What Is an Asset Depletion Mortgage & Is It Right for You?

KEY TAKEAWAYS

- An asset depletion mortgage allows you to qualify for a home loan by converting liquid assets into income.

- These home loans are best suited for individuals who don’t have traditional sources of income and documentation like W-2s, pay stubs, or tax returns, such as the self-employed, retirees, and high-net-worth individuals.

- Liquid assets you may use to qualify you for a mortgage include bank accounts, CDs, investment and retirement accounts, and money market accounts.

An asset depletion mortgage allows borrowers to leverage their liquid assets and secure a mortgage. This offers an alternative route to home financing for business owners, retirees, investors, and others who may not qualify for a conventional mortgage.

When most people think about home loans, they’re thinking of conventional loans. These loans have strict income verification guidelines, allowing underwriters to verify a borrower’s income in only a few ways — with W-2s, tax returns, and pay stubs.

However, not everyone has these documents, or they may not accurately reflect their full income. Some first-time buyers might be shocked to find out they don’t qualify for a traditional home loan because they don’t have the proper documentation.

Self-employed individuals, retirees, business owners, gig workers, and entrepreneurs don’t have W-2s or paystubs because they don’t have traditional jobs. Meanwhile, these same individuals may take significant deductions during the tax season that reduce their taxable income, so tax returns aren’t always an accurate representation of someone’s financial health.

If you don’t qualify for a conventional mortgage because of these factors, you may still qualify for a non-qualified mortgage — or non-QM loan — like an asset depletion mortgage. But what is an asset depletion loan, and is it the right option for you? Keep reading to learn more.

KEY TAKEAWAYS

- An asset depletion mortgage allows you to qualify for a home loan by converting liquid assets into income.

- These home loans are best suited for individuals who don’t have traditional sources of income and documentation like W-2s, pay stubs, or tax returns, such as the self-employed, retirees, and high-net-worth individuals.

- Liquid assets you may use to qualify you for a mortgage include bank accounts, CDs, investment and retirement accounts, and money market accounts.

What Is an Asset Depletion Mortgage?

An asset depletion mortgage, also known as an asset-based home loan, is a type of mortgage loan that allows you to qualify by using your assets as income. Unlike other types of asset-based lending, asset-based mortgages don’t use your assets as collateral. Instead, lenders convert your assets into income to determine whether you have enough money to repay the loan.

An asset depletion mortgage doesn’t require proof of employment income, which some borrowers may not have. For instance, if you’re looking for a mortgage when self-employed, you don’t have pay stubs or W-2s, and your tax returns likely don’t reflect the true state of your finances. If you don’t qualify for a traditional home loan, an asset depletion mortgage might be right for you.

Asset depletion loans are also a retirement mortgage option because you can qualify using your savings and retirement accounts. These types of home loans can benefit individuals who don’t have a regular source of income or the documentation required by conventional loans.

How Does an Asset Depletion Mortgage Work?

An asset depletion loan lets you pay your mortgage by depleting your assets. You can only use liquid assets to qualify for a home loan, so your car, high-end art, and other expensive assets you own aren’t eligible.

With an asset depletion mortgage, you borrow against your liquid assets, which may include:

- Bank accounts (checkings & savings)

- Certificates of deposits (CDs)

- Retirement and investment accounts (stocks, bonds, and mutual funds)

- Money market accounts

There are limits on the amounts of your assets you can use to qualify for a loan. You can use:

- 70% of your retirement assets

- 80% of the remaining value of stocks and bonds

- 100% of your checking, savings, and money market accounts.

So, let’s say you have $1,000,000 in retirement and investment accounts and $500,000 in your checking and savings accounts. In this case, you’d be able to use $1,200,000 in assets to qualify for an asset depletion loan.

Once the lender determines your asset depletion mortgage eligibility, they can calculate the loan amount by determining your monthly income based on the loan terms.

Your assets’ value, or rather, your income as determined by your assets, is not the only factor lenders consider. Asset depletion mortgages work similarly to any other type of mortgage. You must meet a lender’s criteria to be eligible, which means fulfilling requirements like meeting a minimum credit score and down payment amount.

The only difference between these loans and other types of loans is what qualifies as income; instead of employment income, you can qualify for an asset depletion mortgage based on your assets. Therefore, you won’t be required to provide tax returns, pay stubs, or W-2s.

However, your lender might request this information if you have them because they can help determine whether you can get approved for a home loan. For instance, if you work a full-time job and freelance, your lender may want to see your employment income and assets to determine eligibility and loan amount.

How Is an Asset Depletion Loan Calculated?

An asset depletion loan is calculated by converting your assets into income. As we touched on earlier, you can use up to 100% of liquid accounts (checking, savings, and money market), 80% of the remaining value of stocks and bonds, and 70% of retirement assets to qualify for an asset-based loan.

When it comes to calculating qualifying income for an asset depletion loan, you have two options. You can either use a debt ratio calculation or a total asset calculation.

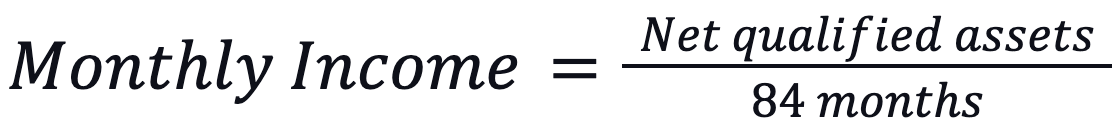

With a debt ratio calculation, borrowers must have at least $1 million in qualified assets or 1.5 times the loan balance, whichever is the lesser of the two figures. Both of these figures must include net down payment, closing costs, and required reserves to qualify. Once you have determined net qualified assets, the calculation is as follows:

You can also calculate qualifying income for an asset depletion loan using a total asset calculation. In this case, your qualified assets must be able to cover the following expenses:

- New loan amount

- Down payment

- Closing costs

- Required reserves

- 5 years of current monthly obligations

Are You Eligible for an Asset Depletion Loan?

Income is an important factor qualifying criterion for determining whether you qualify for a loan and your loan amount. However, it’s not the only factor lenders consider.

To determine if you’re eligible for an asset depletion loan, you can add up your liquid assets and use the formula we discussed above to calculate your monthly cash flow, which lenders will consider your income. Then, they’ll compare that to your monthly debts to determine if you can afford to repay the mortgage loan.

Other eligibility requirements for asset depletion mortgages include the following:

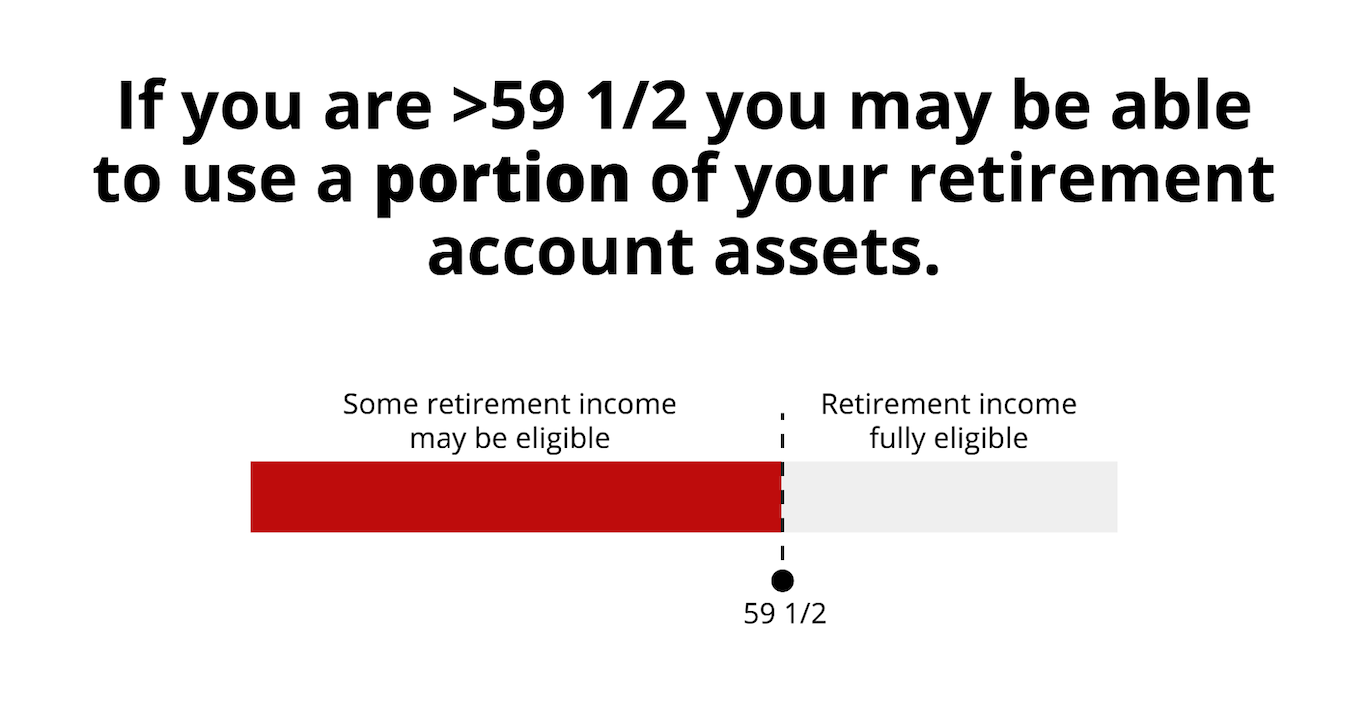

- Age to qualify using retirement accounts: If you want to qualify for an asset depletion mortgage using your retirement accounts (IRAs, 401ks, and so forth), you’ll need to be around retirement age, usually at least 59 ½ or older.

- Down payment: Asset depletion mortgages are a higher risk for lenders because they don’t require employment or employment income verification. Many lenders mitigate their risk of lending to you by requiring a 20% down payment, which reduces the total loan amount. Exact down payment requirements vary by lender.

- Minimum credit score: The credit score requirement varies by lender, but most like to see a score of at least 650, but some may accept credit scores as low as 620. A higher credit score can qualify you for a better interest rate, so it’s worth working to increase your score before applying for an asset depletion loan.

What Are the Benefits of an Asset Depletion Mortgage?

Some of the key benefits of asset depletion mortgage loans are:

- No tax returns required: Qualify using your liquid assets rather than tax returns.

- No employment verification: You don’t need to be employed to qualify for an asset depletion mortgage and there is no employment income verification.

- Borrow up to $3 million: Qualified borrowers can access up to $3 million in financing.

- DTI ratio not calculated in most cases: Your debt-to-income (DTI) ratio is typically not considered during the loan application and underwriting process.

- Finance second homes and investment properties: Using an asset depletion mortgage, you can buy a primary residence, a vacation home, or an investment property.

Who Is an Asset Depletion Loan Best Suited for?

We’ve already touched on a few types of borrowers that can benefit from asset depletion loans, but let’s review them again to help you determine whether they’re the right fit for you. Asset depletion loans are best suited for:

- Self-employed borrowers and business owners who take significant tax deductions

- Retirees with substantial assets

- High-net-worth individuals with no income but significant assets

Apply for an Asset Depletion Mortgage

An asset depletion mortgage can help you achieve your dreams of homeownership without verifying employment income. Instead, you can use your bank accounts, retirement savings, and investments as income to qualify for a home loan.

Griffin Funding is a premier asset depletion mortgage lender that can help you determine whether this type of loan is right for you. If not, our mortgage experts can help you find the best home loan for your unique circumstances. Get started online today or contact us at 855-698-1098 to learn more about our mortgage offerings.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What is the minimum DTI ratio for an asset-based loan?

Since DTI measures the percentage of your income that goes toward paying debts, lenders use it to determine if you can afford a mortgage payment on top of existing debts.

This requirement varies by lender. However, they generally look for a percentage no higher than 43%.

Is there an age limit for asset-based mortgages?

Do you have to be retired to use retirement accounts as assets?

You may still qualify if you're not retirement age based on other assets like your bank accounts and investments.

What are the drawbacks of asset depletion mortgages?

While asset depletion mortgages offer an array of benefits to the right borrower, this type of loan isn’t for everyone. Some of the drawbacks of asset depletion mortgages include:

- Only qualifying assets count as income: You won’t be able to use non-liquid assets such as real estate, art, vehicles, equipment, or collectibles to qualify. You can only use liquid assets as income, and even then there may be limits on the amount of a particular asset you can use.

- Higher interest rates: Asset depletion mortgages tend to have higher rates relative to conventional loans since they present a higher level of risk for the lender.

- Loan amount is limited by your assets: The loan amount you qualify for will be directly limited by the value of your qualifying assets.

How can I get the best rate on an asset depletion mortgage?

There are several steps you can take to get the best rate on an asset depletion mortgage:

- Maximize your credit score: Your credit score will have a big impact on the rate you qualify for. In order to optimize your credit score, make sure to pay bills on time, dispute any errors on your credit report, and keep your credit utilization relatively low.

- Make a large down payment: A large down payment lowers the level of risk for the lender, which in turn can lead to a lower rate.

- Include other sources of income: While an asset depletion mortgage doesn’t require borrowers to be employed or earn regular income, including any income you bring in on your application can help strengthen your financial profile.

- Work with the right lender: Partner with an experienced asset depletion mortgage lender in order to get a competitive rate and ensure the loan process goes smoothly.

Recent Posts

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...

Mortgage Refinance Limits

Your Refinancing Options Most owners have several refinancing pathways depending on their financial goals and ...

Pros and Cons of FHA Loans

What Is an FHA Loan? An FHA loan is a mortgage insured by the Federal Housing Administration, a division of th...