How to Sell Your House

Having a stress-free home selling process is crucial for anyone wondering how to sell their home. Most people don’t want to invest too much time or money into the process and often choose to work with professionals to help them sell their homes. Unfortunately, selling a home is complicated, and there’s a lot the homeowner has to be involved in.

For instance, you must decide your asking price based on your comfort level, market conditions, and geographic location. Then, once you’ve received offers, you have to determine which ones make the most sense for you and negotiate with buyers.

Selling a home can be time-consuming and difficult, especially if you’re doing it on your own. First, you must have a basic understanding of the local real estate market and potential buyers. Then, as a seller, you must be prepared for anything. Wondering, “How do I sell my house?” You’ve come to the right place.

This article will discuss how to sell your house to reduce stress and make the process easier. Keep reading to learn the 11 steps you should take when it’s time to sell your home.

KEY TAKEAWAYS

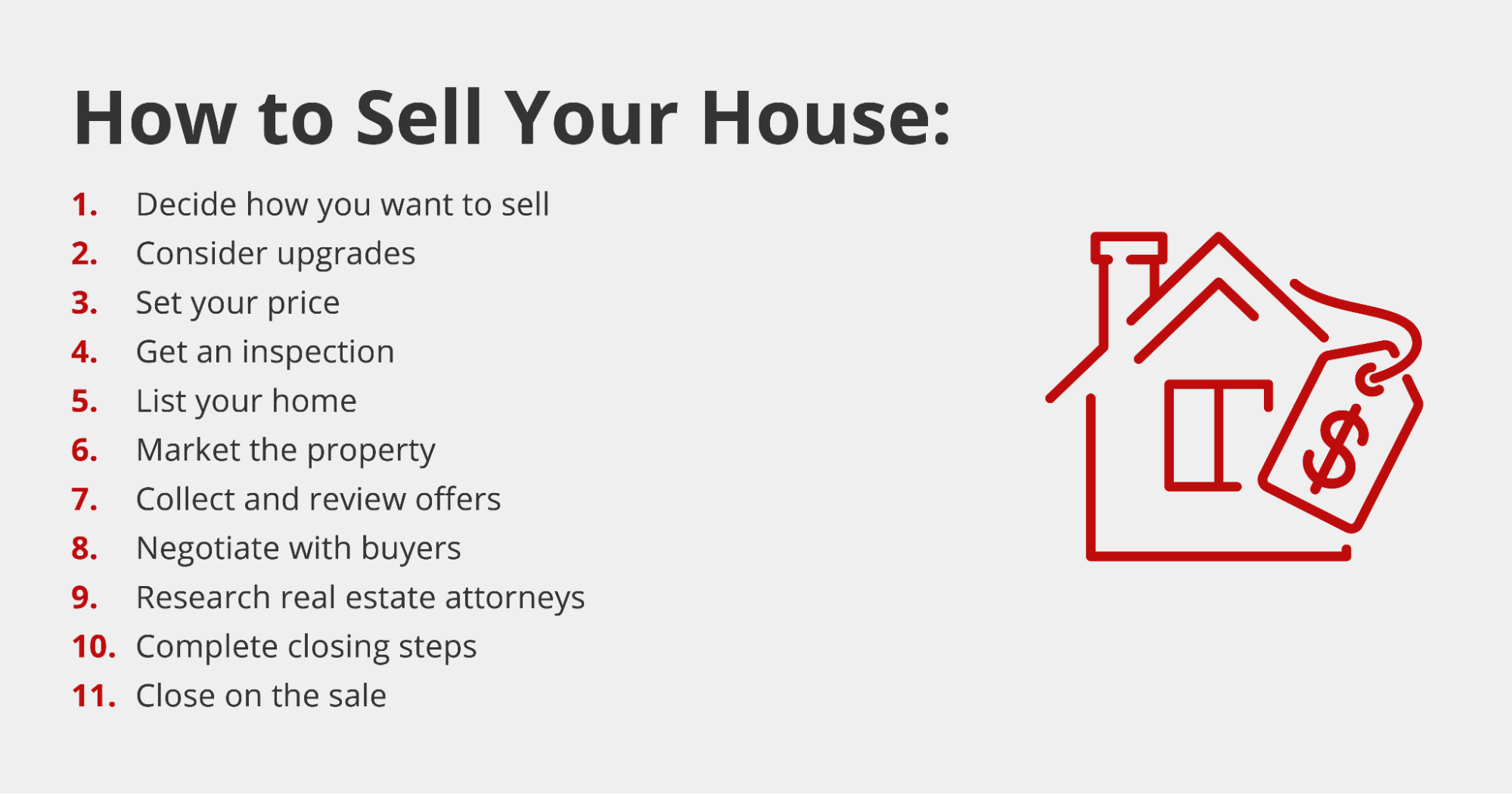

How to Sell Your House: 11 Steps

Selling your house can be a complicated, time-consuming process. If this is your first time selling a home, you may not know where to start. Luckily, you’ve already purchased a home, so you can start understanding the buyer’s perspective, which can help with negotiations later. But what do you do when you’re ready to sell your house? Here are a few simple steps for how to sell a house:

Determine how you want to sell

If you’re reading this article wondering, “How can I sell my home?” you have a few options. For instance, you can work with a real estate agent to take care of most of the heavy lifting, or you can decide to save on their commission by selling it yourself.

Whether you decide to work with a realtor or list the home yourself can greatly impact how much work you’ll need to put into the process and how much you earn from the sale of the home. While the choice is up to you, many first-time sellers decide to work with a realtor to make the process easier since they’ve never done it before.

Getting a realtor vs. sale by owner

For sale by owner (FSBO) is a popular way of selling your home because it’s more affordable. Instead of using a real estate or listing agent, you’ll take care of the entire home-selling process yourself, which means listing and marketing the home, staging, arranging showings with prospective buyers, and negotiating.

When you work with a realtor, they’ll take care of most of the process for you, but at a price. Real estate agent commission fees are typically around 6% of the sale price, which may then be split with the buyer’s realtor. The seller pays the commission fees, so you’ll be responsible for paying your own realtor and the buyer’s realtor.

Selling your home without a real estate agent can help you save money, but since many people don’t have the time to spend on every aspect of the process, most sellers choose to work with a realtor. However, there are some instances where selling your home yourself makes sense. For instance, if you have a friend or family member who is a real estate agent willing to help you, or you have the time to learn how to sell a home, FSBO might be right for you.

Another example of when you may not need a real estate agent is if you know the person you’re selling your home to because there’s no need to market or list the property.

That said, if you’ll need to list your home and market it to attract buyers, working with a real estate agent is ideal because it saves time and energy. In addition, if you decide to work with a realtor, you can be as involved in the process as you want; ultimately, your real estate agent can’t make any decisions without you, and they can serve as a resource to walk you through the entire process and support your decisions.

Consider upgrades

Upgrading your home can increase its value, which means earning more on the sale. However, not all upgrades are worth the investment. When considering upgrades before selling your home, you should consider the types of buyers you’re trying to attract and your potential return on investment (ROI). Ultimately, you don’t want to spend time or money on costly upgrades that won’t help you earn more on the sale of your home.

This is why working with a real estate agent is beneficial for most sellers — they can help you determine if upgrades are necessary to increase the value of your home and, if so, which ones can give you the highest ROI.

As a general rule of thumb, kitchen and bathroom updates typically yield the highest ROI. Many buyers see the kitchen as the heart of the home and the bathrooms as their own personal oasis. Simple updates like hardware or cabinetry can make your home look more modern and appealing to buyers. If you don’t have money to upgrade your home, you might consider repainting it to make it look fresh without spending too much on upgrades.

Price your home

Once your home is ready to put on the market, you must determine your asking price. Depending on market conditions, you may get more or less than your asking price, but it’s crucial to price your home correctly during the initial stages.

How you price your home depends on current market conditions and your local real estate market. The best way to determine how much you can ask for your property is to review home prices for similar homes in the area. Pricing your home too high, even during a seller’s market, may make it stay on the market longer because it intimidates buyers. Remember, you’re competing with other sellers in the area. If someone has a home similar to yours and is asking for less, buyers are more likely to be interested in the other property.

On the other hand, undervaluing your home can lead to lost money. While buyers might see your home as a deal, which can help you attract more prospects, you don’t want to sell your home for less than it’s worth. Your home is an investment, and you want the highest return on your investment possible.

As mentioned, to price your home correctly, you’ll need to start with comps — listings of recently sold comparable properties in the area. Knowing how much similar homes recently sold for can help you determine your home’s value and how much buyers might be willing to pay for it.

If you’re selling your home yourself, one of the biggest mistakes you can make is pricing your home too high and planning to lower it based on interest from prospective buyers. However, when you price your home too high, you can scare away prospective buyers who won’t even be willing to look at the property. You can’t expect those buyers to return when you reduce your asking price.

Additionally, if you continue to reduce your asking price over a period of many months, buyers might think that the seller is desperate because something is wrong with the home. While this may not necessarily be true, buyers don’t know any better and won’t even consider looking at the property.

Get an inspection

Buyers will get the home inspected before they agree to purchase it, and their mortgage lenders will probably require it before funding their loans. Getting an inspection before listing your home allows you to identify major problems and maintenance concerns to avoid unwanted surprises. For instance, if the buyer’s home inspection reports major issues, they may ask you to reduce the asking price to cover their costs or walk away from the sale altogether.

If you want to get the biggest return on your investment when selling your home, getting an inspection before listing it is crucial. By getting these repairs out of the way before you start showing your home to buyers, you can streamline and reduce friction later in the process.

Create a listing

Once your home is ready to go on the market, you’ll need to create a listing that attracts buyers. Your listing includes everything from details about the home and photos to help potential buyers determine whether they want to schedule a showing. If you’re working with a realtor, they’ll handle the listing process for you by listing the property with the multiple listing service (MLS).

Agents use the MLS to find properties for buyers in the area, and the best way to get your home listed is to work with a real estate agent. You can also list your home with the MLS for a fee. Most realtors use the database to find available properties for their clients, so there’s no reason not to have your home listed. However, you want your listing to stand out from the rest, so it may be worth taking professional photos or hiring a real estate agent to handle staging, photos, and writing descriptions on your behalf.

If you’re selling your home yourself, there are plenty of other listing sites you can use to attract buyers. However, since writing real estate listings requires a certain skill set, we recommend working with a listing agent or realtor to help since using these platforms is one of the best ways to market your home. A few listing sites you can use when selling FSBO include the following:

- Beycome: Beycome is specifically designed for FSBO properties and works with both buyers and sellers who want to forgo working with a realtor. This platform offers reasonable fees to have your property listed on the MLS, with premium packages designed to help with marketing.

- Zillow: Zillow is one of the most popular real estate websites and apps today and has tools for sellers that help them accurately price their homes, find agents, and advertise for free.

- Trulia: Trulia is the second-largest real estate website. Buyers can look for FSBO properties or agent listings. However, the only way to list your home is through its partner, Zillow, which automatically places you on the Trulia website.

Unfortunately, there are some tools you can’t use when selling your home yourself. For instance, Realtor.com uses the MLS listings sourced from hundreds of databases, and you can’t get your home listed on the site unless you work with a real estate agent who has access to your local MLS.

Market your property

After you’ve created your listing, it’s time to market your property. It’s not enough to list the home for sale on various websites because those websites are crowded with your competition. You’ll need professional photos, staging, and open houses to effectively market your property.

- Professional photos: If you’re working with a real estate agent, they can handle this process by scheduling a photo shoot of your home. High-quality photos can help attract buyers who begin their searches online and determine whether they want to see a property based on the quality of the photos. If you’re not working with a realtor, you’ll have to find a photographer on your own and ensure they take photos that highlight the best parts of your property.

- Staging: You can stage your property for professional photos, showings, or both to help prospective buyers visualize themselves in the home. Staging is the process of decluttering your home and removing personal belongings to make the home look more like a blank canvas for buyers. Again, if you’re working with a realtor, they’ll take care of the staging for you, which may include hiring a professional staging company.

- Showings: Once you’ve attracted prospective buyers with your online listing, you’ll need to dazzle them with in-person showings. Many homebuyers prefer to see the home in person before making an offer, so it’s crucial to have showings that allow them to tour the home and see everything for themselves. During showings, it’s usually best for the homeowner not to be there unless the homeowner is acting as their own real estate agent. In most cases, it’s better to have only your real estate agent there because they’re sales professionals that can convince buyers to make an offer.

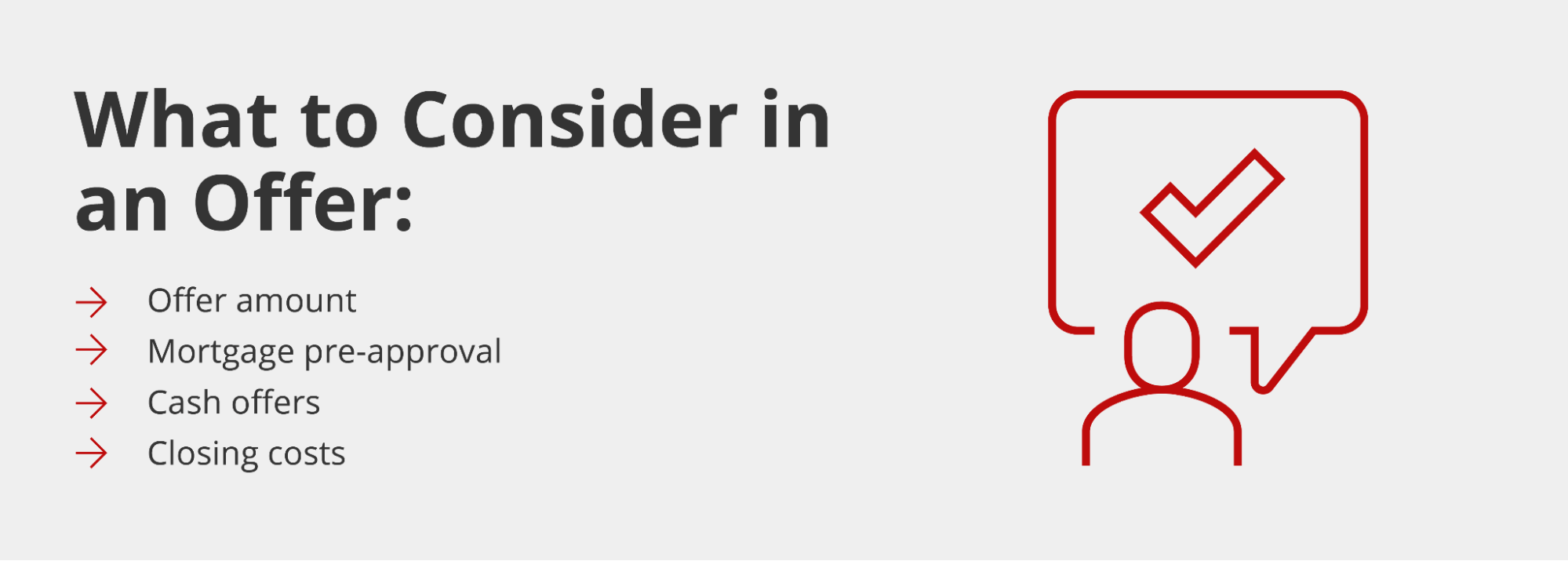

Collect and review offers

Hopefully, after many showings, you’ll have a few offers from prospective buyers. If you’re working with a real estate agent, they can present the offers for you and provide guidance and advice to help you make the right decision. A few factors to consider when reviewing offers include the following:

- Offer amount: You can’t always expect a bidding war that increases the amount buyers are willing to pay for your home. However, you can choose the offer that’s closest to your asking price.

- Mortgage pre-approval: Whether your prospective buyers are using Non-QM loans, adjustable- or fixed-rate mortgages, conventional, or VA loans, you need to know they’re pre-approved. While pre-approval doesn’t guarantee your buyers will be approved for the loan and amount required, it does set them apart from buyers who aren’t pre-approved because it means they’ve taken the necessary steps to help ensure they qualify for a loan.

- Cash offer: Some buyers don’t need mortgages and are willing to pay in cash. Accepting a cash offer on your home means quicker closing because there’s no mortgage lender involved. Additionally, there’s less risk for you because you don’t have to wait to see if a lender will be willing to loan a buyer a specific amount; instead, you’ll get guaranteed money. Cash offers tend to be lower, but they can help you complete the process faster without appraisals, making it ideal for selling your home in as-is condition.

- Closing costs: Typically, buyers and sellers pay closing costs, but how much you pay can vary depending on negotiations. Sellers typically pay realtor commissions, title fees, homeowners association fees, and property taxes, while buyers pay attorney, home inspection, appraisal fees, and escrow fees.

Negotiate with potential buyers

Negotiations are common during the home-selling process. If you sell your home with a realtor, they’ll handle the negotiations with your guidance. Having a real estate agent at your side can help since you’ll most likely be dealing with the buyer’s agent.

When you receive an offer, you can accept, reject, or counter. Countering is usually the best option if the offer is close to what you want. A counter offer allows you to negotiate on the price or terms of the sales agreement, and all counter offers should be made in writing and give the buyer a deadline for a reply.

For instance, let’s say the buyer’s home inspection came back and discovered that your roof is in need of repair. The buyer may request that you either reduce the asking price or make the necessary repairs before they sign the purchase agreement. You can either agree to either of those options or reject it.

When selling your home, there are several things you can negotiate on, such as:

- Earnest money deposits: An earnest money deposit is a small deposit that goes into an escrow account to let the seller know a buyer is serious. Some sellers may require an escrow account, while buyers may offer it to give the seller more confidence in them. The earnest money deposit is negotiable, and a third party will set aside the money in escrow until closing.

- Contingencies: Many home sales are contingent on various factors, like the buyer’s ability to secure a mortgage loan. There’s also a home inspection contingency, so the home must pass inspection before the buyer decides to purchase the home. If you’re selling your home yourself, you may not be aware of all the contingencies, so it’s usually best to work with a realtor to help you understand what circumstances can make a buyer back out of the sale.

- Closing costs: As mentioned, buyers and sellers pay closing costs, but what they pay and how much is negotiable. Buyers can request that sellers pay a portion of their closing costs and vice versa.

- Closing date: Buyers may need more time to get approved for a mortgage loan, and sellers can ask for additional time to move out of their homes after closing. Ultimately, you and the buyer can come to an agreed closing date based on your needs.

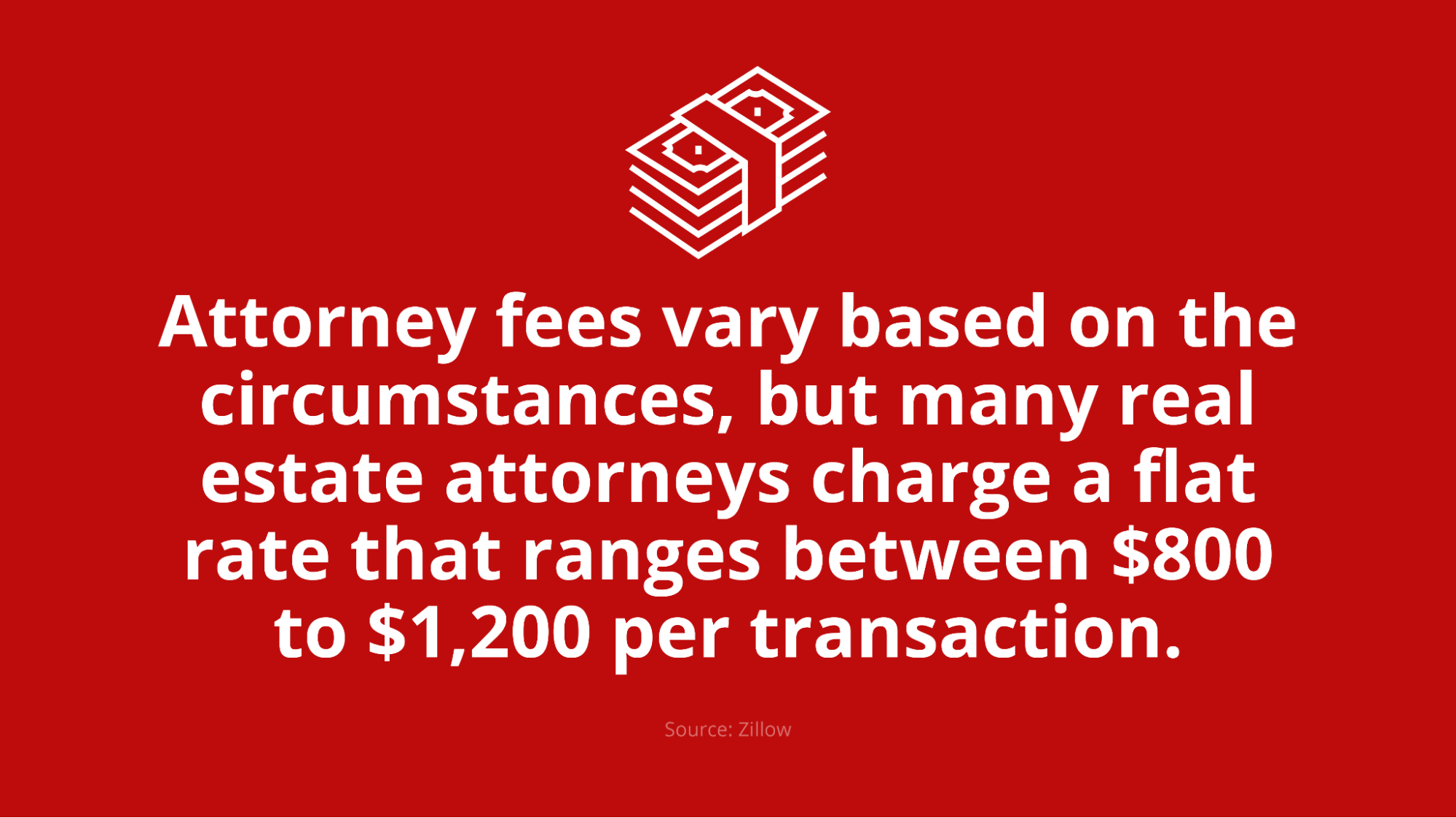

Look into real estate attorneys

Even if you work without a real estate agent, you should have a real estate attorney. Some states require an attorney for real estate transactions whether or not you have a realtor. An attorney can help protect you, write purchase agreements, review contracts, and ensure that both parties agree to the terms and conditions. Attorneys can also find title issues, such as liens, mortgage balances, and tax issues.

Complete closing steps

Selling a home requires lots of paperwork and documentation to ensure the process is legal and both parties uphold their end of the deal. Real estate agents can help to make sure you have all the necessary documents to complete closing. To close on the sale of your home after both parties have signed the purchase agreement, you’ll need the following:

- Completed home inspection: The inspection usually occurs within a few days after signing the purchase agreement and is designed to ensure the property is safe and has no major repair needs.

- Home appraisal: If the buyer is funding the purchase with a mortgage, the lender will require an appraisal of the property to ensure the borrower isn’t spending more than the home is worth. An independent company completes the appraisal, which is necessary for all mortgage loans.

- Final walkthrough: Once the home inspection and appraisal are complete, the buyer can do a final walkthrough of the home to ensure it’s clean and ready for closing.

Close on the sale

When you’re ready to close on the home sale, you’ll sign all the appropriate documents to transfer the property to the buyer. During closing, you’ll pay your existing mortgage amount and fees to the individuals who contributed to the sale, such as the realtor and attorneys.

In most cases, you’ll meet with the buyer and the various parties involved to sign the final documents. Most real estate transactions involve an escrowee, also known as a settlement agent. The settlement agent handles the final documents and money and coordinates the process to complete the transaction. If the buyer purchased the home with the loan, their lender or an attorney will handle the escrow account and ensure all the proper documents are signed and notarized.

Take Control of the Home Selling Process

Selling your home can be stressful, time-consuming, and expensive. However, working with a realtor can make the process easier, even though it means paying a commission fee. If your buyer is working with a mortgage lender, the sales process can take longer, and your purchase agreement will have a financing contingency that allows them to back out of the deal if they can’t get a mortgage loan.

Griffin Funding aims to complete the home loan process within 30 days or less to help buyers get the financing they need to purchase a home quickly. Our process also benefits sellers because you’ll know whether a buyer can secure financing faster, which means less waiting on approvals to determine if you can sell your home.

Interested in learning more?

Get StartedFrequently Asked Questions

What’s the first thing I should do when preparing to sell my house?

How can I increase the value of my home before selling?

Along with repairs, you may consider upgrades to your home. Luckily, many minor upgrades can significantly increase your ROI. For instance, painting, updating hardware, and replacing windows are affordable ways to increase your home’s value without spending too much time or money on upgrades.

How much equity should you have before you sell your house?

Recent Posts

Bonus Depreciation for Real Estate: What It Is & How It Works

Understanding the concept of bonus depreciation and its practical application can help you capitalize on this ...

No Doc Business Loans: What You Need to Know

While “no doc” is short for “no documentation,” there are actually no true no doc loans. Instead, they...

BRRRR Method: Buy, Rehab, Rent, Refinance, & Repeat

Read on to learn more about BRRRR loans and explore how this approach can open doors to lucrative opportunitie...