What Is a Bank Statement? How to Get Bank Statements & Secure a Loan

If you are a first-time home buyer, it’s important to explore all your options when trying to secure funding for your dream house. There are several types of home loans to consider. However, if you’re self-employed or have 1099 income due to working as a contractor, things become a bit more complicated. Without a W-2 showing the wages you earned from an employer, you might find it challenging to get a mortgage.

Fortunately, there are other ways to prove your income, including a bank statement loan. This article answers the question, “What is a bank statement?” and discusses how you can obtain a bank statement to get a home loan.

Bank statement loans are ideal for prospective homeowners with no proof of income from an employer. Whether you’re a real estate investor, a freelancer, or a retiree, a bank statement loan can help you achieve your homeownership goals.

- What Is a Bank Statement?

- How to Get a Bank Statement

- What Is a Bank Statement Loan?

- How Does a Bank Statement Loan Work?

- Benefits of a Bank Statement Loan

- Apply for a Bank Statement Loan Through Griffin Funding

What Is a Bank Statement?

If you have a bank account, you should get a bank statement every month. This document includes all transactions that occurred during the statement period. As well as containing your account information, it will show a detailed description of all deposits and withdrawals.

Your bank will issue these statements so that you can review your transactions. Typically, you’ll receive the statement on a specific day. All transactions appear in order by date.

Financial income statement with calculator and pencil. Balance the investment portfolio

Other information you might find on a bank statement includes the following:

- Statement period: This represents the dates covered in a bank statement. For example, your bank statement might run from January 15th to February 14th and come in the mail or to your email address at the end of February.

- Starting and ending account balances: By looking at your beginning and ending balances, you can calculate how much your balance increased or decreased based on your most recent spending.

- All completed transactions: Each line shows the date of the transaction occurred, the amount of the transaction, and the name of the person or entity sending or receiving money from the account. You can also see pending transactions.

- Fees and any interest earned: If you have an interest-bearing account, it will show how much interest you earned.

- Bank information: The statement has the issuing bank, account number, and contact information, such as the phone number or mailing address.

Transaction level details typically include the amount involved, the payee, and the date. You can also see the same information for withdrawals, deposits, checks, and bank fees.

Bank Statement Example

A simplified bank statement might include a beginning balance of $1,000, one deposit for $3,000, and one withdrawal for $2,000. Assuming no service charges, you would have an ending balance of $2,000.

The bank statement should include the date and description for the withdrawal and deposit, as well as any other transactions that occur during the statement period.

How to Get a Bank Statement

Most banks and financial institutions have online portals where you can access your financial information, including your bank statements. If you can’t find your bank statement on the website, try calling the bank directly for instructions or to request paper copies.

Paper copies come through traditional mail. If you’re worried about security or don’t want to waste the paper, you can request electronic delivery of your statement. You can also download a free PDF file with your printable bank statement.

You can review financial information for a selected time, typically 60 to 90 days. The main account page will also list recent account information, such as the current balance. It’s a good idea to review your bank statements for accuracy periodically.

What Is a Bank Statement Loan?

Bank statement loans provide a convenient alternative for self-employed borrowers and others who don’t have traditional jobs. They serve as an alternative for workers or business owners who don’t receive pay stubs or W-2s from employers. As such, bank statement loans are classified as Non-QM loans.

These non-traditional loans require additional documentation to prove your income and ability to pay your mortgage. We can assist self-employed borrowers with our bank statement loan program. If you’re still wondering whether you qualify, keep reading or reach out to Griffin Funding to discuss your options.

Rest assured that self-employment does not necessarily disqualify you from getting a mortgage. You won’t have to submit tax returns to apply for a first-time mortgage loan. You can also use bank statement loans to apply for cash-out refinance loans on your current home.

If you are a realtor, restaurant, small business owner, or a member of the gig economy, this could be your best option for buying a new home or cashing out equity on the one you have.

Here are some of the most popular types of bank statement borrowers:

- Business owners

- Realtors

- Entrepreneurs

- Sole proprietors

- Retirees

- Freelance employees

- Contract workers

- Consultants

- Gig economy workers

- Independent contractors

If you’re a self-starter who likes to control your own destiny, one or more of these occupations may apply to you. Find out how a bank statement loan works and how you can use it to pursue your real estate investment goals.

How Does a Bank Statement Loan Work?

When you apply for a bank statement loan, you won’t need your tax returns, W-2s, pay stubs, or employment verification forms. As an alternative, you can use your checking and savings account bank statements to show cash flow and income trends.

However, you’ll still need to gather certain paperwork needed by your banker or the underwriter and have all requested documents ready before you get approved for a bank statement loan.

Here are some of the typical requirements for your bank statement loan application:

- 12 to 24 months of bank statements

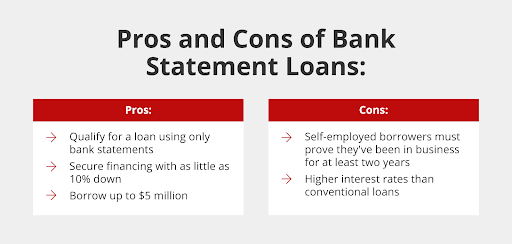

- Self-employed for at least two years

- Your business license, if applicable

- Proof of liquid assets for collateral

- A credit report showing a score of 620 or more

- Minimum 10 percent down payment

You may wonder why we need all this information. The truth is that the more information we have, the better case we can make for your mortgage loan request.

Benefits of a Bank Statement Loan

Although getting a loan at all may seem like a huge benefit if you’ve been denied traditional loans, there are other benefits of choosing a bank statement loan, including the following:

- No need to bring tax returns or undergo a traditional income verification process.

- Deposits to the account represent your monthly income.

- It’s relatively easy to get up to two years of statements if you are a business owner and prepare P&L statements. A certified public accountant will review your financials as required.

- You can get a loan with as little as 10% for the down payment.

- With a cash-out refinance loan, you can borrow 80% of your equity to fund new projects.

- You can borrow up to $5 million using only bank statements.

- You can choose a fixed-rate, adjustable rate, or interest-only mortgage.

Apply for a Bank Statement Loan Through Griffin Funding

A bank statement loan is a great alternative if your tax returns don’t reflect your true income. However, many self-employed workers may wonder if they’re eligible for other types of loans. We can help you work through the process and choose a loan that’s consistent with your borrowing needs and sources of income.

Bank statement loans have their downsides, but they are a great tool if you need a better way to show your revenue. At Griffin Funding, we offer bank statement loans and other types of asset-based loans to speed up the application process in your favor.

Contact us today to set up an appointment and discuss your real estate investment needs. By working with one of our loan specialists, you can find a home loan that best suits your goals.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

Conventional Loan Limits in 2025

If you plan to purchase or refinance a home in the coming year, understanding the conventional loan limits in ...

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...

Mortgage Refinance Limits

Your Refinancing Options Most owners have several refinancing pathways depending on their financial goals and ...