No Doc Loans

Traditional mortgages have stringent lending requirements. Lenders verify your income in several ways, including reviewing pay stubs and W-2s. But what happens if you don’t have those documents? Many borrowers are self-employed, retirees, and business owners who don’t get these documents because they’re not employees of a single company. Instead, they might run companies or have a different type of income, which isn’t as easily verified.

In the past, these individuals may have been rejected for home loans because they didn’t fit a lender’s strict requirements. For example, they didn’t have W-2s to share, so lenders could not verify their income. Luckily, freelancers, retirees, and business owners no longer have to fit within a lender’s strict criteria for conventional loans. Instead, they may qualify for no doc mortgage loans.

No doc mortgage loans can help borrowers with various income situations get approved for a loan and achieve their dreams of homeownership. These loans can also be used to refinance existing loans to reduce monthly premiums and overall loan amounts. But what is a no doc mortgage? And is it the right option for you? Keep reading to find out.

What Is a No Doc Loan?

A no doc mortgage loan is a Non-QM loan that can allow borrowers to qualify for financing using alternative methods. Instead of requiring standard documentation like pay stubs, W-2s, and tax returns, lenders verify your income using bank statements and assets to determine your ability to repay the loan. The name “no doc mortgage loan” is slightly misleading because documents are still required.

To qualify for no doc loans, borrowers must still submit proof of income. However, the type of proof of income will vary depending on the loan. For example, you can apply for a bank statement loan and provide the lender with bank statements, or you can apply for an asset-based loan, and the lender will ask for proof of income in the form of bank statements, investment accounts, certificates of deposit (CDs) and so forth.

The goal with no doc loans is to ensure borrowers can afford their monthly mortgage premiums and have a stable source of income. At one point, lenders had no doc loans that didn’t require the borrower to provide income documentation. Instead, borrowers provided a declaration that indicated they could repay the loan. For example, with a stated income-stated assets loan (SISA), the borrower discloses their income and assets, and the lender accepts the figures provided without verifying them.

These types of loans are severely restricted and no longer available for owner-occupied properties, due in large part to the 2008 financial crisis. Instead, borrowers can get stated income-verified assets loans (SIVA) where the borrower must verify a prospective borrower’s assets, including everything from bank statements to investment and retirement accounts.

There’s also a no-income-verified assets loan (NIVA), which is similar to the SIVA loan, except the borrower doesn’t have to disclose their income. Instead, the lender verifies just the assets. These types of loans tend to be riskier than traditional loans for the lender because they don’t require income verification. However, they’re often still offered to allow for more flexible requirements for borrowers who can repay their loans.

Who Are No Doc Loans For?

No doc loans are best for borrowers with unconventional sources of income, such as:

- Self-employed individuals

- Small business owners

- Retirees

- Investors

As mentioned, several types of no doc loans are available, so it’s crucial to find the best one for your unique financial situation. For example, the SIVA loan may be best for self-employed individuals with a high net worth or those who rely on cash. With a SIVA, most lenders only ask for 12 to 24 months’ worth of bank statements to verify assets rather than income.

Meanwhile, the NIVA loan is usually best suited for retirees who don’t have income from a regular job. These individuals may need to provide statements from their retirement accounts and document other assets, such as savings accounts, to prove their ability to repay the loan.

A no doc loan might be right for you if you can’t easily prove your income or you don’t have the correct documentation. Here are some situations where you might choose a no doc mortgage loan over a traditional loan:

- You deduct business expenses: If you’re a small business owner or freelancer, you likely deduct business expenses from your tax returns to lower your taxable income. This can be beneficial in helping you save money during the tax season. However, it reduces your taxable income, which many lenders use to determine your ability to repay a home loan. A low net income can potentially hurt your chances of getting approved for a traditional loan, especially if you can’t provide other documentation like pay stubs or W-2s. In these cases, lenders can choose to verify your assets instead of your income to ensure you can afford the loan.

- You have seasonal or irregular income: Lenders like to see that you have a consistent or regular income. Unfortunately, many people don’t. Take a small business, for instance. If you work in a tourist area, you might have a higher income during the travel season and a much lower income during the off-season. Many lenders won’t consider you for a traditional home loan if you have an irregular income. However, you may still qualify for a no doc loan that proves your ability to repay by looking at your total annual income via bank statements or profit and loss statements.

- You’re a real estate investor: Real estate investors may get approved for a loan based on the value of the property instead of the lender verifying their personal income. If you’re buying an investment property, your expected rental income can factor into a lender’s decision to approve your loan.

- You have a high net worth: Retired individuals no longer work and don’t have traditional income. In addition, certain individuals no longer work because they’ve inherited money, won the lottery, or otherwise acquired a large sum of money. There is no income to verify in these instances, so a no doc loan can make the most sense.

Qualification Requirements for No Documentation Loans

No documentation loans are not too different from traditional home loans—the main difference is that lenders verify income and assets using alternative methods instead of W-2s and pay stubs. However, these loans are considered higher risk for the lender, so there are several requirements a borrower must meet to qualify.

Remember, no doc loans don’t mean that lenders will give anyone money for a home loan. Instead, they must make an effort to ensure borrowers can repay the loan. Here are some of the requirements you’ll need to meet:

- Credit score: No doc loans typically require a higher credit score than traditional mortgages because they’re a higher risk for the lender. Therefore, a lender must confirm you’re someone who pays their debts on time to ensure they’ll get their money back.

- Employment type: Many lenders require borrowers to be self-employed, business owners, or retired. However, these requirements vary by lender. In addition to employment type, your lenders may require you to be performing the same work for at least one or two years to ensure you have a steady and reliable source of income.

- Underwriting and approval: Like all loans, lenders must perform underwriting to ensure the information you provide them is accurate. For example, they can no longer take your word for how much you earn yearly; instead, they must do their due diligence to ensure you earn enough or have enough in savings and assets to repay the loan.

- Asset verification: Asset verification is part of the underwriting process during which an underwriter will verify your assets to ensure the information you provided them is accurate. Ultimately, the goal of the underwriter is to confirm you can afford your monthly mortgage premium and ensure you’re not overpaying for a home based on the appraisal.

- Debt-to-income (DTI) ratio: Even though no doc loans don’t verify your income in traditional ways, lenders still must ensure your debts won’t affect your ability to repay. Your DTI will compare your debts to your income to ensure there’s enough left over to pay for your mortgage.

- Down payment: In addition to the other requirements, lenders may require a larger down payment. However, this isn’t always the case. That said, a larger down payment can help you reduce your interest rates to pay less over the life of the loan.

- Reserves: Some lenders require borrowers to have at least a few months’ worth of cash reserves to ensure they can make their mortgage payments after closing. The exact amount you’ll need will vary by lender and your income. For example, seasonal workers may need to have a certain amount of money on hand during their off-season to ensure they can afford their payments.

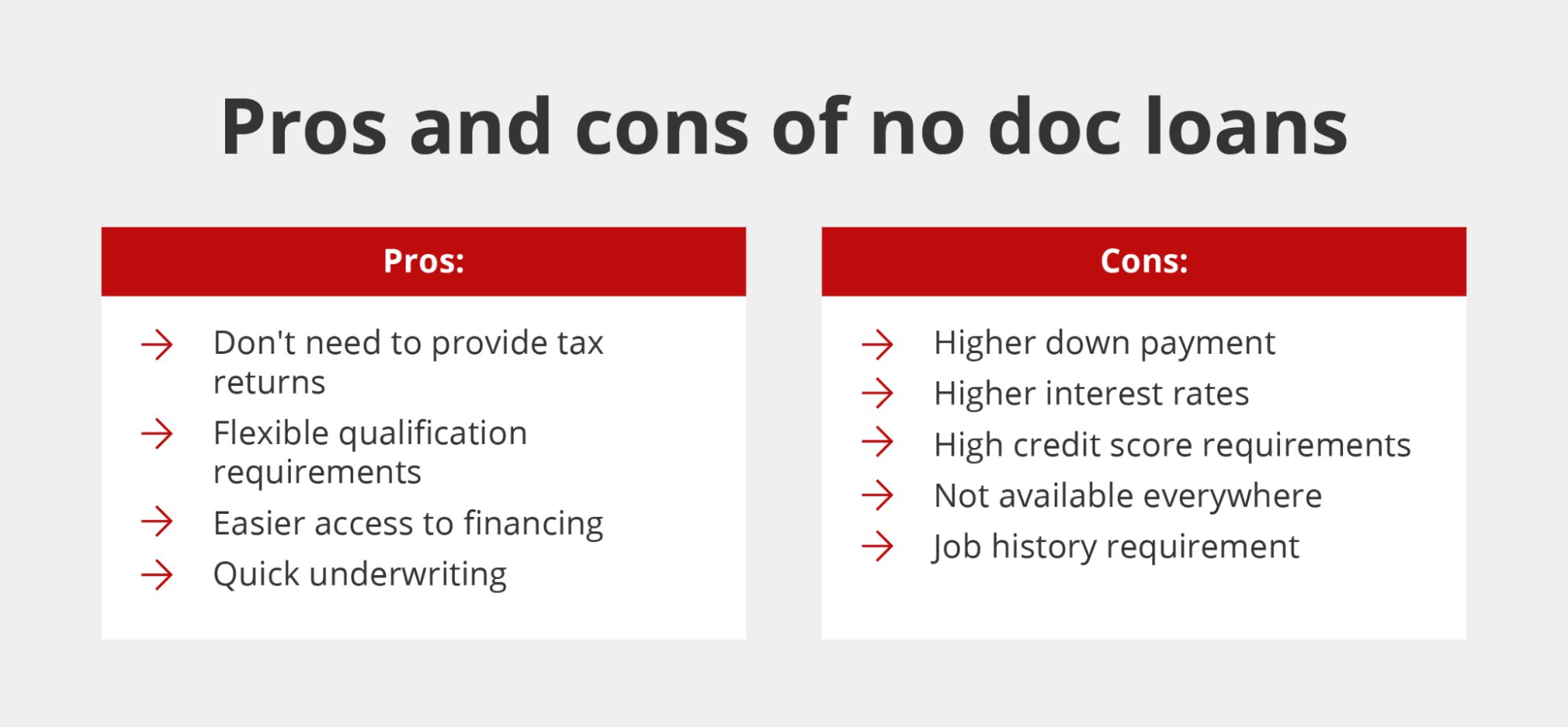

No Doc Loans: Pros and Cons

No doc loans make sense for several specific types of borrowers—those who don’t have traditional income sources and aren’t W-2 employees. These loans make home buying more accessible for non-traditional borrowers and often come with a faster underwriting process. However, they may come with higher borrowing costs because they’re considered higher risk than other types of loans. There are several pros and cons of no doc loans to consider before applying with a lender, including the following:

Benefits of a No Doc Mortgage

The most significant benefit of no doc mortgage loans is that they can help non-traditional borrowers reach their dreams of homeownership by providing them with more flexibility in how they can provide information on their ability to repay the loan. Other benefits of this loan program include the following:

- No need to provide tax returns: No doc loans don’t require lenders to verify your income in traditional ways, so there’s no need to provide tax returns, pay stubs, or W-2s. Instead, a lender will aim to verify your assets to ensure you can repay the loan. That said, providing your lender with your tax returns can make you more appealing to lenders, and they’ll keep in mind that many business owners take significant deductions to lower their taxable income. In any case, your tax returns are less important with no doc loans because they’ll verify your ability to repay the loan in other ways.

- Flexible qualification requirements: No doc loans offer more flexible qualification requirements, such as the ability to qualify for a loan based on how much money is in your savings account. However, in some ways, they’re stricter than traditional loans. For example, some lenders might require a larger down payment and higher credit score to qualify.

- Easier access to financing: Many self-employed individuals take significant deductions on their tax returns to reduce their taxable income. The result of this is that their tax returns aren’t an accurate reflection of how much they earn. For example, a freelancer may write off their home office, office supplies, fees, and more, reducing their taxable income by thousands of dollars, even though they have the ability to repay the loan. By using alternative verification methods, lenders can ensure a borrower earns enough or has enough money to repay their mortgage premium every month, meaning fewer self-employed borrowers, business owners, and retirees are rejected.

- Faster underwriting process: A no doc loan is technically a low doc loan because your lender must still verify your ability to repay based on your assets like bank accounts. However, because there are fewer documents to review and verify, the underwriting process is typically much quicker for no doc loans, allowing you to close faster on a home after signing a purchase agreement.

Drawbacks of a No Doc Mortgage

While no doc mortgage loans make home loans more accessible for several types of borrowers, a few drawbacks may deter you from applying for one. The potential cons of no doc loans include the following:

- Higher down payment than many conventional loan types: Because lending to a no doc loan borrower is a higher risk for lenders, many require higher down payments. While you may be able to get a traditional home loan with a 3.5% down payment, many Non-QM lenders require a down payment of at least 10% of the purchase price or more. The minimum down payment requirement varies by lender, with some requiring down payments as high as 20%, so it’s a good idea to do your research and talk to several lenders before applying. However, if you can make a higher down payment, it can translate to lower mortgage payments and help you avoid private mortgage insurance (PMI).

- Higher interest rate than some loan types: No doc mortgage loans usually come with less favorable terms because they’re a higher risk for the lender. You can expect higher interest rates than some other types of loans, but you can reduce your interest rate by making a higher down payment or refinancing your loan at a later time.

- High credit score is needed to qualify: In addition to a higher down payment, you typically need a higher credit score to qualify for a no doc loan. The lender must ensure you have a history of repaying your debts on time and in full to ensure it’s safe to lend to you. Typically, you should aim for a credit score of 700 or higher to qualify for these loans. In addition, a higher credit score can reduce your interest rate to help you save more over the life of the loan.

- Not offered by every lender: Most home loan lenders offer conventional mortgages. However, not all of them offer no doc loans because they don’t want to take on the associated risk. If you think a no doc mortgage loan is right for you, you may have to shop around in your area to find a lender.

- Job history requirement: Most home loans have a job history requirement to ensure you have a consistent and steady source of income. While no doc loans may not verify your income in traditional ways, lenders must ensure you have a way to earn money to pay your monthly mortgage premium. Most lenders require at least two years of work history performing the same job or duties. Therefore, if you’re a freelancer, they want to see that you’ve been in business for at least two years. However, many lenders have more flexible requirements. For example, if you went from a full-time job to freelancing and stayed within the same industry with the same duties, lenders may overlook how long you’ve been in business.

Types of No Doc Loans

There are several types of no doc loans to choose from, allowing lenders to verify your income and assets in non-traditional ways. A few types of no doc loans Griffin Funding offers include:

- Asset-based loans: Asset-based loans are a type of no doc loan that allows lenders to use your assets as income in the verification process. These loans are best for retirees, business owners, and self-employed individuals because they allow you to qualify for a home loan based on several asset types, including bank accounts, CDs, stocks and other investment accounts, and money market accounts. Essentially, any asset that can easily be converted to cash will count toward your “income” to help lenders determine how much you can afford to borrow.

- Bank statement loans: Bank statement loans are similar to asset-based loans. However, instead of using any and all assets that can easily convert to cash, lenders will review your bank statements. Most lenders require at least one to two years’ worth of bank statements from borrowers to qualify and prove that they have a consistent income.

- DSCR loans: DSCR mortgage loans are designed for investors, allowing them to qualify for a loan based on the gross rental income of the property instead of personal income. Lenders use the debt service coverage ratio (DSCR) to compare cash flow to debt to determine if the property’s generated income is sufficient to cover its debts.

- Interest-only loans: Interest-only loans make home loans more affordable for the first portion of the loan by allowing homeowners to pay just the interest instead of the principal balance. After the initial period, the payments are recalculated to include the principal balance.

Griffin Funding also offers a variety of other types of home loans to help you find the right option for you. If you’re not eligible for a no doc loan, you may still qualify for one of our other offerings, such as a VA loan, USDA loan, or jumbo loan.

How to Get a No Doc Loan

Griffin Funding is a premier provider of Non-QM no doc mortgage loans, helping more qualified borrowers achieve their dreams of homeownership. Applying for a no doc loan is simple.

1. Get Pre-approved

Getting pre-approved for a no doc loan can help you understand the likelihood of approval and how much you can afford to borrow. It also gives you more purchasing power when house hunting, as sellers will take you more seriously with a pre-approval letter.

2. Find Your Dream Home

Armed with your pre-approval, you can begin house hunting knowing a range of what you can afford. In addition, your pre-approval can prevent disappointment if you want to apply for a loan on a house you can’t afford. Instead, as long as you provide us with accurate information during the pre-approval process, the loan amount should be similar.

3. Complete the Application

Once you’ve found your dream home, you can start the application process through our digital mortgage platform, or we can send you a secure PDF or mail the print application to you overnight. We’ll also send you a checklist of documentation we’ll need for the underwriting process.

4. Appraisal & Inspection

After reviewing your application, we’ll order the appraisal to value the home and ensure you’re paying what it’s worth. You’ll be responsible for ordering a pest inspection to ensure the home is livable.

5. Approval

Once your loan is approved, we’ll reach out with any items we need to order your final loan documents. Then, you can review your loan documents and meet with a notary to sign the documents and close on your home loan.

What Banks Offer No Doc Loans?

Many banks and financial institutions offer no doc loans. However, since they’re considered riskier loans for the lender, not all financial institutions have them available. Griffin Funding is a trustworthy no doc loan lender who can help walk you through the application process and ensure this loan is right based on your unique circumstances.

See If You Qualify for a No Doc Loan

If you don’t qualify for a traditional loan, a no doc loan might be right for you. No documentation mortgage loans are ideal for self-employed individuals, small business owners, freelancers, and retirees. Wondering if no doc loans are right for you? Contact Griffin Funding to see if you qualify or apply online today.

Interested in learning more?

Get StartedRecent Posts

Bonus Depreciation for Real Estate: What It Is & How It Works

Understanding the concept of bonus depreciation and its practical application can help you capitalize on this ...

No Doc Business Loans: What You Need to Know

While “no doc” is short for “no documentation,” there are actually no true no doc loans. Instead, they...

BRRRR Method: Buy, Rehab, Rent, Refinance, & Repeat

Read on to learn more about BRRRR loans and explore how this approach can open doors to lucrative opportunitie...