Griffin Funding vs Veterans United: 2025 VA Loan Comparison

KEY TAKEAWAYS

- Griffin Funding offers personalized service with competitive rates and comprehensive VA loan products including purchase, refinance, and specialty programs.

- Veterans United VA loan rates remain competitive in the market, though individual rates vary based on credit profile and loan specifics.

- Both lenders provide strong technology platforms, but differ in their approach to customer service and loan processing speed.

- Griffin Funding’s local expertise and community focus may appeal to borrowers seeking more personalized attention throughout the loan process.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformVeterans deserve the best possible home financing, and choosing the right lender can make a significant difference in your homebuying journey. This comparison guide examines two prominent VA loan providers to help you make an informed decision for your home purchase or refinance needs.

Choosing a VA Loan Lender in 2025

The mortgage landscape continues to evolve, making lender selection more important than ever. Veterans face many choices when trying to select the best mortgage lender for VA loans, with each offering different strengths to help secure optimal terms for unique financial situations.

Why Compare VA Mortgage Lenders?

Shopping around for VA loan lenders offers several benefits:

- Interest rates and fees vary significantly between lenders, potentially saving thousands over your loan term.

- Processing speeds differ dramatically, affecting your ability to close on time in competitive markets.

- Customer service quality ranges from highly personalized to more automated approaches.

- Loan product offerings vary, with some lenders providing specialty programs others don’t offer.

- Technology platforms and tools differ in user-friendliness and functionality

Comparing multiple options ensures you find the best mortgage lender for VA loans that aligns with your priorities and timeline.

About Griffin Funding

Griffin Funding operates as a mortgage banker specializing in various loan programs, including comprehensive VA loans. Founded with a commitment to personalized service, we focus on building relationships with borrowers throughout the entire loan process.

Griffin Funding offers competitive rates, local market expertise, and a streamlined approach to home financing that emphasizes transparency and customer satisfaction.

About Veterans United

Veterans United stands as one of the largest VA loan originators in the United States, exclusively focusing on serving military members and veterans.

Veterans United emphasizes its military-focused culture and understanding of the unique challenges veterans face during the homebuying process. Military borrowers seeking a VA loan with Veterans United benefit from the company’s specialized expertise in veteran-specific financing needs.

Interest Rates & Loan Products

Both lenders offer competitive rate structures, though specific rates depend on individual borrower profiles, credit scores, and current market conditions.

Griffin Funding

Griffin Funding provides competitive interest rates across all VA loan products, including purchase loans, VA cash-out refinance, and VA streamline refinance options. Our rate structure reflects current market conditions while maintaining competitive positioning. Griffin Funding’s loan officers work closely with borrowers to explain rate factors and help secure optimal terms based on individual financial profiles and loan requirements.

Veterans United

Veterans United VA loan rates remain competitive within the current market, with the company leveraging its high loan volume to negotiate favorable rate structures. The Veterans United VA loan product suite includes standard purchase loans, refinancing options, and specialized programs. Veterans United VA home loan rates fluctuate with market conditions, and the company provides rate transparency through its online platform and loan specialists.

Customer Experience & Reviews

Customer service quality and borrower satisfaction play crucial roles in the mortgage experience. Both companies have developed different approaches to serving their clients throughout the loan process.

Griffin Funding

Griffin Funding emphasizes personalized service with dedicated loan officers who guide borrowers through every step. Testimonials highlight responsive communication, transparent processes, and successful loan closings.

Borrowers frequently praise our accessibility and willingness to explain complex mortgage concepts. Griffin Funding’s approach focuses on building long-term relationships rather than simply processing transactions.

Veterans United

Veterans United VA loan reviews also reflect positive experiences with the company’s military-focused approach. The company receives recognition for its understanding of military life complexities and VA loan intricacies. Veterans United’s large-scale operations allow for extensive resources and support systems, though some borrowers note less personalized attention compared to smaller lenders when pursuing a Veterans United VA home loan in certain situations.

Technology & Application Process

Modern mortgage technology streamlines the application process and improves communication between lenders and borrowers. Both companies invest in digital platforms to enhance the borrowing experience.

Griffin Funding

Griffin Funding offers streamlined digital applications combined with personal service from experienced loan officers. Our technology platform facilitates document upload, application tracking, and communication throughout the process. Griffin Funding also provides useful tools like a VA loan calculator and VA loan affordability calculator to help borrowers understand their purchasing power and monthly payment obligations.

Veterans United

Veterans United provides a digital platform designed specifically for military borrowers, including mobile applications and online account management. The company’s technology infrastructure supports high-volume processing while maintaining user-friendly interfaces.

Pros & Cons: Griffin Funding vs. Veterans United

Each lender brings distinct advantages and considerations to the table. Evaluate each of these factors based on your individual priorities and preferences.

Griffin Funding Pros & Cons

Some of Griffin Funding’s key advantages include:

- Personalized service with dedicated loan officers throughout the process.

- Competitive rates and transparent fee structures.

- Local market expertise and community-focused approach.

- Strong communication and relationship-building emphasis.

- Comprehensive VA loan product suite including specialty refinance options.

Potential considerations of Griffin Funding include:

- Smaller national footprint compared to larger competitors.

- Selective lending criteria may limit options for some borrowers.

- Fewer physical branch locations for in-person consultations.

Veterans United Pros & Cons

Some of the advantages of using Veterans United:

- Extensive VA loan specialization and military-focused expertise.

- Large-scale operations enable comprehensive resources and support systems.

- Streamlined processes designed specifically for veteran borrowers.

- Strong national recognition and brand reputation in military communities.

- Educational materials and tools tailored to the complexities of military life.

Potential drawbacks of Veterans United include:

- High loan volume may result in less personalized attention.

- Exclusive VA loan focus limits options for other loan types.

- Some borrowers report more automated service compared to smaller lenders.

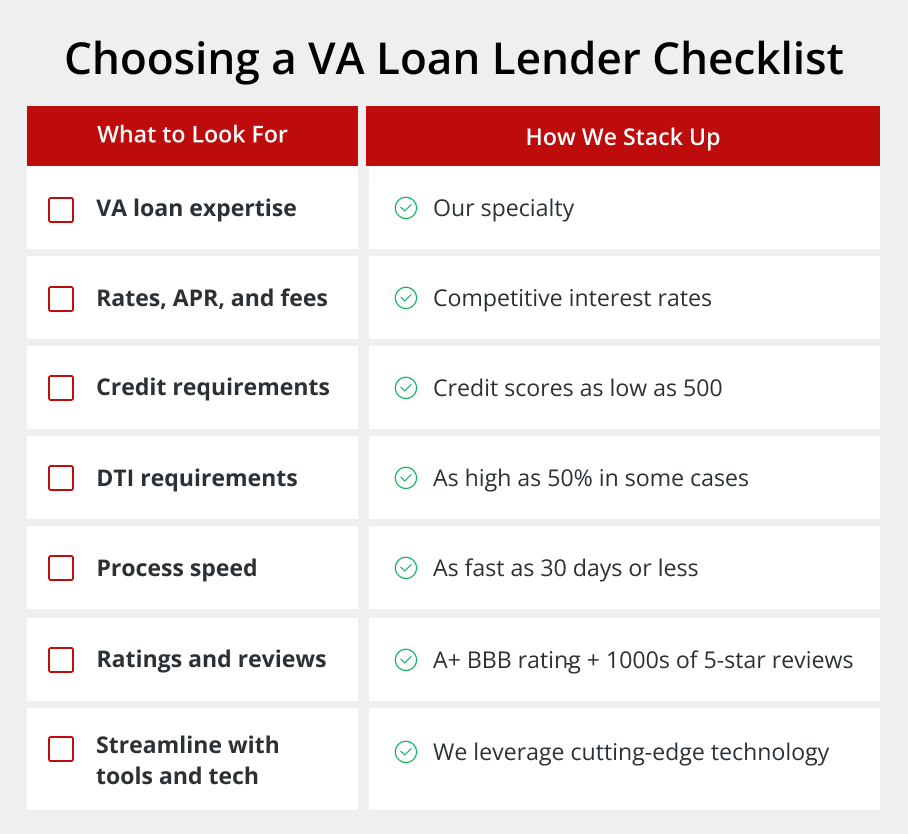

Tips for Choosing a VA Loan Lender in 2025

Compare multiple lenders to find the best fit for your specific needs and financial situation.

- Check VA loan experience and expertise to ensure your lender understands military-specific situations and VA guidelines.

- Compare rates, APR, and fees from multiple lenders, as these can vary significantly and impact your total loan cost.

- Understand VA funding fee structures and any available exemptions based on your military service or disability status.

- Check credit score and debt-to-income requirements to ensure you meet each lender’s qualification standards.

- Compare pre-approval processes and lending speed, especially if you’re working within tight closing timelines.

- Consider customer service quality and read reviews from other military borrowers who have used each lender.

- Evaluate available technology and tools, including mobile apps and online account management capabilities.

- Consider the lender’s military and community knowledge, as this can impact their understanding of your unique circumstances.

Compare Your VA Lending Options

Choosing the right VA loan lender requires careful consideration of rates, service quality, and lender expertise. Griffin Funding combines competitive pricing with personalized service and local market knowledge.

Explore your options with Griffin Funding’s VA loan brochure and discover how our experienced team can help you achieve your homeownership goals.

Plus, you can manage your finances more effectively with our Griffin Gold app, which offers budgeting tools, expense tracking, and financial planning resources to help you achieve your homeownership goals and maintain long-term financial health.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What are the pros and cons of VA loans?

VA loans offer significant advantages, including:

- No down payment required for most borrowers.

- No private mortgage insurance premiums.

- Competitive interest rates are typically below conventional loans.

- Reusable benefit for multiple home purchases.

- Assumable loans that can transfer to qualified buyers.

However, consider some of these disadvantages of VA loans:

- VA funding fee required (unless exempt due to disability).

- Limited to primary residence purchases only.

- Specific property requirements must be met during inspection.

- Not available for investment properties or vacation homes.

What credit score is needed for a VA loan?

Most VA loan lenders require minimum credit scores between 580-620, though the VA itself doesn't set a minimum credit score requirement. Griffin Funding evaluates each application individually, considering overall credit profile and compensating factors. Higher credit scores typically qualify for better interest rates and terms, while lower scores may require additional documentation or higher down payments in some cases.

What are alternatives to VA loans?

VA loans often provide the most favorable terms for eligible veterans, but these alternatives may work better for specific property types or financial situations:

- Conventional loans. 3% down payment options available and they're good for investment properties. However, they require mortgage insurance below 20% down.

- FHA loans. 3.5% minimum down payment and more flexible credit requirements, but they include mortgage insurance premiums.

- USDA loans. Zero down payment for eligible rural properties; income limitations apply and they're limited to specific geographic areas.

- Jumbo loans. For high-value properties exceeding conforming loan limits. These typically require larger down payments and higher credit scores.

Is Veterans United better than Griffin Funding for VA loans?

Both lenders serve veterans, but they differ in focus. Veterans United is a large national lender with an exclusive VA focus, while Griffin Funding provides a personalized experience with broader mortgage expertise and VA automatic authority. Griffin Funding may be ideal for veterans who value 1-on-1 advisory service and customized loan strategies.

What are Veterans United VA loan rates compared to Griffin Funding?

VA loan rates vary daily based on credit score, loan amount, and market conditions. Both lenders offer competitive rates, but Griffin Funding often provides customized rate options and can match or beat major lenders through its direct-to-consumer model. Always request a personalized quote from both lenders to compare APRs and fees accurately.

Does Griffin Funding have VA automatic authority like Veterans United?

Yes. Griffin Funding is directly approved with the Department of Veterans Affairs and holds VA automatic authority, allowing it to issue VA loan approvals in-house without waiting for external VA review — just like Veterans United. This can speed up closing times and provide more flexibility during underwriting.

Which lender is better for refinancing a VA loan in 2025?

Griffin Funding’s VA refinance options include VA IRRRL (streamline) and VA cash-out refinance loans, both designed for fast approval and funding. Veterans United also offers these programs, but Griffin Funding’s smaller structure allows for quicker communication and tailored refinance strategies, especially for borrowers exploring 100% cash-out options.

How do I decide between Griffin Funding and Veterans United for my VA loan?

Consider your priorities:

- Prefer personal service and direct communication with a dedicated advisor? → Griffin Funding

- Want a large brand with nationwide military resources? → Veterans United

- Need a combination of competitive rates, local expertise, and fast closings? → Griffin Funding

Always compare official Loan Estimates from both lenders before deciding.

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...