How Does a Recession Affect the Housing Market?

KEY TAKEAWAYS

- A recession usually slows the housing market due to lower buyer confidence and tighter lending rules.

- House prices during a recession can drop, but not evenly across all regions.

- Mortgage rates often fall, but stricter approval standards can still make buying tough.

- Smart investors can find opportunities in a recession, but due diligence is key.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformThe words “recession” and “housing” often spark a lot of worry — and for good reason. When the economy takes a hit, the housing market usually feels it too. But the effects aren’t always simple or predictable. Whether you’re thinking about buying, selling, or investing, it’s important to understand how a recession affects the housing market.

What Happens to the Housing Market During a Recession?

A recession sends shockwaves through the economy. Companies slow hiring, people lose jobs, and consumer confidence drops. When uncertainty rises, large financial decisions like buying a home get delayed — sometimes indefinitely.

If you’ve been dreaming about buying a home, you might hesitate when headlines scream about layoffs or shrinking GDP. Buyers tend to stay on the sidelines during a recession, and sellers often have to adjust their expectations. That slowdown can ripple across the entire housing sector.

Banks also respond by tightening their lending standards. They worry more about borrower risk, so getting a mortgage becomes harder, even for those with decent credit. First-time buyers feel the pressure most, but even seasoned homeowners might find financing more stressful.

History backs this up. The 2008 recession caused one of the largest real estate collapses in modern times. Foreclosures surged and the market took years to recover.

Compare that to the 2020 recession: government intervention and low housing supply kept prices surprisingly resilient. Understanding the connection between a recession and housing shows you why today’s market could look different from the last downturn and why keeping an eye on trends matters.

Impact on House Prices During a Recession

You might wonder: Do home prices drop during a recession? Often, they do — but it depends.

Typically, prices fall because there are fewer buyers competing for homes. Sellers get nervous and either lower their asking price or pull listings entirely. High-priced markets feel this first. Luxury homes, second properties, and homes in already slow-moving areas see the biggest discounts.

But high-demand areas, like major metro hubs, can sometimes hold steady. Think about places where jobs are more stable or where inventory remains very low. In those areas, even a recession might not push prices down much.

The supply of homes matters, too. If inventory remains tight and builders scale back new projects (as often happens during recessions), prices might not fall as sharply. Inflation and housing trends add another layer. When inflation sticks around, construction costs stay high, making it harder for home prices to drop too far, even during a recession.

Urban versus rural divides grow sharper too. Rural or economically distressed areas often suffer bigger declines, while strong urban markets might bounce back faster once recovery begins. These nuances help you better predict where opportunities, or risks, might show up.

Mortgage Rates in a Recession

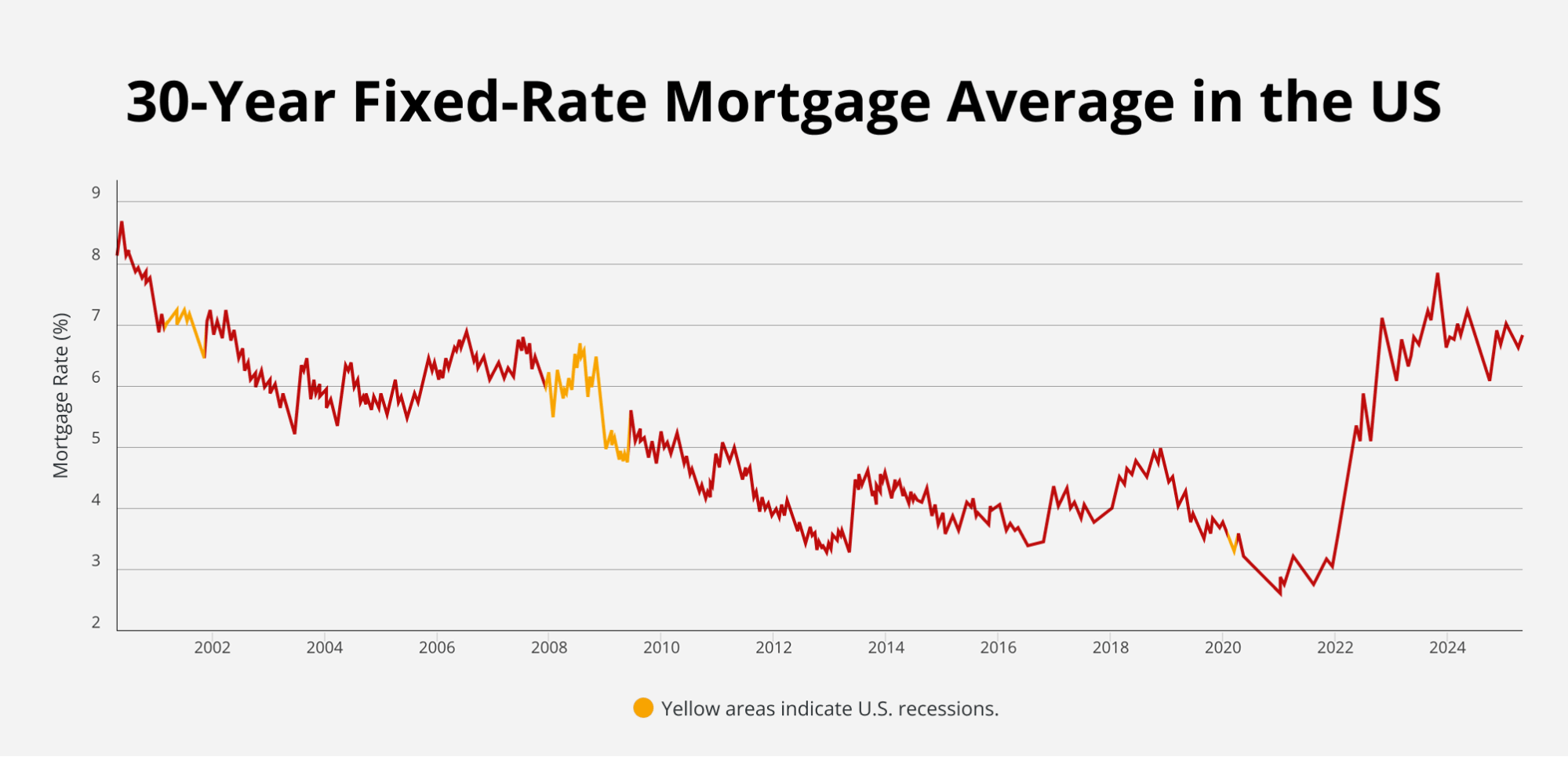

In an effort to stimulate a slowing economy, the Federal Reserve usually lowers interest rates during a recession. Lower borrowing costs help encourage spending, business investment, and home buying.

As a result, mortgage rates usually fall. This creates a tempting window if you’re thinking about buying a home. Lower rates mean smaller monthly payments, and over time you could save thousands of dollars.

However, it’s not always as simple as “rates are low, so buying is easy.” Banks tighten their mortgage requirements during recessions because they view lending as riskier. You might need a higher credit score, a bigger down payment, or more thorough documentation to qualify.

Plus, even if you lock in a great rate, recession and economic instability could make you question whether it’s smart to commit to a major purchase right now. If you’re worried about your job or future income, buying a house may not feel right — no matter how attractive the rate.

Buying a Home in a Recession: Pros & Cons

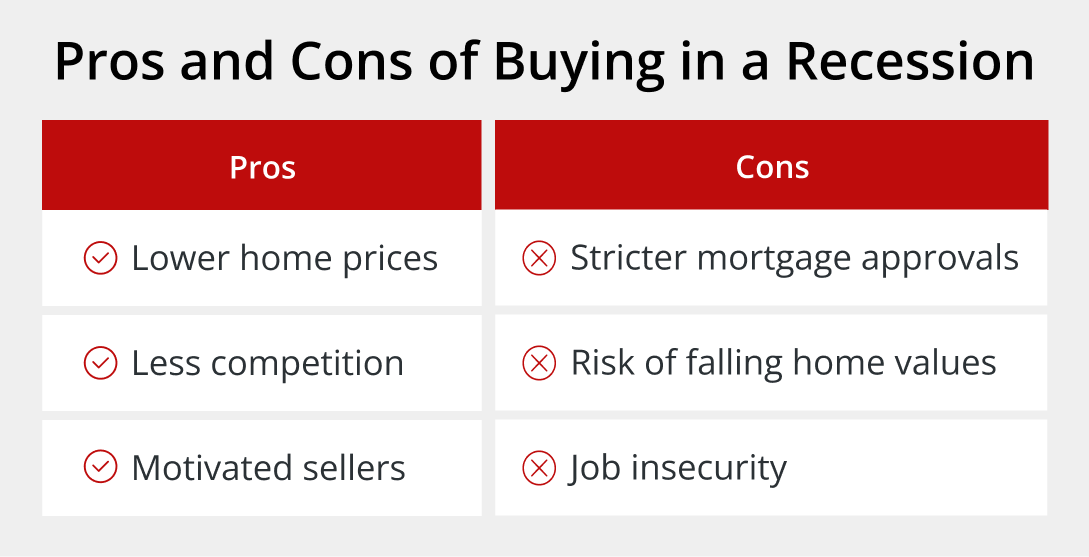

Buying during a recession has some real advantages, but it also carries risks you need to weigh carefully. Some of the pros of buying a home in a recession include:

- Lower home prices: You can often find deals that simply don’t exist in a booming market.

- Less competition: Fewer buyers mean more negotiating power. You might snag extras like closing cost credits or flexible move-in dates.

- Motivated sellers: Some homeowners urgently need to sell during a recession, giving you more leverage.

On the other hand, it’s important to understand some of the following cons:

- Stricter mortgage approvals: Getting financing could be a hurdle even if your financials look good on paper.

- Risk of falling home values: Even after buying, house prices during a recession could dip more. Short-term losses are possible.

- Job insecurity: If your employment situation feels shaky, taking on a mortgage might cause more stress than it’s worth.

Remember, buying during a recession isn’t automatically risky, but you need to be crystal clear about your finances and your long-term goals. If you feel ready, a recession could be the perfect moment to make a move others are too scared to take.

Selling a Home During a Recession: What to Expect

Selling your home during a recession usually feels more challenging. As there are fewer buyers in the market, you are likely facing a longer selling process and possibly some tough price negotiations.

Buyers become much more cautious during a recession. They scrutinize every flaw, question every asking price, and often expect deals. This means you may have to price your home competitively from the start. Overpricing could leave your property sitting stale, which often forces even bigger price cuts later.

Staging becomes even more critical during slow markets. You want to present your home in its best possible light, making it feel like a safe, welcoming investment. Professional photos, minor upgrades, and decluttering can go a long way in standing out.

Average days on market also increase during recessions. Expect your home to take longer to sell, and build that expectation into your moving plans. Knowing what the recession and housing trends typically bring can help you stay proactive and adjust your strategy instead of getting discouraged.

Investing in Real Estate During a Recession

Real estate investing during a recession might seem counterintuitive, but many smart investors actually thrive during these periods.

A recession often exposes distressed properties, motivated sellers, and undervalued markets. If you focus on properties that generate strong rental income (rather than banking on rapid appreciation), you can build a more resilient portfolio.

The housing market under Trump today adds another layer of uncertainty. Regulatory changes, tax shifts, and economic policies can impact both residential and commercial real estate markets (sometimes for better, sometimes for worse). Investors should watch policy developments carefully and stay flexible.

Due diligence is more critical than ever during a downturn. Look closely at local employment trends, rent stability, and long-term market fundamentals before jumping into any deal.

If you stay patient, avoid overleveraging yourself, and buy based on cash flow instead of speculation, a recession could offer you opportunities that simply don’t exist during an economic boom. History shows that many of today’s real estate moguls built their empires by buying when others were too fearful to act.

Understand the Relationship Between a Recession and the Housing Market

Understanding how a recession affects the housing market helps you make smarter decisions, whether you’re buying, selling, or investing. While a slowdown in the recession and economy can create challenges, it can also create opportunities if you stay informed and ready.

Regional differences, mortgage lending standards, and broader economic policies all shape how housing reacts to a downturn. The more you understand these moving parts, the better positioned you’ll be to adapt, rather than react.

At Griffin Funding, we’re here to help you navigate whatever the market throws your way. Our Griffin Gold app gives you easy access to financial management tools, smart calculators, and personalized mortgage support. Whether you’re planning your next move or simply exploring your options, you don’t have to do it alone.

In uncertain times, knowledge is power — and the right financial partner makes all the difference. Contact us today to explore your mortgage and refinancing options.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...

Can I Refinance With Griffin Funding?

Borrowers can refinance with Griffin Funding to lower their rate, change their loan term, or alter their loan ...

What Is PACE Financing?

Property Assessed Clean Energy (PACE) financing has become an increasingly popular option for homeowners looki...