PMI vs MIP

A home is often one of the most significant purchases you’ll ever make. Unfortunately, not everyone realizes the various costs of taking out a mortgage. Apart from your monthly mortgage premium, you’ll be responsible for everything from closing costs and administrative fees to mortgage insurance.

The type of mortgage insurance you may be responsible for paying depends on your down payment and home loan type. Most borrowers believe that they have to make a 20% down payment to get a mortgage, but that’s simply not true. However, if you choose to put down less than 20%, you’ll be responsible for paying mortgage insurance, which protects the lender.

Mortgage insurance enables you to make smaller down payments on a home, but it also adds to your monthly mortgage premium. There are two types of mortgage insurance: PMI and MIP. Learning about both can help you find the best loan based on your financial situation and needs.

PMI and MIP sound the same, so it’s easy to confuse them. Learning about these two types of mortgage insurance will help you make a more educated decision when it comes to finding a home loan. Keep reading to learn more about PMI and MIP and how they work.

KEY TAKEAWAYS

- There are two types of mortgage insurance: PMI and MIP.

- Private mortgage insurance (PMI) is required for conventional loans when borrowers make a down payment of less than 20%.

- MIP stands for mortgage insurance premium and is required on all FHA loans.

- You can’t choose between MIP and PMI since they’re associated with different loan types, so comparing FHA loans vs. conventional loans is crucial to find the best mortgage for you.

What Is PMI?

Private mortgage insurance (PMI) is only required for conventional loans when the borrower makes a down payment of less than 20%. When most people think about home loans, they primarily think of conventional loans with a 20% down payment requirement to avoid additional insurance costs. Conventional loans are typically conforming, so they must meet Fannie Mae and Freddie Mac guidelines for lenders to sell them on the secondary mortgage market.

When comparing mortgage insurance vs. PMI, you should understand that PMI is a type of mortgage insurance, but it’s not the only one. Mortgage insurance typically refers to either PMI or MIP, which we’ll discuss later in this article.

Additionally, PMI is not the same as homeowners insurance. While both are a type of insurance associated with homeownership, homeowners insurance protects the homeowner if the home is damaged, someone gets hurt on your property, or you’re the victim of theft. Conversely, PMI protects the lender while allowing you to make a down payment lower than 20%.

Do I Have to Pay PMI?

You only have to pay PMI on a conventional loan if you put less than 20% down on a home. PMI is not required for government-backed loans like USDA or VA loans.

Since PMI adds to your monthly mortgage payment, you can avoid it altogether by putting down at least 20% when applying for a conventional loan. Additionally, you can avoid having to pay PMI by shopping around with local lenders to find a mortgage program that doesn’t require PMI.

How Much Is PMI?

How much you pay for private mortgage insurance depends on factors like your down payment amount and credit score. PMI is calculated as a percentage of your total loan amount and is not based on the home’s purchase price. Instead, the average PMI cost ranges from 0.1% to 2%.

A few factors that can influence PMI costs include:

- Credit score: Borrowers with lower credit scores typically have higher PMI costs to protect the lender.

- Debt to income (DTI) ratio: A high DTI ratio means you have less monthly income to pay your mortgage, so lenders will see you as a higher risk. Since you’re putting down less than 20% on your home, you’re an even higher risk to them, so you can expect higher PMI costs.

- Down payment amount: The more you put down on a home, the less your PMI will cost. It’s usually best to put down as close to 20% as you can to reduce PMI costs.

How Long Do You Pay PMI?

PMI stops once you’ve reached around 20% to 22% equity in your home. Once you reach 20% equity, you can contact your lender and request they cancel your PMI. How long it takes to build 20% equity in your home depends on a variety of factors, but most homeowners can accomplish it in around ten years. Of course, the larger your down payment, the faster you can reach that equity amount.

What is MIP?

A mortgage insurance premium (MIP) is required for all FHA loans. There are two types of MIP, also known as FHA mortgage insurance: upfront mortgage insurance premium (UFMIP) paid at closing and annual MIP. UFMIP is typically rolled into the loan amount while your annual MIP is paid as part of your monthly mortgage premium.

The upfront mortgage insurance premium is an upfront fee of 1.75% of the home’s purchase price. This is one of the most significant differences between PMI and MIP; PMI costs are based on various factors like your down payment and credit score, while UFMIP is a fixed amount of the purchase price.

Do I Have to Pay MIP?

MIP is required for all FHA loans because it has flexible down payment and credit score requirements. So, whether you put down 5% or 40%, you must pay MIP. In addition, any borrower using an FHA loan to purchase a home must pay both the UFMIP and annual MIP.

If you’re taking out an FHA loan, you can’t avoid MIP, but you can ensure a lower MIP payment to reduce your monthly mortgage payments. For instance, if you can put down at least 10%, your MIP will stop after 11 years. Additionally, you can refinance your FHA loan into a conventional loan to cancel MIP payments.

When you refinance to a conventional loan, you won’t have to worry about MIP, but you may have to pay PMI if you put less than 20% down. However, you can avoid both types of mortgage insurance if you refinance your home once you have 20% equity.

How Much Is MIP?

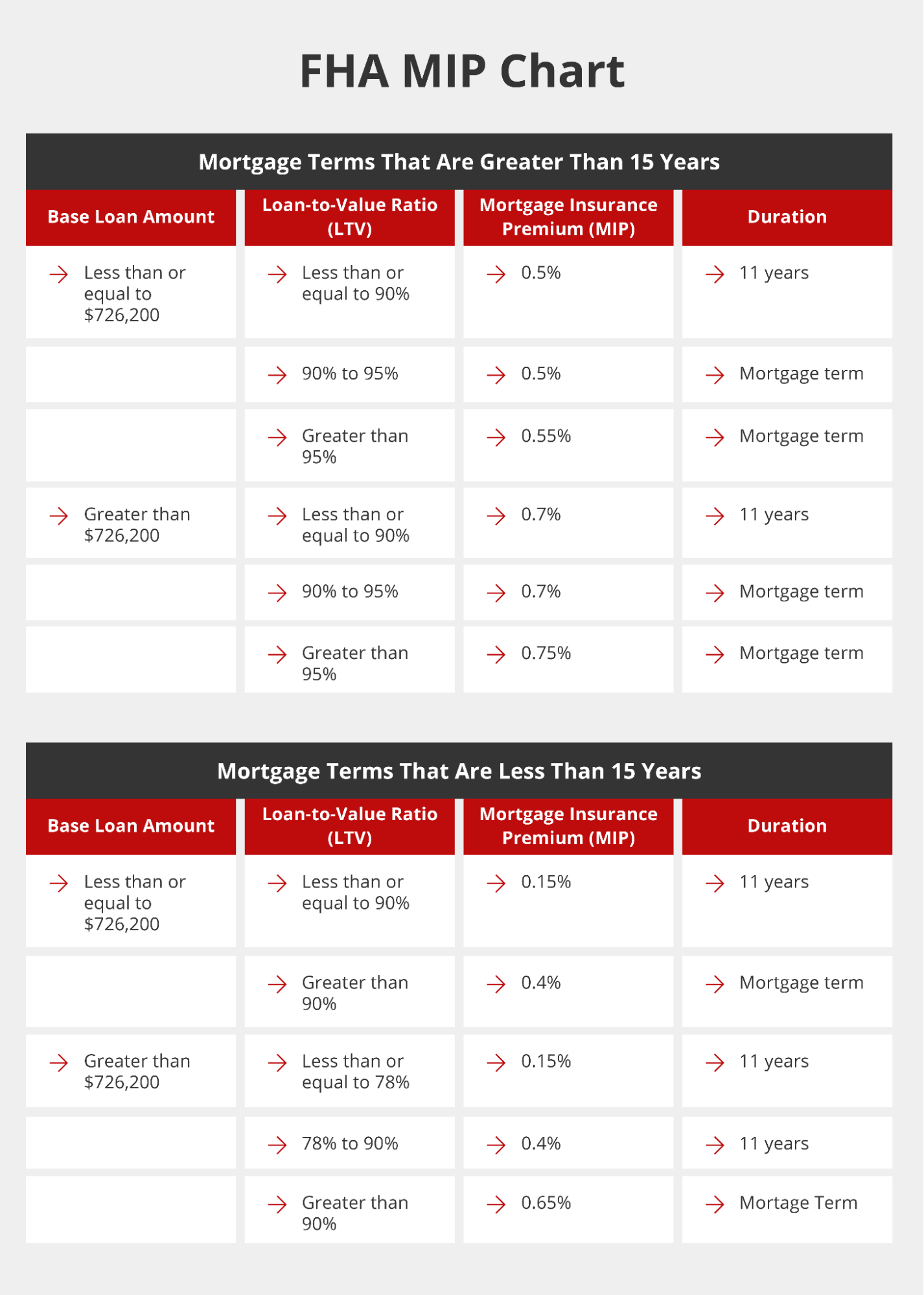

As mentioned, the upfront mortgage insurance premium is 1.75% of the home’s purchase price while the annual MIP is determined by various factors, such as mortgage terms, loan amount, and loan-to-value ratio (LTV), which compares the mortgage amount to the home’s appraised value. Annual MIP premiums range from 0.15% to .75% of the total loan amount.

The more you borrow, the more you’ll pay in MIP, so it’s usually best to make your down payment as large as possible, even though FHA loans allow you to make down payments as low as 3.5%. Additionally, loans with longer terms typically have higher MIPs than those with shorter terms.

How Long Do You Pay MIP?

How long you have to pay MIP depends on your down payment amount. Unlike PMI, lenders don’t cancel your MIP payments once you reach a certain amount of equity in your home. Instead, the amount of time you pay MIP depends on whether you put more or less than 10% down on the home.

If you make a down payment of at least 10%, you’ll only pay MIP for 11 years. However, if you put less than 10% down, you must pay MIP for the entirety of the loan unless you refinance it with another type of loan.

Differences Between PMI and MIP

Your mortgage loan is one of the most important things to consider when buying a home. Choosing the wrong mortgage means potentially paying more monthly and over the life of the loan.

While you shouldn’t choose a mortgage based solely on PMI vs. MIP alone, these additional costs should factor into your decision. MIP and PMI are just two potential costs associated with homeownership. Still, you may be able to avoid them altogether by making a larger down payment and choosing a different loan type.

Let’s take a look at MIP vs. PMI to help you understand the various differences between the two and help you find the right mortgage.

Loan Type

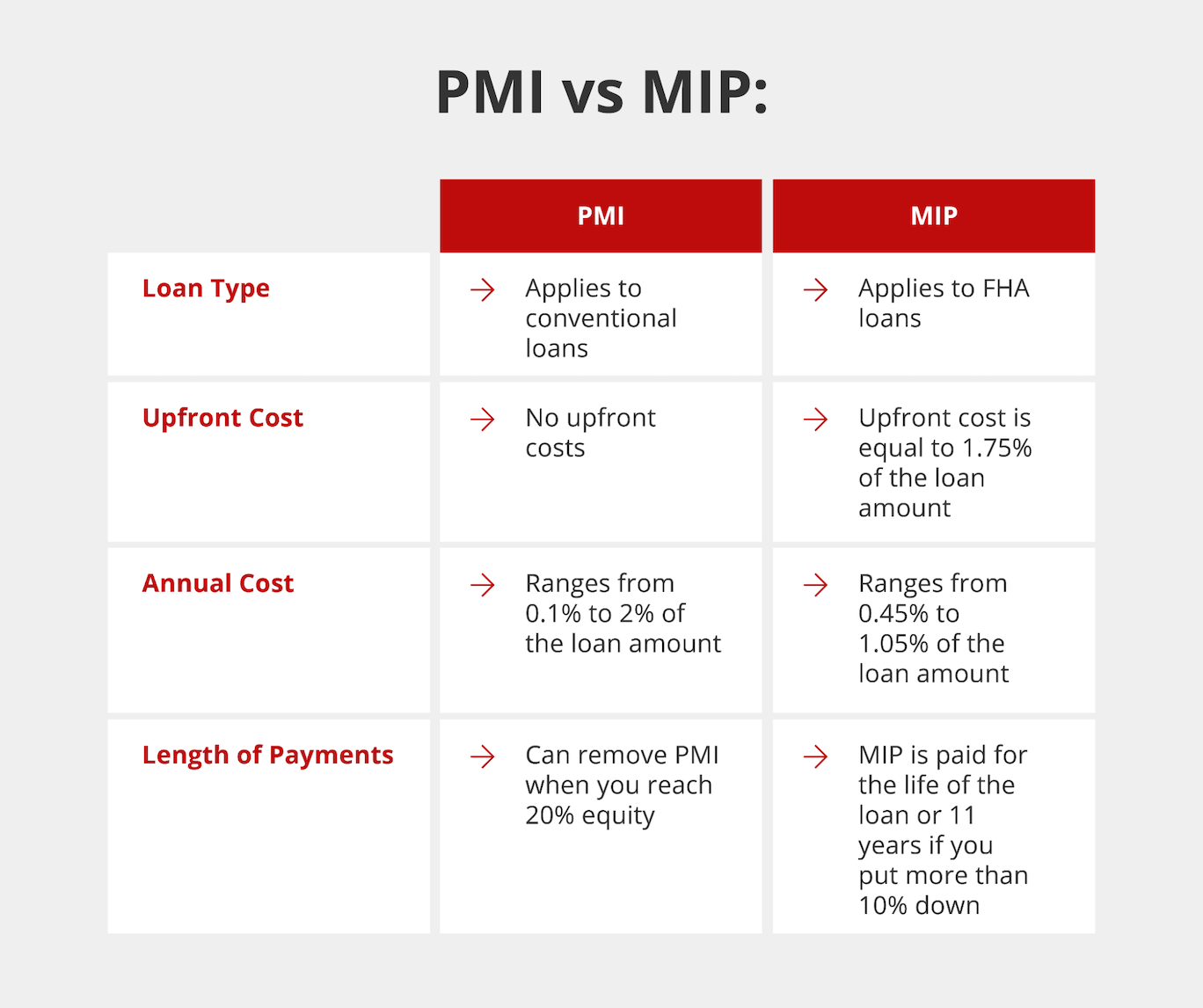

PMI and MIP are both types of mortgage insurance, but they’re connected to different types of loans. For example, you only have to pay PMI if you put down less than 20% on a conventional loan; if you make a down payment of 20% or more using a conventional loan, you’re not required to pay mortgage insurance.

Conversely, all FHA loan borrowers must pay MIP regardless of their down payment amount. So if you put down a 3.5% down payment or a 20% down payment, you’ll pay MIP. However, the amount you pay in MIP varies by down payment amount, so if you want to pay less over the life of your loan, you should always make a larger down payment when possible.

Ultimately, you can’t choose between PMI or MIP because they’re associated with two different types of mortgages. Additionally, you should never decide on a type of mortgage based on these two types of insurance alone. Instead, you should compare the various loan products and all their associated costs to determine which is best for you.

Upfront Cost

FHA loans have two types of MIPs: the upfront and annual mortgage insurance premiums, while conventional loan PMI doesn’t require any upfront costs. The upfront MIP is 1.75% of the loan amount and is typically paid at closing, and the annual PMI is included in your monthly mortgage payments.

On the other hand, PMI is paid as an annual premium, and a portion of it is included in your monthly payments. There are no upfront costs associated with PMI, but there are other costs associated with both conventional and FHA loans, such as closing costs and administrative fees.

If you take out a conventional mortgage and are required to pay PMI, you may be able to pay it in one lump sum at closing, but it’s not necessarily considered an upfront fee because it’s not required.

Annual Cost

When comparing FHA mortgage insurance vs. PMI, you’ll notice that they’re similar in that they both have annual costs typically included in your monthly mortgage bill. However, the amount you pay in MIP vs. PMI is different. Generally, FHA borrowers pay between 0.15% to .75% of the total loan amount in MIP, with the exact cost depending on your loan amount, terms, and down payment size.

Annual PMI rates vary between 0.1% to 2% of the total loan amount and are determined by down payment size and credit score rather than terms or loan length. Typically, conventional loan borrowers with good credit scores can get better rates, but your credit score won’t influence your MIP payments.

Some MIP rates are lower than PMI rates and vice versa, depending on the specific borrower. However, since MIP comes with an upfront insurance premium, you may end up paying more for an FHA loan.

Since every borrower has different financial needs, it’s impossible to determine whether an FHA or conventional loan is more affordable based on mortgage insurance alone. Both PMI and MIP influence your total loan costs, but mortgage insurance is not the only or most important factor in determining how much your home loan will cost.

Length of Payments

Conventional loan PMI can be canceled once you’ve reached 20% equity in your home, drastically reducing your monthly mortgage payments. Unfortunately, the same can’t be said for MIP payments. If you put down less than 10% on an FHA loan, you’ll pay MIP for the life of the loan. However, if you put down more than 10% on the loan, you’ll only have to make MIP payments for 11 years, at which point you can request your lender cancel them.

You can also cancel MIP payments by refinancing an FHA loan to a conventional loan. However, if you put down less than 20%, you’ll be required to pay PMI, so there may be no way to avoid mortgage insurance, depending on your financial situation.

PMI Pros and Cons

A low down payment mortgage is ideal for individuals who simply can’t afford 20% or more. These types of mortgages help more people become homeowners even though they don’t have a significant amount saved for a down payment. However, whether a conventional mortgage loan is right for you depends on more factors than the associated PMI. Still, it helps to know the various pros and cons of PMI to help you make the best decision.

Pros

- PMI enables more borrowers to achieve their dreams of homeownership without putting down more than they’re comfortable with.

- Potential for better rates with a higher credit score, translating to lower monthly payments.

- No upfront costs.

- Payment cancellation once you reach 20% home equity.

Cons

- Conventional loans have more stringent lending criteria.

- PMI may be more expensive if you have a low credit score but still qualify for a conventional loan.

- Makes your monthly payments more expensive than conventional loans without PMI.

MIP Pros and Cons

You only have to worry about MIP if you take out an FHA loan. MIP is required for all FHA loans because it helps protect the lender against higher-risk borrowers most likely to take advantage of FHA loan offerings. While FHA loans allow you to purchase a home without a significant down payment, MIP has pros and cons.

Pros

- MIP enables lenders to have more flexible lending requirements with FHA loans, such as lower down payments required.

- It may be more affordable than PMI.

- Removal after 11 years if you make a down payment of 10% or more.

Cons

- You’ll be responsible for paying your upfront and annual MIP, which can make purchasing a home more expensive.

- You can’t remove MIP unless you put down more than 10%. Otherwise, you’ll pay MIP for the life of the loan.

- Higher monthly mortgage payments.

MIP vs. PMI: Which Is Better?

Technically, there’s no one option that’s better because every borrower is different. Ultimately, you won’t decide between PMI vs. MIP; instead, the better question for you is whether FHA or conventional loans are better. MIP vs. PMI is just one piece of the puzzle when choosing a mortgage. While mortgage insurance of any type will increase your monthly costs, you can’t always avoid it.

Generally, conventional loans with PMI are better for borrowers with high credit scores or those who can make larger down payments because they reduce your PMI amount. Conversely, FHA loans with MIP are best suited for borrowers with lower credit scores since they have less stringent lending requirements. However, your credit score will impact both MIP and PMI, so the higher the score, the better.

Of course, the best option is no mortgage insurance. Avoiding both PMI and MIP can give you the lowest possible monthly payments and reduce your overall loan amount, meaning you pay less over the life of the loan. While avoiding mortgage insurance isn’t always possible, there are several home loan options available that don’t require PMI or MIP, such as:

- VA loans: VA loans are available for eligible veterans, active-duty service members, and surviving spouses and offer the option of 0% down with no mortgage insurance required. Since the VA guarantees 25% of these loans, lenders don’t have to mitigate their risk by requiring mortgage insurance.

- USDA loans: USDA loans are backed by the federal government and can help borrowers purchase a home in rural areas. Similar to VA loans, USDA loans don’t require a down payment to avoid PMI or MIP. However, both types of government-backed loans have other fees associated with them.

- Bank statement loans: Bank statement loans are a type of non-qualified mortgage (Non-QM) loan that doesn’t adhere to the strict requirements of Fannie Mae or Freddie Mac, so lenders don’t have to charge PMI. However, unlike government-backed loans, there are strict down payment requirements that vary by lender.

- DSCR loans: Debt service coverage ratio (DSCR) loans are designed for investors who want to qualify for an investment property loan using cash flow instead of personal income and don’t require PMI. Instead, you’ll qualify for the mortgage based on your DSCR, which tells lenders whether your rental property generates enough cash flow to repay the loan. Like conventional loans, they come with a down payment requirement, making them more difficult to qualify for.

When choosing a mortgage loan, it’s crucial to factor in all the associated costs, not just the mortgage insurance. Therefore, there’s no one-size-fits-all solution for borrowers since everyone’s financial situation and needs are different.

When comparing MIP vs. PMI, you should be comparing conventional versus FHA loans to understand the full picture. For some, conventional loans may be better because they can make a higher down payment, while others may prefer an FHA loan because they may be more affordable.

Find the Right Mortgage Insurance for Your Needs

Determining PMI vs. MIP rates may not be on any first-time home buyer checklist, but that doesn’t mean they’re not important terms you should know if you’re comparing conventional loans and FHA loans. Both types of mortgage insurance increase your monthly costs, but one type of loan might be better suited for you based on your financial situation.

Wondering whether MIP vs. PMI is right for you? You’re probably not going to decide on a mortgage program based on the type of insurance, but it’s an important factor to consider. Now that you understand mortgage insurance, you can learn about the various mortgage programs available and find the right fit for your budget.

Contact Griffin Funding today to get professional help in determining the right mortgage for your needs. Our mortgage experts can help you determine which loan is best for you based on your ideal down payment amount, credit score, income, and debt.

Interested in learning more?

Get StartedRecent Posts

Bonus Depreciation for Real Estate: What It Is & How It Works

Understanding the concept of bonus depreciation and its practical application can help you capitalize on this ...

No Doc Business Loans: What You Need to Know

While “no doc” is short for “no documentation,” there are actually no true no doc loans. Instead, they...

BRRRR Method: Buy, Rehab, Rent, Refinance, & Repeat

Read on to learn more about BRRRR loans and explore how this approach can open doors to lucrative opportunitie...