The NAR Settlement and Its Impact on VA Loans: What to Know

KEY TAKEAWAYS

- The NAR settlement requires buyers to sign agreements with their agents upfront.

- VA loan rules about non-allowable fees create unique challenges when buyers need to pay their agent’s commission.

- Sellers may need to cover more costs in VA transactions, making negotiation skills more important than ever.

- Working with experienced VA-approved lenders and realtors is critical for a smooth transaction.

The National Association of Realtors (NAR) settlement officially took effect in August 2024 and changed many aspects of home buying and selling. For military families and veterans using VA loans, these changes bring unique challenges that may not affect other home buyers. Understanding how the NAR settlement and VA loans intersect is crucial for anyone planning to buy a home with military benefits.

Keep reading to learn about how the NAR settlement affects VA loans and the home buying process.

What Is the NAR Settlement?

The NAR settlement came from a series of lawsuits that challenged how real estate commissions worked for decades. The core complaint was that the traditional system artificially inflated commission costs and limited competition among buyer’s agents.

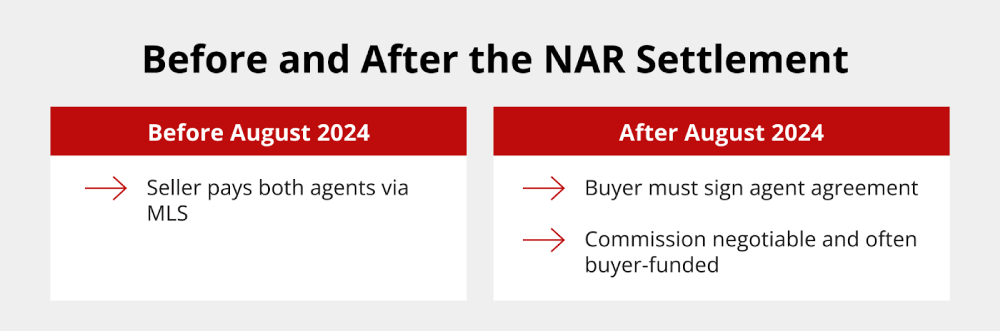

Before the settlement, listing agents would typically offer to split their commission with the buyer’s agents through the Multiple Listing Service (MLS). This meant sellers paid for both their own agent and the buyer’s agent. Keep in mind that sellers and buyers still could negotiate for whichever buyer’s agent commission structure they wanted; it just wasn’t a very transparent rule for either party, so many people simply didn’t know.

The landmark changes that took effect in 2024 include two major shifts. First, MLS listings can no longer advertise commission offers to buyer’s agents, giving buyers and sellers both more room to negotiate. Second, buyers must now sign written agreements with their agents before touring homes, clearly outlining how much they’ll pay their representative.

These changes were designed to increase transparency and give consumers more control over commission negotiations. However, they’ve created new complications, especially for buyers using specialized loan programs like VA loans that have strict rules about what fees borrowers can and cannot pay.

Understanding VA Loans and Their Requirements

VA loans are one of the best and most financially helpful benefits available to military service members, veterans, and eligible surviving spouses. These specialized loans are backed by the Department of Veterans Affairs and offer incredible advantages that make homeownership more accessible for those who have served our country.

VA loan rates are competitive, but the most significant benefit is the no-down-payment option. While conventional loans require at least 3% down and FHA loans need 3.5%, qualified VA borrowers can finance 100% of their home’s purchase price. This feature alone can save military families tens of thousands of dollars upfront.

Another notable benefit of the more flexible VA loan requirements is that these loans don’t require private mortgage insurance (PMI), which conventional borrowers must pay when they put down less than 20%. Instead, VA loans include a one-time funding fee that can be rolled into the total loan amount. For many borrowers, this results in lower monthly payments compared to conventional financing.

However, VA loans come with specific rules about what costs borrowers can pay. The VA maintains a list of non-allowable fees for VA loans that protect borrowers from excessive charges. Understanding these restrictions is especially important now that the NAR settlement has changed how VA loan realtor commissions work.

How the NAR Settlement Affects VA Loans

The changes from the NAR settlement created unique challenges for VA borrowers that other home buyers don’t face. While conventional loan borrowers now have more flexibility in how they handle buyer agent commissions, VA borrowers have a few other things to keep in mind.

Under the new system, if a seller chooses not to pay the buyer’s agent commission, the buyer typically needs to cover this cost directly. The VA has recently updated its rules to keep up with these changes. Before the NAR settlement, agent commissions were considered an unallowable fee, meaning borrowers couldn’t be charged for them.

After the settlement took effect, the VA recognized that their old rules might leave military families at a serious disadvantage in the new real estate market because sellers could now refuse to pay buyer agent commissions entirely (although these were always negotiable). Sellers could always choose to turn a VA buyer away to avoid paying additional commission fees, and there was nothing the borrower or their agent could do because they simply weren’t allowed to cover those fees themselves.

What makes this situation so challenging is that VA borrowers often compete with conventional and cash buyers who have more flexibility in how they handle commission arrangements. Sellers might prefer offers for buyers who can easily accommodate their preferred commission structure, potentially putting VA borrowers at a disadvantage.

Ultimately, if VA borrowers couldn’t pay agent commission fees while other buyers could, veterans might find themselves shut out of competitive housing markets or unable to work with the agents they wanted. Luckily, the VA updated guidance that gives borrowers more options for handling buyer agent compensation.

What VA Buyers and Sellers Should Know

Successfully handling the challenges from the NAR settlement when using a VA loan requires preparation. VA buyers need to understand their options before they begin house hunting. Here’s what you should know:

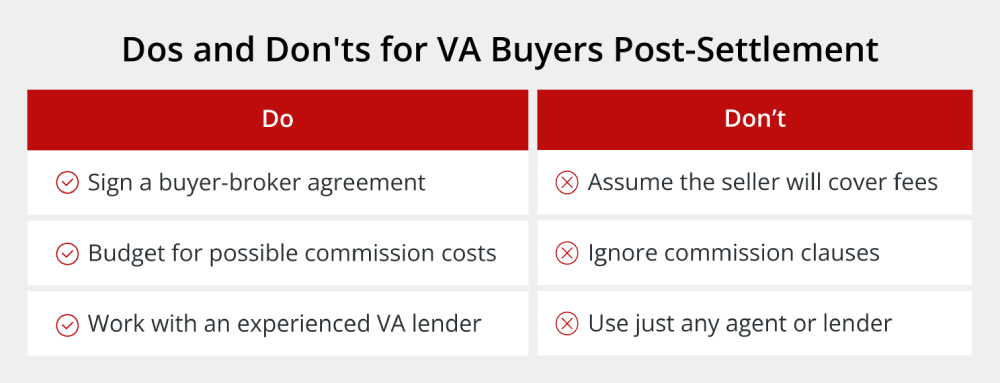

- Discuss commission arrangements upfront: Many experienced agents understand VA loans and can work with you to structure agreements that comply with both the new NAR rules and VA requirements.

- When signing a buyer-broker agreement, pay close attention to the commission terms: Some agreements allow for flexible payment arrangements, such as having the commission paid only if the seller agrees to cover it. Others might require you to pay regardless of the seller’s decision. Understanding these terms before you start looking at homes prevents surprises later.

- Budget for potential commission costs: Use a VA loan calculator to understand your total costs, including potential commission payments. This helps you plan appropriately and understand what you can afford to offer sellers as incentives to cover your agent’s commission.

- Work with experienced VA-approved lenders and realtors: Choose professionals who understand both the NAR settlement changes and VA loan requirements. They can help structure your transaction within the new commission framework and ensure you stay compliant with VA rules.

If you purchased your existing home with a VA loan and plan to sell it, keep in mind that the NAR settlement doesn’t necessarily impact you. Sellers have always been able to negotiate whether or not to pay buyer’s agents and how much, even if not paying them meant potentially limiting their buyer pool.

The NAR Settlement’s Impact on VA Lenders and Realtors

The NAR settlement impacts real estate professionals just as much as buyers and sellers. Loan officers working with VA clients need to understand how the new commission structure works with VA loan requirements to guide their clients.

For lenders, this means staying updated on both NAR settlement changes and any evolving VA guidance about commission payments (which will affect closing costs).

Both realtors and lenders need to work together to ensure transactions proceed smoothly while keeping borrowers compliant with VA requirements. This might involve creatively structuring VA loan closing costs or finding alternative ways to compensate buyer’s agents.

Real estate agents working with VA buyers need to adapt their business models to accommodate the new reality. This might mean adjusting commission structures, being more flexible about payment timing, or developing relationships with sellers who are willing to pay buyer agent commissions.

The most successful professionals in this new environment will be those who can effectively work with both sets of rules. They’ll need to understand VA loan restrictions while also complying with the new NAR requirements for buyer representation agreements.

Stay Informed About VA Loan Guidelines

The real estate industry is still adapting to the NAR settlement changes, and VA loan guidelines may continue evolving as well. As a VA loan borrower, you should stay informed about these developments to ensure you make the right decision when you’re ready to buy a home.

Griffin Funding understands the complexities that military families face when working with VA loan requirements and the changing real estate market. Our experienced team stays current with all developments affecting VA borrowers, ensuring you get accurate guidance through your home buying journey.

Whether you’re exploring your first VA loan or a seasoned military home buyer, having the right lender can help you make the best choices. The Griffin Gold app provides easy access to all your loan information and connects you with our team of VA loan specialists who can help you handle these complex changes.

Ready to begin your home buying journey? Get started online today.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

Down Payment Calculator

Planning to buy a home? One of the biggest questions you’ll face is figuring out how much cash you need ...

No Capital Gains Tax on Home Sales Legislation: What to Know

The current tax structure creates challenges for homeowners who have seen their property values soar over rece...

Bank Statement Loan Document Checklist

The main difference between bank statement loans and conventional mortgages is how your income is verified. Tr...