Letter of Explanation

KEY TAKEAWAYS

- Letters of explanation are used to clarify concerns regarding eligibility.

- Letters of explanation are not always required, but they are common.

- When writing a letter of explanation, you should provide documentation to support your claims.

If you are going through the process of applying for a mortgage, you understand that you might be asked for certain documentation. For example, your lender will ask for information about your financial situation, the various debts you carry, and where your income is coming from.

To get a better financial picture, they might even ask for a letter of explanation for your mortgage.

To make this process easier, you might want to use a letter of explanation template. That way, you don’t overlook anything.

Keep reading to learn more about why letters of explanation are required and how to write one for your lender.

KEY TAKEAWAYS

- Letters of explanation are used to clarify concerns regarding eligibility.

- Letters of explanation are not always required, but they are common.

- When writing a letter of explanation, you should provide documentation to support your claims.

What Is a Letter of Explanation?

A letter of explanation is a document that the lender may request to learn more about your specific financial situation. Mortgage loans are significant, and lenders need to be confident that you’re going to be able to repay the loan.

To qualify you, they will take a look at where all your income is coming from, where it is going, and whether it is a consistent stream. Whether you’re applying for a fixed-rate mortgage, adjustable-rate mortgage, or any other type of home loan, this is standard.

If the lender is unsure about where your money is coming from or where it’s going, they may be a bit concerned. If your financial situation isn’t consistent, the lender might be worried that you won’t be able to make regular payments on your mortgage. In this case, they will often ask for a letter of explanation in an effort to dispel any worry or confusion they might have about your ability to repay the loan.

Why Do I Need a Letter of Explanation?

Lenders will ask for a letter of explanation if they want to learn more about your credit standing, employment history, or income. Anything that raises a red flag regarding your financial situation could trigger a request for a letter of explanation.

Generally, if something out of the ordinary appears on your financial documentation, the lender may ask for more information.

Some of the most common reasons why a lender might ask for a letter of explanation include:

- You may have some discrepancies in your address on official documents. The lender wants to make sure that you are not a victim of identity theft.

- If you have a significant gap in your employment history, the lender will ask for more information. They want to make sure that you have a consistent source of income to ensure you can repay the mortgage.

- If you had a sizable deposit into one of your bank accounts recently, the lender may ask for more information. If it doesn’t appear to come from a job, they’ll likely want to know more about the source.

- If you have a history of late or missing payments to other sources of debt, your lender will want to learn more about why that happened.

- If your income is inconsistent, your lender will want to figure out why that is the case and whether it’s going to continue moving forward.

If you can clarify any worries that the lender might have, you should be able to improve your chance of being approved for a loan.

How Do You Write a Letter of Explanation?

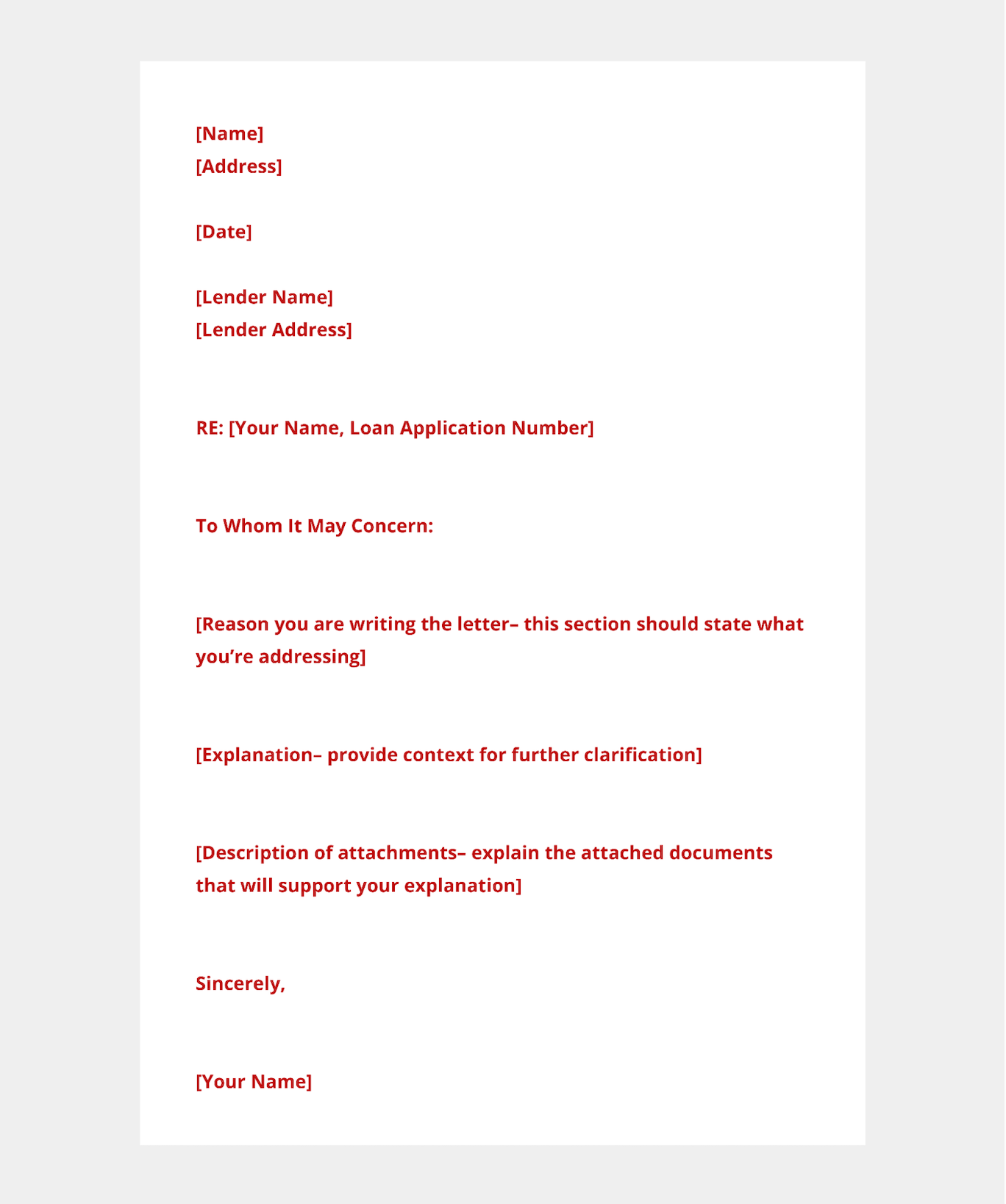

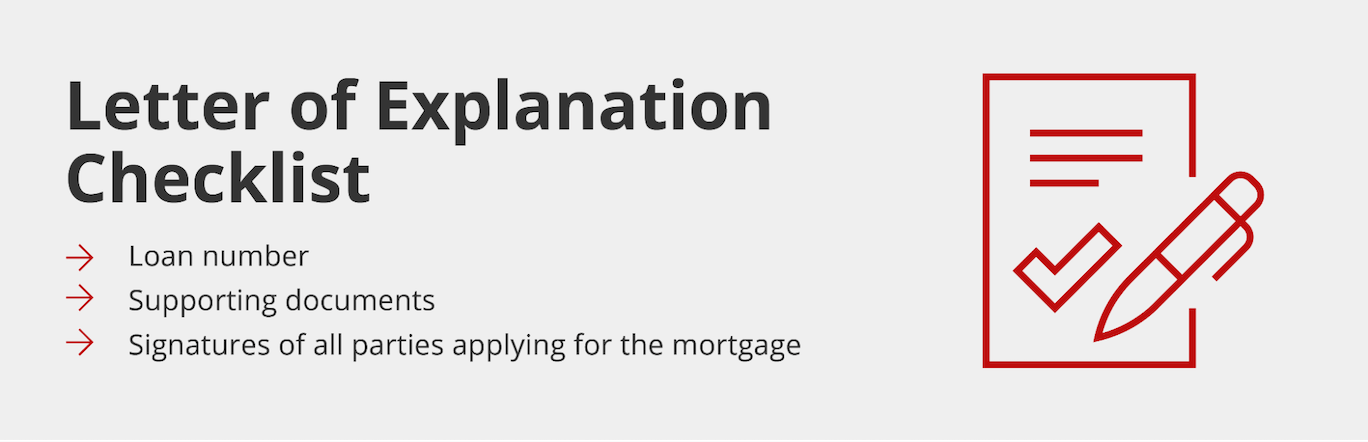

If you have been asked to write a letter of explanation, you may want to use a template to make sure you don’t forget anything. The general steps are as follows:

- You need to start by acknowledging any concerns that the lender might have. That way, you and the lender are on the same page. Reiterate why you have been asked to write the letter from your point of view.

- Then, state the facts as they appear on your documentation. Reiterate the specific numbers that the lender has questions about.

- Clearly explain where the money has come from, where it is going, the gaps you have in your employment, or any other issues that your lender might have raised.

- For example, you might have a sizable deposit in your account because you recently earned a bonus, or maybe there was a gap in your employment because you had a baby.

- Finally, you need to explain why these discrepancies are not going to happen again and why you have the financial capacity to repay the loan.

- Make sure to include your name, street address, the date of the letter, and your contact information when you submit it to the mortgage underwriter. This information is usually included at the top.

Remember, it’s crucial to provide specifics, be as clear as possible, and advocate for yourself because your ability to get a loan for your house may hinge on its success.

Tips for Writing a Letter of Explanation

If you have been asked to write a letter of explanation for a mortgage, here are a few tips we recommend following:

Keep It Short

You need to keep the letter short and to the point. Include the necessary information and elaborate where necessary, but don’t include frivolous details.

You want the lender to take away key clarifying points on the issues standing in the way of your approval. Keeping it concise prevents confusion.

Create Subheadings for the Various Issues

For many people, a letter of explanation will be fairly short and touch on one or two points. However, for some, there may be many aspects of their finances to clarify. If that’s the case for you, you may want to use subheadings to improve organization.

Using subheadings makes it easier for the person reviewing it to find the information that pertains to each concern.

For example, if they’ve asked for explanations about late payments, create subheadings that point directly to each payment that requires clarification. If they are asking about a gap in your employment history, make sure you create a section specifically to address that gap.

On the note of making it easier to read, typing letters of explanation is highly recommended.

Be Detailed, But Not Irrelevant

You need to be as detailed and as specific as possible. Remember that this is your one chance to alleviate concerns that the lender might have about your ability to repay the mortgage.

Do Not Get Emotional

Getting approved for a mortgage is generally all about the numbers. While it is certainly an emotional experience because you are trying to get approved for a home loan, you don’t want to get emotional when sorting out the logistics with your lender.

Instead of pleading with the lender to approve you, be as professional as possible and stick to the facts. They will appreciate your transparency and compliance.

Thank the Reviewer

You want to be polite and professional when you write this letter, so always thank the reviewer for their time. Remind them that you appreciate the opportunity to be considered for a home loan, and invite them to reach out to you if they have any further questions or concerns.

Last but not least, have someone proofread the letter for any grammar or spelling issues.

What Happens If a Letter of Explanation is Rejected?

If your letter of explanation for a mortgage is rejected, don’t panic. Talk to the lender to see if providing further clarification would help or ask for more details on why they’ve rejected the letter. That can help you decide what the next steps are.

While there is a chance that you might get rejected for the mortgage, keep in mind that you have other options available.

Apply for a Mortgage with Griffin Funding

If your letter of explanation is rejected and you’re denied a mortgage, you may want to pursue other types of home loans available to you.

For example, you may not qualify for a traditional loan based on your financial circumstances, but you might be eligible for bank statement loans with another lender.

At Griffin Funding, we have worked with people of all backgrounds who are looking for more flexible ways to get approved for a home loan. If you find that you are having a difficult time getting approved by a traditional lender, we can review your financial circumstances to see if you qualify for one of our other loan options.

We understand that everyone is in a different financial situation and strive to find solutions that work for the modern borrower. We would be happy to discuss our options with you and see if we can find a mortgage loan option that suits you.

Contact us at 855-698-1098 today to speak to a member of our team and learn more about our home loan offerings. You can also request a quote online to get started.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Are letters of explanation a common part of the mortgage process?

What are the most common reasons a letter of explanation is requested?

Does it reflect negatively on you if the lender asks for a letter of explanation?

Recent Posts

Conventional Loan Limits in 2025

If you plan to purchase or refinance a home in the coming year, understanding the conventional loan limits in ...

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...

Mortgage Refinance Limits

Your Refinancing Options Most owners have several refinancing pathways depending on their financial goals and ...