Cash-Out Refinance vs HELOC

KEY TAKEAWAYS

- A cash-out refinance and home equity line of credit are two common ways for homeowners to leverage their existing equity and get cash.

- A cash-out refinance replaces your current mortgage with a larger one, allowing you to pocket the difference and receive a lump sum of cash.

- A home equity line of credit functions like a credit card, allowing homeowners to borrow up to a certain amount without having to touch their first mortgage.

- Cash-out refinance loans and HELOCs offer different strengths and weaknesses, so you’ll need to consider your goals and your own financial situation to determine whether a home equity loan vs HELOC is better for you.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformWhen tapping into your home’s equity, choosing the right option is key. Two popular routes homeowners explore are cash-out refinancing and home equity lines of credit (HELOCs), each offering unique benefits and trade-offs. This article will break down how these options work, their pros and cons, and how to decide which might suit your financial needs best.

KEY TAKEAWAYS

- A cash-out refinance and home equity line of credit are two common ways for homeowners to leverage their existing equity and get cash.

- A cash-out refinance replaces your current mortgage with a larger one, allowing you to pocket the difference and receive a lump sum of cash.

- A home equity line of credit functions like a credit card, allowing homeowners to borrow up to a certain amount without having to touch their first mortgage.

- Cash-out refinance loans and HELOCs offer different strengths and weaknesses, so you’ll need to consider your goals and your own financial situation to determine whether a home equity loan vs HELOC is better for you.

Cash-Out Refinance

A cash-out refinance allows you to replace your existing mortgage with a new one for a larger amount, giving you access to the equity you’ve built in your home. This popular option is often used for goals like consolidating debt, covering major expenses, or funding home renovations. With a manageable refinancing timeline and the flexibility to use the funds for various needs, such as refinancing for home improvements, this option can be a smart move for many homeowners.

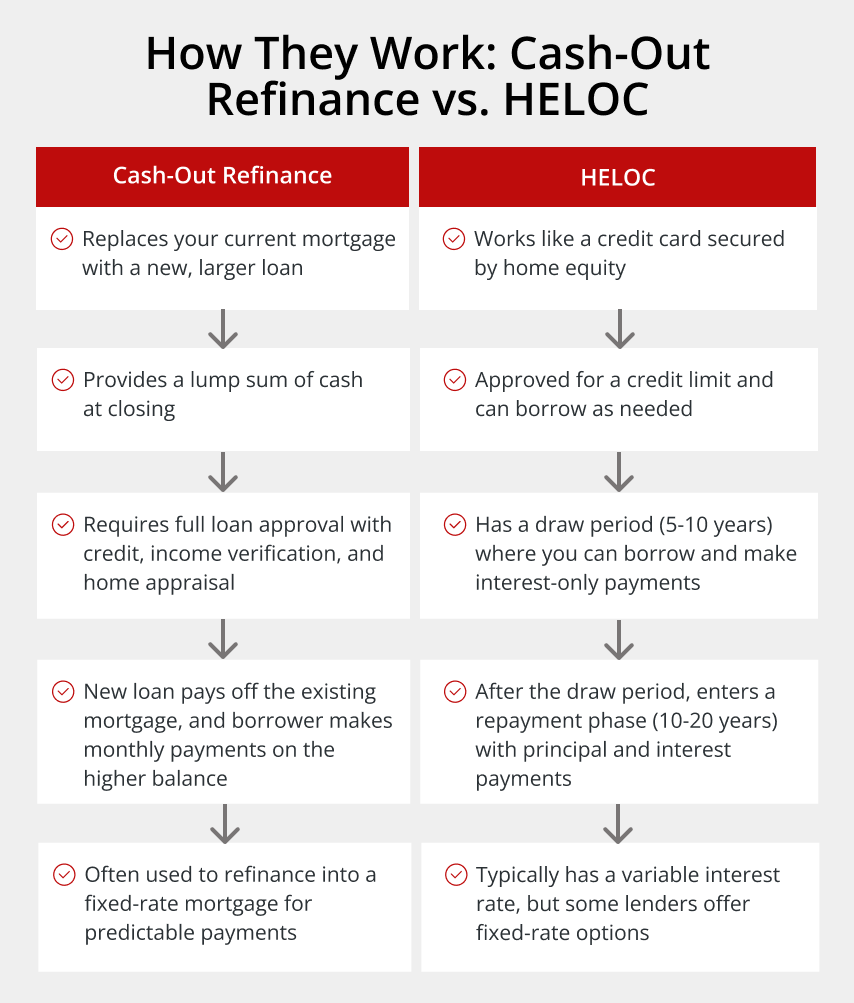

How does a cash-out refinance work?

A cash-out refinance allows you to leverage the equity in your home by replacing your current mortgage with a new one for a higher amount, letting you keep the difference as cash. This option essentially combines two financial moves: refinancing your existing mortgage and accessing your home equity.

The process begins with applying for the new loan, during which you’ll typically need to provide financial documentation and meet the lender’s credit and income requirements. Next, a home appraisal is conducted to determine your property’s value, ensuring there’s enough equity to support the new loan. Once approved, you’ll close on the new mortgage, replacing your old loan and receiving the remaining funds in a lump sum.

Many homeowners use a cash-out refinance for purposes such as refinancing for home improvements, paying off high-interest debt, funding education, or covering other major expenses. It’s also a popular choice if you’re looking to refinance an adjustable-rate mortgage (ARM) into a fixed-rate loan, offering more predictable monthly payments. By consolidating these benefits into a single financial tool, a cash-out refinance can be a strategic way to achieve your financial goals.

Pros and cons of a cash-out refinance

When comparing a HELOC vs cash-out refi, it’s important to weigh the advantages and disadvantages of the latter.

Pros:

- Secure significant financing at a low rate: Access to potentially large sums of cash at a lower interest rate than personal loans or credit cards.

- Switch from a variable rate to a fixed rate: Ability to refinance an ARM into a fixed-rate mortgage for predictable payments.

- Flexibility in how you use funds: Funds can be used for any purpose, including refinancing for home improvements or other investments.

- Potential tax benefits: May offer tax benefits if funds are used for qualifying home improvements.

- Qualify as a self-employed worker: Self-employed refinance options available.

- Potentially lower your mortgage rate: Lower interest rate if your current rate is higher.

- Shorten your term: Start over with a new 30 year fixed, keep the same term you have now, or shorten your term to a 15 year to shave time off of your mortgage.

Cons:

- Increase your loan term: Extends or resets your mortgage term, which could mean paying more interest over time. However, you can also refinance into a lower term loan.

- Closing costs: Closing costs can be significant and reduce the net cash received.

- Lower home equity: Reduces the tappable home equity available to you.

- Potentially sacrifice your current rate: You may give up a lower rate if the current prevailing market interest rate is higher.

Home Equity Line of Credit

A home equity line of credit (HELOC) works like a revolving credit line and it’s secured by the equity you’ve built in your home. Once approved, you are given a maximum credit limit, which you can borrow against as needed during the initial draw period, typically lasting 5 to 10 years. After this period ends, a repayment period will begin.

This structure allows homeowners to tap into their equity strategically, borrowing only what they need when they need it. Whether you’re planning to finance a major renovation or cover ongoing costs, a HELOC’s revolving nature makes it a practical solution for a variety of financial goals.

How does a HELOC work?

A HELOC functions like a credit card secured by the equity in your home. You’re approved for a maximum credit limit and can draw funds as needed during the initial draw period, typically 5 to 10 years.

During the draw period, you may have the option to make interest-only payments on the amount borrowed, giving you flexibility in managing your monthly expenses. This phase is particularly beneficial for homeowners with recurring or unpredictable expenses, such as phased home improvement projects, medical bills, or educational costs.

After the draw period ends, the HELOC enters the repayment phase, during which you can no longer borrow funds and must begin paying back both the principal and interest. The repayment period often spans 10 to 20 years and payments are made on a monthly basis. While a HELOC typically comes with a variable rate, we also offer a fixed-rate HELOC for those who want an added layer of stability. Some lenders also offer the option to refinance or renew the HELOC before the draw period ends, which can provide additional flexibility.

Pros and cons of a HELOC

Before deciding on a HELOC, you should be aware of the pros and cons of this type of loan.

Pros:

- Get ongoing access to funds: Provides access to funds as needed, giving flexibility for ongoing or unpredictable expenses.

- Only pay interest on what you borrow: Interest is charged only on the amount you borrow, not the total credit limit.

- Competitive rates: Lower interest rates compared to unsecured loans or credit cards.

- Potential tax benefits: May offer tax benefits if funds are used for qualifying home improvements.

- Cover recurring costs: Ideal for covering recurring costs, such as educational fees or phased renovations.

- Keep the rate on your first mortgage: You can keep the rate on your first mortgage if it is lower than current rates.

Cons:

- Typically comes with variable rate: Variable interest rates can increase your payments over time. Griffin Funding does offer a fixed-rate HELOC as well.

- Potential for foreclosure: Risk of foreclosure if you fail to make payments, as your home is the collateral.

- Lower your equity: Borrowing against your line of credit will diminish equity in your home.

- Temptation to overspend: It can be easy to overspend if you don’t use a HELOC strategically.

Cash-Out Refinance vs HELOC: Which Is Better?

Deciding between a cash-out refinance vs. a HELOC depends on your financial goals, circumstances, and how you plan to use the funds. Each option has distinct advantages that may make one more suitable than the other. Let’s explore some of the pros and cons of a HELOC vs a cash-out refinance to help you determine the best fit.

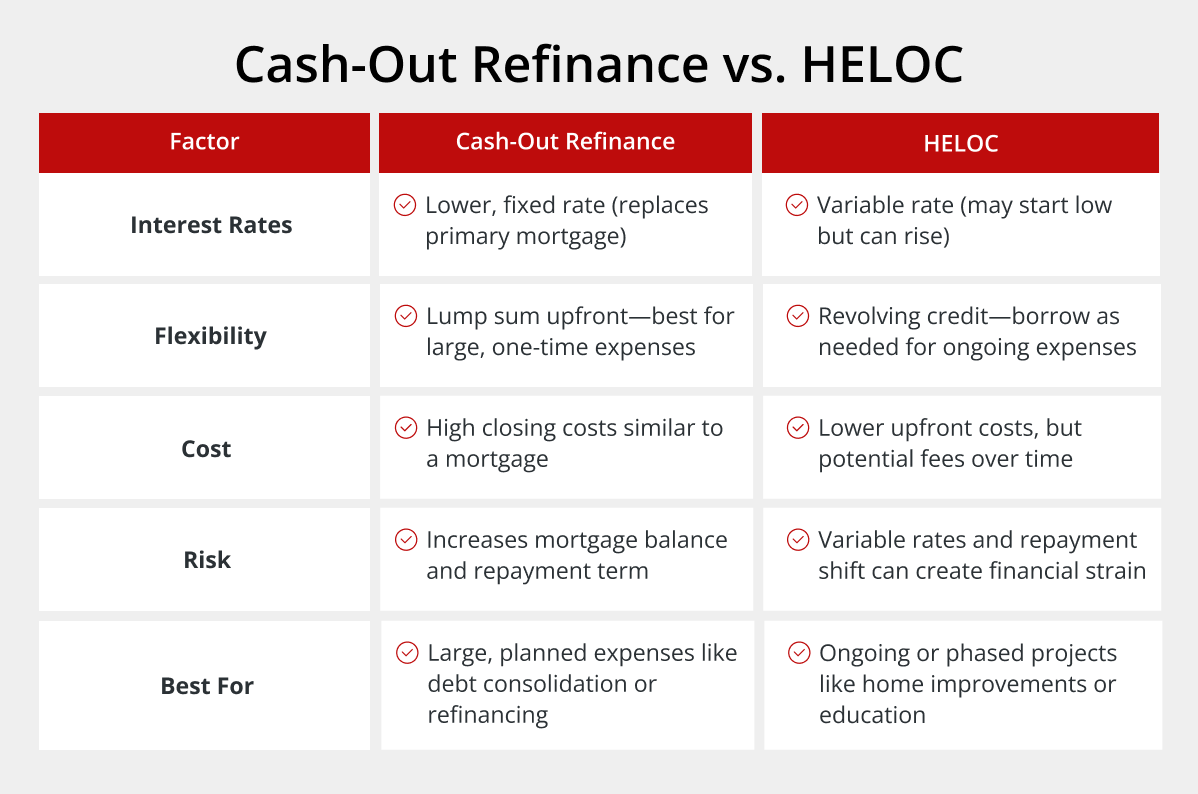

1. Interest Rates

- Cash-Out Refinance: Typically offers lower interest rates since it replaces your primary mortgage. This can be advantageous if you’re also looking to refinance an investment property or secure better terms on your home loan.

- HELOC: Often comes with a variable rate, which may start low but can increase over time, adding unpredictability to your budget.

2. Flexibility

- Cash-Out Refinance: Provides a lump sum upfront, making it ideal for large, one-time expenses like paying off high-interest debt or major home renovations.

- HELOC: Offers a revolving credit line, allowing you to borrow as needed, which is useful for ongoing or phased projects.

3. Cost

- Cash-Out Refinance: Includes closing costs similar to your original mortgage, which can be significant and reduce your net cash. However, if you’re already refinancing for a better rate or term, it may be a cost-efficient way to access equity.

- HELOC: Generally has lower upfront costs, but fees and higher interest rates over time can add up, especially during the repayment phase.

4. Risk

- Cash-Out Refinance: Ties your equity to a long-term loan, increasing your mortgage balance and potentially extending your term, which could mean paying more in interest over the life of the loan.

- HELOC: Variable rates and the shift from interest-only payments during the draw period to full repayment can create financial strain if not planned for.

When comparing a HELOC vs refinance, a HELOC might be the better choice if you need flexibility for ongoing expenses, like multiple rounds of home improvements or covering education costs. On the other hand, a cash-out refinance is often better for securing a lump sum at a potentially lower rate, especially if you’re already looking to refinance an investment property or consolidate debt.

Ultimately, the better option comes down to individual preferences, financial goals, and the specific trade-offs that work best for your situation

Explore Ways to Tap Into Your Equity

Tapping into your home’s equity is a powerful way to achieve financial goals, whether it’s funding home improvements, consolidating debt, or investing in your future. Choosing between a cash-out refinance vs a home equity loan depends on your unique needs — but you don’t have to navigate the process alone.

Griffin Funding is here to help you make the most of your home equity with tailored solutions and expert guidance. Plus, with the Griffin Gold app, managing your mortgage and accessing financial tools has never been easier.

Ready to explore your options? Contact Griffin Funding today to learn more and compare a HELOC vs cash-out refi when it comes to your unique financial situation. Get started today!

Find the best loan for you. Reach out today!

Get StartedRecent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...