARM Loan Payments

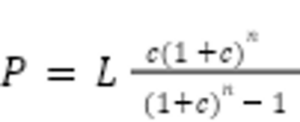

Calculating VA ARM loan payments can be confusing because you ultimately won’t know the market conditions until they happen. To calculate your payments, you must know your initial rate, balance, and term length. You’ll also need to know the new interest rate, your remaining balance, and how many years you have left on your mortgage.

When you apply for an ARM loan, you’ll receive a loan estimate from the lender, which will give you information about the loan, including projected payments based on changes in your interest rate. This estimate can help you determine how much you’ll pay after the initial introductory period is over and every year after that.

The formula for calculating your VA ARM payments is as follows:

- P= Monthly payment

- L= Loan amount

- c= interest rate (annual rate divided by 12)

- n= number of months in the loan

During the first five years of a $200,000 loan, you have a fixed interest rate of 3%. Using this formula, your monthly payment is $843. Now, let’s say that after 5 years, you have around $188,000 remaining on the loan.

Now, you have 25 years left on the loan and a 4% interest rate after the introductory period. To find your new payment, you’ll use the formula again, but with the number of years left on the mortgage. Your new monthly payment is $1,056.

Applying for a VA ARM Loan (& How We Can Help)

Griffin Funding streamlines the VA ARM loan application to help you determine your eligibility. After our initial discovery meeting, we’ll determine if a VA ARM loan is right for you before getting you pre-approved for a loan.

After you find your dream home, you can begin the application online or contact us to help you through the process. After we receive your application, we’ll perform underwriting to ensure you qualify for a loan and determine your interest rate and loan amount.

Griffin Funding works with our borrowers to ensure you provide us with the necessary paperwork and information to streamline the underwriting process and help you get faster loan approval. Additionally, we’re always here to answer your questions and ensure you have a positive experience when shopping for your next home.

Secure a Loan Today

Ready to begin your home-buying journey? Get pre-approved online or contact us to discuss VA ARM loans to determine your eligibility. We can help you understand how ARM loans differ from fixed-rate mortgages and help you find the right option for you and your budget.

Call us at 855-698-1230 or request a quote online.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Who is best suited for a VA ARM loan?

However, these loans can be a good option for individuals who plan to live in their homes for the entire length of the loan because they allow you to save on the initial period and build wealth over time.

If you believe your income will grow in the next few years, an ARM loan can help you save now and pay more when you earn more.

Is it more difficult to qualify for a VA ARM loan?

An ARM loan can also allow borrowers to qualify for larger mortgage amounts under the same 30-year term.

What ARM term is best?

You might choose the longer introductory term if you’re looking to save for longer and want to live in your new home for less than seven years or refinance during that time.

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...