DSCR Loan Calculator

KEY TAKEAWAYS

- Debt service coverage ratio (DSCR) measures a property’s cash flow versus its debt obligations.

- A DSCR of 1.0 indicates that a property is earning enough rental income to cover its debt, while a DSCR below 1.0 indicates that the property’s debts outweigh the rental income being generated.

- DSCR loans use a property’s DSCR rather than a borrower’s personal income to make a lending decision.

- Our free DSCR loan calculator can help you quickly estimate the DSCR of a given property and determine whether this type of mortgage is right for you.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformIf you want to better understand how to calculate your debt service coverage ratio, you’re in the right place. Use our DSCR calculator to estimate your DSCR based on a range of different variables.

KEY TAKEAWAYS

- Debt service coverage ratio (DSCR) measures a property’s cash flow versus its debt obligations.

- A DSCR of 1.0 indicates that a property is earning enough rental income to cover its debt, while a DSCR below 1.0 indicates that the property’s debts outweigh the rental income being generated.

- DSCR loans use a property’s DSCR rather than a borrower’s personal income to make a lending decision.

- Our free DSCR loan calculator can help you quickly estimate the DSCR of a given property and determine whether this type of mortgage is right for you.

Investing in rental properties is a great way to grow your wealth. With over 49.5 million rental housing units in the U.S., there’s tons of potential. Unfortunately, financing these investments can be challenging.

Real estate investors can choose many different types of home loans to finance their property purchases. A DSCR loan allows investors to avoid high rates, lengthy approval processes, and stringent lending criteria by qualifying based on cash flow instead of personal income.

This DSCR loan calculator can help you determine your debt service coverage ratio to ensure a high enough net operating income (NOI) to pay back the loan and ensure a return on investment. Keep reading to learn how to calculate DSCR or use our DSCR calculator below to help you determine whether you qualify for a loan.

How Do You Calculate Your DSCR?

Your DSCR is the rental income your property generates divided by the property’s debt service.

Here’s how to calculate your debt service coverage ratio using the DSCR calculator above:

-

1. Enter the Purchase Price

Enter the total cost of your property.

-

2. Enter the Interest Rate

DSCR loan rates vary depending on a borrower’s financial profile and change throughout the year based on market conditions. You can find today’s current DSCR loan rates by doing a quick search online or visiting this page.

-

3. Tell Us Your Loan Term in Years

DSCR loans have terms of anywhere from 5 to 25 years with the length determined by the lender based on several financial factors, such as property type and projected cash flow.

-

4. Enter Estimated Taxes

- Input the estimated annual property taxes for the investment property. You can find this information by contacting the local tax assessor’s office, checking the county’s property tax records online, or reviewing recent tax bills for the property. The calculator defaults to 1.25% of the purchase price but you can enter a different value if you’d like.

-

5. Enter HOA Fees

- If applicable, input the estimated annual homeowners association dues for the investment property. You’ll own the property, so you’ll be responsible for these fees, but you can pass the cost onto tenants by including it in their rent.

-

6. Enter Down Payment

- Specify the amount you plan to put down on the property. Most lenders require a down payment of 20% to 40% of the property’s purchase price.

-

7. Indicate the Total Loan Amount

Loan amounts vary, with loan amounts of up to $20 million available. The lender will determine your total loan amount based on your DSCR. However, you can enter how much you need to borrow into our debt service coverage ratio calculator to help you find your DSCR.

-

8. Review Loan Payment

The DSCR calculator will determine your loan payment based on the other information you’ve given us. This metric will tell us your monthly debt obligations.

-

9. Enter Insurance

Input the estimated annual investment property insurance, which is also known as landlord insurance or rental insurance.

-

10. Enter Gross Rental Income

- Specify the total monthly rental income you expect to receive from the property before expenses. If you aren’t sure of the rent, you can use our free rental income estimator.

-

11. Review Your DSCR

- Once you’ve entered all the necessary information, our DSCR calculator will give you a decimal. This final number is your debt service coverage ratio that lenders use to determine your eligibility for a loan.

DSCR Loan Calculator

Use our DSCR loan calculator to quickly estimate your debt service coverage ratio:

What Is a Debt Service Coverage Ratio (DSCR)?

Debt service coverage ratio (DSCR) is a metric used by lenders and investors to determine how well a rental property performs. For example, investors might calculate DSCR to determine if they’re making a profit, while lenders use it to determine a borrower’s ability to repay a loan.

A DSCR above 1.0 indicates that a borrower is earning enough from their rental property to cover their monthly debt obligations, while a DSCR below 1.0 indicates that the borrower’s debt obligations are greater than the income being earned.

Try out the above DSCR calculator for rental properties to get a snapshot of your investment property’s cash flow and see whether you’d be a good candidate for a DSCR loan.

What Is a DSCR Loan and Why Does It Matter?

A DSCR loan allows a real estate investor to qualify for financing based on a property’s cash flow rather than their personal income.

Real estate investors may have lower taxable income because they take deductions on their tax returns. With conventional commercial loans, this adjusted income might not be enough to qualify.

Instead, lenders can use the DSCR to determine eligibility based on cash flow, demonstrating if the property generates enough income for a borrower to repay the loan. The higher a DSCR, the more an investor earns, which is crucial for determining if they can turn a profit after paying their debts and provide them with a cushion for paying additional expenses.

In addition to DSCR purchase loans, Griffin Funding also offers DSCR home equity loans, which make it possible for investors to leverage the income generated by an investment property and tap into its equity. Investors can use funds from DSCR HELOANs and DSCR cash-out refinance loans for anything, including:

- Maintenance and repairs

- Renovations and upgrades

- Business expenses

- Down payments for additional investment properties

It’s important to note that DSCR loans are designed for real estate investors. Therefore, to purchase a primary residence, you’ll need to choose another type of funding, such as a conventional mortgage, non-QM loan, or a first-time home buyer grant.

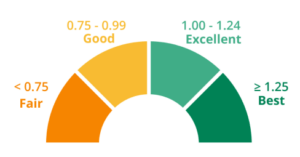

What’s a Good DSCR?

A DSCR of 1 demonstrates that you have enough cash flow to repay the loan. However, most lenders require borrowers to have a higher DSCR because it allows for extra cash for expenses that won’t compromise their ability to repay the loan. The higher your DSCR, the stronger your position and the more likely you’ll be eligible for a loan.

The minimum DSCR required for a loan varies by lender and condition of the economy. For example, lenders may accept lower ratios if more credit is available. That said, lenders usually require a DSCR of at least 1.25.

Borrowers may still qualify for a loan with a lower DSCR as long as they can prove their ability to repay the loan in other ways, such as using personal income documentation. Griffin Funding allows you to qualify for a loan with a negative DSCR in certain cases. However, a higher DSCR can get you better terms and reduce your interest rate.

DSCR Formula

Our calculator uses this DSCR formula to calculate your ratio: DSCR= monthly NOI / debt payments.

If you don’t know your NOI, you can use the formula: NOI = (1 – expenses) (1 – vacancy) x Gross Income

In the DSCR calculation, gross income (GI) is the monthly rent your tenants pay you. Your expenses include operating costs, such as:

- Paying employees

- Maintenance and repairs

- Cleaning

Meanwhile, vacancy is the rate of how often you don’t have tenants. You can calculate the vacancy rate of a property using the following formula: Vacancy Rate = (Number of Days Vacant) / (Number of Days Available for Rent).

How Does DSCR Impact Your Loan Approval?

Your DSCR is one of the most significant metrics lenders use to determine loan eligibility and amounts, so you must ensure your ratio meets those requirements. However, since these loans are based on the NOI of a property, qualifying is easier than some other types of commercial loans. The application process is also much more streamlined since the requirements for DSCR loans are more flexible than other types of financing.

The DSCR loan approval process works similarly to other real estate loans. For example, you’ll be required to pay closing costs, including origination, appraisal, and escrow fees, after loan approval. Additionally, if you’ve put down an earnest money deposit, we can provide a streamlined experience to help you get approval and funding quickly.

Can a Low DSCR Be Improved?

A few ways borrowers can improve a low DSCR before applying for a loan include:

- Reducing operating costs

- Increasing rental income

- Refinancing the existing mortgage

- Raising the property value

You still have options if you don’t qualify for a DSCR loan based on your ratio. Griffin Funding has more flexible requirements than other lenders, but if you fall below our requirements, you might qualify for another loan you can use for investing. We offer a wide range of investment property loans that are available to both new and experienced real estate investors.

How Does DSCR Differ from Other Financial Ratios?

DSCR is just one financial ratio lenders use to determine loan eligibility for investors. However, depending on the type of loan you get, there are a few other ratios to consider, including the following:

- Interest coverage ratio: The interest coverage ratio compares your profits to the interest payment on debts instead of the total amount of debt itself. This ratio is similar to DSCR and can be used to help lenders determine if a company or borrower can pay back its debt.

- Asset coverage ratio: This ratio compares your ability to cover debt services by selling off assets.

- Cash coverage ratio: The cash coverage ratio determines if you can repay your debt using cash on hand.

Explore Our Other Mortgage Calculators

In addition to our DSCR mortgage calculator, we offer a number of other free and easy-to-use mortgage calculators:

Get Pre-Approved for a DSCR Loan Today

DSCR loans can help investors of all types qualify for a loan based on cash flow instead of personal income so they can build their real estate portfolios. Griffin Funding can calculate your DSCR to determine your ability to repay the loan and the amount you qualify for. Then, once you’re ready to invest in real estate, you can apply for a DSCR loan.

Our mortgage experts can guide you through every step of the process — from application to closing — for a streamlined experience. Reach out to Griffin Funding today to explore your investment property financing options.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What is an example of calculating DSCR?

Let’s say you have an investment property that generates $75,000 in rental income per year, and your yearly debt service (including mortgage payments, taxes, and insurance) amounts to $55,000. To find your DSCR, you would perform the following calculation:

DSCR = $75,000/$55,000 = 1.36

In this scenario, your DSCR is 1.36, which means the property’s income exceeds its debt obligations by 36%. Most lenders would consider a 1.25 to be a good DSCR when evaluating applications for DSCR loans, so you’d have a good chance of getting approved.

How does a DSCR loan work?

A DSCR loan is a type of financing for investment properties that focuses on the property’s rental income potential rather than the borrower’s personal income or creditworthiness.

The DSCR is a key factor in determining loan approval and terms. Lenders use this number to assess whether the property’s income can cover its debt obligations and leave a little left over for the property owner to run their business.

A higher DSCR means there’s less risk involved for lenders, which allows them to offer better terms.

What is the minimum down payment for a DSCR loan?

If you are not prepared to make a 20% down payment, we encourage you to explore other investment property loan options. For example, you can qualify for a bank statement loan with as little as 10% down.

Do I have other financing options if my DSCR is too low?

If your debt service coverage ratio doesn’t meet lenders’ requirements, you still have several options for financing an investment property. You can visit this page to find information about Griffin Funding’s investment property loans, such as:

- Conventional loans: Comparing a DSCR loan vs. a conventional loan, traditional mortgages are best suited for borrowers with strong credit and stable income. They often offer competitive interest rates and terms for investment properties.

- Bank statement loans: Ideal for self-employed investors, these loans use 12-24 months of bank statements as proof of income. They provide flexibility for those with complex income structures or tax write-offs.

- Asset-based loans: These loans consider the value of your assets rather than focusing on your wages. They can be a good option for investors with significant assets but lower reportable income.

- Private money loans: Hard money loans provide quick funding with more flexible terms. They’re often used for short-term financing or when traditional loans aren’t accessible.

- Home equity loans: If you have enough equity in your house or an investment property, you can borrow against it to finance another investment property.

Recent Posts

Real Estate vs Stocks: Which Is the Better Investment?

Understanding the Basics Before you can make an informed decision about investing in stocks vs. real estate, i...

Down Payment Calculator

Planning to buy a home? One of the biggest questions you’ll face is figuring out how much cash you need ...

No Capital Gains Tax on Home Sales Legislation: What to Know

The current tax structure creates challenges for homeowners who have seen their property values soar over rece...