Tax Benefits of Real Estate Investing

KEY TAKEAWAYS

- Investing in real estate can help diversify your portfolio and build wealth over time, and it has several tax advantages other types of investments don’t.

- Tax deductions for properties you hold, whether rental properties or fix and flip properties, can help you reduce your tax burden.

- If you want to take advantage of the tax benefits of real estate investing without holding property, you may prefer a REIT or tax-advantaged retirement account.

Investing in real estate can help you build wealth over time while expanding your portfolio with new opportunities. In addition, the tax benefits of real estate investing make it even more appealing for new and veteran investors alike. Tax deductions for rental properties are one of the most significant benefits of investing in real estate, but various types of investments have their own tax advantages.

Different types of real estate investments come with different tax benefits. If you’re considering investing in real estate, knowing these benefits can help you find the right investment opportunity based on your goals, risk tolerance, and preferences.

Investing in real estate can help you build a real estate portfolio, but the type of real estate you invest in can impact your tax benefits. Keep reading to learn more about the various investment property tax benefits.

KEY TAKEAWAYS

- Investing in real estate can help diversify your portfolio and build wealth over time, and it has several tax advantages other types of investments don’t.

- Tax deductions for properties you hold, whether rental properties or fix and flip properties, can help you reduce your tax burden.

- If you want to take advantage of the tax benefits of real estate investing without holding property, you may prefer a REIT or tax-advantaged retirement account.

Does Investing in Real Estate Reduce Taxes?

Investing in real estate can sometimes reduce taxes, especially compared to other types of investments. However, situations vary, and investing in real estate isn’t necessarily a way to reduce your tax burden. When you invest in real estate, you earn an income, and that income is subject to taxation, so investing in real estate may increase your tax burden.

However, there are several tax benefits of investing in real estate that might help reduce your tax burdens, whether you’re a house flipper, landlord, or full-time investor.

Top 7 Tax Benefits of Real Estate Investing

The tax benefits of investing in real estate vary by the investment type. For instance, house flippers have different tax benefit opportunities than individuals that purchase real estate stocks.

Let’s take a look at the top benefits of real estate investing to help you understand how it works and how real estate investments may reduce your tax burden.

Depreciation

Depreciation is the loss of value for a property or another type of asset. For instance, your car depreciates in value as soon as you drive it off the lot, meaning it’s likely that no one is ever going to pay more for your car once it’s used. Typically, property appreciates in value over time, but this isn’t always the case.

Depreciation may occur due to general wear and tear of a property. If you purchase a single-family home to rent and the previous tenant destroys the property, it will depreciate in value until you fix it. Depreciation is one of the top tax benefits of rental properties because you can deduct it as an expense on your taxes.

Investment property tax deductions like depreciation reduce your taxable income, so you’ll pay less in taxes for that year.

With most real estate investments, depreciation for the property’s improvements—but not the land—takes place over 27.5 years. This means that you can claim a depreciation deduction on the property every year for those 27.5 years, provided the property continues to meet the minimum requirements to be considered depreciable.

As far as when depreciation starts, that typically depends on when a property is placed in service and ready to use as a rental. While getting a property ready may take some time in certain cases, there are real estate investments that allow you to begin 100% depreciation deduction in the first year of ownership. This means that you can quickly write off the cost of 100% of eligible property using the depreciation deduction.

Once you sell your property, you’ll pay income tax on any claimed depreciation because the IRS calculates capital gains based on your profits.

Bonus depreciation

Using the bonus depreciation deduction, you can streamline the depreciation process. Rather than claiming a standard depreciation deduction, bonus depreciation allows you to write off a larger portion of the value of certain items in the same year that they were purchased.

While bonus depreciation can be a great tool for real estate investors, it began getting phased out in 2023. This means that the percentage of bonus depreciation an investor can claim will get lower and lower each year, until bonus depreciation is completely phased out by January 1, 2027.

Investment property tax deductions

Depreciation is just one investment property tax deduction, but it’s not the only one. As an investor, you’re a business owner, so you can deduct business expenses from your taxable income. You’re allowed to deduct expenses related to the management or maintenance of your rental property, which may include the following:

- Property taxes

- Insurance

- Management costs

- Maintenance

- Utilities

- Repairs

Additionally, you can deduct any expenses related to your business, which may include things like advertising, legal and accounting fees, and equipment needed to operate the business.

Since your tax deductions can be significant, depending on the type of property you own, it’s always best to keep receipts and track expenses in case the IRS ever audits you. If you’re unsure how to track your expenses, you can ask an accountant or tax preparer to ensure you have everything you need if the IRS audits you. Tracking your expenses and keeping records will also ensure you’ve deducted everything you can from your taxable income to reduce your overall tax burden.

Capital gains

Capital gains refer to your profit after you sell an asset like an investment property or stocks. Whenever you sell an investment property that grows in value, you’ll be required to pay taxes on your capital gains, which are applied to the appreciation — or increase in value — of the property. For instance, house flippers purchase a house, fix it up, and resell it for more. Their profits are taxed because they sold an asset for more than they purchased it for.

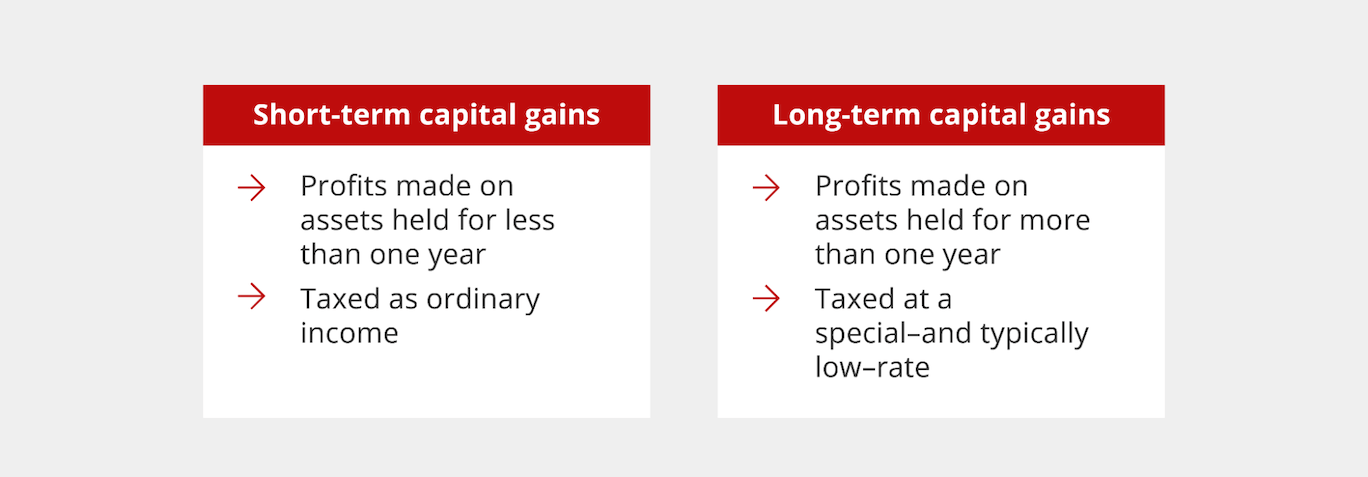

There are two types of capital gains that depend on how long you owned the asset: short- and long-term capital gains.

Short-term capital gains

Short-term capital gains refer to the profit earned on an asset you’ve held for less than twelve months. Most house flippers have short-term capital gains because the faster they sell a property, the faster they can move on to the next to grow their wealth.

Short-term capital gains can negatively affect how much you owe in taxes since this type of capital gains is taxed as regular income.

Long-term capital gains

If you owned the property for longer than 12 months before selling it, you have long-term capital gains. Your profits from long-term gains are taxed at a lower rate than short-term capital gains. Long-term capital gains have a lower tax rate than short-term capital gains regarded as standard income. Short vs. long-term gains aren’t necessarily a tax benefit, but you can benefit from longer-term investments if you can keep them for more than a year.

However, short-term capital gains taxed as regular income shouldn’t deter you from selling properties quickly if you’re a house flipper. Ultimately, you’ll have a higher tax rate, but you stand to earn more from being able to fix and flip multiple properties within the same year.

Self-employment and no FICA tax

Investors are considered self-employed, and the self-employment tax is 15.3% of your income for Social Security and Medicare. If you’ve ever had an employer, they covered half of those costs for you. However, when you work for yourself as an investor, you must pay the 15.3% self-employment tax out of your own pocket.

That said, rental income is not subject to Federal Insurance Contributions Act (FICA) taxes like regular self-employment income.

Another way to reduce SE tax is to own the investment property in a separate business entity such as a corporation or LLC. Holding the property in an LLC can help protect you personally from lawsuits and other unforeseen liabilities.

Passive income and the pass-through tax deduction

Your rental income can be considered a passive qualified business income (QBI). A pass-through deduction allows you to deduct up to 20% of your QBI on your personal taxes when you own a rental property. Therefore, if you make $100,000 from rental income, you may be able to deduct up to $20,000 from your taxable income.

Unfortunately, the pass-through tax deduction will no longer be available after the 2025 tax season, so you should consider taking advantage of it while it lasts.

Investment incentive programs

Investors may be able to take advantage of investment incentive programs depending on the structure of their business. Investment incentive programs are designed to provide additional tax savings on several types of investments and income.

Opportunity zones

The government created opportunity zones that allow people to invest in areas of the nation to promote economic growth and stimulate the economy. These areas typically include low-income communities that help create jobs while giving investors tax benefits.

Real estate investors can get investment property tax benefits by rolling their capital gains into an opportunity fund within six months of the sale of a property. Your investment goes into a Qualified Opportunity Fund that goes toward improving these communities, and taking advantage of the program offers you the following benefits:

- Avoid paying capital gains if you stay invested for ten years.

- Deferring capital gain taxes until 2026 or until you liquidate your stake.

- Growing your gains by 10% for holding the fund for five years, or holding the fund for seven years and growing your gains by 15%.

Investing in opportunity zones makes sense if you want to defer your capital gains while growing them at the same time. If you’re considering this type of investment, we recommend speaking with your accountant to determine if it makes sense for you. Once you’re required to pay taxes on your capital gains, your tax rate may be much higher, so it’s not the right option for all types of investors.

1031 exchanges

If you want to sell your investment property and purchase another while avoiding capital gain taxes, you might try a 1031 exchange. According to the IRS, the new property must be of greater or equal value than the one sold, so it’s not an option for every investor.

Additionally, 1031 exchanges aren’t a method for eliminating capital gain taxes, but using them can defer your taxes. It won’t reduce your tax bill, and if you continue to defer your payments, your tax rate might increase over time, so you’ll end up owing more.

You can use these exchanges for as long as you want, but when you decide to cash out your profits, you’ll pay taxes. That means your profits are tied up in the exchanges until you want them, which may not be a good option for all types of investors. For instance, if you need access to your profits immediately after selling an investment property, you shouldn’t use a 1031 exchange to buy another one.

Tax-advantaged retirement accounts

Retirement accounts like Roth IRAs, SDIRAs and 401(k) plans allow you to invest in real estate without purchasing property. For instance, you can invest in stocks, bonds, private and commercial real estate, real estate investment trusts (REITs), and other real estate holdings.

Tax-advantaged retirement accounts come with many benefits, such as growing your wealth over time. With a tax-advantaged retirement plan, your gains are tax-deferred, meaning anything you earn won’t be taxed until you decide to pull money out of your retirement account. Tax-deferred retirement accounts accumulate funds tax-free until you start withdrawing money. Meanwhile, there are also tax-advantaged retirement accounts like Roth IRAs that aren’t subject to taxes when withdrawn because you pay taxes on the money deposited in them.

Choosing a tax-advantaged retirement account will depend on whether you want to pay taxes now or later. Keep in mind that deferring your taxes means potentially paying more in taxes later on. However, saving on taxes now might be well worth it since your retirement account will grow with time.

Real Estate Investment Options

Different real estate investment opportunities give you access to various tax benefits. However, you shouldn’t choose how to invest based on the tax benefits alone. Keep in mind that you’ll pay taxes on your profits, whether they’re deferred or not, but there are several ways to reduce your taxable income.

Being an investor is the same as being a business owner as far as the IRS is concerned, so when you’re trying to reduce your tax burden, you’ll focus on deductions. You can deduct anything related to operating your business, regardless of whether you’re a house flipper or purchase rental property.

Let’s take a closer look at a few ways you can invest in real estate and their tax benefits.

Rental property

When you invest in rental property, you become a landlord. You can purchase a single or multi-family property, condo, apartment, residential and commercial properties, or even a manufactured home and earn rental income.

As a rental property investor, you’ll have a lot of responsibility, which includes managing the property and ensuring your tenants are happy. Also, you’ll be responsible for a down payment on your loan. The average down payment for investment properties varies, but you should expect to put at least 20% down.

Once you earn enough, you can hire a property management company to take care of the daily operations for you, but this option might not be worth it if you’re renting out a single-family home.

The most significant downside of investing in rental property is that your ability to pay your mortgage depends on having tenants. If you don’t have tenants for a prolonged period of time, you’ll have to pay for your mortgage out of pocket.

When you invest in rental property, your income is considered passive income for tax purposes. Therefore, until the year 2025, you can use the pass-through tax deduction and deduct up to 20% of your total business income on your tax return. In addition, many of your operating costs are deductible, such as:

- Advertising

- Property managing fees

- Landscaping

- Pest control

- Repairs and maintenance

- Property taxes

- Insurance

- Professional services

- Utilities

Your mortgage interest is also fully tax-deductible, and you can get the depreciation deduction if the property depreciates in value.

Another tax benefit of rental property is that you can defer capital gains tax using a 1031 exchange and invest in another rental property.

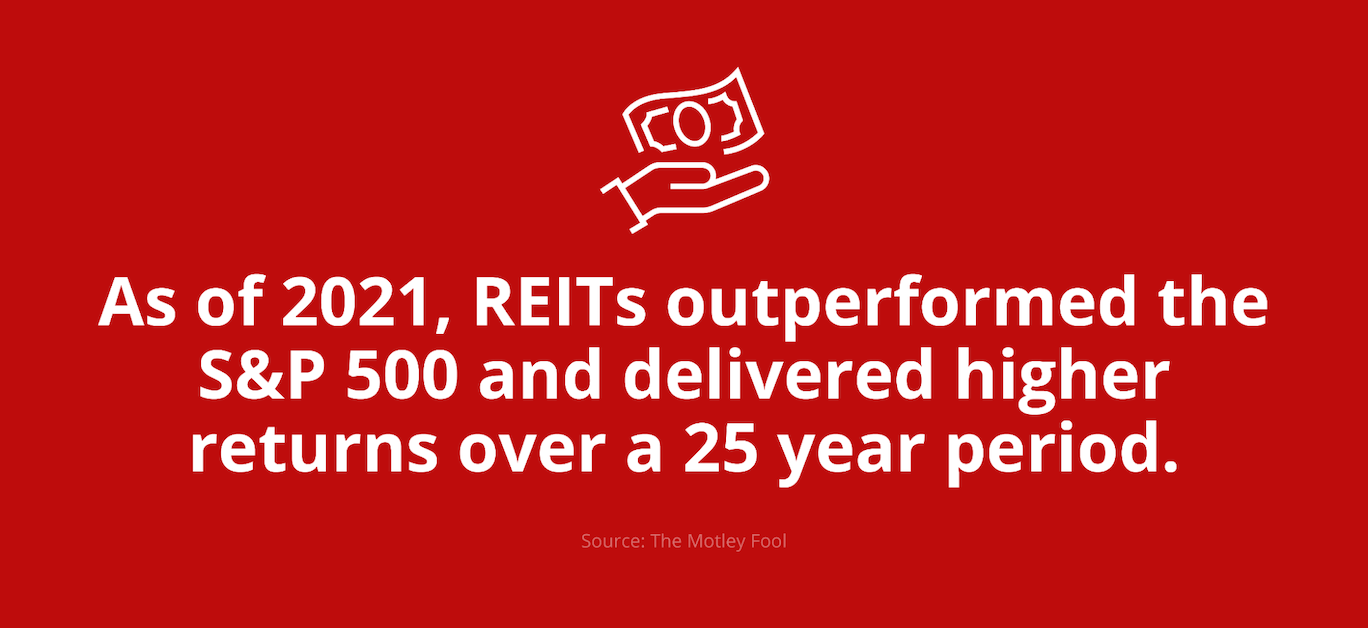

Real estate investment trusts

A real estate investment trust (REIT) is a company that owns or finances real estate. When you invest in a trust, you can get the returns of real estate investment without actually owning the property. Instead, it’s similar to owning a stock that you can sell at any point. REITs are liquid, giving you more flexibility and control of your gains, and they have several advantages over other types of investments.

With REITs, you don’t have to worry about taking out an investment property loan or paying off a mortgage. Instead, you can invest in real estate without the commitment of owning property and renting or selling it.

However, REITs are essentially stocks, so they fluctuate with the market. If the market declines, REIT prices will also decline. Therefore, these types of investments are ideal if you’re looking to invest in the long haul. However, if you choose to sell your stock, you run the risk of losing money on your investment.

The upside to REITs is that you can start with a minimal investment without applying for DSCR loans for rental properties or other types of mortgage loans for house flipping. Instead, your investments are liquid, and you’ll earn regular dividends.

There are also several tax advantages of investing in real estate with REITs. For instance, you can use the pass-through deduction and only have taxes on 80% of your earnings. In addition, the return on dividends isn’t taxed, and you can avoid double taxation since you don’t pay corporate taxes.

House flipping

House flipping is another popular real estate investment method. However, because the goal is to fix and flip as many houses as possible to increase your profits, flippers are often subject to short-term capital gain taxes.

The main advantage of flipping is that you can earn profits faster than by managing a rental property, but it still takes plenty of work.

Typically, flippers find undervalued homes that could use updates, repairs, and renovations. Then, once those changes are made, they can sell the property for more than they paid for it.

If you’re interested in flipping, you can start with your first house by taking out a bank statement loan and testing the waters. Remember, you’re on the hook for the mortgage payments until you find a buyer, so the faster you work, the more you’ll typically earn.

If you own a property for less than a year, you’re subject to capital gain taxes, which are taxed the same as your income. However, if you own a property for longer than a year, you can take advantage of long-term capital gains because they have a lower tax rate. Long-term capital gains are not subject to FICA taxes, so you can avoid the self-employment tax altogether.

House flippers can also take advantage of a 1031 exchange and defer tax payments by exchanging one property for another.

Online real estate investment platforms

Online real estate investment platforms allow you to invest in real estate without holding property, making them more convenient and flexible if house flipping or becoming a landlord don’t interest you. These platforms connect investors and developers with your investments funding real estate for a potentially high return.

Online real estate investment platforms allow you to take part in several different types of investments, including commercial real estate deals that pay cash distributions. However, there’s a significant barrier to entry because most of them only accept investors with high net worths.

If you get accepted to use one of these platforms, you won’t have to manage anything yourself and can diversify your portfolio without owning property. However, unlike investing in REITs, this option has less liquidity and higher upfront costs that can deter many new investors.

The types of taxes you’ll pay on your gains will vary depending on the type of investment. For instance, some may be treated similarly to REITs with tax advantages like no corporate taxes. Any profits earned from your investments will be subject to capital gain taxes.

Start Reaping the Tax Benefits of Real Estate Investing

The tax benefits of investing in real estate can help you determine when is the right time to purchase property and what type of investment is right for you. Of course, you shouldn’t base your decision on tax advantages alone. Even though some real estate investments come with higher or more taxes, they could also come with higher profits.

And don’t forget! Purchasing a primary residence is a type of real estate investment because your property is likely to appreciate in value over time. There are many tax benefits to purchasing a home, whether for your family or as an investment property.

Ready to become a real estate investor or fund your next investment? Apply for a mortgage online with Griffin Funding today. We can help you find the best investment property loan based on your goals, property type, and financial situation.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...

Mortgage Refinance Limits

Your Refinancing Options Most owners have several refinancing pathways depending on their financial goals and ...

Pros and Cons of FHA Loans

What Is an FHA Loan? An FHA loan is a mortgage insured by the Federal Housing Administration, a division of th...