What Is a VA ARM Loan?

KEY TAKEAWAYS

- A VA ARM loan has an initial, lower rate that is adjusted based on a market index after a predetermined period of time.

- The interest rate on an ARM loan is tied to an index, and will be recalculated periodically throughout the life of the loan, which can change a borrower’s monthly payments.

- Your interest rate may go up or down over the life of a VA ARM loan, but the rate will never exceed a preset cap.

The U.S. Department of Veterans Affairs (VA) backs mortgage loans taken out by eligible service members and veterans who obtain financing through the VA home loan program. In doing so, eligible borrowers are able to take full advantage of a number of benefits, including no down payment, competitive interest rates, and lower VA loan closing costs.

VA mortgage loans can be either fixed-rate loans, which feature the same interest rate for the life of the loan, or adjustable rate loans, which will have an initial rate for a period of time and then a rate that fluctuates for the remainder of the loan term. These VA adjustable rate mortgage (ARM) loans provide an option for borrowers who want a rate that can go down or up depending on the market.

Understanding how a VA ARM loan works, including the necessary steps needed to apply for one and how your rates are calculated, is important as you look into financing options for a home. While you may be familiar with traditional fixed-rate loans, the potential benefits of ARM loans, especially for VA borrowers, can make these loans an attractive option in a world of rising interest rates.

KEY TAKEAWAYS

- A VA ARM loan has an initial, lower rate that is adjusted based on a market index after a predetermined period of time.

- The interest rate on an ARM loan is tied to an index, and will be recalculated periodically throughout the life of the loan, which can change a borrower’s monthly payments.

- Your interest rate may go up or down over the life of a VA ARM loan, but the rate will never exceed a preset cap.

What Is a VA Adjustable Rate Mortgage?

An adjustable rate mortgage (ARM) is one with an interest rate that changes throughout the term of the loan. There are two types of ARM loans: those in which the rate can change every month and hybrid ARMS, which have an initial fixed rate that then changes after a period of time.

A VA adjustable rate mortgage consists of the latter type of ARM. This loan type will generally begin with a fixed rate for a number of years and then the rate is adjusted every year through the rest of the loan period, which is often a 30 year term.

How Do VA ARM Loans Work?

A VA ARM loan is a mortgage available with 0% down to active U.S. military, reservists, veterans, and eligible surviving spouses. Like all ARM loans, a VA adjustable rate mortgage provides a borrower with an initial fixed interest rate, which is often relatively low compared to rates on other loan types.

After the initial period expires, the interest rate will be recalculated once per adjustment period—which is usually one or two years—based on a market index plus some amount of margin. Using the new interest rate, the overall amortization schedule on the mortgage will be recalculated to determine the new monthly payment for the next period.

How Are VA ARM Rates Determined?

All ARM rates, including those for VA ARMs, are determined based on the constant maturity treasury (CMT). A margin is added to this index to determine the total interest rate that is applied for the next year. The CMT is determined by the U.S. Treasury every day and is based on the yield of recently auctioned U.S. treasury securities, such as Treasury Bills, Bonds, and Notes.

On the day when a VA ARM rate is calculated, the CMT for the day and the margin, usually around 2%, are combined. For example, if the CMT on the adjustment date is 2.7% and the margin is 2%, the ARM rate for the next year would be 4.7%.

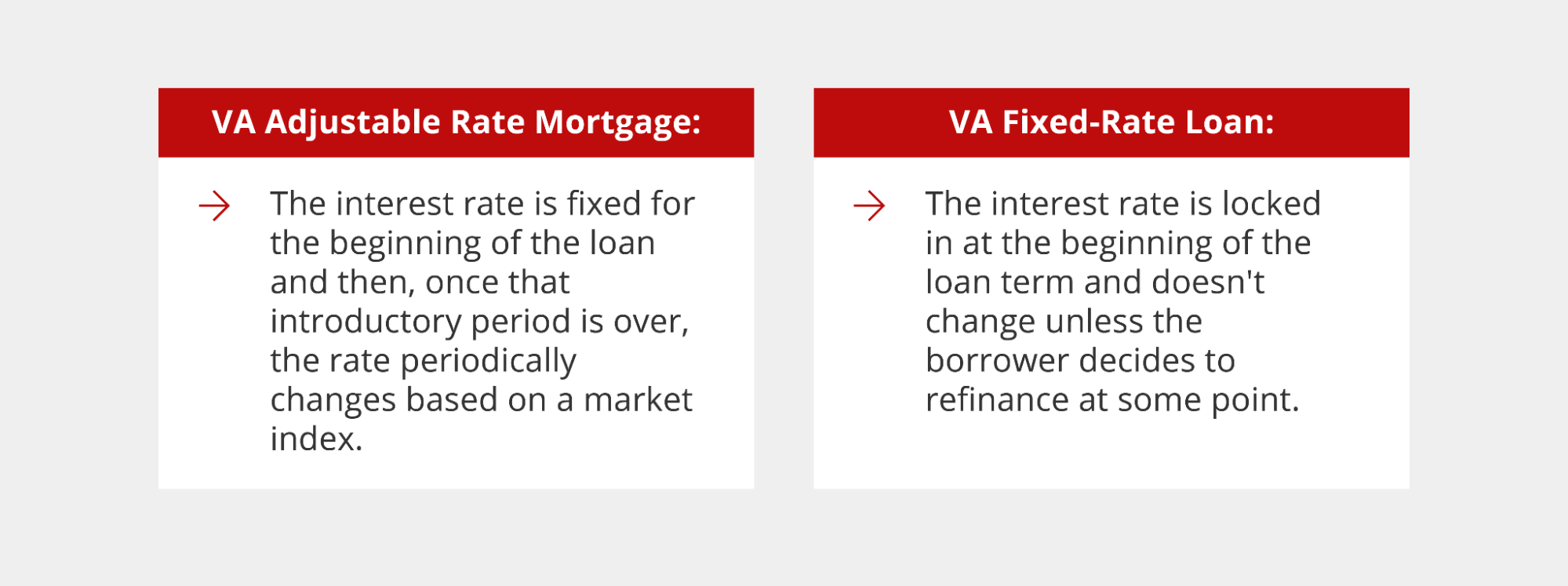

Fixed-Rate vs ARM VA Loans

Both fixed-rate and ARM VA loans provide the same benefit of 0% down for those eligible. However, fixed-rate vs ARM loans are different from each other in a number of ways. The most notable difference is that a fixed-rate mortgage will have the same interest rate from the first day to the last. In this way, a specific rate is locked in, and regardless of how market-wide interest rates change over the life of the loan, the rate paid by the borrower will never change. This means that even if rates increase, the rate paid on a fixed-rate mortgage will remain the same.

In contrast, an ARM VA loan will have an initial interest rate that is lower than most fixed-rate loans, but following the initial period the interest rate will fluctuate each time it is recalculated. A low initial rate can be beneficial for a borrower who may want to make lower payments for several years or someone who, like many military borrowers, will be moving before the initial rate expires.

However, for a borrower who transitions into the adjustable rate periods, the interest rate and subsequent payments will change throughout the remainder of the loan.This means that the borrower’s interest rate can rise or fall depending on the CMT.

Benefits of VA ARM Loans

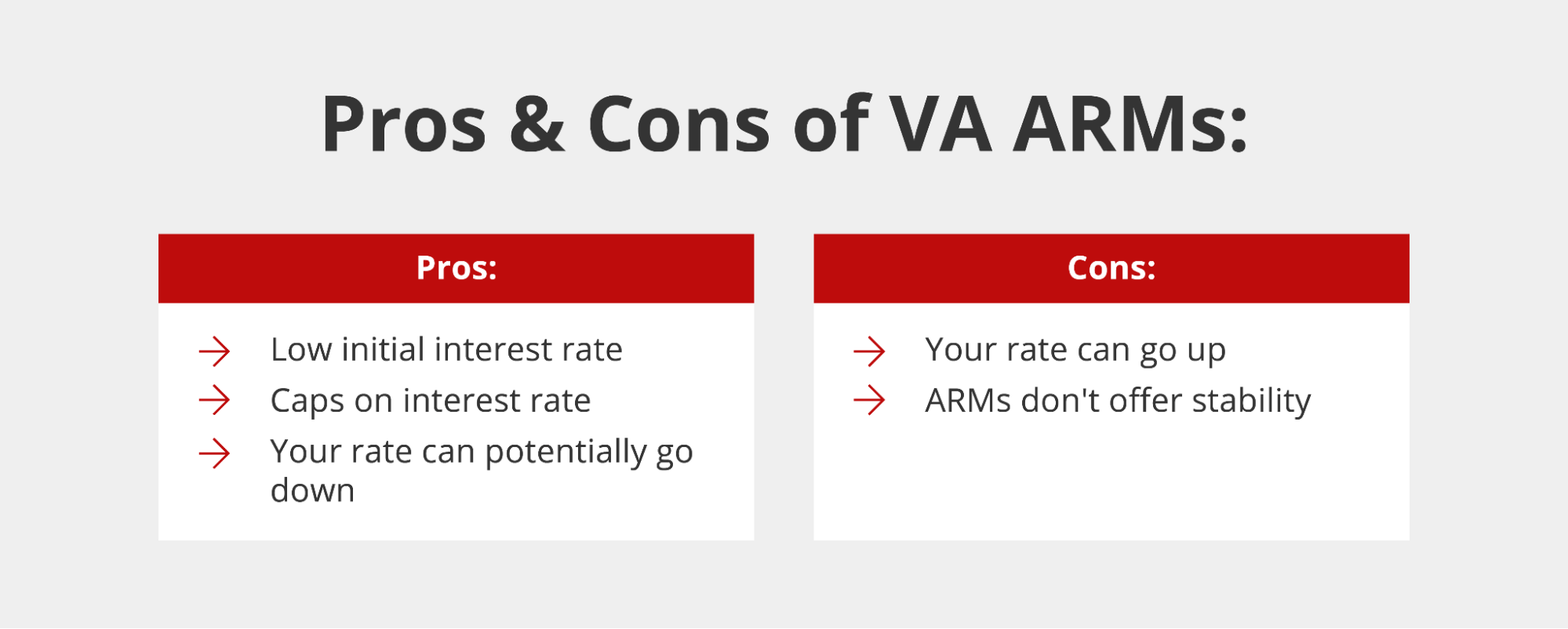

VA ARMs have several benefits, similar to other ARM loans. These benefits include:

- A low initial rate: Like all ARM loans, a VA ARM will begin with a low initial rate. This means that the interest paid during the first part of the loan will typically be less than traditional fixed-rate mortgages.

- Interest rate cap: For VA borrowers who do pay the adjustable rate, that rate is capped at a certain level. This means that the rate will never go above that cap, even if the market experiences severe fluctuations and interest rates spike. This offers some built-in protection for borrowers.

- Potentially lower rate: Because the rate is changed every year based on the CMT, if the index goes down, so will the ARM rate. Compare this to a fixed-rate mortgage, which will never go down, regardless of how interest rates fluctuate during the life of the loan.

Drawbacks of VA ARM Loans

Like all ARM loans, there are some potential drawbacks of VA ARMs that need to be carefully considered. These drawbacks include:

- The rate can increase: Again, since the adjustable rate is changed every year based on the CMT, if that index goes up, so will the interest rate on your VA ARM loan. While the cap on the interest rate will keep it below a specified level, the fact that over the adjustable period the rate can go up means that more interest may be paid compared to a fixed-rate mortgage.

- Overall lack of stability: As the VA ARM rate fluctuates each year, the payments and amortization will change. Therefore, every time the rate is recalculated, the monthly payment will be changed to reflect the remaining amortization. This will mean different payments every twelve months, which can make it difficult to plan long-term for mortgage payments.

How to Apply for a VA Adjustable Rate Mortgage

When it comes time to apply for your first VA loan, an ARM VA loan might be something that you’re considering. While some of the requirements for any mortgage apply to ARM loans, there are some additional things to consider when applying for a VA ARM.

We recommend beginning the application process by finding a lender that is knowledgeable about the overall VA ARM process. Schedule a consultation with Griffin Funding to see if you qualify for a VA ARM loan, determine whether it’s right for you, and get more insight into the steps you need to take in order to apply.

Once you have found the lender you will be working with, the next step is to obtain your Certificate of Eligibility (COE). This document will declare that you meet the initial requirements to apply for any VA mortgage loan, including a VA ARM.

After getting your COE, you can get pre-approved for a loan. Then it’s time to find the home you wish to purchase and sign a purchase agreement. Once this has been finalized, you will apply for the VA ARM loan to specifically cover the purchase of the home. This process is similar to any mortgage application process, and will involve providing your lender with documents showing income and assets. After your mortgage has been processed and you are approved, the final step is to sign the appropriate documents and move into your new home.

Access Competitive VA ARM Rates

For eligible military borrowers, a VA ARM can be a good option when it comes to purchasing a home. Because the initial rate will be lower than most fixed-rate mortgages, military borrowers can potentially save money and not enter into the adjustable rate period if they move to a new location. However, before securing any mortgage, it’s a good idea to work closely with a qualified and knowledgeable loan provider like Griffin Funding.

The team at Griffin Funding can help you evaluate the benefits and potential drawbacks of all of your options. To that end, we invite you to contact us with any questions you may have regarding our services and inquire about our competitive VA loan rates. We will help you understand the steps you need to take to apply for and secure your VA adjustable rate mortgage, and ensure you get the most out of your VA benefits.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

Conventional Loan Limits in 2025

If you plan to purchase or refinance a home in the coming year, understanding the conventional loan limits in ...

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...

Mortgage Refinance Limits

Your Refinancing Options Most owners have several refinancing pathways depending on their financial goals and ...