Can You Buy a Foreclosure With a VA Loan?

KEY TAKEAWAYS

- It’s possible to purchase a foreclosure home with a VA loan, but it’s more complicated than with other types of home loans.

- To purchase a foreclosed home with a VA loan, the property must meet the VA’s minimum property requirements.

- Purchasing a foreclosed home allows you to save money because they’re often cheaper than comparable homes in the area. However, they usually require more repairs and maintenance.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformBuying a foreclosure with a VA loan can be a smart way to score a great deal on a home, but it’s not without its challenges. This guide breaks down what you need to know about using your VA loan benefits to purchase a foreclosure property.

Foreclosures often allow buyers to purchase a home under its current market value. Since lenders and banks don’t want to hold onto foreclosed properties, they’re typically motivated to sell, giving buyers more bargaining power.

Of course, foreclosed homes may need repairs because they’re often sold as-is. However, it might be well worth it to save on your mortgage payments or put some of your loan amount toward fixing up the home. If you’re eligible for a VA loan, you probably already know that the VA and lender have various requirements you must meet before your loan application is accepted.

So can you buy a foreclosure home with a VA loan? You absolutely can, as long as it meets the VA’s minimum property requirements (MPRs) and you’re eligible for the loan. Keep reading to learn more about buying a foreclosure with a home loan to decide if it’s the right option for you.

KEY TAKEAWAYS

- It’s possible to purchase a foreclosure home with a VA loan, but it’s more complicated than with other types of home loans.

- To purchase a foreclosed home with a VA loan, the property must meet the VA’s minimum property requirements.

- Purchasing a foreclosed home allows you to save money because they’re often cheaper than comparable homes in the area. However, they usually require more repairs and maintenance.

What Are Foreclosure Properties?

A foreclosure occurs when the lender seizes the property because the borrower didn’t pay off their mortgage and defaulted on the loan. If a home is foreclosed, it’s owned by the lender or bank that provided the mortgage loan. Mortgage loans are collateral-based, so the mortgage puts a lien on the property, and if you fail to pay your mortgage payments, lenders can seize it from you.

Lenders have to go through a daunting process for foreclosure homes, which includes notifying the homeowner after missed payments and loan default. Next, the lender evicts the homeowner and has to publish that the property will be for sale in a local paper before selling the property at a public auction. If the home doesn’t sell, the lender becomes the homeowner, and they can continue to attempt to sell it. If you’re purchasing a home with a VA loan, you’re probably buying it after it didn’t sell at the public auction. However, it’s possible to purchase it at a public auction if you’re aware of it.

At first, purchasing a foreclosed home may not seem ideal because it’s unlikely the homeowner put any work into it since they couldn’t afford their mortgage payments. However, the benefit of this is that you can save money on your home purchase.

Can I Purchase a Foreclosure With a VA Loan?

You can buy a foreclosure home with a VA loan, but the home must meet the VA’s minimum property requirements and you must be eligible for the VA loan. You must meet various lenders and VA requirements, such as the VA’s minimum service requirement to ensure you’re eligible for the loan, and the lender’s specific requirements, such as minimum credit score, debt-to-income (DTI) ratio, and income requirements.

VA Minimum Property Requirements

It’s more complicated to purchase a foreclosure with a VA loan than with conventional and Non-QM loans because of the VA’s minimum property requirements (MPRs). These requirements ensure that the home you purchase is safe and structurally sound. A few key requirements include the following:

- Residential zoning

- No major roof repairs requirement

- Heating, plumbing, and electrical are in working order

- No lead-based paint

- Free of pests like termites

- Accessible from public and private streets

- Sufficient living space depending on family size

Unfortunately, the VA can determine your eligibility for the VA loan, but these particular requirements still must be met in order to qualify. This is a common problem because foreclosure properties are sold as-is, so there’s no homeowner seller to fix the problems to help you get approved. Instead, the lender or bank owner probably doesn’t want to have to spend money on the property.

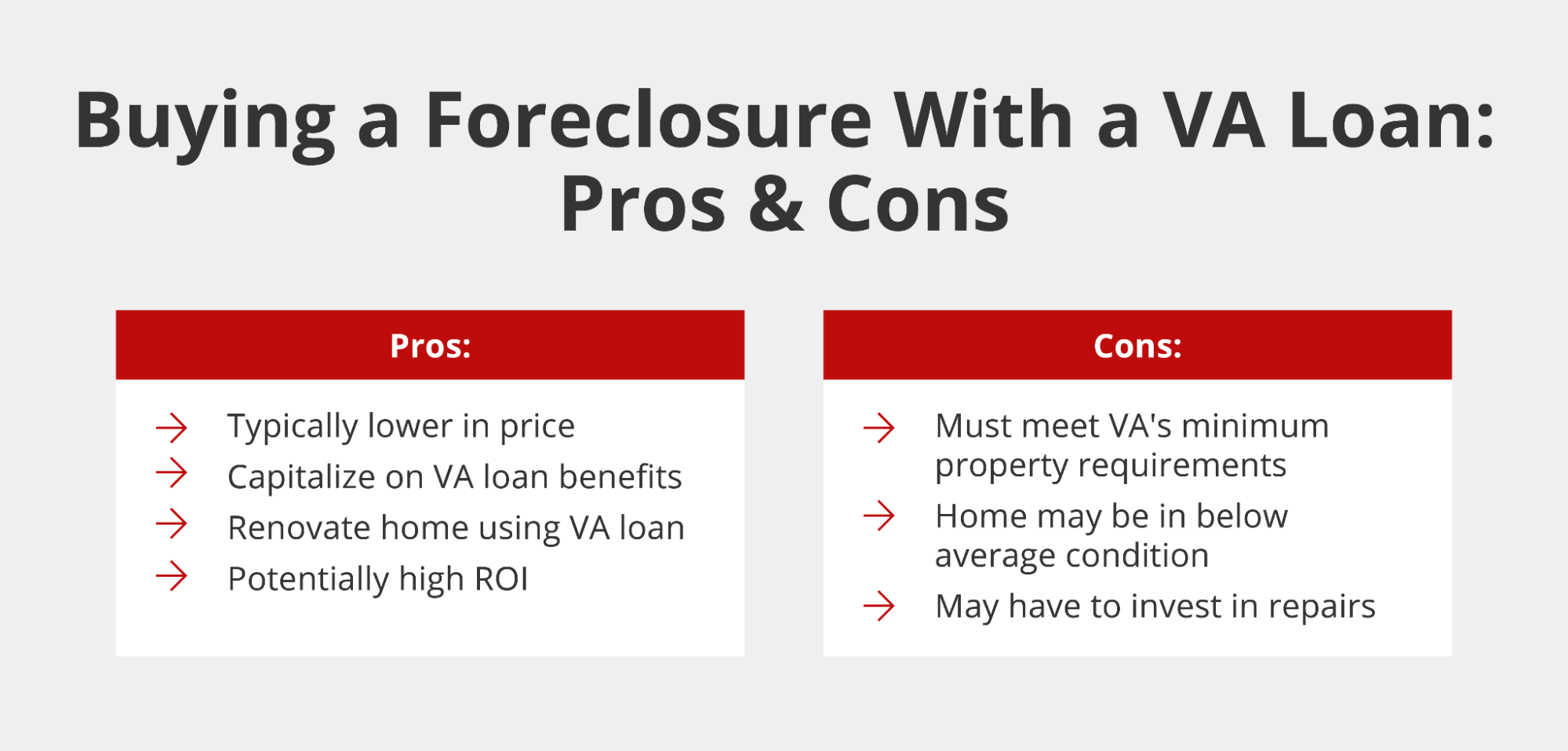

Pros and Cons of Buying a Foreclosure With a VA Loan

It’s essential to weigh the pros and cons if you’re considering using a VA loan for a foreclosure. Below, we list some of the key considerations for buyers.

Pros:

- Lower price: Buying a foreclosure with a VA loan can help you save money. A foreclosed home is typically available at a lower selling price than comparable homes in the area, which can help you make the most out of your VA loan.

- Use VA loan benefits: Because VA loans come with the benefit of a zero percent down payment, competitive VA loan rates, and more flexible lending requirements, you can combine the advantages of purchasing a foreclosure and using a VA loan.

- Renovate using VA loan funds: Other homes on the market are usually renovated before you buy them, but since foreclosed properties are sold in as-is condition, you can use the remaining part of your loan to repair and renovate the home however you like. While this is seen as a con to some, others prefer having a home where they can start fresh and renovate it the way they want it.

- Potentially increase ROI: Purchasing a foreclosure with a VA loan can offer a higher return on your investment. Since you purchased a home for much less than others in the area, you can resell it and increase your return once you’ve made repairs and renovations to increase its value.

Cons:

- Property must meet minimum requirements: When purchasing a foreclosure with a VA loan, you will be restricted in what you can buy due to the VA’s minimum property requirements.

- Home condition may vary: Buying a property in as-is condition means it’s probably been neglected for some time. The condition of foreclosure homes can vary, so make sure you’re comfortable with the home’s condition before buying.

- May necessitate costly repairs: If a home has been foreclosed on, it’s possible that the previous owner didn’t keep up with regular maintenance issues. While some of these issues may be minor, other problems — such as issues with the foundation, plumbing, or electrical wiring — can end up being expensive to address.

How to Buy a Foreclosure With a VA Loan

So can you buy a foreclosure with a VA loan? Yes, but the process is more complicated than using another home loan type. For example, there are several ways to purchase a foreclosed home: through a short sale, at auction, or through the lender.

A short sale is when the homeowner who is behind on mortgage payments sells the home for much less than they owe on the mortgage. At this point, the foreclosure process hasn’t been completed, and the homeowner still owns the home.

Once the foreclosure process is underway, you can purchase the home at auction, where you’ll agree to purchase the home as-is. If the home doesn’t sell at auction, you can purchase it directly from a lender. However, it’s worth noting that lenders rarely work directly with buyers. Instead, you’ll need to work with a real estate agent to purchase a foreclosure from the lender.

Before you begin house hunting, you should get pre-approved for a mortgage to give you more purchasing power. Mortgage pre-approval can show lenders and banks that currently own the home that you’re a serious buyer. Then, once you’ve found the property you want to purchase, you can apply for a VA loan, which requires you to provide your Certificate of Eligibility (COE) from the VA. At this point, the VA will order an appraisal to determine if the property meets the minimum property requirements.

Unfortunately, many foreclosed homes won’t meet the minimum property requirements because the previous homeowner didn’t keep up with the home’s maintenance. In addition, the VA won’t approve properties with significant damage or structural concerns in houses sold in as-is condition, which makes getting VA loans for a foreclosure more complicated. However, this isn’t true for all foreclosures. Some can pass the VA’s inspection, allowing you to purchase a home for less and with zero down payment.

Don’t forget that your loan application will also go through a lender’s underwriting process, where they verify information like income and assets, DTI ratio, and credit score to determine your ability to repay the loan.

Apply for a VA Loan Today

You can buy a foreclosed home with a VA loan as long as the particular home meets the VA’s minimum property requirements and you, as the borrower, meet the requirements set by the VA and your lender. However, there are several things to consider, such as whether you’d want to purchase a home that requires repairs even though you’ll be purchasing it for less than comparable homes in the area.

VA loans make purchasing a foreclosure home more complicated, but because these homes are typically more affordable, it can reduce the total loan amount required. Before going down this path, ensure your VA entitlement is sufficient to cover the loan, especially if you’ve used it before or plan to in the future.

Ready to purchase a home? Get a VA loan from Griffin Funding and receive personalized support throughout the VA loan process. Get started online or contact us to learn more about our offerings.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Is it worth it to buy a foreclosure with a VA loan?

To help determine if a foreclosure fits within your budget, you can use a VA loan calculator to estimate your monthly payments and overall loan costs. Whether it’s the right choice depends on your financial situation, homeownership goals, and willingness to navigate potential challenges.

How long does it take to close when buying a foreclosure with a VA loan?

Why work with Griffin Funding?

Plus, our expertise in VA loans means we can help you overcome challenges, like meeting VA property requirements, to turn your homeownership dreams into reality. With the Griffin Gold app, you can track your loan progress, upload documents, and stay connected with your loan officer for a seamless and stress-free experience.

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...