Can My Spouse Use My VA Loan Without Me?

You may qualify for the VA home loan if you’re a veteran, active duty service member, or surviving spouse. The VA loan offers members unique benefits that allow them more flexibility in the approval process. For example, VA borrowers can expect lower (or no) down payment requirements, credit score flexibility, and more competitive interest rates. However, if you’re married, you might wonder, “Can my spouse use my VA loan without me?”

The Department of Veteran Affairs allows some spouses to use a VA loan, but there are a few caveats. The VA will determine your spouse’s eligibility based on certain requirements, and they can only use your VA loan if they meet the criteria. Let’s learn more about VA loan spouse requirements to help you determine if your spouse can use your VA entitlement to purchase a home.

- VA Loan Spouse Requirements

- Can My Spouse Use My VA Loan Without Me?

- Should I Add My Spouse as a Co-borrower?

- Check Your VA Loan Eligibility Today

- Frequently Asked Questions

VA Loan Spouse Requirements

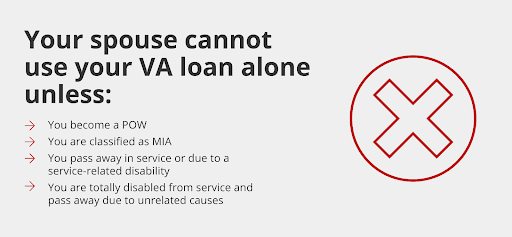

As mentioned, the VA sets requirements for whether a spouse can use a VA loan. In general, military spouses can’t use your VA loan without you. However, there are a few exceptions. According to the VA, a spouse can receive a certificate of eligibility (COE) if:

- The veteran is missing in action (MIA) or a prisoner of war (POW)

- The veteran died while in service or due to a service-related disability

- The veteran was fully disabled and passed away, but their disability wasn’t the cause of death

Additionally, your spouse isn’t allowed to remarry for a certain period of time if they want to use your VA loan. For example, if the veteran died in service and their spouse didn’t remarry before the age of 57, they qualify to use the loan on their own. However, if they marry before that time, they’re no longer eligible for the home loan.

Can My Spouse Use My VA Loan Without Me?

Based on the VA’s current spouse requirements, your spouse cannot use your VA loan without you unless you’ve passed away or become missing in action or a prisoner of war. There are several benefits and loans for military spouses. However, the VA home loan is not one of them. So, ultimately, unless something happens to you, your spouse cannot use your VA loan without you. However, they can use your VA loan with you by becoming a co-borrower or co-signer as long as they meet the minimum qualification requirements set by the lender.

It’s important to note that a co-borrower and co-signer aren’t the same, so you must determine your spouse’s income and credit to determine whether they can help you obtain a higher low amount or hurt your chances of getting a VA loan.

A co-borrower is someone who joins you and is considered a co-homeowner. Their income, credit score, and debts are used to help them qualify for the loan, which means you’ll share the financial responsibilities with them. When you have a co-borrower, both names will appear on the house title.

A co-signer is someone who is not an owner. Instead, they agree to take responsibility if you default on your payments. However, they don’t have a legal claim to the home. Therefore, if they must continue paying toward your loan, they won’t own it. Your spouse can be a co-signer to help you qualify for a loan using their credit score and income. In most cases, you want your spouse to be an owner with you, so they’ll become a co-borrower and share the financial responsibilities with you.

Should I Add My Spouse as a Co-borrower?

There are several benefits to adding your spouse as a co-borrower. Their credit and income will affect the maximum loan amount and other details. For example, if you have low credit and they have high credit, the lender will take into account both scores, allowing you to potentially get a better interest rate on your loan. Therefore, if you have a spouse with a high income and a good or better credit score, you could qualify for a larger loan amount and better interest rates.

However, the opposite is also true. If your spouse has bad credit and low income, they could make you qualify for higher VA loan rates and lower loan amounts. For example, let’s say you have a perfect credit score of 850, and your spouse has one of 550. Lenders will most likely take the lower credit score. In this case, your new credit score is 550, which is still considered poor. However, you could get better interest rates by applying by yourself with a credit score of 850.

That said, in most cases, a spouse’s income will likely help you qualify for a larger loan amount as long as they don’t have any significant debt. Unlike credit scores, lenders won’t take the average. Instead, they’ll add your incomes together, which can effectively reduce your debt-to-income (DTI) ratio to help you qualify for better terms.

Overall, you can expect the following benefits of adding your spouse as a co-borrower on a VA loan:

- Avoid credit issues: As mentioned, if you have a low credit score, adding your spouse to your mortgage loan can make you more attractive to lenders.

- Save on interest: Higher combined credit scores result in lower interest rates, helping you save more on your monthly premiums and over the life of the loan.

Unfortunately, there are potential downsides to adding your spouse as a co-borrower. The same factors, including debts, income, and credit score, can negatively impact your ability to become eligible for a loan and may result in lower loan amounts.

Whether or not you should add your spouse as a co-borrower depends on your unique situation. However, if you’re unsure, you can contact Griffin Funding to discuss your options and let us advise you on the best option.

Check Your VA Loan Eligibility Today

Every situation is different, so you won’t know if you or your spouse are eligible for the VA loan until you obtain a certificate of eligibility (COE). If you haven’t requested this document from the VA, Griffin Funding can do it on your behalf to determine your VA loan eligibility.

We understand that many veterans and service members have civilian spouses who take care of the home loan process while they’re stationed overseas. If your spouse becomes a co-borrower and you qualify for a VA loan, we can work with either borrower to ensure you understand the requirements and find the best option for you and your family.

Ready to start the VA loan approval process? You can get pre-approved with Griffin Funding using our online application.

Frequently Asked Questions

Can my wife use my VA home loan without me?

No, your wife can’t use your VA home loan without you. However, she can become a co-borrower or co-signer. Ultimately, a spouse of any service member or veteran can’t use the VA by themselves; the veteran must be the primary borrower of the loan. However, there are several exceptions. Spouses can use home loans without the veteran if the veteran has passed away due to a service-related injury or disability.

Can a surviving spouse get a VA loan?

A spouse cannot use a VA loan. However, there is one caveat. The Honoring America’s Veterans and Caring for Camp Lejeune Families Act of 2012 expanded benefits to surviving spouses. Now, there are more qualifiers to help eligible spouses secure a home loan. To qualify, the veteran must have:

- Been missing in action or a prisoner of war (POW) for at least 90 days

- Died in service due to service-related circumstances or a service-related disability

- Been fully disabled as a result of their service and died of unrelated causes

Additionally, there are requirements regarding a surviving spouse’s marital status. According to the VA, surviving spouses are still eligible for the VA loan if they haven’t remarried before their 57th birthday or before December 16, 2003.

How does a divorce impact VA home loan eligibility?

A divorce can impact VA home loan eligibility in several ways. Remember, the VA loan is designed for veterans, helping them secure a home loan with more flexible requirements. Ex-spouses are not eligible for a new VA loan. However, if you and a co-borrower are on the same VA loan, it can get complicated during a divorce.

According to VA rules, former spouses can remain in the home if they’re co-signers on the loan, but if they weren’t co-signers, they can’t stay in the home if the veteran has moved out. Therefore, if you and your spouse divorce and you move out, they’re not allowed to live there. Additionally, there’s the issue of VA entitlement. You may still have some of your entitlement if you’ve used your VA loan. However, you can only restore your full entitlement once you pay off or refinance the existing VA loan.

For a veteran to keep their VA loan benefits, they must meet occupancy requirements set by the VA, which require them to live in the home for at least 12 months. If they can’t meet these requirements, the loan must be refinanced as a non-VA loan.

Interested in learning more?

Get StartedRecent Posts

Bonus Depreciation for Real Estate: What It Is & How It Works

Understanding the concept of bonus depreciation and its practical application can help you capitalize on this ...

No Doc Business Loans: What You Need to Know

While “no doc” is short for “no documentation,” there are actually no true no doc loans. Instead, they...

BRRRR Method: Buy, Rehab, Rent, Refinance, & Repeat

Read on to learn more about BRRRR loans and explore how this approach can open doors to lucrative opportunitie...