Do VA Loans Have PMI? What to Know About VA Loans & Mortgage Insurance

KEY TAKEAWAYS

- Private mortgage insurance protects lenders in case a borrower defaults on the loan.

- Unlike other loan types, VA loans don’t require borrowers to pay PMI.

- Although the VA funding fee is often compared to PMI, the former is a one-time payment while the latter is a monthly cost.

- Every VA loan borrower is required to pay the VA funding fee unless they qualify as exempt.

- The VA funding fee can be financed into the loan amount so you don’t have to come out of pocket.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformIf you’re considering a VA loan, you might be wondering whether private mortgage insurance (PMI) is required. VA loans work differently than conventional loans, and understanding how mortgage insurance fits in can help you make a more informed decision.

It can be tough to save up for a down payment, but VA loans offer an alternative since you may not have to put any money down at all if you meet the eligibility requirements. However, down payment is only one of the costs associated with buying a home. Another cost home buyers have to deal with is mortgage insurance or PMI—but the good news is that VA loans offer a benefit when it comes to that, too. By securing a VA loan pre-approval, you can also get a better sense of the total costs involved in your home purchase and avoid unnecessary surprises along the way.

Do VA loans have mortgage insurance? The great news is that there’s no need for VA loan PMI here. However, other fees at the closing table —such as the VA funding fee—could still come into play. Learn more about VA loan mortgage insurance requirements and how PMI differs from the VA funding fee.

KEY TAKEAWAYS

- Private mortgage insurance protects lenders in case a borrower defaults on the loan.

- Unlike other loan types, VA loans don’t require borrowers to pay PMI.

- Although the VA funding fee is often compared to PMI, the former is a one-time payment while the latter is a monthly cost.

- Every VA loan borrower is required to pay the VA funding fee unless they qualify as exempt.

- The VA funding fee can be financed into the loan amount so you don’t have to come out of pocket.

What Is Private Mortgage Insurance (PMI)?

If you are looking to buy a home but can’t put down more than 20% of the purchase price, you may be required to pay for private mortgage insurance (PMI) when you take out a home loan. PMI is an extra layer of protection that helps protect the lender if payments are not made on time. This coverage is arranged by your lender and provided by private insurers.

Essentially, you pay a private insurance company a monthly premium and that company agrees to reimburse your lender with a certain portion of the total loan amount in the event you default. In this way, PMI protects banks and lenders from losing too much money if a borrower can no longer make payments.

Borrowers can typically avoid PMI by providing a down payment of at least 20%. Homeowners who pay PMI can typically get it removed once they reach 20% equity in their home or improve their loan-to-value (LTV) ratio.

Do VA Loans Have PMI?

Many loan types require PMI for borrowers putting down less than 20%—but do VA loans have mortgage insurance? One of the most attractive benefits of VA loans is that they don’t require PMI, but you will pay a VA funding fee when you close, which ranges from 0.5% to 3.3% of the loan’s total value. The VA funding fee helps to support the VA benefits program for future borrowers. This coverage is arranged by your lender and provided by private insurers.

VA loans don’t mandate any type of mortgage insurance premiums, so you do not have to worry about any sort of monthly PMI payments on a VA loan. Instead, you’ll pay the VA funding fee as part of the home’s closing costs. The VA funding fee can be rolled on top of the loan amount so you don’t have to come out of pocket with the fee.

What Is the VA Funding Fee?

The VA funding fee is a cost that all borrowers of VA loans are required to pay. The funding fee represents a small percentage of the total loan amount and it’s paid at closing, alongside other costs like the VA appraisal fee and mortgage origination fee. The cost of this one-time fee goes towards supporting future veterans who want to purchase homes through loan programs offered by the Department of Veterans Affairs.

How much is the VA funding fee?

Buying a home with a VA loan comes with its own set of costs, including the VA funding fee. This fee can seem like an obstacle when it’s time to purchase your first house, but understanding how much you’ll pay and what options are available for paying it off can help make this part of the process smoother.

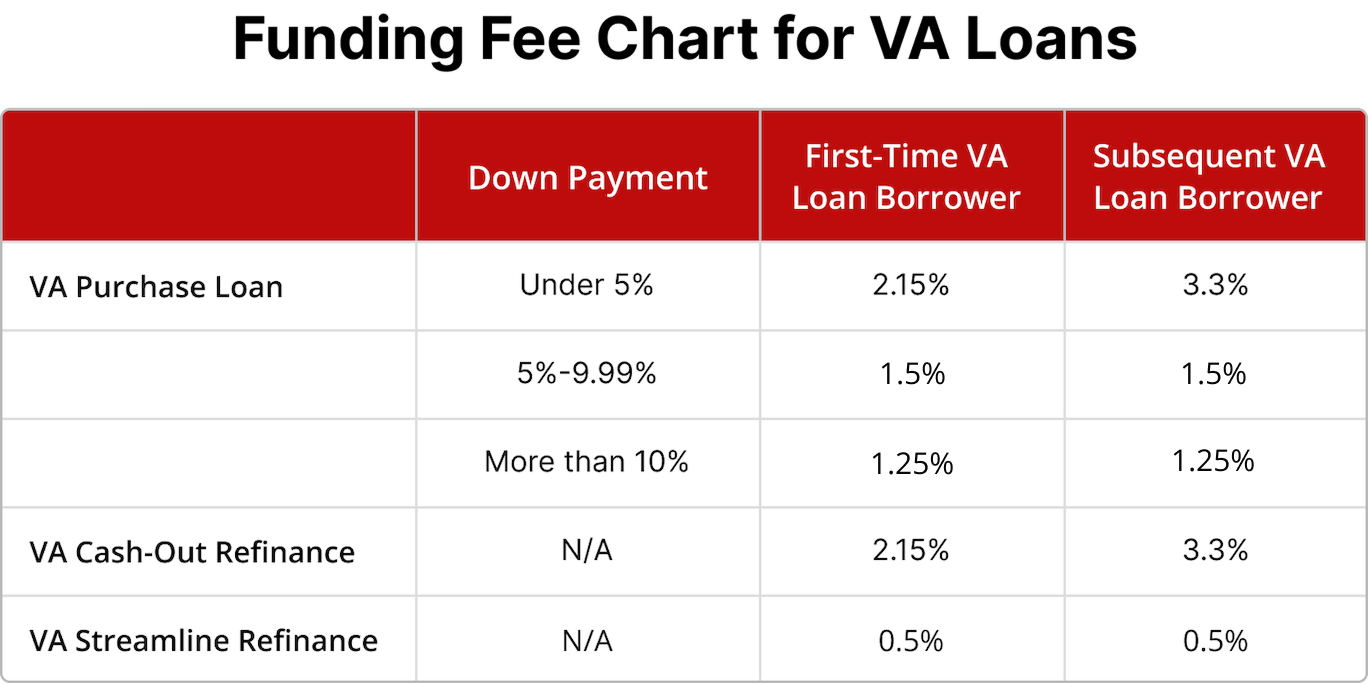

First-time buyers who put down less than 5% on their home will pay 2.15% of the loan amount. Borrowers putting down less than 5% on subsequent loans will have to pay 3.3% in funding fees.

If you’re able to place more money down, then you’ll be eligible for reduced percentage points. If you put down between 5%-10%, your VA funding fee is 1.5%. By putting down over 10%, the fee drops to 1.25%.

Homeowners that do a VA cash-out refinance will pay 2.15% if it is their first time using their VA benefits and 3.3% if it is subsequent use.

While this fee can be expensive, there are other options available. You may be able to file a request for financing through your mortgage or ask the seller if they’d consider covering these expenses instead. Using a VA loan calculator can also help you estimate your total costs and explore different scenarios before you commit.

Is the VA Funding Fee Required?

Yes, the VA funding fee is required for everyone as a part of the VA loan process unless you meet certain exemptions. While it can be a real obstacle paying these closing costs, this cost helps fund the VA benefits program and provides other veterans and service members with the opportunity to purchase a home using a VA loan.

The VA has made it easier for veterans to purchase a home and, without adequate money coming back in, there might be no program available at all. That’s why every time someone pays their VA funding fees at closing, they are not only taking care of themselves but also helping other borrowers by contributing towards making homeownership more accessible.

VA funding fee exemptions

In some cases, borrowers may qualify for exemptions that make it possible to avoid paying the VA funding fee. Be sure you look into whether or not you’re eligible for any VA funding fee exemptions, because recently changes were made that allow certain Purple Heart recipients an exemption as well. Here’s a quick breakdown on who qualifies:

- Individuals with service-related disability compensation/payments

- Veterans who are deemed eligible to receive disability compensation

- Active duty military personnel awarded a Purple Heart medal

- Surviving spouses who are currently receiving Dependency and Indemnity Compensation (DIC)

- Retirees receiving retirement pay or those still serving with an active-duty paycheck

To know if any exemptions apply in your case, check what’s written on your Certificate of Eligibility (COE), which classifies each borrower as either “exempt” or “non exempt”. You can also learn more about your exemption status by reaching out directly to the Department Of Veterans Affairs or consulting with your lender.

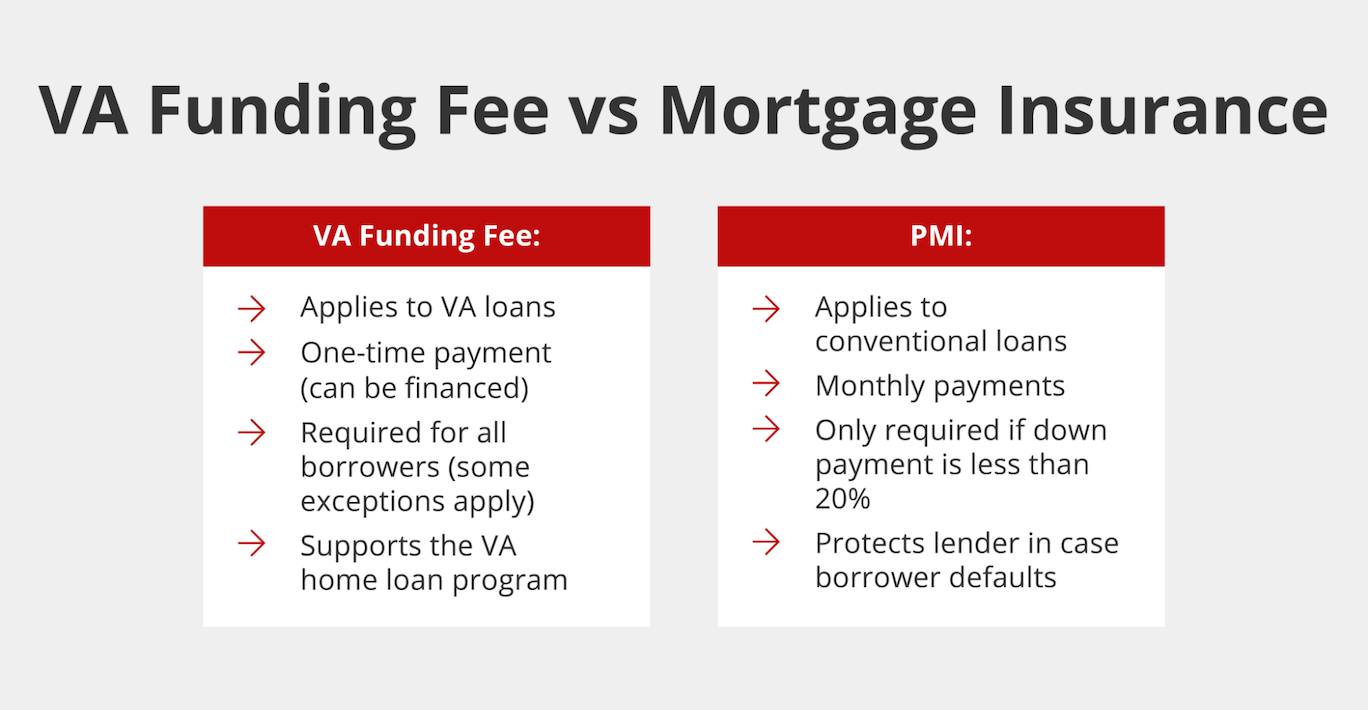

VA Loan: PMI vs Funding Fee

Many people compare the VA loan funding fee to PMI, but the two are not the same. When it comes to buying a house, conventional loans usually require monthly private mortgage insurance if your down payment is less than 20%. With an FHA loan, buyers will have both upfront and regular mortgage insurance payments for at least eleven years.

However, when you take out a VA loan, you don’t have to pay mortgage insurance. Instead of being a monthly premium, the VA funding fee is a one-time fee that you pay at closing. The money goes back to the VA to keep the program alive.

Thus, the key difference between mortgage insurance and the VA funding fee is that PMI is an ongoing payment meant to protect the lender, while the funding fee is a one-time payment that’s required to support the VA benefits program.

Enjoy No PMI With VA Loans

When it comes to purchasing a home, qualifying veterans have access to an incredible benefit in the VA loan. With no down payment required, this loan provides service members with the opportunity to purchase a house without having to save up for years and years. For those in the military who are constantly on-the-go and may not have had time or resources to save money or build credit, the VA loan can be a great option.

Plus, unlike conventional loans which require private mortgage insurance when borrowers don’t put at least 20% down upfront, veterans do not have to worry about this payment. This translates into major savings over the lifespan of the loan!

If you’re interested in applying for a VA loan, reach out to Griffin Funding today. At Griffin Funding, we are honored to help veterans and their families find the right loan package to meet their needs. We offer competitive VA loan rates and 100% financing on purchase and cash-out refinance loans. Additionally, you can use our Griffin Gold app to easily track and manage your loan application, making the process smoother and more efficient. We would be happy to work with you to finance your next home. Reach out today to speak to a member of our team, and let us help you find the right mortgage to meet your needs.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Can I eliminate PMI on my current mortgage by refinancing to a VA loan?

Yes, eligible borrowers can eliminate PMI by refinancing to a VA loan through a VA cash-out refinance. Since VA loans don’t require private mortgage insurance (PMI), refinancing from a conventional loan where you're paying PMI can help reduce your monthly payments.

This option is ideal for veterans who have built up equity in their homes. However, you must meet certain eligibility requirements and the property needs to serve as your primary residence.

What is included in VA loan closing costs?

In addition to no mortgage insurance requirement on VA loans, this mortgage program prevents borrowers from paying certain closing costs and lists non-allowable fees. However, borrowers will still need to pay some closing costs when taking out a VA loan. Here are some common VA loan fees and closing costs:

- VA Funding Fee: A one-time fee that helps fund the VA loan program.

- Appraisal Fee: Required to assess the value of the property.

- Discount Points: You can purchase discount points upfront to lower the rate on your VA loan.

- Loan Origination Fee: Covers the processing and underwriting of the mortgage.

- Credit Report Fee: Charged to pull your credit history.

- Title Insurance: Protects against legal issues related to a property’s title.

- Recording Fees: Paid to officially record the transaction with the local government.

- Inspection Fees: Costs needed to cover a VA pest inspection or home inspection.

- Property Taxes: You may need to pay some state and local property taxes upfront at closing

Do you pay homeowners insurance with a VA loan?

Yes, homeowners insurance is required with a VA loan. Unlike PMI, which is for conventional loans, homeowners insurance protects the property from damage due to unexpected events like fire or storms. Lenders require this insurance to safeguard both your investment and theirs. Homeowners insurance payments are typically made annually, but many lenders collect it through your monthly mortgage payment and place it in an escrow account.

Recent Posts

How to Get the Lowest Mortgage Rate: 7 Strategies

How Mortgage Rates Are Set Before we teach you how to get the lowest mortgage rate, it helps to understand wha...

What Is an Escalation Clause in Real Estate?

A real estate escalation clause is an addendum to a purchase offer that authorizes your bid to increase automa...

Mid-Term Rentals: Guide for Real Estate Investors

Mid-term rentals are furnished properties leased for 30 days to 12 months, targeting traveling professionals, ...