Credit Repair for Veterans: VA Credit Help

KEY TAKEAWAYS

- Credit repair for veterans can help increase your credit score by removing inaccurate information.

- You can repair your credit yourself or hire a credit repair agency. However, agencies are the more expensive route, and they can’t do anything for you that you can’t do yourself.

- There are several credit repair and financial programs available to help veterans improve their financial health.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage Platform

According to a recent study, veterans are more likely to have credit issues than civilian borrowers. While your credit score may seem like just another financial number you have to worry about, it’s crucial for obtaining a loan or opening a credit card. Unfortunately, most of us will require various loans throughout our lives. The most common are car and home loans, but if you want to open up a credit card, you’ll need a fair or better credit score.

Unfortunately, building credit while in the military can be challenging because you have a specific set of challenges that can affect your financial health. For example, building credit can be impossible if you’re stationed overseas and don’t have any debt or credit cards, resulting in little or no credit history.

Many veterans have credit issues, so you’re not alone if you have a poor credit score. In 2019, around 16% of Americans had a FICO score between 300 and 579, also considered poor credit. However, veterans credit repair can help increase your credit score to help you when it’s time to apply for a loan. Keep reading to learn more about credit repair for veterans and your options to increase your score.

KEY TAKEAWAYS

- Credit repair for veterans can help increase your credit score by removing inaccurate information.

- You can repair your credit yourself or hire a credit repair agency. However, agencies are the more expensive route, and they can’t do anything for you that you can’t do yourself.

- There are several credit repair and financial programs available to help veterans improve their financial health.

What Is Credit Repair for Veterans?

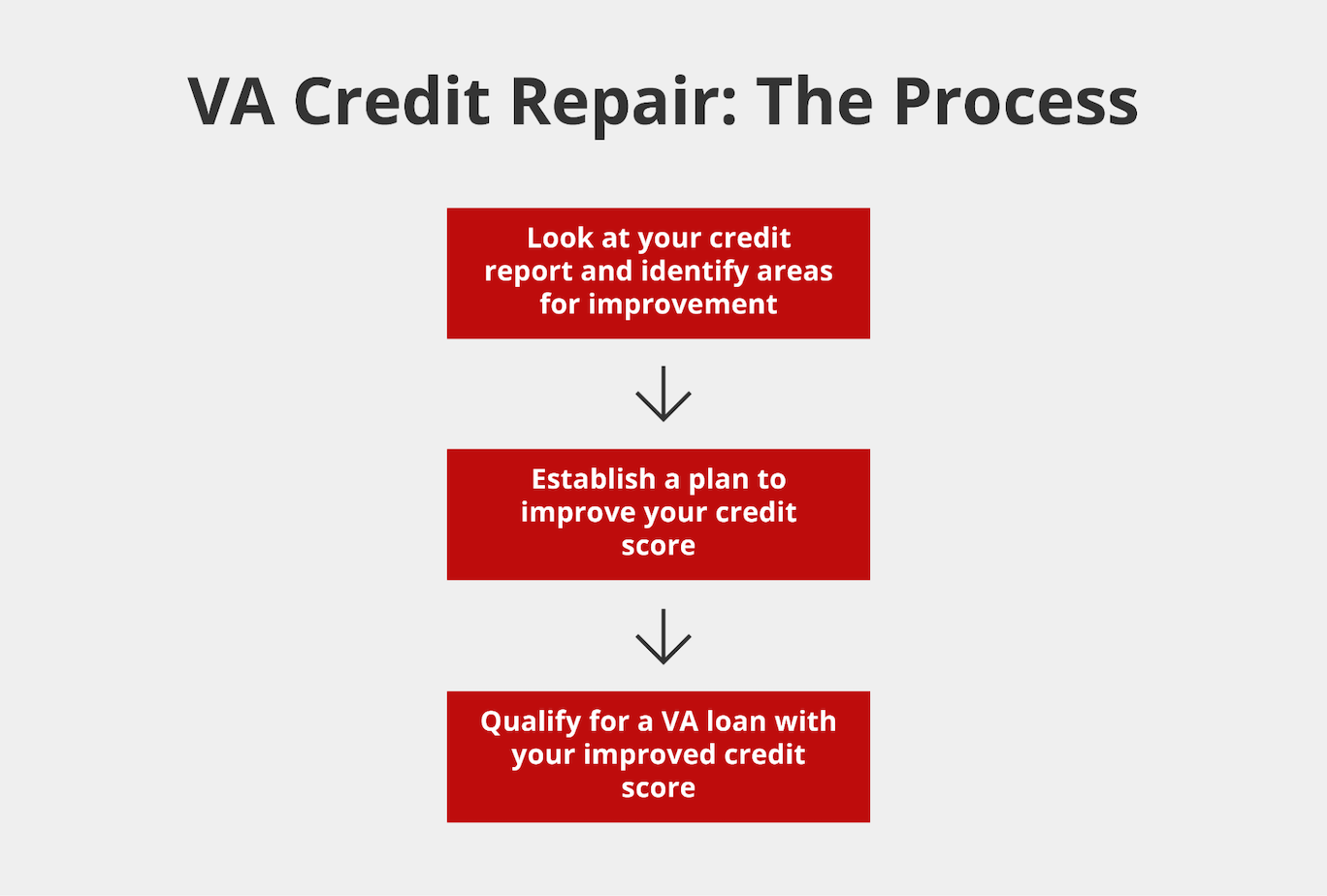

Veterans credit repair allows you to increase your credit score over time by reviewing your credit history and making the necessary changes. For some, veterans’ credit repair may be as simple as disputing incorrect information, but for others, it may mean finding ways to pay off massive amounts of debt or building credit over a longer period of time to increase their score.

There are several aspects of VA credit repair, ranging from learning basic financial habits like budgeting and monitoring your spending to correcting information on your credit report, all of which take time and effort. However, credit repair for veterans can drastically improve your financial health, helping you secure loans with lower interest rates when needed.

For example, you can check today’s VA interest rates, but the lender will determine your final interest rate after reviewing your financial information and credit history.

Veterans credit repair typically refers to credit repair companies that will help you clean up your credit report to remove incorrect information and provide you with an action plan to improve your credit score.

Unfortunately, you can’t easily remove inaccurate information from your credit report. Instead, you’ll need to provide dispute information for the major credit companies to investigate and determine whether the information on your credit report is accurate or inaccurate.

Credit repair companies can help you dispute inaccurate information in your credit report, or you can do it on your own. However, you should first obtain a copy of your credit report and review it for errors. You’re entitled to a free annual copy of your credit report from the major credit reporting bureaus, and you can request them online.

You can also review your FICO credit score through your bank or by signing up for a service. Depending on your credit score and history, VA credit repair may be as easy as paying off your debts or as complicated as building your credit while disputing inaccurate data.

Whatever the case, credit repair for veterans is crucial because it can impact your ability to get a loan in the future.

How Does VA Credit Repair Help?

If you’ve ever wondered how to get a VA loan, you might realize that it’s actually much more complicated than you thought. Eligible veterans, active duty service members, and surviving spouses must meet the US Department of Veterans Affairs (VA) minimum service requirements, and the property must pass the VA’s minimum property requirements.

Additionally, since VA loans are guaranteed by the VA but not offered by them, you’ll have to meet your lender’s requirements to qualify, which typically includes meeting a minimum credit score.

The minimum credit score for a VA loan varies by lender, and you can still get a VA home loan with bad credit. However, most lenders prefer veterans to have a credit score of at least 580 to qualify. The VA doesn’t have a minimum credit score, so the lender is free to set their own requirements.

That said, your VA loan eligibility isn’t the only thing impacted by a poor credit score. VA credit repair can help by boosting your credit score to make it easier to take out loans of all types, including personal and car loans.

Additionally, the higher your credit score, the lower your interest rate, allowing you to receive more favorable lending terms on a variety of loan types.

Credit repair can also help lower your car, home, and renter’s insurance premiums while making it easier to rent an apartment. Unfortunately, credit can impact all aspects of your life. For example, some employers may include a credit check as part of their employment screening process.

A bad score could be a red flag that prevents your ability to secure a job. Meanwhile, many landlords require a certain credit score to accept your rental application.

Credit repair for veterans can improve your overall quality of life while reducing stress because so much of your life is impacted by your credit history. Therefore, even though it may take time, effort, and money, it’s well worth it for allowing you to build wealth faster, save on interest rates, and make it easier to get a job or rent an apartment.

How to Get Credit Help for Veterans

There are several credit repair agencies that focus on helping veterans. However, these businesses cost money and may not be the best option based on your current budget. Ultimately, credit repair companies can’t do anything to increase your credit score that you couldn’t do on your own. They have no magic solution to repair your credit. Instead, they simply do the work for you.

As long as you’re willing to take the time to review your credit history and make the necessary improvements or dispute inaccurate information by reaching out to each of the three credit bureaus, you can improve your credit score. However, if you’re unwilling to take the time, paying a fee for a credit repair company might be well worth it.

One of the most important aspects of credit repair for veterans is reviewing your accounts and ensuring the information is accurate. You should make sure your credit history doesn’t consist of accounts and bankruptcies that don’t belong to you, negative marks that shouldn’t be included, and debts that aren’t validated.

VA credit repair doesn’t have to cost you anything since you’ll have access to your credit reports to help you create a plan that improves your score.

Veterans Credit Repair Programs

There are plenty of credit repair companies out there that can help you dispute inaccurate or unverifiable information on your credit report. However, there are also VA credit repair programs geared specifically toward veterans to help them build wealth and learn good financial habits.

Unfortunately, military service doesn’t fix your credit score if you have a history of not paying your debts.

However, it does give you access to a variety of resources and programs to help you get your credit back on track and control your debts. A few credit help for veterans programs include the following:

- Military Saves: Military Saves is a non-profit that works with military members to help them save money and reduce debt. They work with government agencies, credit unions, military banks, and other organizations to improve their members’ financial health with a variety of resources available.

- Military OneSource: Military OneSource is a Department of Defence program that offers help with taxes, spouse employment, online training, and deployment tools to help veterans and active-duty service members better manage their finances. They offer financial counselors that can provide advice and answer questions to ensure military members make the best choices regarding their finances.

- Veterans Benefits Administration: The Veterans Benefits Administration (VBA) is an organization that helps veterans understand their benefits and provide them with education and financial resources. They offer everything from financial counseling to repair credit for veterans and a fiduciary program to protect veterans who can’t manage their own finances.

None of these organizations have the sole purpose of credit repair for veterans. Instead, they educate and work directly with you to improve your credit score and teach you how to save money, offering more comprehensive services that do more than improve your credit score; they give you the tools and resources you need to make good financial decisions throughout the rest of your life.

Flexible VA Loans with Griffin Funding

One reason why it’s so important to try to increase your credit score is to secure a VA home loan. VA home loans are one of the most significant benefits of joining the military, and you should be able to take advantage of them. Unfortunately, if your credit score is too low, you may not qualify with a lender.

Griffin Funding’s VA loans offer more flexible lending criteria to help more eligible borrowers achieve their dream of homeownership. These loans are backed by the VA and are designed to help you buy, build, repair, and refinance your home.

Our VA loans have competitive interest rates, higher debt-to-income (DTI) ratios accepted, low minimum credit score requirements, and don’t require a down payment as long as you have your full entitlement.

Find Out If You Qualify with Your Current Credit

If you’re eligible for a VA loan, you can find out if you qualify for a Griffin Funding VA loan by contacting us today. We can obtain your COE within a matter of seconds to verify that you’ve met the VA’s minimum service requirements and can obtain a VA loan. Then, we’ll discuss your credit score to determine whether you qualify. Apply now.

Graphic Source

- Consumer Credit Counseling Service of Buffalo, Inc. (n.d.). Veteran debt statistics. Consumer Credit. https://www.consumercredit.com/debt-resources-tools/military-veterans/the-facts-military/veteran-debt-statistics/

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What Credit Score is Needed for a VA Loan?

What types of VA loans does Griffin Funding Offer?

- Purchase loan: VA purchase loans are used to purchase property, build a home, or repair and improve your home.

- VA streamline refinance loan: VA streamline refinance loans, also called interest rate reduction loans (IRRRLs), are a type of mortgage refinancing loan that replaces your current VA loan with a new one to reduce your interest rates. For example, you can switch from an adjustable-rate mortgage to a fixed-rate mortgage or refinance when interest rates are lower to reduce the total cost of your loan.

- Cash-out refinance: A VA cash-out refinance loan allows you to replace your current mortgage with a new one, but instead of using your new mortgage for the home, you’ll receive cash to use for anything from paying off debts to paying off non-VA loans.

After you improve your credit score, can you get a better interest rate?

Recent Posts

How to Get the Lowest Mortgage Rate: 7 Strategies

How Mortgage Rates Are Set Before we teach you how to get the lowest mortgage rate, it helps to understand wha...

What Is an Escalation Clause in Real Estate?

A real estate escalation clause is an addendum to a purchase offer that authorizes your bid to increase automa...

Mid-Term Rentals: Guide for Real Estate Investors

Mid-term rentals are furnished properties leased for 30 days to 12 months, targeting traveling professionals, ...