Bank Statement Loan Requirements & Qualifications

If you meet the following criteria, you may be eligible for a bank statement loan:

- You must have been a business owner or self-employed for at least two years (one year allowed with two years of experience in the same line of work)

- You must have at least 10% down (90% loan to value, w/ a 720+ credit score),

- You must have at least 15% down (85% loan to value w/ a 700+ credit score

- You must have at least 20% down (80% loan to value w/ a 660+ credit score)

- You must have at least 25% down (75% loan to value w/ a 620+ credit score)

- You must have three months of PITI reserves in the bank for loan amounts under $1 million and six months for loan amounts over $1 million. Twelve months of PITI reserves are required on loans over $1.5 million.

- You may qualify with as little as 12 months of bank statement deposits.

- You must have a credit score of 620 or above to qualify.

- The minimum loan amount is $100,000, and the maximum loan is $5,000,000.

Bank Statement Mortgage Loan Rates

The Bank Statement Loan Application Process

To apply for a bank statement loan, you can upload the last 12 or 24 months’ worth of bank statements from a business account or have our digital mortgage software sync with your bank and pull the information from your account. Bank statement loans are processed through a manual underwriting process. Since these loans are being reviewed by a person, they can take between 21 and 30 days to process. For more complex cases, it may take up to 45-60 days.

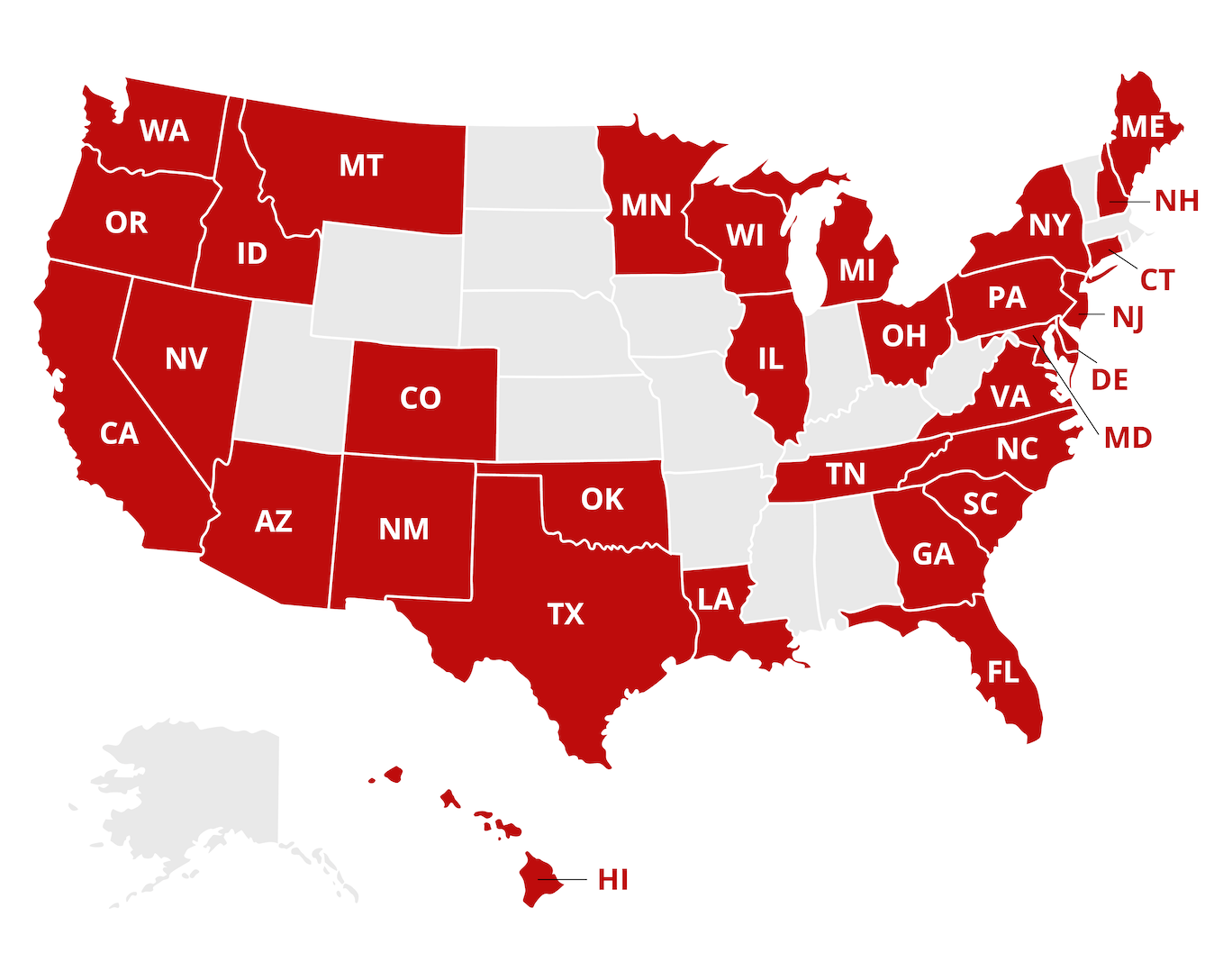

What States Are Bank Statement Loans Available in?

Self-employed workers have access to different bank statement loan programs depending on the state they’re in and the lender. Griffin Funding is proud to offer bank statement loans for borrowers in many states across the U.S.

View the map below to see if your state qualifies:

Bank Statement Loan Success Story

Ricardo is an excellent example of how a bank statement loan can help someone who is self-employed or who owns their own business. Ricardo, as a successful self-employed construction worker, had a healthy and regular income each month, but after writing off his expenses, he was unable to report sufficient income to qualify for a traditional loan.

Thanks to a bank statement lending program, Ricardo was able to apply for a bank statement loan without having to show his tax returns, which meant that his business write-offs were not a problem. Ricardo’s monthly income bank deposits over the past 12 months were enough to qualify him for a bank statement loan. His bank statements showed:

- January: $5,250

- February: $4,200

- March: $3,500

- April: $8,400

- May: $9,500

- June: $5,300

Ricardo had a six-month average income of around $6,000 per month. After reviewing a full year of Ricardo’s bank statements, the lender was able to approve a loan based on that amount. Although the down payment and interest rate were slightly higher than a traditional loan, Ricardo was happy to be able to purchase a home. What’s more, he could always return the following year and, if he could report an increase in income, he would have the option of refinancing with a conventional loan with a potentially lower interest rate.