The Latest Home Price Appreciation Report: Why Real Estate is a Strong Investment in 2023

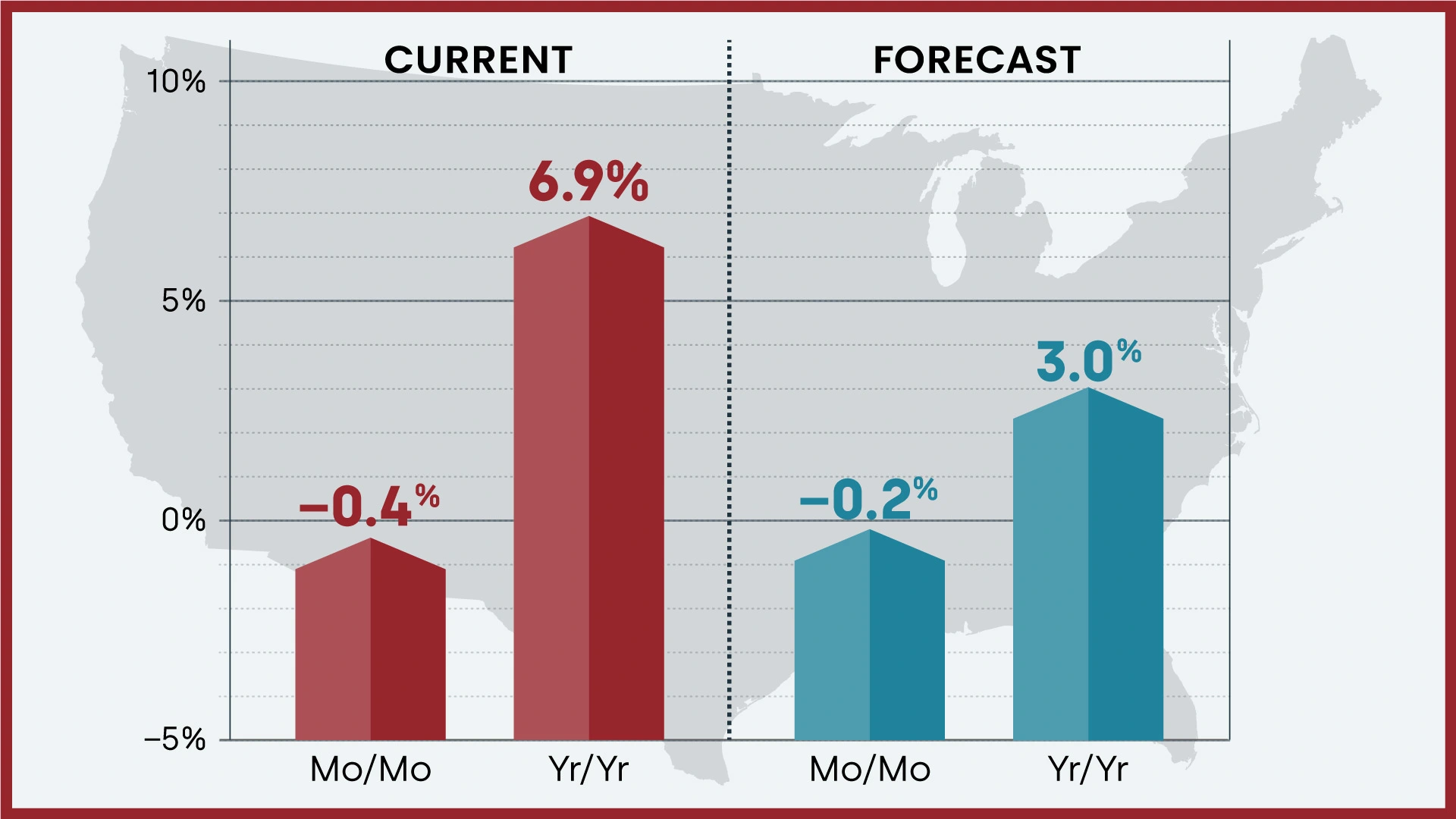

CoreLogic recently released its Home Price Appreciation Report, revealing that home prices in the US appreciated by 6.9% in 2022. This growth is expected to continue in 2023, with the company forecasting a 3% increase in home prices.

While the media and neigh sayers think we are headed for a housing bubble or crash… it seems quite the opposite. Consider that this is a national average, and some states and cities will see bigger swings vs. others. So, to understand what this really means, the appreciation for 2022 dipped from a peak of 20% down to 6.9%. For 2023 it’s forecasted that we will see an appreciation factor of 3%. While it’s less… it’s nowhere near a bubble or major decline.

Appreciation has slowed down, but it’s still a great time to invest in real estate investment properties. You own an appreciating asset that will increase exponentially over time, and you can deduct taxes, insurance, mortgage interest, expenses, and depreciation to offset your income from the tax liability!

It’s a no-brainer, especially if your rent covers your payment and your property cashflows.

Real estate has consistently proven to be a solid investment over time. One of the main reasons for this is the scarcity of land, aged housing stock, lack of inventory, and the growing population, which drives demand for housing. When demand for housing increases, so does the value of homes. Additionally, as inflation rises over time, the value of real estate often rises along with it, providing a hedge against inflation.

It is also worth noting that the forecasted 3% increase in home prices is a strong number, considering the current headwinds in the housing market, including but not limited to interest rates. Despite these challenges, the real estate market continues to perform well, making it a smart investment for those looking to secure their financial future.

In conclusion, the recent CoreLogic report highlights the ongoing strength of the real estate market and serves as a reminder that investing in real estate can provide a reliable source of long-term growth and stability. If you’re considering investing in real estate, now is a good time to do so. At Griffin Funding, we are committed to helping you find the right investment opportunities to meet your financial goals. Get a quote or apply now.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

How Does a Recession Affect the Housing Market?

What Happens to the Housing Market During a Recession? A recession sends shockwaves through the economy. Compa...

Conventional Loan Limits in 2025

If you plan to purchase or refinance a home in the coming year, understanding the conventional loan limits in ...

Current Mortgage Rates

What Affects Mortgage Rates? Mortgage rates fluctuate constantly based on a variety of economic variables and ...