Home Equity Loans in Utah

Your home is likely your most valuable asset, but the equity you’ve built up over years of mortgage payments is locked away and inaccessible. Griffin Funding’s home equity loans (HELOANs) and home equity lines of credit (HELOCs) in Utah offer a way for you to unlock your home’s value, turning your equity into cash you can use. Whether you’re planning a major home renovation, consolidating high-interest debt, or funding a child’s education, our flexible home equity solutions provide the financial leverage you need.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformTable of Contents

How Does a Home Equity Loan Work in Utah?

A home equity loan in Utah offers a way for homeowners to capitalize on their property’s value by allowing them to convert a portion of their home’s equity (the difference between your home’s current market value and its outstanding mortgage balance) into usable funds.

But how do home equity loans work? Utah home equity loans typically offer:

- Fixed interest rates

- Lump-sum payouts

- Predictable monthly payments

- Terms ranging from 5 to 40 years (when you partner with Griffin Funding)

When you take out a home equity loan in Utah, you’re getting a second mortgage. The loan is secured by your property, just like your first mortgage, which means you could risk foreclosure if you don’t make on-time payments. However, because your home secures your mortgage, lenders offer lower interest rates compared to other options like personal loans and credit cards.

HELOAN vs HELOC

When you want to tap into your home’s equity, you have two options: Home equity loans and home equity lines of credit. However, they work a bit differently.

As mentioned, HELOANs give you a lump sum upfront. Home equity loan rates in Utah are fixed, meaning you’ll have the same money payment throughout the life of your loan. These loans are best for one-time, large expenses.

On the other hand, HELOCs in Utah have a revolving balance like a credit card. HELOC rates in Utah are fixed or variable; if they are adjustable, how much you pay can fluctuate. HELOCs also have a flexible draw period followed by a repayment period. These lines of credit are ideal for ongoing expenses or projects with uncertain costs because they allow you to continue drawing funds for a set period of time.

Utah homeowners may choose HELOCs for their flexibility, especially when tackling long-term home improvement projects. However, if you don’t need to pull funds continuously and prefer the stability that comes with fixed payments, a HELOAN might be the better option.

Think you qualify for a loan? Contact us today to find out!

Contact UsPros and Cons of Utah Home Equity Loans

When considering a home equity loan in Utah, carefully weigh the advantages and potential drawbacks. These financial tools can offer significant benefits but also come with responsibilities and risks that every homeowner should understand. Let’s explore the pros and cons to help you decide whether this option is right for your financial situation.

Advantages of Utah home equity loans include:

- Lower interest rates: Home equity loans in Utah offer lower interest rates than other borrowing options like credit cards and personal loans. These lower rates can lead to huge savings over time, especially when consolidating high-interest debt.

- Access to large sums: Based on your home’s value, you can potentially borrow a significant amount of money. This can be crucial for major expenses like home renovations or funding education.

- Fixed rates and predictable payments: Utah home equity loan rates are fixed, making budgeting easier with consistent monthly payments throughout the loan term.

- Flexibility in fund usage: Generally, you can use a home equity loan for any purpose, providing financial flexibility to meet various needs.

Disadvantages of home equity loans are:

- Risk of foreclosure: Your home is collateral for the loan, so if you can’t make payments, you could potentially lose it through a process called foreclosure.

- Reduced home equity: When you take out a home equity loan, you decrease your overall home equity, which could impact your long-term financial plans or ability to sell your home in the future.

- Closing costs and fees: The process of obtaining a home equity loan can include substantial closing costs and fees, which might offset some of the potential savings, especially for smaller loan amounts.

Need Financial Assistance? See if you qualify for a loan today!

See if you QualifyWhat Can a Utah Home Equity Loan Be Used for?

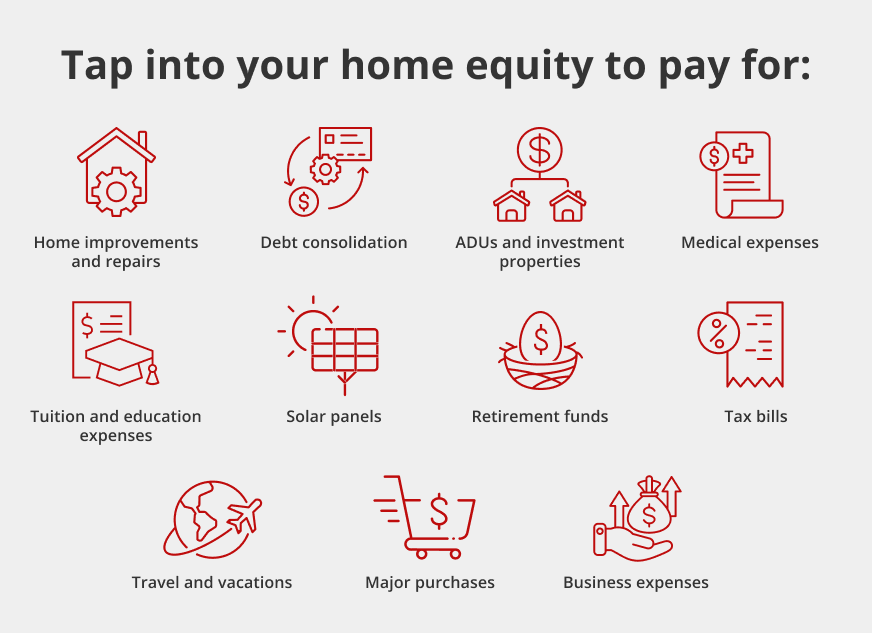

From funding home renovations to consolidating debt, home equity loans can be used for all kinds of purposes. Ultimately, you can use the funds from a Utah home equity loan for whatever purpose you may need. Access funds to finance real estate investments, cover big expenses, make necessary repairs, and much more.

Utah Home Equity Loan Qualification Requirements

Lending criteria for home equity loans in Utah may vary by lender. However, you can typically expect your lender to require the following:

- Sufficient equity: Most lenders require you to maintain 15-20% equity in your home after taking out the loan. This ensures you have a financial stake in the property and reduces the lender’s risk.

- Strong credit score: While requirements vary, a credit score of 660 or higher is ideal.

- Stable income: Even though you already have a home or home loan, lenders still need to make sure you can repay that loan with a reliable source of income. Griffin Funding also offers self-employed home equity loans for those with non-traditional income sources, allowing entrepreneurs and freelancers to tap into their equity through flexible income documentation requirements.

- Low debt-to-income ratio (DTI): Your total monthly debts, including the new loan payment, should typically not exceed 43% of your gross monthly income.

- Property value: Your home’s current market value will be assessed through an appraisal. This determines how much you can borrow and confirms the property’s value as collateral.

- Payment history: A track record of timely mortgage and other debt payments is crucial. This demonstrates your reliability as a borrower and can influence loan approval and terms.

Download the Griffin Gold app today to track your loan and stay connected with your loan officer throughout the process. The Griffin Gold app makes managing your home loans and finances easier and more convenient.

Apply now for a Utah FHA loan with Griffin Funding.

Apply NowApply for a Home Equity Loan in Utah

Ready to leverage your home’s equity? Griffin Funding is here to help Utah homeowners access the funds they need with competitive rates and personalized service. Our streamlined application process and expert loan officers make it easy to explore your options and find the right home equity solution for your needs.

Whether you’re interested in a fixed-rate home equity loan or a flexible HELOC, we can guide you through the process. Put your home’s equity to work for you with Utah home equity loans. Apply now to get started!