VA Loans: Rates, Benefits, & Qualification Requirements

If you are a current service member or veteran, there are mortgages specifically designed to help you buy a home, known as VA loans. With a VA home loan, you can purchase or refinance a home with no down payment.

If you qualify for a VA home loan, you can enjoy many benefits, like no longer having to wait to purchase your dream home while you save up for a down payment and having access to lower interest rates. Griffin Funding is proud to help service members and veterans find the right mortgage solution for their needs.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformTable of Contents

Types of VA Loans Griffin Specializes in

VA Purchase Loan

Purchase a home with no down payment and lower interest rates with a VA purchase loan available for current service members and veterans.

VA Cash-Out Refinance

Turn your home’s equity into cash by refinancing with a VA cash-out loan. Your original home loan doesn’t need to be a VA loan to qualify.

VA Streamline Refinance

Refinance your original VA home loan with a VA streamline refinance loan to potentially lower your interest rate and save money on your mortgage payments.

What Is a VA Loan?

A VA loan is a mortgage that is backed by the Department of Veteran Affairs, commonly referred to as the “VA”. VA home loans originated in 1944 as part of the original Servicemen’s Readjustment Act, also known as the GI Bill of Rights.

VA loans are available to qualifying veterans, service members, and surviving spouses. This type of financing lowers the upfront costs of buying a home and allows borrowers to get a government-backed loan at a competitive rate.

Key VA loan features include:

- No down payment option available

- Lower interest rates

- No PMI required

- Flexible credit and income requirements

- Limited closing costs and no prepayment penalties

Types of VA Loans

At Griffin Funding, we provide several types of VA loans including:

VA Purchase Loan

A VA purchase loan is the type of loan you would want to use if you’re buying a new home. These loans are typically ideal for qualifying veterans or service members because they can help you purchase a home with better terms—especially if you’re having trouble finding other financing options.

VA Cash-Out Refinance Loan

A VA cash-out refinance loan gives qualified veterans the opportunity to refinance their conventional or VA loan into a lower rate while extracting cash from the home’s equity. A VA cash-out refinance loan replaces your existing mortgage instead of complementing it.

Qualified homeowners can choose to refinance up to 90 percent of their home’s value for mortgage debt, or refinance a lower percentage and use the cash to cover debt payments and other needs. Refinancing up to 100 percent of the home’s value is available at higher interest rates.

VA Streamline Refinance Loan

A VA streamline refinance loan, or interest rate reduction refinance loan (IRRRL), is one of the best options for homeowners who already have a VA Loan and would like to refinance into a lower monthly mortgage rate. This refinance type is relatively easy and can be completed quickly, due to the fact that homeowners are refinancing from one VA Loan product to another.

With this type of refinance, there are several prominent advantages, including:

- No required appraisal in some cases

- No pest inspection

- No income qualification

- No need to obtain another COE

- Little to no out-of-pocket costs.

Today’s VA Loan Interest Rates

With the added security of backing from the Department of Veteran Affairs, interest rates on VA loan rates are typically lower than those for other types of home loans. When it comes to understanding your interest rate on your VA loan, there are a few key points to keep in mind:

VA Loan Rates

- Mortgage lenders set their interest rates, not the VA.

- Your interest rate is based on personal factors like your income and credit score.

- The interest rate on your VA purchase loan or VA loan refinance will also depend on the length of the loan.

- Current market conditions can impact loan interest rates, meaning that rates can change frequently.

- Interest rates may vary depending on the type of VA loan you’re applying for.

Pros and Cons of VA Loans

Below, we highlight some of the most important benefits and drawbacks to consider before taking out a VA loan.

Pros of VA loans

There are many benefits to pursuing a VA home loan as opposed to a traditional mortgage. Primarily, VA home loans:

- Do not require a down payment

- Have lower interest rates than traditional financing

- Are backed by the Department of Veterans Affairs

- Do not need private mortgage insurance

- Have more flexible loan requirements

- Only require limited closing costs

- Have no penalty fee if you pay off your home loan early

- Allow you to sell your home or refinance without restrictions

- Can be used to purchase a home, condo, duplex, manufactured home, and other types of properties

- Allow for the funding fee to be financed with the loan (or sometimes waived completely)

- Are assumable, meaning they can be transferred to a VA-eligible buyer

- Can have a non-spouse family member added for VA joint loans

- Cashout up to 100% of the home’s value

“With VA Automatic Authority and years of expertise as a VA SAR underwriter, I ensure that veterans receive the benefits they’ve earned through seamless and compliant loan approvals.”

Phuong Lee, Underwriting Manager at Griffin Funding.

Cons of VA loans

Some of the cons of VA loans include:

- You must meet service requirements in order to qualify

- You have to pay the VA funding fee

- You must adhere to occupancy requirements

- VA loans generally cannot be used for investment properties

- You don’t have the option to waive a VA home inspection or appraisal

For most borrowers, the benefits of VA loans tend to outweigh the drawbacks. Since VA home loans do not require monthly mortgage insurance (MI) and offer more favorable terms, they are usually more affordable. As such, borrowers can potentially buy a house with low income while focusing on paying off debt and other financial obligations.

How Does a VA Home Loan Work?

VA guaranteed loans are made by private lenders, such as banks or mortgage companies, to eligible veterans for the purchase of a home. The Department of Veteran Affairs guarantees a portion of the home loan.

This guarantee acts as an alternative to the traditional down payment, which is typically required to help protect the lender if a borrower defaults on the loan. This guarantee is also known as an entitlement, which works as a substitute for a down payment.

There are two parts to the VA entitlement:

- Basic Entitlement: The VA will insure up to 25% of loan amounts up to $144,000 or $36,000, whichever amount is less. Unless you live in a fairly affordable part of the country, you will likely need to use both your basic entitlement and your bonus entitlement.

- Bonus Entitlement: The VA will insure up to 25% of loan amounts between $144,000 to the current conforming loan limit in your county which is established by the Federal Housing Finance Agency. Bonus entitlements are used when the cost of a home is over $144,000. They also serve as a secondary layer of protection should you default on your mortgage.

What Is the Maximum Amount for a VA Loan?

Generally speaking, the maximum amount for a VA loan varies per each borrower’s circumstances. The VA does not limit the maximum amount you can borrow for a VA home loan. However, there may be a limit on how high of a loan you can qualify for without a down payment. These limits are based on your entitlement:

VA Loan Limits

- If you still have your full loan entitlement, there are no longer loan limits.

- If you have not restored the part of your entitlement that you used to purchase your current home, you will be held to the Federal Housing Finance Agency’s 2025 loan limits.

- If you have previously defaulted on a VA home loan, you will be held to the current VA loan limits.

Typically, you can borrow up to four times your entitlement amount. When both the basic entitlement and bonus entitlement are utilized, you can qualify for a loan of $484,350, or in some cases, more.

While these amounts are standardized, the loan limit and entitlements may be greater in high-cost areas. To determine the maximum amount you can use a VA loan for, you need to look at the loan limit for the county you plan to purchase in, while considering the above factors.

There is also the Blue Water Navy Vietnam Veterans Act of 2019 to consider, which has authorized changes to VA home loans as of January 1, 2020. Under the Act, qualifying veterans can now purchase a home valued up to $1,500,000 with zero down payment.

For all qualifying VA home loan applications moving forward, the following will apply:

- Maximum $3,000,000 loan amount

- Minimum 700 FICO for loan amounts greater than $1,000,000

- Full 25% guarantee from entitlement required

- Manual underwriting not allowed for loan amounts exceed FHFA conforming

To learn more about this legislation and how it can impact your VA loan, review the VA’s page that covers the changes to benefits. You can also use our free VA loan calculator to see what this type of mortgage would look like for you or try our VA loan affordability calculator to see how much home you can afford with a VA loan.

Keep in mind that if you live in a county with low housing costs and do not need to use the entirety of your entitlement, you can use it toward your next down payment if you sell this home and move. Since VA loan limits change, it can be difficult to be fully informed. Our knowledgeable loan officers can provide further clarification on how VA home loans work.

What are VA jumbo loans?

When a VA loan exceeds the loan limit in a given county, it’s referred to as a VA jumbo loan. You can get a VA jumbo loan to purchase a home that’s situated in a high-cost area, broadening your housing options and giving you access to homes that may be situated near big cities or large metro areas.

While a VA jumbo loan affords you more flexibility in terms of budget, it’s often accompanied by stricter requirements when compared to standard VA loans. Borrowers must prove to the lender that they’ll be able to repay a higher loan amount, thus income, credit score, and DTI requirements will likely be more stringent for those applying for a VA jumbo loan.

At Griffin Funding, we offer VA jumbo loan amounts of up to $3,000,000. Reach out today to see if you qualify for a VA jumbo loan and discuss the competitive VA home loan rates we can offer you.

VA Loan Requirements: Who Qualifies?

You may be eligible for a VA home loan if you:

- Are a veteran, current service member, or a surviving spouse

- You must meet minimum active-duty service requirements to be eligible

- Have obtained a Certificate of Eligibility (COE)

- Have a minimum 550 FICO score

- Meet income qualifications

While this is the most basic criteria, there are a variety of additional VA home loan requirements regarding both applicants and the desired property. Delve deeper by reviewing our full breakdown of VA loan eligibility.

What Documents Do You Need for VA Loan?

These are a few of the most important documents you should prepare to share with your lender whether you’re applying for a traditional VA or VA jumbo loan:

- ID: All lenders must verify your identity using a state-issued ID like a driver’s license or government-issued ID.

- Certificate of Eligibility (COE): The Certificate of Eligibility is unique to the VA loan and proves you’re eligible for the home loan benefit. Not everyone who serves in the military is eligible since there are minimum service requirements you’ll need to meet. You can request your COE online from the VA, or your lender can do it for you by searching their database.

- Income documentation: Your lender must ensure you can repay your loan, so they’ll need income documentation, which may be pay stubs, tax returns, bank statements, and W-2s. Bank statements can also help your lender understand your savings to ensure you can pay closing costs. To qualify for a VA loan, lenders like to see at least two years of employment history.

Your lender will also ask your permission to pull your credit history. While the VA doesn’t set a minimum credit score requirement, lenders do. However, credit score requirements are typically more lenient for VA loan borrowers.

What is a Certificate of Eligibility for a VA loan?

The Certificate of Eligibility is provided by the VA and verifies that a borrower meets the minimum service requirements to qualify for the VA loan for a home. Without this document, you won’t be eligible for a VA loan because lenders must ensure you’ve met the VA’s requirements and that the VA will guarantee a portion of the loan.

The COE also provides the lender with information about how much of your entitlement you have remaining. There’s no limit on the number of times you can use a VA loan, but if you have partial entitlement, you may be required to provide a down payment.

You can request your COE via the following methods:

- Use the VA’s eBenefits portal

- Mail a request form

- Work directly with your lender

When applying for your CEO, you’ll need to provide the VA or your lender with several types of documentation, such as:

- Your discharge or separation proof, also known as form DD-214.

- Statement of service signed by commander, adjutant, or personnel officer (for active service members only)

Griffin Funding offers competitive interest rates that can potentially help you save money over the course of your loan.

Think you qualify for a loan? Contact us today to find out!

Contact UsHow Many Times Can You Use a VA Loan?

There is no limit to the number of times you can use a VA loan entitlement. If you qualify for the VA loan program, it is a life-long benefit that you will be able to enjoy. That said, there are some stipulations for using your VA loan. As mentioned above, you typically need to restore your entitlement before you can use it for another VA home loan—meaning you pay off the remaining balance of your mortgage.

However, there is an exception that allows you to have two VA home loans at the same time—reassignment. If you are required to relocate for PCS, you may be able to retain your primary residence that the original VA loan was used for and use the remaining entitlement to purchase a residence in the new location.

Think you qualify for a loan? Contact us today to find out!

Contact UsHow Do You Get a VA Home Loan?

It can seem overwhelming trying to figure out how to get a VA home loan, however, the process is fairly straightforward:

- Secure your COE from the VA or have Griffin Funding do it for you.

- Contact Griffin Funding so that one of our loan officers can evaluate your eligibility and provide you with a quote.

- Submit your application, sign disclosures, and provide any necessary documentation.

- Schedule a VA appraisal and ensure a pest inspection is performed.

- Review your final loan documents and have them notarized.

- Receive funding for your loan. (VA purchase loans receive same-day funding but a VA refinance loan will be subject to a three-day waiting period.)

At Griffin Funding, it is our goal to complete all of these steps within 30 days or less.

Where We Offer VA Loans

Griffin Funding lends VA loans in several states to help service members and veterans find a home in their ideal location. Learn more about VA home loans in your desired state of residence:

Our team can help you understand the requirements and specifications of VA loans in these regions. Reach out today to take the first step towards getting pre-approved for a VA loan.

Learn More About VA Home Loans

It’s important that you have a thorough understanding of VA home loans before moving forward with your application. For more info on Griffin Funding VA loans, speak with one of our loan specialists who will be happy to provide clarity, or you can use the following resources:

- U.S. Department of Veteran Affairs

- Map of 2024 County Loan Limits

- USA.gov: Housing Help for Veterans

- Debt.org: Military & Veteran Debt Relief Options

- Free VA Loan Calculator

Apply for a VA Loan

Ready to apply for a VA purchase or refinance loan? Get started online or speak with a loan officer today by calling (855) 394-8288. As a top VA home loan lender, we consider it a privilege to serve veterans and look forward to helping you find the right VA loan for your needs.

Griffin Funding is an experienced VA loan lender with deep ties to the veteran community. For many years, we’ve partnered with Shelter to Soldier, a nonprofit organization that pairs veterans dealing with psychiatric issues with rescue dogs with and trains them to become service dogs. As part of this partnership, we give $100 per loan funded to STS in the name of the borrower.

In addition to offering a wealth of experience and support, we’re also happy to provide free tools such as the Griffin Gold app. Using our app, you can compare home financing options, manage your finances, leverage smart budgeting tools, track home values, and so much more. Download the Griffin Gold app today to get your finances in order and better prepare yourself for homeownership.

Frequently Asked Questions

Determining whether a VA home loan is worthwhile depends on your individual circumstances. As with all home-buying decisions, committing to a mortgage is a personal decision.

That said, both the short-term and long-term VA home loan benefits cannot be understated. From having more available income to afford current expenses, to being able to pay off debt and increase savings over the course of the loan, you are likely to be in a much better financial position if you secure a VA home loan or VA refinance loan with Griffin Funding.

In addition to VA home loans that help you purchase a house, you can also refinance your current VA loan or another mortgage loan. VA loans can also be used to build, repair, and adapt your home.

A home refinance loan can not only improve your current rate and terms, but can give you a chance to change the type of loan you are in, increasing your loan payoff time.

Refinancing your home loan enables you to replace your existing home loan with a new home loan that features better terms while giving you the opportunity to get cash back from the equity you have built in your home. Using the equity in your home is a powerful way to help you improve your overall financial well-being and pay off high-interest loans, debts, and credit cards.

VA loans are assumable, which means they can be transferred to someone else who will take over the existing terms of the loan. In these cases, the buyer will have the same mortgage payment even though they may not traditionally qualify for a VA loan.

However, for a VA loan to be transferred, the borrower must meet specific requirements, and lenders must evaluate their ability to repay the loan. You can’t transfer the loan to someone else without your lender’s permission.

Any type of borrower, whether they qualify for VA benefits or not, can assume a VA loan, but they’ll still need to prove their creditworthiness to the lender. Each lender has their own standards, so if you’re considering transferring your VA loan to someone else, work with your lender to find the best possible solution.

How fast closing on a loan is depends on a variety of factors, including whether or not you respond to your lender’s request for more information.

While VA loans can take longer to close than other types of loans because there are additional steps like obtaining a COE and having a VA appraisal before the VA will approve the loan, it’s possible to close on a VA loan in as little as 30 days.

All home loans require an appraisal, which determines the true market value of the home and ensures the borrower is paying a fair price, and the lender isn’t spending more than they should on their investment.

However, the VA appraisal differs from a regular appraisal and instead is more of a combination between an appraisal and a home inspection.

For a property to qualify for a VA loan, it must meet the VA’s Minimum Property Requirements (MPRs) to ensure the property is safe, sanitary, and structurally sound. The appraiser will look for things like roofing issues, lead-based paint, working appliances, access to the property, and so forth.

It’s important to note that while a VA appraisal has some aspects of a home inspection, an appraiser is not qualified to perform a full home inspection to ensure every aspect of the property is up to standards.

The VA appraisal is required, but a home inspection is not. However, it’s generally recommended to have a home inspection to help you find any potentially major issues with the home before closing.

Understanding VA loan closing costs can be challenging because the VA sets rules for lenders. There are two types of fees associated with the VA loan: non-allowable and allowable fees.

Non-allowable fees are those the lender can’t require you to pay, such as prepayment penalties, attorney fees, and so forth. Additionally, lenders are required to use the 1% rule, which dictates that your origination fee can’t be more than 1% of the total loan amount.

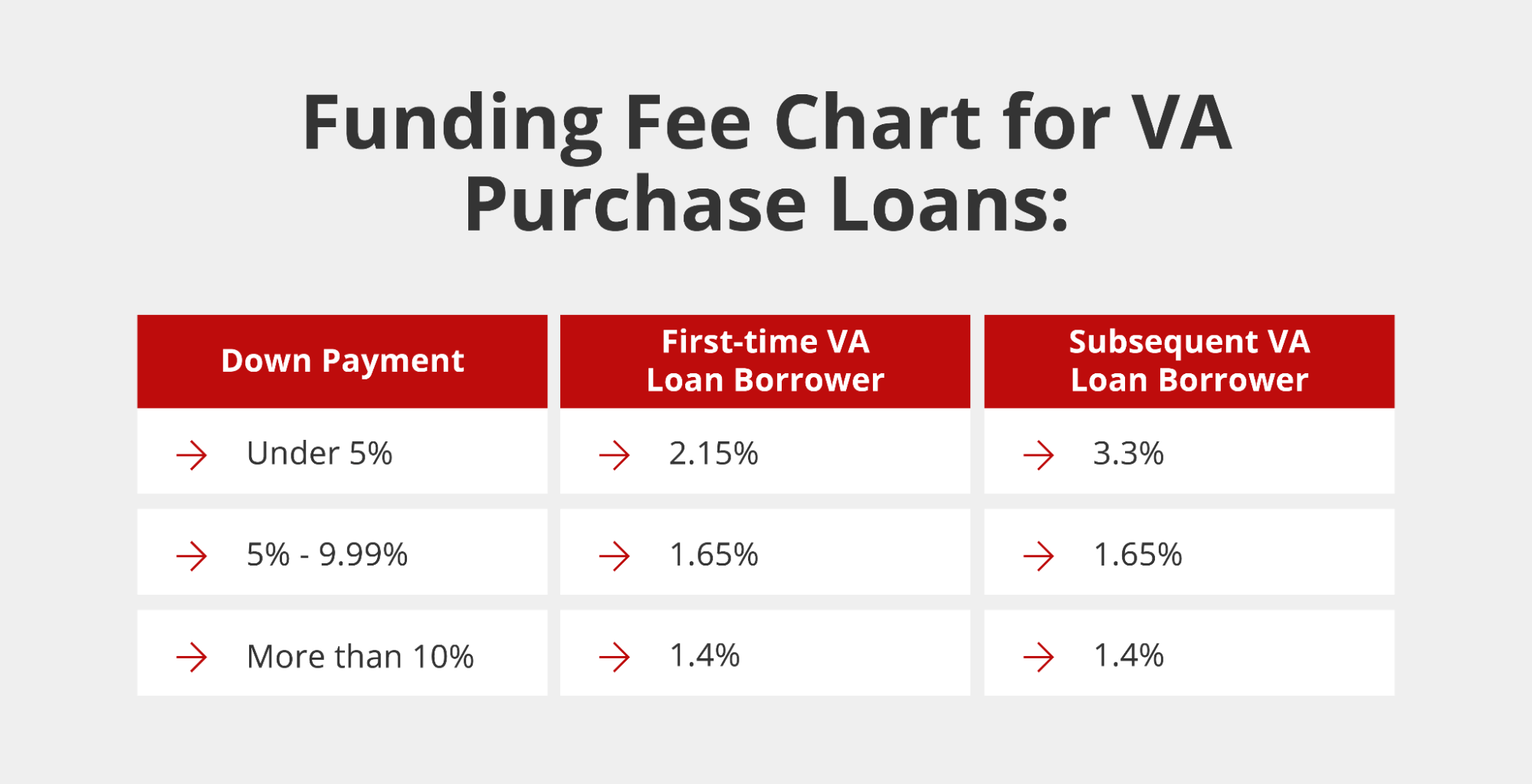

These limited fees can help you save thousands of dollars on your VA loan for a home. However, there’s one fee you should be aware of: the VA funding fee. The VA funding fee is a one-time cost due at closing that’s completely unique to the VA home loan. This fee is paid directly to the VA to help support the VA loan program.

The cost of the fee ranges depending on whether you’ve made a down payment or used your entitlement in the past. If you haven’t used a VA loan before, you can expect a funding fee of 2.15% of the loan amount.

Other fees you’re required to pay include the following:

- VA appraisal fee

- Credit report fee

- Origination fee

- Title insurance

- Recording fee

- Discount points

- VA loan points

Getting a VA loan is relatively straightforward as long as you meet the minimum VA loan requirements. If you meet the basic service requirements, you’ll be able to obtain a Certificate of Eligibility from the Department of Veterans Affairs, which confirms your eligibility for the VA loan program, specifies your available VA loan entitlement, and states whether or not you qualify for a VA funding fee exemption.

Once you confirm your eligibility for the VA loan program, the next step is choosing the right VA lender for your needs. Working with the right lender can make a big difference in how difficult the VA loan process is, from the very first step to the last.

At Griffin Funding, we’re proud to be an experienced VA lender that offers a streamlined process and excellent customer support at every step of the way. In addition to providing borrowers with competitive VA loan rates, we have a dedicated and experienced team that will work as hard as possible to ensure the VA loan process goes smoothly for you and your family.

The VA loan process can seem intimidating to sellers because they just don’t know enough about it. Sellers may reject a VA loan borrower because they believe it’s harder to close on these mortgages, even though that’s not true.

VA loans can take longer to close than traditional loans, but only by a few days. Since sellers prefer fast sales and closings, the best thing you can do is educate the seller to help them learn more about the process.

If you default on your loan, you risk foreclosure. However, the VA offers financial counseling to help avoid foreclosure, which allows them to contact your lender on your behalf to find the best solution before the lender forecloses on your home.

Additionally, you can contact your lender directly to discuss your unique situation and find the best solution, which may be a payment plan, forbearance, or deferment.