Do VA Loans Require Earnest Money?

KEY TAKEAWAYS

- Earnest money is not required for a VA loan, but putting down a good faith deposit can help you look more attractive to buyers.

- Market conditions, your budget, and seller demands will determine whether or not you need earnest money with a VA loan.

- If you’re not careful, you could lose your earnest money deposit. It’s crucial to read your purchase agreement to ensure you’re protected if the deal falls through due to home inspection, appraisal, and financing issues.

VA loans help eligible veterans, active duty service members, and surviving spouses secure financing for a primary residence. However, if you’re actively shopping for a house, you might have heard the term “earnest money.” Maybe it came up with your real estate agent, or sellers have asked for an earnest money deposit from interested buyers.

Earnest money isn’t required to secure a loan. However, it can help you stay competitive in the market. For example, let’s say you and several other buyers are interested in a house. The seller might ask for an earnest money deposit to prove your interest in putting in an offer.

Sellers want to know you’re serious about buying their home because selling a home takes a lot of work and money. Sellers are responsible for paying real estate agent fees, marketing their property, investing tons of time in open houses, and meeting prospective buyers. Therefore, they want to know that a buyer is serious about purchasing the home before they take it off the market and to do this, they might ask for an earnest money deposit.

Earnest money for a VA loan isn’t necessary, but it might help you stand out from other buyers interested in purchasing a particular property. So, if you’re asking, “Do I need earnest money with a VA loan?” you’ve come to the right place. This article will discuss everything you need to know about earnest money and VA loans to ensure you understand what it is and how it affects your ability to purchase a home.

KEY TAKEAWAYS

- Earnest money is not required for a VA loan, but putting down a good faith deposit can help you look more attractive to buyers.

- Market conditions, your budget, and seller demands will determine whether or not you need earnest money with a VA loan.

- If you’re not careful, you could lose your earnest money deposit. It’s crucial to read your purchase agreement to ensure you’re protected if the deal falls through due to home inspection, appraisal, and financing issues.

What is Earnest Money?

Earnest money with a VA loan simply means that you’re putting down a good faith deposit with the seller. Earnest money has nothing to do with the lender. Therefore, it’s not required to secure a home loan of any kind. However, putting earnest money down on a home shows the seller you’re highly interested in purchasing the home. Once they accept your offer, you’ll both sign a purchase agreement, and the home will be removed from the market during closing.

If, for some reason, the deal falls through, you’ll lose that deposit. For example, let’s say you put down an earnest money deposit in exchange for the seller taking the house off the market. You then change your mind about purchasing the house. In this case, you’ll lose your earnest money deposit.

Earnest money deposits can be as high as 3% of the home’s purchase price, but the amount varies depending on market conditions and the seller. Once you give the seller the earnest money deposit, it’s put into an escrow account until you’ve closed on the home. Then, once you’ve applied and been accepted for a VA loan, the money can be applied to associated costs like the down payment or closing costs.

Do I Need Earnest Money With a VA Loan?

Do VA loans require earnest money? Absolutely not. No home loans require earnest money because these deposits are an agreement between the buyer and seller. However, earnest money with a VA loan can help you look more appealing to sellers in a competitive market. For example, if you’re in a bidding war, sellers look more favorably upon buyers who offer an earnest money deposit. In addition, sellers might require it in exchange for taking their home off the market for a set period of time while you apply for the VA loan.

While you don’t need earnest money with a VA loan, you may want to consider it if you’re shopping for a home in a seller’s market. In addition, you can’t use your VA loan for an earnest money deposit. Instead, you have to use your own money, and it can’t be a gift. If you’ve made an earnest money deposit with a VA loan, the VA will verify the source of the funds to ensure it’s not a gift or part of another loan. Since earnest money is typically applied to down payments and closing costs, the VA must ensure the money comes directly from the borrower.

An earnest money deposit with a VA loan minimizes the buyer’s risk. When you purchase a home, you often don’t think about all the things the buyer has to do to sell their home. However, there are many costs associated with selling a home, and the buyer likely spends a significant amount of time talking to prospective buyers and their real estate agents and dealing with frequent tours of the home, which can be inconvenient. Sellers want to take their homes off the market, but you have to give them a reason to trust that your offer won’t fall through.

If the deal does fall through, an earnest money deposit can help reduce some of the risks of being a seller. With this additional money, they can pay for advertising, additional realtor fees, and other home-selling costs. Ultimately, it gives them a reason to trust you while protecting themselves, which can help you build a better relationship with them.

Do You Get Earnest Money Back on a VA Loan?

Earnest money with a VA loan is typically applied to the down payment and closing costs, so in a sense, you get VA loan earnest money back. However, if the transaction falls through or you back out of it because you changed your mind, you could lose the earnest money to the seller. Of course, several contingencies can lead to your earnest money with a VA loan getting refunded, all of which should be listed in your purchase agreement. The contingencies include:

- Home inspection: The home inspection contingency covers anything revealed during the home inspection, such as broken appliances, cracks in the ceiling, plumbing issues, and anything else that would ultimately cost the buyer more than they’re willing to pay. Of course, when buying a home, buyers and sellers can negotiate. For example, if there are serious issues with the home, the buyer can request that the seller either fix them or reduce the asking price to compensate for them. However, if the buyer and seller can’t come to an agreement, the home inspection contingency protects the buyer and ensures a refund on their earnest money deposit.

- Appraisal: The home appraisal determines the true market value of the home based on similar homes in the area that have recently sold and the condition of the home. If the home’s true market value is much lower than the asking price, VA loan earnest money deposits protect the buyer and allow them to back out of the agreement without losing their deposit. A VA loan earnest money deposit works a little differently than earnest money with other types of loans because the VA does its own appraisal. Instead of just determining the home’s market value, the appraiser determines whether a home meets the VA’s minimum property requirements, including health and safety concerns like accessibility, water, heating, lead paint, and so forth. If you’re using earnest money with a VA loan, you can discuss it with the seller to change some of the language to reflect the VA’s unique requirements.

- Financing: Financing issues are common in the mortgage industry. For example, a borrower can get pre-approved for a certain amount only for the actual loan amount to come in much lower than expected. Because of this reason, VA loan earnest money deposits are protected if, for some reason, the buyer doesn’t secure financing.

So do you get earnest money back on a VA loan? Sometimes. Ultimately, it depends on why the agreement falls through. While the three contingencies we discussed above are common in the real estate industry, it’s crucial to read and understand the purchase agreement to ensure they’re listed. If these contingencies are not listed, you should return to the seller and ask them to make adjustments to ensure you’re just as protected as they are. There’s no reason for you to be penalized for a VA loan earnest money deposit if a lender determines that you’re not eligible for the loan, the home needs major repairs, or it’s worth much less than the asking price.

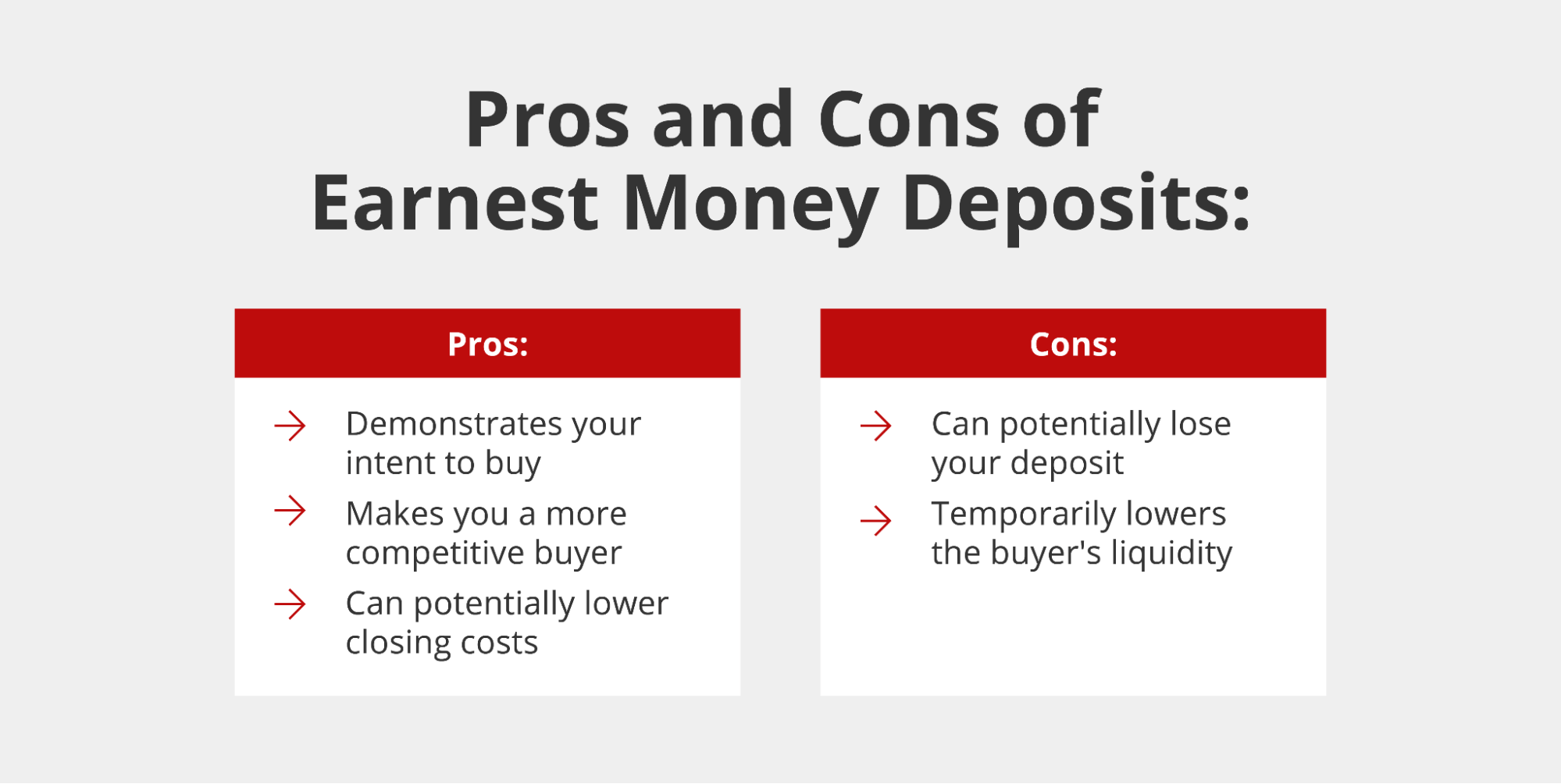

Advantages of Putting Down Earnest Money With a VA Loan

The most significant advantage of putting earnest money on a VA loan is to show sellers that you’re a serious buyer. In a competitive market, sellers might meet hundreds of buyers that seem interested in their homes, only for the deal to fall through once they’ve taken the home off the market. Sellers want to feel protected since they’ve invested significant time and money into selling their homes.

By offering an earnest money deposit with a VA loan, you can show sellers how serious you are and help your offer stand out from the competition. Additionally, some sellers might require an earnest money deposit, so you may not have a choice if you’ve found a home you love.

Risks of Putting Down Earnest Money With a VA Loan

There’s only one major risk of putting down earnest money with a VA loan: losing your deposit. If you back out of the agreement, you lose your money. However, if the buyer backs out, you’ll receive a refund.

Another time when you might forfeit your VA loan earnest money deposit is when you fail to meet the contract terms. For example, many purchase agreements have time limits in which you must obtain funding. You may forfeit your deposit if you fail to obtain financing before the deadline.

With that said, every purchase agreement should have contingencies to protect you in the event that the house needs major repairs or is appraised for much less than the asking price, or you fail to receive financing.

Should I Offer Earnest Money When Using a VA Loan?

Whether or not you decide to offer earnest money with a VA loan depends on several factors, especially the competitiveness of the housing market at the time you’re purchasing a home, the area you’re looking at, and the seller’s demands.

Remember, some sellers require an earnest money deposit from serious buyers to take their homes off the market and continue with closing. However, even if a seller doesn’t demand it, an earnest money deposit can help you stand out from the competition in a competitive market. If you’re purchasing a home in a seller’s market, it will help you build a better relationship with sellers, which could make them more likely to choose you as the buyer.

Additionally, the market conditions will determine how much you should offer as earnest money with a VA loan. Typically, most buyers offer 1 to 3% of the purchase price. However, competitive markets and competitive areas may demand much higher percentages.

Work With Griffin Funding and Get the Most Out of Your VA Loan

Understanding the VA loan process can be confusing because it’s not like any other home loan. The VA guarantees the loan and has strict requirements for VA loan eligibility — for both buyers and properties. Earnest money deposits with VA loans work a little differently because of the VA’s requirements. However, working with an experienced VA loan lender like Griffin Funding can simplify the process.

Is an earnest money deposit required with a VA loan? Absolutely not, but it can help you stand out from the competition. Apply for a VA loan with Griffin Funding today, or contact us to learn more about our loan offerings to find the best option for you.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

How Does a Recession Affect the Housing Market?

What Happens to the Housing Market During a Recession? A recession sends shockwaves through the economy. Compa...

Conventional Loan Limits in 2025

If you plan to purchase or refinance a home in the coming year, understanding the conventional loan limits in ...

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...