What Is APR on a Loan?

Taking out a loan costs money. When you take out a loan, you’ll see various terms on your paperwork that can help you estimate your total costs, such as interest, APY, and APR. Knowing what these terms mean can help you determine if a loan or credit card is right for you based on your unique financial situation.

Every loan is different, and knowing your loan’s specific details and terms is crucial in helping you plan your budget. In this article, we’ll be taking a closer look at APR, which is often used interchangeably with interest. However, these two financial terms actually differ in several ways.

When you sign up for a credit card or take out a loan, knowing the APR can impact how much your loan will cost you on a yearly basis. But what does APR mean? Let’s take a closer look at APR and what it means for your home loan.

KEY TAKEAWAYS

- APR stands for annual percentage rate and can help you calculate your loan’s cost.

- APR is a more accurate measurement than the interest rate alone because it includes the various fees associated with taking out a loan.

- Unfortunately, APRs vary by lender, so you’ll need to do your research to find one that offers the most competitive rates.

What Does APR Mean?

What does APR stand for? Annual percentage rate — it’s the yearly rate you’re charged for a loan. Or, if you have an investment, APR could mean the annual rate earned by the investment. Your home loan APR is ultimately the yearly cost of borrowing money for a mortgage and represents the amount you’ll pay your lender over the life of the loan based on this annual rate.

APR includes your based interest rate and fees associated with taking out a loan, such as administrative fees, underwriting fees, origination fees, discount points, mortgage insurance, and closing costs. The annual percentage rate of a loan product can help you compare various lenders and loan types. If a loan has a higher APR, it will cost more over the life of the loan.

Your APR is influenced by various factors like your credit history and score, so you can lower your APR on a loan by increasing your credit score before applying.

As we’ve mentioned, the annual percentage rate is a good tool to help you determine whether to choose a particular loan. However, it’s not always the most accurate indication of how much your loan will cost you overall. Since APR is calculated assuming certain repayment terms, your actual loan cost can differ.

For instance, let’s say you’re interested in a home loan, and you’re not sure whether you should choose a 15- or 30-year mortgage. In general, your payments on a 30-year mortgage are more affordable because you have more time to pay off the loan. However, because you have 30 years to pay off the loan instead of 15, you’ll pay more in interest over the entire life of the loan.

Additionally, APR is determined by the lender, so the types of fees included will vary.

APR vs Interest Rate

APR may seem the same as interest — they’re both percentages that can help you determine how much a loan will cost you. Both can be useful tools for helping you decide between various loan offers. However, APR is not the same as the interest rate on a loan. The APR includes the loan interest rate and other various fees, so it will always be a higher percentage than the interest rate.

The annual percentage rate includes interest, so you won’t have to worry about paying both. Instead, you’ll pay the APR, which covers your interest rate.

The interest rate is the annual cost of borrowing money from a lender. If you take out a fixed-rate mortgage, your interest rate will stay the same for the entire life of the loan unless you refinance to an adjustable-rate mortgage.

Interest rates are based on inflation, market conditions, down payment, credit score, and debt-to-income (DTI) ratio.

APR, on the other hand, is the annual cost of your loan, which includes both interest and fees like closing costs and administrative fees. Comparing the APRs of loan offerings from different lenders can help you find the best and most affordable mortgage loan.

APR vs APY

Another similar term you’ll read in contracts and hear when talking to financial professionals is APY. APY is the annual percentage yield of an investment like your savings account. An APY reflects your annual rate of return on the investment.

So while both measure interest, APR focuses on the amount you pay, while APY focuses on the amount you earn from various investments. Knowing your APY can help you measure the loan’s annual cost because it measures compound interest.

Compound interest is a measurement of accumulated interest over a period of time. Various types of loans, from student to personal loans, calculate interest using a compounding formula, which means the longer your loan terms, the more interest you’ll pay. Most home loans are simple interest mortgages, so APY might not be the most accurate measurement of how much you’ll pay over the life of your loan.

That said, APR is a simpler measurement because it doesn’t include compound payments; instead, it includes closing costs. APR is often included in marketing and promotional offers to highlight interest rates. For instance, you might get a mailer saying that a new credit card comes with a 0% APR for the first year.

What Is Included in APR?

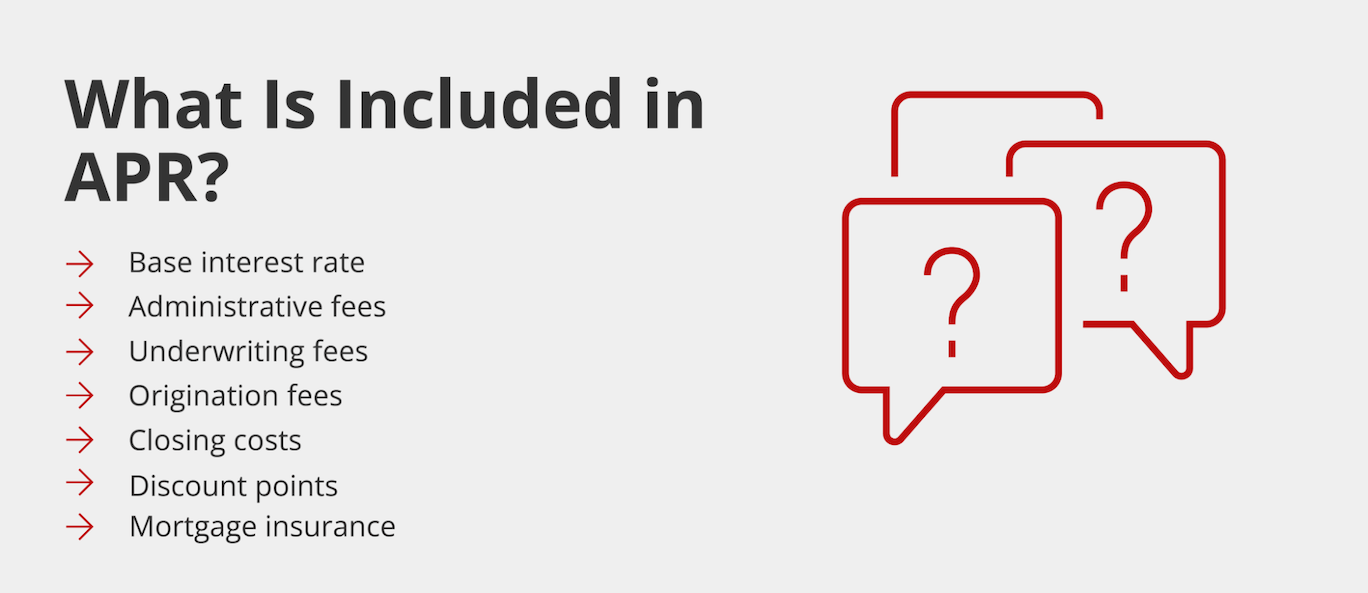

The annual percentage rate represents your annual cost of taking out a mortgage loan, credit card, or any other type of loan, and it’s a more accurate estimate of how much you’ll pay over the life of the loan than the interest rate itself. So what is APR on a loan? The fees included in your mortgage loan’s APR will vary by lender, but in general, they include the following:

- Base interest: Your base interest rate is the rate you can lock in after your mortgage application is approved; it’s the cost of borrowing money from a lender. Your monthly mortgage payments are calculated using the base interest rate, which will be included in your APR.

- Administrative fees: Lenders can charge various administrative fees associated with reviewing your loan application and preparing your loan.

- Underwriting fees: Underwriting is the process by which the lender verifies all the information you’ve provided on the application and determines a borrower’s level of risk. This process ensures lenders only accept borrowers who can demonstrate their ability to repay the loan. The fees of underwriting ultimately cover the costs to verify your credit score, review pay stubs, bank statements, and tax returns, and determine your overall eligibility for a particular loan.

- Origination fees: The origination fee includes fees associated with processing the loan, which may include all the various tasks associated with preparing documents.

- Closing costs: Your closing costs will vary depending on the loan amount, but they cover the lender’s cost of originating the loan. You can pay these costs in full at closing or as part of your monthly mortgage payment.

- Discount points: Discount points allow you to lower your interest rate by paying an upfront cost. While purchasing discount points will lead to a higher cost upfront, it will lower your rate over the life of the loan.

- Mortgage insurance: Borrowers often have to pay private mortgage insurance (PMI) when they put less than 20% down on a home. Those who take out an FHA loan have to pay a mortgage insurance premium (MIP) regardless of how much they put down. These monthly mortgage insurance payments can drive up APR on a mortgage.

What Impacts APR on a Loan?

When shopping for personal, student, or mortgage loans, you can use the APR to determine the best option based on your needs and overall budget. However, APRs aren’t static figures; they change based on various factors, such as your credit score, income, debt-to-income ratio, and payment history.

- Credit score: All loan products have a minimum credit score requirement to protect the lender from a bad investment. A higher credit score can get you a lower APR and base interest rate, reducing the overall cost of the loan.

- Income: Your income may be used to determine whether you can afford a loan without considering other factors like your debt. Credit card APRs typically don’t factor in your debts.

- Debt-to-income (DTI) ratio: For mortgage loans, your APR will be influenced by your DTI ratio, which tells lenders whether you can afford to repay the loan by comparing your debts to your income. Typically, lenders like to see a DTI of 41% or lower, which means only 41% of your gross income goes towards paying debt like credit cards and loans.

- Payment history: Your creditworthiness may also influence your annual percentage rate. Lenders prefer to see that borrowers have a history of paying their debts on time and in full every month.

- Down payment: For mortgages, making a higher down payment can result in a lower APR because it means borrowing less from a lender. The average down payment on a home is around 13%, but some loans require 20% down to avoid private mortgage insurance (PMI). Both MIP and PMI can have a big impact on APR.

Additionally, APRs are influenced by external factors the borrower has no control over, such as market conditions and the loan type.

Loan type: Personal loans and car loans typically have higher APRs than mortgages. However, this isn’t always true and largely depends on the loan product. However, in general, credit card APRs are much higher than mortgage APRs, which is why many homeowners choose to refinance their homes to pay off debts. Additionally, VA loans have lower APRs and interest rates than conventional loans because there’s a cap on how much a lender can charge you in fees.

Loan terms: Earlier, we discussed how 30-year mortgages typically have higher APRs than 15-year mortgages. This is because longer loan terms mean paying more in interest over the life of the loan.

Location: Mortgage interest rates and APYs are typically influenced by the location of the property. For instance, even municipalities have different property tax amounts that can result in higher or lower APYs for the same exact loan.

Fixed vs Variable APR

There are two types of APRs to take into account when shopping for a loan: fixed and variable. The difference between the two can impact the overall affordability of your loan, so deciding which one is best for you is of the utmost importance.

Variable APR

Variable APRs fluctuate based on market conditions and can start lower during the initial term. These APRs are typically associated with adjustable-rate mortgages (ARMs), home equity lines of credit (HELOCs), personal loans, credit cards, and student loans.

Adjustable-rate mortgages always have a variable APR and interest rate, but other types of loans and lines of credit can also have fixed APRs; it ultimately depends on the loan or credit card, financial institution, and various other factors.

Variable APRs are ideal when you want to pay less for the initial term of a loan because interest rates are typically lower than fixed-rate loans. However, if interest rates increase, your loan payments will increase. Many people purchase a home with an adjustable-rate mortgage and refinance it before the introductory period ends to get the best interest rates.

Fixed APR

A fixed APR remains the same throughout the life of the loan. The interest rate is set based on the market conditions of the time you locked in your rate and won’t fluctuate based on current market conditions. Many loan products offer fixed APRs, including federal student loans, mortgages, and personal loans.

With a fixed-rate mortgage, your interest rate and APR won’t change throughout the life of the loan, regardless of market conditions. A fixed APR means you’ll know exactly how much you pay every month. However, the one downside of a fixed APR is that if interest rates drop lower, you’ll have to refinance your mortgage loan for lower monthly payments.

A fixed APR prevents rising interest rates from impacting your budget since you’ll pay the same amount every month, which can make budgeting easier. However, these loans are typically less flexible, and you could end up paying more in interest over the life of the loan if market rates drop.

Whether a fixed or variable APR on a loan is better for you depends on various factors, like your risk tolerance, current interest rates, and the simplicity you want when repaying your loans. If you’d like to know exactly how much you’ll pay every month for the life of the loan, you’ll probably prefer a fixed APR. On the other hand, if you’re willing to take on more risk in the hopes interest rates will drop in the future, a variable APR might be right for you.

How to Calculate APR

You can calculate APR by multiplying the interest rate by the number of payments in a year. The formula looks like this:

![APR = [(Fees + interestPrincipaln) x 365] x 100](https://griffinfunding.com/wp-content/uploads/2023/06/Captura-de-pantalla-2023-06-28-a-las-15.24.04.png)

To calculate APR on a loan, you’ll need to know the following information:

- Interest rate: Your mortgage lender will allow you to lock in your interest rate once they’ve accepted your mortgage loan application. If you need to know your interest rate, you can usually find it on the contract and documents detailing information about your loan.

- Fees: Fees vary by lender and loan, so you may need to check your terms and conditions to fully understand what fees are included in your APR.

- Total loan amount: The total loan amount is your principal balance or how much the lender is willing to lend you.

- Days in loan term: APR measures the annual percentage rate. There are 365 days in a year, which you can multiply by the number of years of your loan.

With the formula above and your loan details in hand, you can calculate your APR in five simple steps:

- Determine interest rate by determining your monthly payment and add the relevant fees

- Divide fees and interest by the principal loan amount.

- Divide the new number by the number of days in the loan term.

- Multiply by 365 to get a decimal.

- Multiply the decimal by 100 to find your annual percentage rate.

Annual Percentage Rate Calculation Example

Now that you know the steps of how to calculate APR, let’s take a look at an example. Let’s say you take out a personal loan for $10,000 with an interest rate of 6% and a loan term of 5 years.

To calculate your simple interest, you’ll multiply the loan amount by the interest rate and loan term in years. In our example, this equation looks something like this:

$10,000 x .06 x 5 = $3,000.

Now, let’s say you have $150 in fees associated with the loan. The total interest paid and additional fees come out to be $3,150 ($3,000 + 150).

Next, you’ll divide that amount by the principal amount of $10,000, giving you 0.315 ($3,150/10,000).

Now, you’ll divide the decimal by the number of days in the loan term. In our example, our loan term is five years, which equals 1,825 days. 0.315/1,825 = .0001726.

Next, you’ll find the annual rate by multiplying the decimal by the number of days in a year: .0001726 x 365 = 0.063.

Then, to convert the annual rate into a percentage, you’ll multiply it by 100, giving you an APR of 6.3%.

What Is a Good APR on a Home Loan?

A good APR on a home loan varies based on the borrower, market conditions, and the fees the lender includes in the percentage. APRs tend to fluctuate daily for mortgages, so it’s always a good idea to lock in your interest rate as soon as possible. A good APR is anywhere from 3.5% to 6%, depending on the borrower’s financial information and market conditions.

However, it’s important to remember that APR is just one tool you can use to help you compare loans and lenders; it’s not the most important factor when choosing a home loan.

Tips for Securing a Lower APR

Your annual percentage rate on a home loan depends on various external factors you have no control over. However, there are some things you can control that can effectively reduce your interest rate and overall APR, such as:

Optimize your credit score

The higher your credit score, the better your interest rate. And the better your interest rate, the lower your APR. Since credit score can impact all aspects of your loan, including eligibility and loan amount, we recommend increasing your score as much as possible before applying for a mortgage loan.

Compare lenders

Lenders can determine what fees are included in their APRs. For this reason, it’s usually best to find a lender that offers the most competitive rates. APRs vary by lender and mortgage program, so even if you find a lender you like, you’ll need to compare their various mortgage programs to determine which APR makes the most sense for you.

Make a big down payment

A larger down payment can reduce your interest rate and APR. The more money you put down toward your loan, the lower your mortgage amount, so you’ll pay less over the life of the loan and on a monthly basis. Some loans have low down payment options, but you should still try to aim for a higher down payment if you can afford it.

Lower your DTI ratio

Your DTI is the percentage of gross income that goes toward paying your debts each month. A higher DTI indicates that you’re a higher-risk borrower to lenders, and you may not qualify for a home loan with a DIT higher than 41%. You can lower your DTI by increasing your income or paying off your debts faster.

Buy mortgage points

Mortgage points, also known as discount points, allow you to lower your interest rate. One point equals 1% of the total mortgage amount, which can drastically reduce your interest rate and monthly payments on a fixed-rate mortgage. Of course, before determining whether you should buy mortgage points, you must determine whether you can afford them since they’re purchased upfront.

Get a Competitive Mortgage Rate With Griffin Funding

A competitive mortgage interest rate means a lower APR, so you’ll pay less over the life of your loan. In addition, APR is a more accurate measurement of how much your loan will cost you annually than the interest rate alone because it includes various fees associated with originating your mortgage loan.

Wondering about Griffin Funding’s mortgage APRs? Apply online today to lock in your interest rate, or contact us to learn more about our loan programs.

Interested in learning more?

Get StartedRecent Posts

Bonus Depreciation for Real Estate: What It Is & How It Works

Understanding the concept of bonus depreciation and its practical application can help you capitalize on this ...

No Doc Business Loans: What You Need to Know

While “no doc” is short for “no documentation,” there are actually no true no doc loans. Instead, they...

BRRRR Method: Buy, Rehab, Rent, Refinance, & Repeat

Read on to learn more about BRRRR loans and explore how this approach can open doors to lucrative opportunitie...