The VA Loan Pre-Approval Process

KEY TAKEAWAYS

- VA loan pre-approval is the initial assessment the lender makes for borrowers who plan on taking out a VA loan to purchase a home.

- Getting pre-approved for a VA loan is not the same as formal approval; in order to be formally approved for a loan, the mortgage has to go through an underwriting process.

- Obtaining VA loan pre-approval helps borrowers better understand how much money a lender will loan them and what their loan terms will look like.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformGetting pre-approved for a VA loan can help those shopping for a home better understand their budget and become more competitive buyers. By going through the VA loan pre-approval process, you’ll be able to see what you can afford based on your finances and establish a relationship with a lender that can help streamline the closing process. In this post, we highlight the benefits, requirements, and steps involved in the VA loan pre-approval process.

Both veterans and active military service members can qualify for a VA loan if they meet the minimum qualifications. If you’re hoping to buy a home with a VA loan, then consider getting pre-approved for a VA loan as one of the first steps in the lending process.

With VA home loan pre-approval, you can get a better idea of how much you can afford when house hunting and potentially be a more competitive buyer. If you are thinking of purchasing a new home, learn more about the VA home loan pre-approval process to streamline your efforts.

KEY TAKEAWAYS

- VA loan pre-approval is the initial assessment the lender makes for borrowers who plan on taking out a VA loan to purchase a home.

- Getting pre-approved for a VA loan is not the same as formal approval; in order to be formally approved for a loan, the mortgage has to go through an underwriting process.

- Obtaining VA loan pre-approval helps borrowers better understand how much money a lender will loan them and what their loan terms will look like.

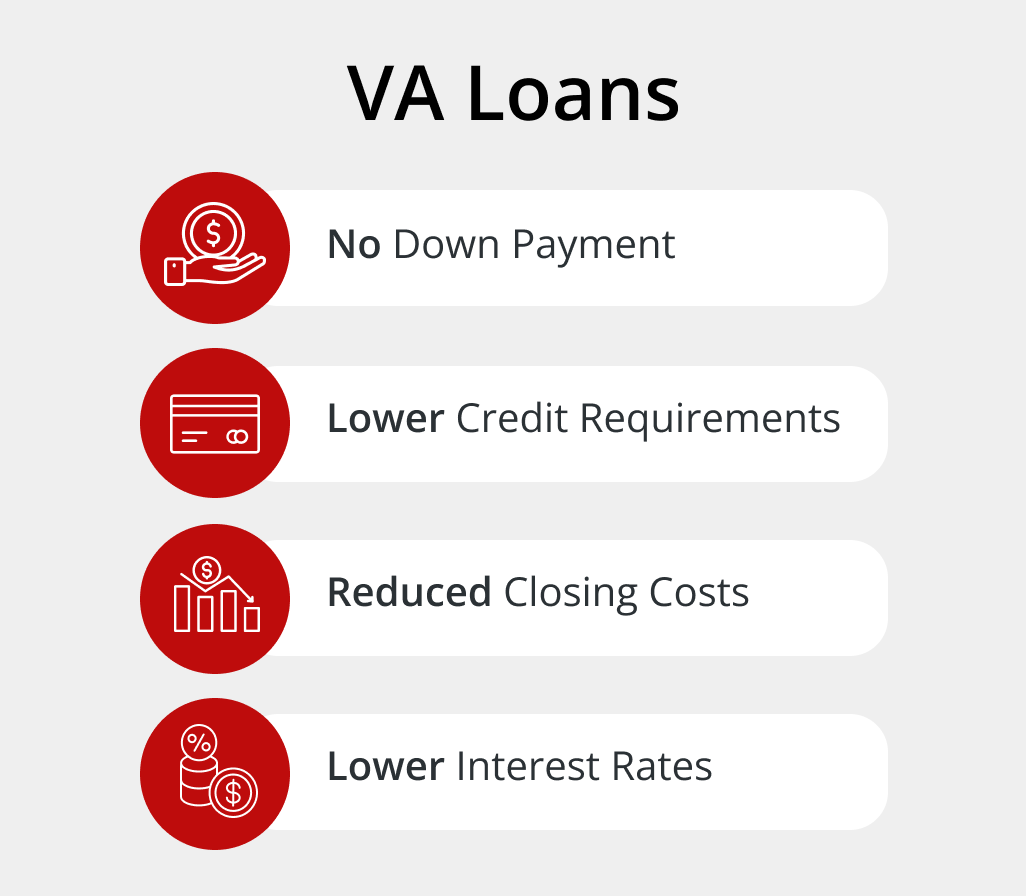

VA Loans Overview

For those who are on active duty in the military or are veterans, applying for a VA loan can open up an affordable path to homeownership. VA loans were designed for veterans and military members to make buying a home more affordable while providing advantages unavailable with most other loan types. For those who qualify for a pre-approved VA home loan, you will gain access to the following benefits:

- No down payment: One of the main benefits of VA loans is that borrowers are typically not required to make a down payment when buying a home. With a traditional mortgage, most individuals are required to put anywhere between 5-20% down on the loan amount they request. While VA loans do not require a down payment like traditional mortgage loans, there is a funding fee that VA loan borrowers will be required to pay, if they don’t have a service-related injury/disability rating.

- Lowered credit requirements: Those who qualify for VA home loan pre-approval can obtain housing with less-than-perfect credit. VA loans are backed and guaranteed by the government, which make it easier for lenders to be flexible when it comes to credit scores.

- Reduced closing costs: Using a VA loan to purchase a new home can be a great way to save on closing costs. Closing costs and lender fees can quickly add up with a traditional mortgage. However, VA loans limit the amount of closing costs that the borrower has to pay.

- Lower interest rates: When obtaining a traditional mortgage loan, interest rates may vary. However, those who receive pre-approval for VA loans will also benefit from lower interest rates than the average civilian. Lenders are able to offer competitive VA loan rates since the VA guarantees part of the loan.

Can You Get Pre-Approved for a VA Loan?

Yes, it is possible for those who are serving in the military as well as veterans to get pre-approved for a VA loan. You can get pre-approved for a VA loan with Griffin Funding by contacting us or submitting an online application. Before getting pre-approved for a VA loan, you’ll just need to provide us with some basic information as well as your Certificate of Eligibility (COE).

Why Get Pre-Approved for a VA Loan?

Getting pre-approved for a VA loan is highly advisable for those who qualify and are looking to buy a home. Pre-approval for a VA loan is beneficial for the following reasons:

- Know what you can afford: When you’re pre-approved for a VA loan, it’s much easier to enter the buyer’s market knowing exactly what you can afford ahead of time.

- Become a competitive buyer: Those who are pre-approved for a VA loan that is government-backed are more likely to stand out as qualified and competitive buyers. Having the ability to make offers on properties provides you with more flexibility and opportunities when it comes to finding the home of your dreams.

- Know the terms of your loan: Understanding the terms of your VA loan ahead of time will provide you with clarity and peace of mind. The pre-approval process will walk you through the terms that matter most when it comes to your VA loan.

- Streamline the closing process: Another notable advantage of getting pre-approved for a VA loan is the ability to streamline the closing process once you have settled on a house to purchase. When closing on a home, a VA loan helps reduce closing costs and additional fees while ensuring the process goes as smoothly as possible, due to the loan being government-backed.

VA Loan Eligibility Requirements

Before you begin researching and comparing VA loan rates, it is important to understand what qualifications you must meet to qualify for VA loan pre-approval. Getting approved for a VA loan requires at least one of the following from applicants:

- Individuals must have served at least 181 days during peacetime (on active duty)

- Individuals must have served at least 90 days during wartime (on active duty)

- Spouses who have survived a veteran or active military member who was killed in the line of duty. Spouses may also qualify for a VA-backed loan if their military spouse was killed in action (KIA) or lost their life due to another service-related disability.

- Veterans must have served at least six years in the National Guard or Reserves or at least 90 days on active duty under Title 32. Out of the 90 days served, at least 30 of them must be consecutive.

During the pre-approval process, the mortgage lender you choose to go with will review your current credit score, your debt load, as well as your active or retired military status. While you do not need to have a perfect credit score for a VA loan, a higher credit score will help you earn a better interest rate and loan terms.

How to Get Pre-Approved for a VA Home Loan

Here are the basic steps you’ll need to take in order to get pre-approved for a VA loan:

- Obtain your Certificate of Eligibility (COE): If you meet the VA loan eligibility requirements listed above, you’ll be able to obtain your COE, which states your current VA entitlement. It can take some time to get your COE, so start on it sooner rather than later. If you need help, we can work with you to request your COE.

- Prepare your documentation: Collect identifying documents and financial documentation that you’ll need for pre-approval. This may include things like your current driver’s license, tax returns, pay stubs, proof of employment, and bank statements.

- Choose a VA-approved lender: Find a VA-approved lender that you’d like to work with. When shopping around for a VA mortgage lender, you’ll want to pay attention to things like the rates they offer, customer reviews, and the amount of experience they have funding VA loans.

- Fill out a loan application: Once you’ve chosen a lender, the final step is to complete a loan application and submit documentation to your lender. With a VA pre-approval letter in hand, you’ll be able to better understand your budget and have more confidence during the home buying process.

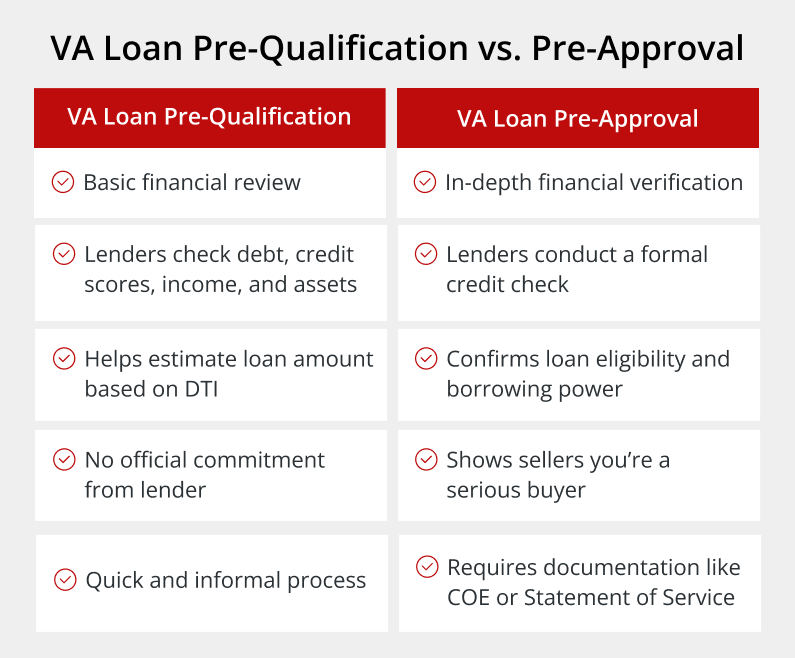

VA Loan Pre-Approval vs. Pre-Qualification

Before you submit your application for a VA loan, it’s important to understand the differences between pre-approval and pre-qualification. Pre-approval for a VA loan and pre-qualification are not the same.

During the pre-qualification stage of obtaining a VA loan, lenders will take a look at your current debt as well as your credit scores across multiple scoring agencies. You may also receive a request to provide information regarding your personal assets as well as your current income. This basic information during the pre-qualification process will help lenders to calculate your DTI, or your debt-to-income ratio. Once this is calculated, it is much easier to determine the loan amount you qualify for based on your current DTI as well as projected income.

After the pre-qualification process is complete, you can then move towards becoming pre-approved for a VA loan. The pre-approval process for a VA loan will include the following:

- Credit check: Another credit check will be conducted once you proceed with the pre-approval process for a VA loan. This will help to verify your current debt as well as your overall DTI, or debt-to-income ratio. Keep in mind that your credit score is not as important when applying for a VA loan compared to a traditional mortgage loan.

- Statement of Service: You will also need to provide a statement of service to prove that you are currently serving in the military. This applies only to those who are currently on active duty. Veterans may be asked to provide prior proof of serving in the military—such as their COE—in order to confirm their eligibility for a VA loan.

Documents Needed to Get VA Loan Pre-Approval

Whenever you are thinking of applying for a VA loan, keep in mind that you will need to provide a variety of documents to complete the process. Lenders will request the following documents for veterans and active military members:

- Identification: You will be asked to provide identification such as a driver’s license as well as a Social Security card or number.

- Certificate of Eligibility (COE): This is a document provided by the VA which states that you meet the minimum service requirements and you qualify for VA loan benefits.

- Employment verification: Individuals who are applying for a VA loan will need to verify their current employment. This may include W-2s from past years as well as current pay stubs to verify income.

- Asset verification: Bank statements, proof of assets, and even retirement accounts may all be considered as asset verification when completing the pre-approval process for a VA loan.

How Long Does It Take to Get Pre-Approved for a VA Loan?

Understanding the VA loan timeline can help you to maintain your peace of mind while looking for a new home for you and your family. When attempting to get pre-approved for a VA loan, it’s important to remember that the circumstances for individual loans may vary. However, the pre-approval process for a VA loan usually doesn’t take longer than any conventional mortgage loan.

The VA loan pre-approval process can move quickly if you have all of the required documentation. At Griffin Funding, we can often provide VA loan pre-approval in less than a week. Once you receive your pre-approval, your pre-approval letter will remain in good standing between 60 and 90 days, providing you with a set window of opportunity to find a home and make your decision.

Get VA Loan Pre-Approval Through Griffin Funding

Whether you are applying for your first VA loan or you are curious about the VA loan pre-approval process, Griffin Funding can help. Griffin Funding is here to assist you through the process of becoming pre-approved for a VA loan for your first home or help out if you are thinking of refinancing. In addition to VA purchase loans, we offer VA cash-out refinance loans and VA streamline refinance loans.

Reach out to the team at Griffin Funding to get the VA loan pre-approval process started!

Find the best loan for you. Reach out today!

Get StartedRecent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...