VA Inspection vs Home Appraisal

KEY TAKEAWAYS

- The VA requires the VA appraisal for a property to be eligible for a VA loan.

- The VA does not require a VA home inspection, but it’s recommended to ensure the home is a good investment for the buyer.

- The most significant difference between the VA appraisal and home inspection is that the appraisal ensures the property meets the minimum property requirements set by the VA and determines the home’s value.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage Platform

The VA loan program was designed to help eligible veterans, active duty service members, and their families qualify for a home loan with less stringent criteria, making homeownership more affordable for the individuals that serve our country.

When you apply for a home loan, you may hear the terms VA appraisal and VA home inspection used interchangeably. However, they’re not the same. The VA requires an appraisal, which is different from an appraisal for any other type of loan, but they do not require a home inspection.

Learning the differences between the VA inspection and home appraisal can help you through the process of buying a home and understanding what’s required of you and the property to purchase a home using the VA loan benefit.

Keep reading to learn more about the VA inspection vs. home appraisal and get a better understanding of how they might affect your home-buying journey.

KEY TAKEAWAYS

- The VA requires the VA appraisal for a property to be eligible for a VA loan.

- The VA does not require a VA home inspection, but it’s recommended to ensure the home is a good investment for the buyer.

- The most significant difference between the VA appraisal and home inspection is that the appraisal ensures the property meets the minimum property requirements set by the VA and determines the home’s value.

Is a VA Inspection the Same as a VA Appraisal?

Many are confused about the difference between a VA appraisal and a home inspection. A VA appraisal is mandatory for all VA loans. The borrower is required to pay for it, and it has a direct effect on the loan. It is used to establish the fair market value of a home as well as make sure the property meets VA standards.

On the other hand, a home inspection is optional for a VA streamline refinance, also known as an interest rate reduction refinance loan (IRRRL), but mandatory for a cash-out refinance. It is a full analysis of a home intended to find any issues or flaws in construction that may be concerning to the potential homeowner.

It is always suggested to seek a qualified home inspector’s advice on a home before you make any final decisions to move forward with it. The VA appraisers that come out are not trained to look for asbestos and other foundational defects that can affect you and the home later down the line.

This is why the VA stresses that the final judgment on a home is with the buyer. They cannot guarantee whether or not it is a good investment. You should be sure to shop around and do your homework to make the most educated decision possible. Even though a home inspection is optional on some loans, it should be a part of your home-buying process to make sure you are making the right decision.

VA Minimum Property Requirements

The VA establishes minimum property requirements (MPRs) to make sure the property is safe, sanitary, and structurally sound before a borrower buys it. Ensuring the home meets the minimum property requirements is part of the VA appraisal process, so it’s mandatory for all homes.

A home that meets VA minimum property requirements has not passed a comprehensive home inspection; it just ensures that the home is safe for the borrower and their family. Some home buyers will start with the VA home inspection before the appraisal because it’s more thorough and can catch issues the appraisal can’t. If a property passes the home inspection, it’s more likely to pass the VA’s minimum property requirements inspected during the appraisal. However, it doesn’t matter which order you do them in.

Some buyers opt out of getting a home inspection and only do the VA appraisal to ensure the property is safe before purchasing a home. It’s important to remember that VA home loan inspection requirements for the appraisal are not the same as a home inspection. Nonetheless, they’ll determine whether the property is safe, sanitary, and structurally sound.

A few of the most important minimum VA loan inspection requirements include the following:

Space

VA inspection requirements aim to ensure that the property you wish to purchase is safe, which means it must have ample space for everyone who will live there. So during the VA appraisal, they’ll look for things like adequate living space, bedrooms, cooking areas, and bathrooms to ensure the home is large enough to meet your family’s needs.

Access & property encroachments

Any properties purchased with a VA loan must have street and private road access with permanent easement. Additionally, the property can’t encroach on another property.

Potential hazards

Hazards include flood hazards, asbestos, lead paint, and anything else that would cause a property to be unsafe. Any properties with safety hazards that can affect your health or the structural integrity of the property are not allowed under the VA home inspection requirements.

Water

According to the VA’s MPRs, the property must have access to safe water for drinking and bathing. It must also have hot water and bathroom facilities with safe sewage disposal.

Utilities

Every house purchased with a VA loan must have electricity, gas, and HVAC systems in good working condition. The VA requires that the heating system is operational unless the borrower lives in a more mild climate.

Structure

One of the main criteria of the MPRs is that the home is structurally sound. The appraiser will inspect the roof, crawl spaces, basement, and attic for things like termite damage, mold, or infestations that might affect the property’s structural integrity.

Property Type

In addition to ensuring the safety and structural integrity of the property, the VA appraisal ensures the home is zoned for residential use. You can use a VA loan to purchase a property partially used for business only when the property is primarily residential. The appraiser ensures the home is zoned for residential use because VA loans can only be used for primary residences; they can’t be used for commercial businesses or investment properties.

VA Home Inspection

When most people talk about a VA home inspection, they’re actually referring to the appraisal. This can be confusing because the VA appraisal is a combination of a home inspection and a regular appraisal; it determines the home’s fair market value while ensuring the property meets the VA’s MPRs.

Simply put, there’s no such thing as a VA home inspection because the VA does not require them. While the appraisal is required, a borrower can determine whether they want a home inspection.

However, a home inspection for a VA loan is a good idea in any case because the appraisal isn’t a comprehensive inspection. While it ensures the safety of the property, appraisers aren’t trained to look for the same issues as a home inspector.

What is a VA home inspection?

As we’ve mentioned, there’s no such thing as a VA home inspection — it’s just a home inspection you’d get when purchasing any property with any other type of loan. When most people refer to a VA home inspection, they’re thinking of the appraisal, which has a VA inspection component. However, a comprehensive home inspection isn’t required by the VA. Instead, they recommend it so that buyers can be more informed about the property they’re purchasing and check for items an appraiser can’t.

Your lender, on the other hand, may require a home inspection before approving your application, but most don’t. So instead, buyers should get a home inspection because it’s more comprehensive than the VA appraisal.

When you get a home inspection, you’re not working with anyone from the VA. Instead, you can hire your own home inspector who will look at the electrical, plumbing, and HVAC system to ensure no major issues require repair. Additionally, they’ll inspect the foundation, attic, fireplaces, roof, and appliances to ensure they’re safe.

Home inspectors also look for potential hazards like asbestos and pests that could cause health issues to homeowners.

Is a VA home inspection required?

No, a VA home inspection is never required by the VA. Instead, the VA requires an appraisal, which determines a fair market value for the home and ensures the property meets the minimum property requirements.

That said, it’s highly recommended to get a home inspection. Even if you pass your VA appraisal, having a home inspection will ensure there are no serious issues with the property. VA appraisers aren’t trained to look for different types of hazards like carbon monoxide leaks that could put you or your family in danger.

What does the VA look for in a home inspection?

The VA doesn’t order the home inspection, so you’ll be responsible for hiring a home inspector on your own. The VA appraisal process includes a home inspection component, but it’s not as thorough as a complete home inspection. Therefore, you should never rely on the VA inspection because it’s less comprehensive than hiring a private inspector.

When you order your own home inspection, you’ll be able to find as many potential problems as possible. You should be with the home inspector the day they inspect the property so you can ask any questions while they look for major tissues. Once they’ve inspected the home, they’ll give you a report that covers problems that need attention.

Your home inspector will look for the following:

- Foundation problems

- Evidence of leaks

- Drainage issues

- Crawl space accessibility

- Cracks

- Damaged roof

- Garage condition

- Chimney condition

- Basement condition and water damage

- Issues with the attic, including staining, decay, ventilation, insulation, etc.

- Plumbing issues

- Water pressure issues

- Hot and cold water

- Toilet stability, flushes and fills properly

- Kitchen plumbing

- Exhaust fans

- Garbage disposal

- Appliances in working order

- Floor, wall, ceiling damage

- Malfunctioning light switches

- Electrical outlets

- Heating and cooling issues

- Fireplace safety issues

- Operating smoke and carbon monoxide detectors

- Electrical systems in good condition

- HVAC system in working condition

What happens if my home doesn’t meet VA inspection requirements?

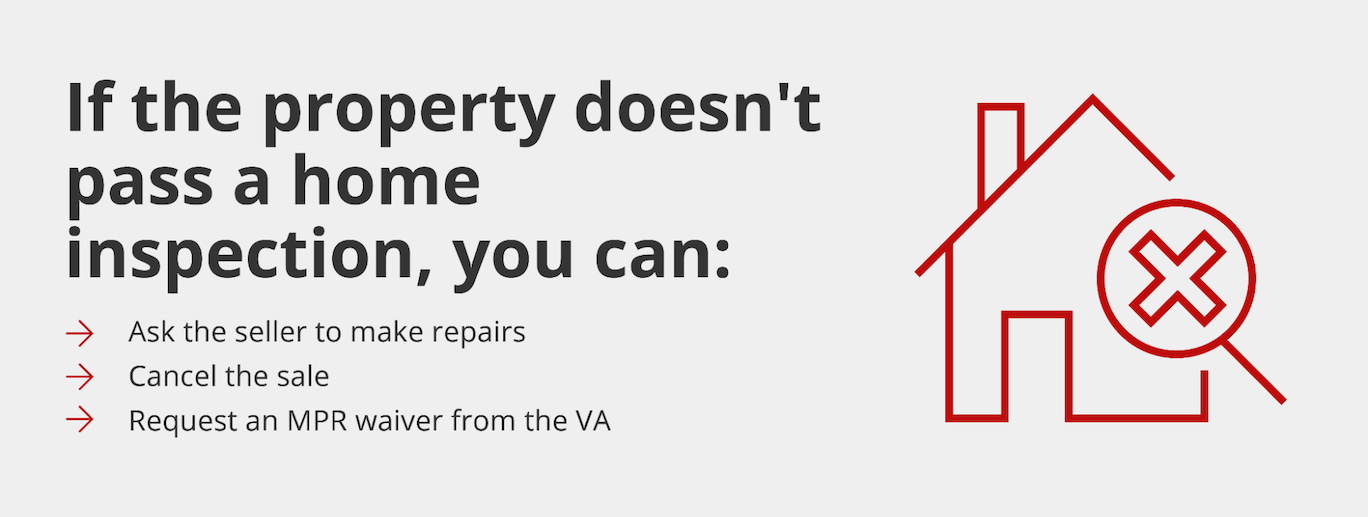

If your home inspection reports back issues, you can discuss them with the seller and ask that they make repairs or reduce their asking price. You’ll still qualify for your loan.

However, if the home doesn’t meet the VA’s home inspection component of the appraisal, the property won’t qualify for the VA loan. In this case, there are several things you can do, such as:

- Ask the seller to fix the issues: If the home doesn’t meet the MPRs, you can ask the seller to fix the issues before signing a purchase agreement. Since the property isn’t eligible for the VA loan without passing the VA inspection, the seller might be willing to make repairs.

- Cancel the sale: In some cases, sellers may not be willing to fix the issues reported in the VA inspection because they have other buyers that don’t have the same limitations as you do. For instance, other loans don’t require an inspection, so they can sell their home to another buyer without making repairs. If this is the case, the buyer can choose not to sell to you, or you can cancel the sale altogether since the home isn’t safe.

- Request an MPR waiver: There are some instances where you can receive a VA appraisal MPR waiver if the property doesn’t meet the requirements. These are usually given on a case-by-case basis, and you must write a letter justifying why the requirement should be waived. Your lender must also agree to the request, but the home must still be habitable, safe, and structurally sound.

VA home inspection checklist

The VA home inspection, the MPR inspection component of the appraisal, consists of looking for various safety issues with a property. The main items covered include:

- Structural integrity of the home: The home’s construction must be sound, including roof, ceilings, floors, foundation, and so forth.

- Plumbing: The home must have plumbing in working order.

- HVAC: The HVAC system must work to heat or cool the entire home.

- Pests: The inspection will ensure there are no pests like termites that could damage the home or be dangerous for your family.

- Electricity: The electrical system, including the wiring, must be safe and not at risk of causing fires.

- Space: The home must provide enough space for you and your family.

VA Pest Inspection

Pests such as termites and carpenter ants can jeopardize the safety of the home’s occupants and pose a threat to the structural integrity of a house. Therefore, the VA will often require a home to pass a pest inspection before approving a VA loan. By conducting a VA pest inspection, an inspector can identify evidence of termites and other wood destroying insects and recommend a treatment plan if necessary.

What is a VA pest inspection?

One of the requirements of the VA loan program is that when a borrower takes out a VA loan, they must occupy the home within a reasonable amount of time, which is typically considered to be within 60 days of your closing date. Thus, it’s important that the home you purchase using a VA loan is move-in ready.

A VA pest inspection helps ensure that the home you’re purchasing is move-in ready and pest-free. When conducting a VA pest inspection, an inspector will examine the exterior and interior of your home to look for signs of pests such as termites, bedbugs, carpenter ants, cockroaches, rodents, and more. Upon completion of the inspection, the inspector will provide you with a document that states whether certain pests are present in the home, detail any structural damage inflicted by pests, and recommends treatments or repairs that may help moving forward.

Is a VA pest inspection required?

In most states, VA loan borrowers are required to order a VA pest inspection. The states that currently require a VA pest inspection as part of the VA loan approval process include:

- Alabama

- Arkansas

- Arizona

- California

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Iowa

- Illinois

- Indiana

- Kansas

- Kentucky

- Louisiana

- Massachusetts

- Maryland

- Mississippi

- Missouri

- North Carolina

- Nebraska

- New Jersey

- New Mexico

- Nevada

- Ohio

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Utah

- Virginia

- West Virginia

- Washington, D.C.

In other states, a VA inspection may be discretionary depending on whether the VA appraiser finds an issue with the home or not required at all. However, ordering a VA pest inspection is typically a good idea regardless of the state you live in, as pest infestations and structural damage resulting from pests can lead to serious problems down the road.

VA Appraisal

We’ve already touched on the VA appraisal a little bit because it includes a VA inspection component. After applying for a VA loan, your lender will order the VA appraisal. While a home inspection isn’t required for VA loans, the appraisal is because it determines the market value for the home and the VA inspection component that ensures the property meets the VA’s minimum property requirements.

What is a VA appraisal?

A VA appraisal determines the home’s fair market value to ensure you’re not paying more than you should for a home. In addition, lenders require an appraisal because it tells them if you’re taking out a loan for what the home is actually worth.

As we’ve mentioned, the VA appraisal has an inspection component that’s slightly different and less comprehensive from your regular home inspection. Its main goal is to ensure the home is safe, sound, and sanitary. Unlike a regular home appraisal, a VA appraisal requires an appraiser to determine the home’s value and evaluate it for potential safety issues.

Again, the appraisal, even though it consists of an inspection, is not a full home inspection. Instead, the appraiser only looks at what they can see. On the other hand, a home inspector looks throughout the home to find issues.

Is a VA appraisal required?

Yes, a VA appraisal is required for VA loans because it ensures the property is safe for your family while also establishing its fair market value. However, just because a property passes the VA appraisal doesn’t mean it’s necessarily safe for your family. A VA appraiser is not trained to report on every potential issue with a home that affects your family’s health and happiness.

On the other hand, a home inspection will evaluate the entire home to uncover potential issues that might make your investment not worthwhile.

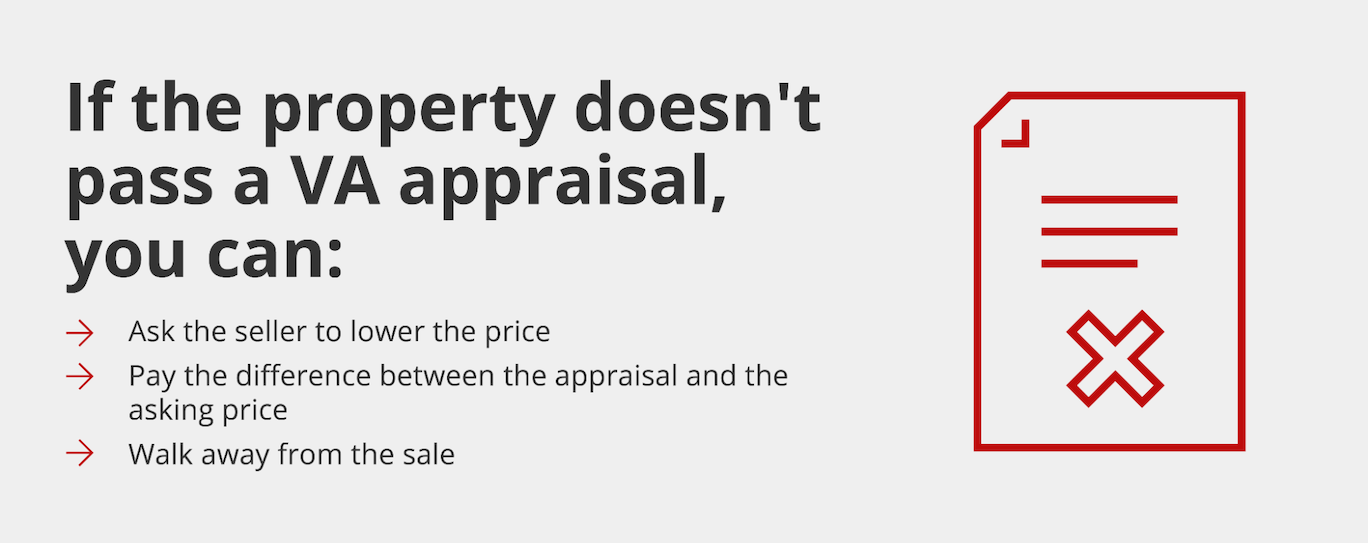

What happens if my home doesn’t pass an appraisal?

If your home’s appraised value comes in lower than expected, there are a few options. The VA loan amount can’t exceed the market value, so your lender will not let you take out a VA loan in this instance. However, you can ask the seller to lower the sale price to meet the appraised value. Some sellers will agree to lower the sale price, which prevents you from losing the sale.

This may require some negotiation. Some sellers won’t want to reduce their asking price too much, so you may have to meet in the middle and pay the difference.

If the seller doesn’t budge on the sale’s price, you can pay the difference out of your own pocket. This is called an appraisal gap and happens when the appraised value comes in lower than the asking price, and the buyer still wants to purchase a home. Down payments aren’t required for VA loans, so that might mean you have a little extra money to spend on a home. In this case, you pay the difference. However, this means paying more for the home than it’s worth at that point in time.

If, for any reason, the home doesn’t pass the VA appraisal, whether it’s because it didn’t meet the MPRs or the appraised value came in much lower than the asking price, it may be a good idea to walk away from the sale. Some sellers may be willing to work with you and make the repairs or lower their asking price, but some won’t.

You should never be afraid to cancel the sale if you can’t get financing or don’t want to pay the appraisal gap. Luckily, the purchase agreement should have a VA home inspection or financing contingency in it that allows you to walk away.

VA appraisal checklist

We’ve already discussed what a VA appraiser looks for during the VA home inspection part of the process, so let’s discuss what they look for to determine the property’s fair market value.

A few things an appraiser takes into consideration when determining how much a property is worth include:

- General condition: The appraiser will make a note of details about the home and the overall condition of the property. They’ll know everything from glaring issues like cracks in the walls to more minor issues like the home’s upkeep like leaky faucets or maintenance-related issues, damaged windows, ripped carpeting, and so forth.

- Location: Appraisers also consider the location of the home to determine its value. They’ll look at crime rates, proximity to schools, hospitals, and emergency services. They’ll also determine if the home is located on a busy road and how close it is to other homes.

- Age: There’s no disadvantage to purchasing an older home, so a newer home doesn’t technically have a higher value. Still, the appraiser will look at the home’s age to determine its value.

- Exterior: Appraisers make sure the home is structurally sound and look for signs of water damage, cracks, and issues with the foundation or roof.

- Design: If a home is outdated, an appraiser might calculate that into their appraisal since outdated homes typically sell for less.

- Size: One significant factor that determines a home’s market value is its size, number of bedrooms, and bathrooms. Larger homes will typically be worth more than smaller ones, although this isn’t always the case.

- Improvements and updates: If the seller recently made improvements or updates, the appraiser will likely value the home for more.

It’s important to note that an appraiser does not have the same training as a home inspector. Instead, they look at surface issues, noting signs of damage or deterioration. A home inspector, on the other hand, does a much more comprehensive inspection of the home to look for any possible issues that can affect its safety.

Who Pays for VA Inspections and Appraisals?

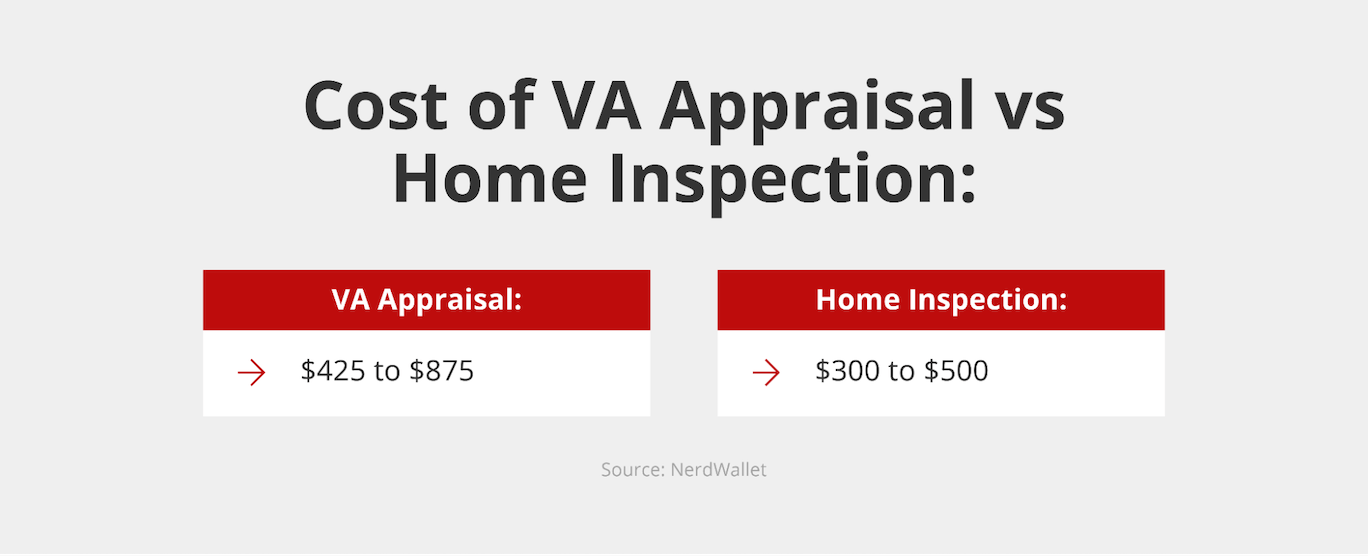

The buyer typically pays for the VA inspection and appraisal. The VA appraisal is required to obtain the VA loan and is often rolled into the VA loan closing costs.

Home inspections are not required, but they’re recommended, and costs vary by location. You can expect to pay at least a few hundred dollars for a home inspection, which you’ll pay before closing because it’s not required by the VA or your lender.

The VA requires the VA appraisal, so you’ll pay it as a closing cost. Like a VA home inspection, a VA appraisal can cost a few hundred dollars, although it tends to be slightly more expensive than the inspection.

You may be able to negotiate these costs with the seller and ask them to pay a portion of your closing costs. However, in most cases, the VA appraisal is an out-of-pocket expense for the buyer.

See If You Qualify for a VA Loan

VA home appraisals are a crucial component of the VA loan process. But it’s not the only requirement you need to meet to secure a VA loan. Find out if you qualify for a VA loan from Griffin Funding today. We’re a premier mortgage loan lender with competitive VA loan rates designed to make homeownership more affordable.

Get pre-approved today, or contact us to speak to one of our mortgage specialists and learn more about VA loans and their requirements.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...