How Many Months of Bank Statement Do You Need to Qualify for a Mortgage?

When applying for a mortgage loan, your lender will ask for various documents to verify your employment and income. For traditional loans, they’ll likely ask for pay stubs, W2s, and tax returns. However, they might also ask you to provide a specific month’s worth of bank statements.

Bank statements are documents that list all of your banking activity, including your balance and amounts deposited and withdrawn. Lenders often use bank statements to verify income and ensure you have enough saved for the down payment and closing costs to ensure you can afford the loan.

So how many months of bank statements do you need for a mortgage? Ultimately, it depends on the type of loan you’re applying for. If your lender will require bank statements with a traditional loan, you usually only need to provide two or three.

However, there are particular home loans that allow you to qualify using bank statements called bank statement loans. If you use one of these Non-QM mortgage loan options, your lender will determine your eligibility and loan amount directly from your bank statements. Bank statement loans typically require at least 12 months’ worth of bank statements, but the exact amount varies by lender.

Keep reading to learn more about bank statement loans and other types of mortgages that might require bank statements to determine how many months of bank statements you need for a mortgage.

KEY TAKEAWAYS

- The number of bank statements you need for a mortgage depends on the type of loan and lender requirements.

- Traditional home loans may require two or three months’ worth of bank statements, but bank statement loans require 12 to 24 months’ worth.

- A bank statement loan might be a good option for you if you don’t have a traditional source of income and your tax returns don’t accurately reflect your ability to repay the loan.

What Is a Bank Statement Loan?

A bank statement loan is a type of non-qualified mortgage (Non-QM) loan that can help borrowers qualify for a home loan with bank statements instead of traditional methods like tax returns, pay stubs, and W2s. With a bank statement loan, the lender verifies your income using only bank statements rather than utilizing conventional income verification methods.

Bank statement loans are ideal for individuals who don’t have traditional income. These borrowers don’t have W2s or pay stubs because they’re self-employed, retired, or business owners who don’t have employers. Additionally, business owners, entrepreneurs, and self-employed individuals usually take legal deductions on their tax returns that effectively reduce their adjusted gross income — an important qualifying factor for a home loan. Therefore, their tax returns don’t paint an accurate picture of their financial situation.

Many borrowers are denied traditional home loans because their tax returns don’t accurately reflect their income. Additionally, they don’t have traditional documentation like regular employees to help lenders verify their income. A solution to this issue is a bank statement loan.

How Do Bank Statement Loans Work?

With bank statement loans, lenders require borrowers to provide a certain number of bank statements to demonstrate their income and ability to repay the loan. When lenders look at your bank statements, they’ll review the total amount of deposits and divide that amount by the number of bank statements.

In some cases, you might be able to use bank statements, tax returns, and W2s to qualify for a loan. This is usually the case with co-borrowers in which one has a W2 job, and the other is self-employed, retired, or a business owner. Ultimately, bank statement loans allow you to qualify primarily based on the income demonstrated in bank statements. However, lenders may use any number of sources to qualify your income. The same is true for other types of loans, such as asset-based loans and conventional loans. If you have a co-borrower, discuss your options with a lender to determine whether bank statement loans are right for you based on your unique situation.

The main goal of a bank statement loan is to verify a borrower’s income before approving them for a home loan. Lenders must do their due diligence to ensure you can repay the mortgage loan. With bank statement loans, lenders use bank statements instead of W2s and tax returns to verify your income, allowing them to streamline the process because there’s less paperwork required.

Bank statement loans work similarly to other types of home loans. Apart from verifying your income, the lender will want to learn more about your complete financial situation by reviewing your credit history to calculate your debt-to-income (DTI) ratio and employment history, whether or not you’re self-employed, retired, a business owner, or a gig worker.

How Many Months of Bank Statements Are Needed for a Mortgage?

How many months of bank statements are needed for a mortgage? It depends on the loan. If your lender wants to use bank statements to verify your income for a traditional home loan, they’ll usually only require two to three months’ worth. However, if you’re applying for a bank statement loan in which the lender uses your bank statements to verify your income, you’ll need to provide more.

If you do apply for a bank statement loan, most lenders require anywhere from 12 to 24 months’ worth of bank statements. This will help them determine your cash flow and ensure you have enough money saved for a down payment, closing costs, and a steady stream of income to pay your monthly mortgage premium.

You can use both personal and business bank statements to demonstrate your income and ability to repay. However, every lender is different, so you may be required to provide both. In any case, lenders like to see that you have bank statements going back at least 12 months to ensure you have a steady, reliable income.

Other Bank Statement Loan Requirements

A bank statement mortgage loan makes qualifying for a home loan easier for individuals without traditional income sources. Like other types of mortgage loans, lenders have requirements you must meet to be eligible. These requirements can also impact your total loan amount. Apart from verifying your income, lenders will want to learn more about you and your financial situation. Other bank statement mortgage requirements include:

Employment

All mortgage loans have some type of employment requirement to ensure you have a reliable source of income to repay the loan. However, not everyone is a W2 employee. Many people are contractors, business owners, freelancers, and retirees with alternative sources of income. For example, a freelance graphic designer doesn’t receive W2s or pay stubs from their clients. Instead, they’ll receive a 1099 and report their income on their taxes.

Even if you don’t have a traditional job in which you work for an employer, you still have an employment history and a source of income. You don’t need to be a W2 employee to qualify for a bank statement loan. Instead, you just need to prove that you can earn an income every month to repay your mortgage.

Since many self-employed individuals apply for bank statement mortgage loans, they typically just have to prove that they’ve been self-employed for at least two years. However, employment requirements vary by lender. For example, some may be willing to work with you if you’ve recently become self-employed and can prove that you have a reliable stream of income. Meanwhile, other lenders may allow you to be self-employed for fewer than two years if you’ve stayed within the same industry and your job duties haven’t changed much.

Small business owners can usually provide a business license or website address to confirm that they’ve been self-employed for the required period.

Credit History

Lenders review your credit history to determine whether you’re a trustworthy borrower. They like to see that you’re someone who pays their debts on time and doesn’t take on more debt than they can afford. Additionally, your lender will review your open accounts to help calculate your DTI ratio to determine whether you can afford to repay the loan based on your income compared to your current bills.

Lenders like to see a credit score of around 620 or higher to ensure that you have good financial habits. However, some lenders may be willing to accept lower credit scores. In any case, it’s always best to increase your credit score as much as possible before applying for a home loan because it can impact your interest rate. The higher your credit score, the lower your interest rate, which can save you thousands of dollars over the life of the loan.

Down Payment

Believe it or not, your credit score can also impact the down payment requirement. Most bank statement mortgage loans require a down payment of at least 10%. However, some lenders have a tiered process for determining down payment based on credit score. For example, at Griffin Funding, a credit score of 700 or higher allows you to make a down payment as low as 10%. However, a credit score that falls below 700 may require a larger down payment.

Reserves

Bank statement loans are considered a higher risk for the lender because borrowers aren’t W2 employees. Since they’re using alternative methods to verify income, they take on more risk. However, lenders mitigate their risk in several ways by passing it on to the borrower. For instance, the lower your credit score, the higher your down payment will be. In addition, many lenders require you to have reserves in the bank to ensure you can repay the loan regardless of any changes to your employment situation.

Griffin Funding requires at least three months of reserves after making your down payment and paying closing costs to cover the principal, interest, taxes, and insurance (PITI) costs associated with the loan. This requirement varies by lender, so you should always understand the requirements before applying for the loan.

Benefits of Bank Statement Mortgage Loans

Bank statement mortgages are designed for borrowers who can’t prove their income with traditional underwriting methods. These individuals simply don’t have the necessary documentation because they’re self-employed, retired business owners who don’t have an employer to provide W2s and pay stubs.

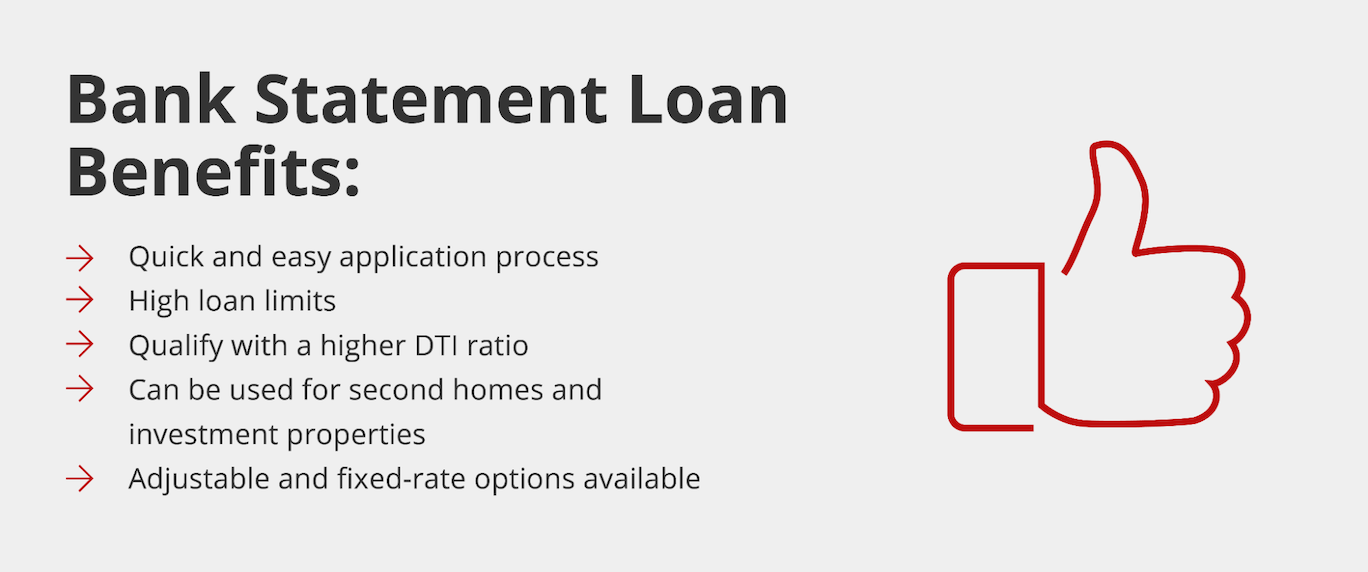

The most significant advantage of these loans is that they allow more borrowers to qualify for a home loan. Many self-employed individuals don’t qualify for traditional home loans because they can’t provide proof of income through traditional methods. However, bank statement loans make it possible for borrowers of all types to qualify based on bank statements. Other benefits of bank statement mortgage loans include:

Streamlined Application Process

Bank statement loans require fewer financial documents because your eligibility and loan amount are based on the deposits in your bank accounts. Compared to the conventional loan process that may require bank statements, W2s, tax returns, and pay stubs, bank statement loans offer a more streamlined process, allowing you to close on a house faster.

High Loan Limits

Bank statement mortgage loan limits vary by lender, but they offer more flexibility than conventional loans because they’re not regulated by Fannie Mae and Freddie Mac’s guidelines. Therefore, lenders can choose their own maximum loan amounts as long as the borrower can prove their ability to repay the loan. For example, Griffin Funding’s bank statement loans have a minimum loan amount of $100,000 and a maximum of $5 million.

Higher DTI Ratios Accepted

Since lenders aren’t restricted to Fannie Mae and Freddie Mac guidelines, they can accept higher DTI ratios. However, this requirement varies by lender. For conventional loans, most lenders accept DTIs no higher than 43%. However, Griffin Funding allows DTIs as high as 55% for some borrowers and loan types.

To find your DTI ratio, divide your monthly income by your monthly debts and multiply that number by 100 to give you a percentage.

Type of Property

Conventional loans have restrictions on the types of properties you can purchase. For example, VA loans can only be used to purchase a primary residence. However, bank statement loans allow for more flexibility, giving you the ability to purchase primary residences, vacation homes, or rental properties.

Adjustable and Fixed-Rate Options

With bank statement loans, you can choose between an adjustable- or fixed-rate mortgage, allowing you to take control of your mortgage payments. Adjustable rate mortgages (ARMs) are ideal for individuals who want to pay less now. However, it’s important to note that rate changes depend on the market, so you could end up paying more for your loan.

Downsides of Bank Statement Mortgage Loans

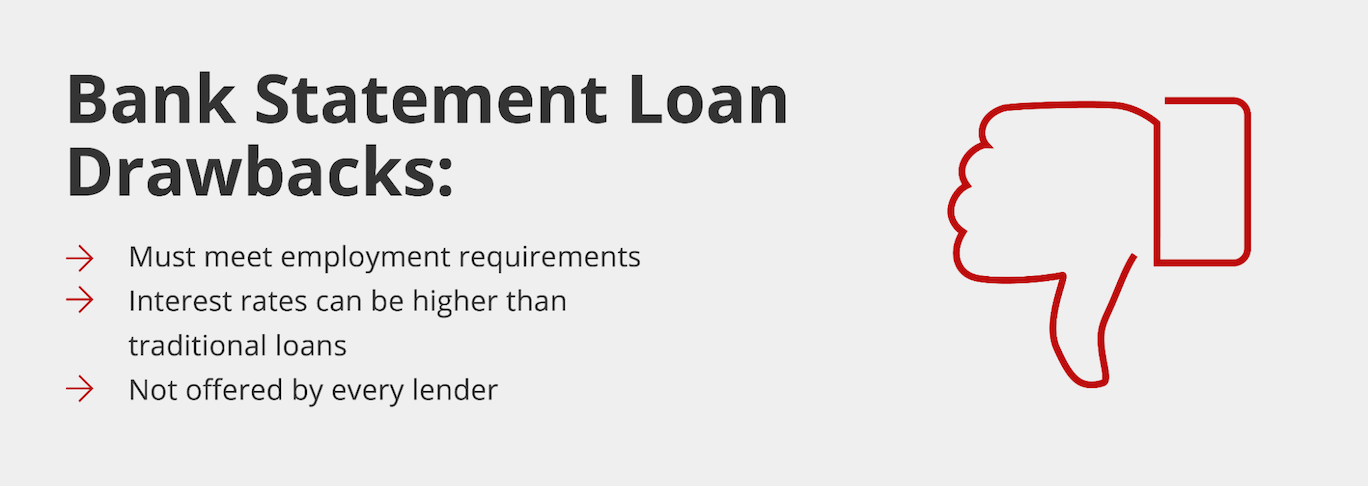

Unfortunately, no loan is perfect for everyone. Bank statement loans are best for individuals who don’t have traditional methods of verifying their income. There are several situations where another type of loan might be a better option. Potential downsides of bank statement mortgage loans for borrowers include:

Employment Requirement

To obtain a bank statement mortgage loan, borrowers must meet the lender’s employment criteria. This usually means operating a business or working as a self-employed individual for at least two years. However, some lenders may be willing to accept self-employment of fewer than two years, depending on the circumstance.

Unfortunately, if you’ve recently become self-employed, you’re a bigger risk to lenders and likely don’t have a method to verify income. Remember our earlier question, “How many months of bank statements for a mortgage do you need?” Lenders want at least 12 months’ worth of bank statements for bank statement loans to verify your income. If you can’t provide that crucial documentation, you won’t qualify.

Interest Rates

Bank statement mortgages typically have higher interest rates than traditional loans. However, you can reduce your interest rate by making a larger down payment and increasing your credit score before applying for the loan.

Accessibility

Not all lenders offer bank statement loans, so you’ll need to research mortgage lenders in your area and their offerings to ensure you find the best option based on your financial situation. Additionally, even if there are several lenders in your area that offer bank statement mortgages, you should shop around to find the best rates and work with a mortgage lender you can trust. This is especially crucial if you’re looking for loans for first-time buyers because the process can seem overwhelming without a mortgage lender that’s willing to work closely with you throughout the process.

How to Get a Bank Statement Loan

Getting a bank statement loan is similar to any other type of mortgage. After getting preapproved and putting an offer in on a home, you can apply for a mortgage. To apply with Griffin Funding, we need at least 12 to 24 months of bank statements from your personal and business accounts to verify your income.

Your application will go through a manual underwriting process to verify all the information you’ve given us about your employment situation, income and assets, and debt to determine your eligibility, loan amount, and interest rate. During the underwriting process, we may need more information, so you must remain in communication with us to streamline the process.

Apply for a Bank Statement Loan Today

Qualify for a home loan with bank statements by applying with Griffin Funding today. Our mortgage specialists can walk you through the application process to ensure you understand bank statement loans and have all the necessary documentation for us to begin the underwriting process.

Don’t qualify for a bank statement loan? We offer a range of mortgage loan options to help you find the best option for you and your family. Contact us today to learn more about the types of loans we offer.

Interested in learning more?

Get StartedFrequently Asked Questions

Do USDA loans require you to submit bank statements?

Additionally, if there are any large deposits, you'll have to explain them in a letter and provide a copy of the source. In addition to bank statements, USDA loans require asset and employment verification, so your lender will need copies of your retirement account statements as well as invoices, 1099s, W2s, and pay stubs.

How do I get bank statements?

What are lenders looking for on bank statements?

On bank statements, lenders are looking for deposits into your account from income sources. For example, if you're a contractor with clients, they'll want to see regular monthly deposits to ensure you earn enough to cover your monthly mortgage payments. Therefore, lenders must see the following:

- Positive account balances

- Regular deposits

- Enough money saved for the down payment and closing costs

- Reserves (if applicable)

- Frequency of deposits

For instance, if you earn $108,000 in six months and $0 the rest of the year and have provided your lender with 12 bank statements, they'll divide your deposits by the number of statements. In this case, you earn $9,000 a month, which should be enough to qualify for a loan, depending on other factors like your credit score and DTI.

In addition, lenders want to ensure that you don't have any undocumented or irregular bank deposits that could indicate your down payment and closing costs are coming from gifts, loans, or other sources.

Recent Posts

Bonus Depreciation for Real Estate: What It Is & How It Works

Understanding the concept of bonus depreciation and its practical application can help you capitalize on this ...

No Doc Business Loans: What You Need to Know

While “no doc” is short for “no documentation,” there are actually no true no doc loans. Instead, they...

BRRRR Method: Buy, Rehab, Rent, Refinance, & Repeat

Read on to learn more about BRRRR loans and explore how this approach can open doors to lucrative opportunitie...