Self-Employed Mortgages

If you are self-employed, you may face unique challenges when it comes to getting a mortgage. Although mortgages for self-employed professionals do have a few extra hurdles that you need to overcome, there are plenty of self-employed mortgage loans available. Explore our self-employed mortgage offerings below.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformTable of Contents

Featured In:

![]()

![]()

KEY TAKEAWAYS

- Self-employed professionals may struggle to get a conventional mortgage because they don’t receive a W-2 and their tax returns often don’t reflect their true income.

- Mortgages for self-employed individuals — such as asset-based loans, bank statement loans, and DSCR loans — use alternative forms of income verification to make it easier for self-employed borrowers to qualify.

- Taking steps such as paying down debt, increasing your credit score, and saving for a larger down payment can help self-employed borrowers more easily qualify for a mortgage at a competitive rate.

Is It Hard to Get a Mortgage When You’re Self-Employed?

Even if you are self-employed, there are plenty of options available when it comes to getting a mortgage. Many traditional lenders may put you through additional steps, but self-employed home lenders offer a wide range of specialized loan programs.

Why can it be hard to get a mortgage when you’re self-employed? Some of the main challenges that self-employed borrowers face in qualifying for a mortgage are as follows:

- Tax returns: Banks will typically qualify borrowers for a traditional mortgage based on the income stated on their W-2. However, self-employed professionals may not receive a W-2. Additionally, the income on a self-employed person’s tax returns may not reflect their true earnings, as those who are self-employed tend to write off more business expenses and take more deductions than the average person.

- Income stability: Lenders want to see stable and sufficient income in order to qualify a borrower for a mortgage. However, self-employed professionals often don’t see the same consistent income as W-2 workers. Their income may vary from month to month due to business performance or seasonality, and some banks see this as a red flag.

- Experience: It can be particularly hard to qualify for a mortgage if you haven’t been self-employed for very long. In most cases, lenders will require a borrower to be self-employed for at least two years in order to qualify for a self-employed home loan. This is because the lender wants to see that the borrower has a sustainable and healthy business that generates enough income to repay the loan.

While these factors can make it harder to qualify for a mortgage as a self-employed professional, securing a home loan is far from impossible. In the next section, we list some of the mortgage options available to those who are self-employed.

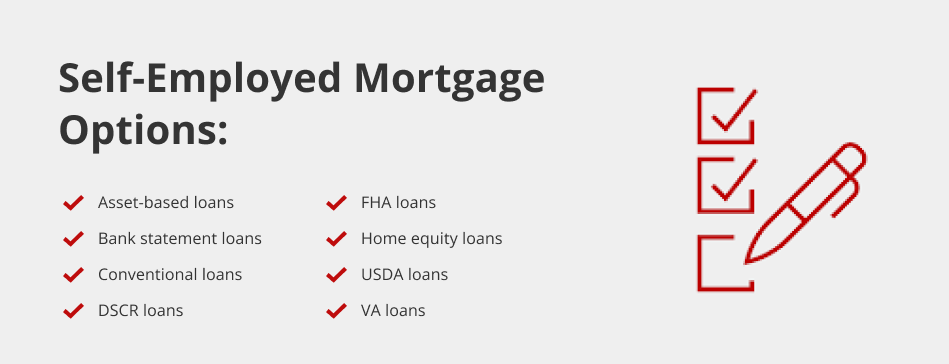

Self-Employed Mortgage Options

If you want to get a mortgage as a freelancer, a contractor, or a small business owner, there are several options that you may want to explore. They include:

If you want to get a mortgage as a freelancer, a contractor, or a small business owner, there are several options that you may want to explore. They include:

Asset-based loans

While most mortgages will ask you to verify your income via tax returns, an asset-based loan allows you to qualify for a mortgage using your liquid assets. Some of the liquid assets you can use to qualify for an asset-based loan include:

- Checking and savings accounts

- Retirement accounts

- Investment portfolios

- Money market accounts

- Certificates of Deposit (CDs)

If you’re not sure whether you have assets that can qualify you for a mortgage, reach out to our team. We can help you determine which assets you can use as income when applying for this type of self-employed home mortgage. Asset-based loans are also known as asset utilization loans or asset depletion loans.

Bank statement loans

A bank statement loan allows you to qualify for a home loan using only your bank statements instead of tax returns. You will typically be asked to provide between 12 and 24 months’ worth of bank statements to prove that you have the ability to repay the loan.

In addition to standard bank statement mortgages, we offer several other bank statement loan options, including:

- Bank statement cash-out refinance loans

- Bank statement home equity loans

- Profit and loss (P&L) loans

Bank statement loans can be a great option for retirees, business owners, freelancers, and any other individual looking for a self-employed home mortgage.

Conventional loans

A traditional conventional mortgage loan is a great option for W-2 employees and self-employed borrowers who claim enough adjusted gross income on their tax returns in order to qualify. The underwriter will need to do a full analysis of all pages of your tax returns. Conventional loans are considered a full documentation loan.

DSCR loans

A debt service coverage ratio (DSCR) loan is a great option if you would like to qualify for a home loan without using your tax returns. This type of mortgage is generally reserved for real estate investors, as you can qualify for financing based on your DSCR, which indicates how much cash flow a rental property has compared to its debt obligations.

If you already own an investment property, we also offer DSCR home equity loans (HELOANs), which allow you to tap into your existing property’s equity without touching your first mortgage.

FHA loans

A government-backed FHA mortgage loan is a loan program for employed and self-employed borrowers who can fully document their adjusted gross income on their tax returns. These borrowers may also be first-time home buyers or homeowners with low income or credit looking for a down payment as low as 3.5%.

In addition to offering FHA purchase loans for home buyers, we also provide FHA refinance loans for current homeowners. Explore FHA cash-out refinance loans and FHA Streamline Refinance loans to cash in on your equity or get a better rate.

Home equity loans/lines of credit

Home equity loans and lines of credit are available for both employed and self-employed borrowers and can be a great option for homeowners looking to access cash without having to refinance their existing first mortgage. We even offer a fixed-rate HELOC for those who want to tap into their home’s equity but don’t want a variable interest rate.

Self-employed borrowers can use a HELOAN or HELOC by fully documenting their income via their tax returns. If your tax returns don’t fully reflect your income, you could also consider a low or no doc home equity loan solution that doesn’t require tax returns, such as a:

USDA loans

USDA loans can be an attractive option for self-employed borrowers who are looking to purchase or refinance a property in a designated rural area. USDA loans offer down payments as low as 0%, but you must show enough adjusted gross income on your tax return to qualify.

If you’re an existing self-employed USDA borrower, you might consider a USDA Streamline Refinance to lock in a better rate or alter your loan terms.

VA loans

A government-backed VA mortgage loan is a loan program for both employed and self-employed borrowers who can fully document their adjusted gross income on their tax returns. These borrowers must qualify for VA loan benefits under the Department of Veteran Affairs. VA loans are full documentation loans and offer a down payment as low as 0%.

In addition to VA purchase loans, we offer VA streamline refinance loans and VA cash-out refinance loans.

Think you qualify for a loan? Contact us today to find out!

Contact UsApplying for a Self-Employed Mortgage: 5 Tips

Some of the most important tips to keep in mind when applying for a self-employed mortgage include:

1. Pay Down Your Existing Debt

When you apply for a mortgage, every potential lender is going to take a look at your existing debt. If you want to maximize your chances of being approved, you should try to pay down any existing debt that you have.

Some of the most common examples of debt include credit card debt, car loans, and even student loans. If you carry the debt with you into the application process, you may have a difficult time getting approved. Try to pay down as much of your existing debt as possible before you apply for a mortgage.

Use our DTI ratio calculator to get a better idea of what your debt burden looks like.

2. Increase Your Credit Score

Just like a traditional loan, your credit score is going to play a significant role in the application process. You need to make sure that your credit score is as high as possible before you apply for a self-employed loan.

Some of the ways you can increase your credit score include:

- Correct any mistakes on your credit report before you apply for a mortgage.

- Try to reduce your credit utilization ratio and increase the amount of credit available to you.

- Make sure you pay all of your bills on time.

If you can max out your credit score before you apply, you can dramatically increase your chances of being approved.

3. Offer to Make a Larger Down Payment

Remember that the lender will be assessing how much of a risk you are to them. If you show that you are willing to make a larger down payment, you can increase your chances of being approved because you will immediately reduce the risk you pose to the lender.

4. Prove You Have Cash Reserves

While your income is important, your assets are important as well. There are emergency expenses that may arise from time to time, and if you show that you have extra cash reserves, you can increase your chances of being approved.

That way, even if your income dries up as a self-employed professional, you will still have plenty of cash reserves you can fall back on to continue to make mortgage payments.

5. Have Your Documentation Ready

Getting your documentation in order before applying can help the process go smoother. Some of the documentation that you may want to bring with you to the application process include:

- Bank statements

- Personal and business tax returns

- Business license or CPA letter

- A list of assets

- Profit-and-loss statements

- A list of any additional sources of income (Social Security payments, alimony, etc.)

Need Financial Assistance? See if you qualify for a loan today!

Contact UsApply for a Self-Employed Mortgage Loan Today

At Griffin Funding, we have a significant amount of experience funding mortgage loans for self-employed professionals. We are experts when it comes to self-employed home loans and non-qualified mortgage options, providing you with a streamlined application process and best-in-class service.

We also offer tools to help you improve your financial wellbeing, prepare for homeownership, and analyze your financing options. Download the free Griffin Gold app today to access a personalized financial dashboard, smart budgeting tools, credit management features, and more.

If you would like to learn more about how we can help you obtain mortgage financing as a self-employed individual, reach out to schedule a consultation or get started online today.

Frequently Asked Questions

Being self-employed won’t prevent you from getting the financing you need to buy your dream home. At Griffin Funding, our mortgage loans for self-employed individuals provide generous amounts of financing so that you can purchase luxury real estate, an investment property, or a home in an expensive area. For instance, our bank statement and DSCR loans offer loan amounts as high as $20 million!

Yes, you can get a mortgage even if you’ve been self-employed for less than two years. While most lenders do want to see two years of self-employment experience, we can be flexible in certain circumstances. For example, if you’ve been self-employed for one year but have been in the same industry for at least two years, we can often make an exception.

It’s not uncommon for mortgage loans for self-employed professionals to come with higher interest rates when compared with conventional mortgages. This is because the lender tends to take on a higher amount of risk when they allow borrowers to provide alternative forms of income verification.

With that being said, the exact rate you qualify for will depend on factors like your income, credit score, DTI ratio, down payment amount, and more. If you’re a self-employed borrower with an excellent financial profile, then it’s very much possible to qualify for a low rate when securing self-employed mortgage financing.

Income calculation for self-employed mortgage applications depends on the loan type:

Traditional Loans:

- Uses adjusted gross income from tax returns (average of two years)

- Business deductions reduce qualifying income

Bank Statement Loans:

- Based on bank deposits over 12-24 months

- 100% of deposits into a personal account qualify as income; 50% of deposits into a business account qualify as income

Asset-Based Loans:

- Liquid assets divided by loan term to determine monthly qualifying income

- Up to 70% of retirement and investment accounts qualify as income; 100% of the value of bank accounts qualifies as income

DSCR Loans:

- Based on rental property cash flow, not personal income

- Property’s net operating income divided by debt service payments

Documentation requirements vary by loan type, but those seeking out mortgage financing for self-employed individuals may need to provide the following documentation:

Employment Verification:

- Business licenses or state certifications

- Client letters or contracts

- CPA letters verifying business existence

- Business insurance documentation

Income Documentation:

- Personal and business tax returns (typically 2 years)

- Bank statements (12-24 months)

- Profit and loss statements

- Asset statements for reserves

In general, traditional loans require complete tax documentation, while alternative programs like bank statement loans focus primarily on cash flow verification through banking records.

Self-employed home lenders typically evaluate net income on a case-by-case basis, as it more accurately reflects your actual cash flow after business expenses and tax obligations. However, exceptions exist depending on loan type and business structure.

Bank statement loans may consider gross deposits with applied expense ratios, while some portfolio lenders analyze gross income alongside detailed expense breakdowns.

Your business entity type (LLC, S-Corp, sole proprietorship) and consistent income history often matter more than the gross versus net income distinction.