How to Calculate PMI

KEY TAKEAWAYS

- PMI typically costs between 0.3% to 1.5% or more of your loan amount annually, paid monthly. Your credit score, down payment amount, and loan-to-value ratio directly impact your PMI rate.

- You can request PMI removal once you reach 20% equity in your home, and it automatically cancels at 22% equity.

- VA loans, USDA loans, and specialty no PMI mortgage loans can help you avoid PMI entirely.

- Putting down 20% upfront, choosing lender-paid PMI, and using piggyback loans can reduce or eliminate your PMI costs.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformPrivate mortgage insurance (PMI) is a cost that most home buyers with less than 20% down will need to factor into their budget. For many first-time buyers, PMI can add a few hundred dollars or more to their monthly housing payment, making it a significant expense that deserves consideration. Understanding how to calculate PMI monthly payment helps you plan for this expense and explore ways to minimize or eliminate it entirely.

What Is PMI?

PMI is insurance for your lender that protects them if you fail to make your mortgage payments, also known as defaulting on the loan. It doesn’t protect you as the borrower, but it allows lenders to offer mortgages to buyers who can’t put down the traditional 20% down payment.

PMI is required on most conventional loans when you make a down payment of less than 20% of the home’s purchase price. This means your loan-to-value ratio is higher than 80%, which lenders consider riskier.

PMI differs from other types of home buyer insurance in several important ways. Homeowners insurance protects your property from damage like fire, theft, or natural disasters, while PMI specifically protects the lender from financial loss. It’s also different from MIP (mortgage insurance premium) that comes with FHA loans, which has different rates and cancellation rules.

Understanding PMI vs MIP can help you choose the right loan type for your situation.

Some borrowers mistakenly think PMI protects them if they lose their job or become disabled, but PMI only benefits the lender in case you don’t repay your mortgage (default).

Factors That Affect PMI Costs

Several factors determine how much you’ll pay for PMI each month. Understanding these variables helps you see where you might have control over your costs and what elements are fixed based on your loan details.

- Loan-to-value ratio: The higher your LTV ratio, the more you’ll pay for PMI. Someone with 5% down (95% LTV) will pay more than someone with 15% down (85% LTV), as lenders view higher LTV loans as riskier investments.

- Credit score: Borrowers with high credit scores qualify for the lowest PMI rates. The difference can be substantial over the life of your loan, sometimes varying by hundreds of dollars annually.

- Loan type and term: Fixed-rate mortgages often have different PMI rates than adjustable-rate mortgages. Shorter loan terms like 15-year mortgages typically come with lower PMI rates compared to 30-year loans since they represent less long-term risk to lenders.

- Down payment and loan amount: A larger loan means higher monthly PMI costs even at the same rate, which is why PMI payments vary between different loan amounts. The actual dollar amount you put down also affects your rate tier with most PMI providers.

How to Calculate PMI on a Mortgage

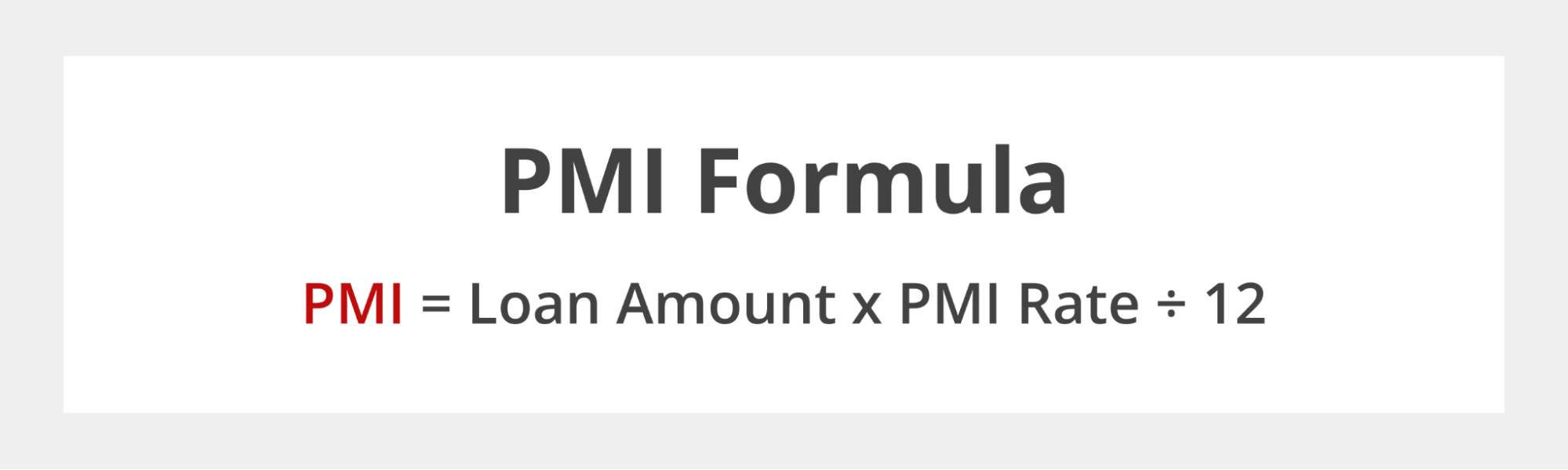

Knowing how to calculate your possible PMI monthly mortgage payment can help you understand the total cost of borrowing. The basic formula is:

PMI = Loan Amount x PMI Rate ÷ 12

Here’s a practical example of how to calculate the PMI on a mortgage:

If you’re buying a $400,000 home with 10% down, your loan amount is 360,000. With a credit score of 720, you might qualify for a 0.5% annual PMI rate. Your calculation would be:

$360,000 × 0.005 ÷ 12 = $150 per month.

Remember, PMI rates vary based on your borrower profile. Excellent credit and higher down payments earn you rates on the lower end, while lower credit scores and minimal down payments push you toward the higher end of this range.

When learning how to calculate PMI on mortgage payments, remember that this cost gets added to your monthly housing payment along with principal, interest, taxes, and insurance (often called PITI + PMI). This affects your debt-to-income (DTI) ratio and overall affordability calculations when lenders evaluate your loan application.

Many borrowers are surprised to discover that PMI can push their total monthly payment beyond what they initially budgeted for, which is why calculating this expense upfront is so important for realistic home shopping.

How to Calculate PMI Removal Timeline

Understanding how to calculate PMI removal helps you plan when this monthly expense will end. PMI is automatically canceled when your loan balance reaches 78% of the original home value, which typically happens when you’ve built 22% equity through payments and appreciation.

You can request PMI removal once you reach 20% equity in your home. To calculate this timeline, divide your current loan balance by your home’s current value. When this ratio drops to 80% or below, you’ve hit the 20% equity threshold.

Here’s how the math works: If you originally borrowed $300,000 on a $350,000 home, you need your loan balance to drop to $280,000 (80% of $350,000) to request removal. However, if your home has appreciated to $400,000, you could potentially request removal when your balance drops to $320,000 instead. Conversely, if your home’s value has declined, you might need to wait longer even after reaching 20% of the original purchase price.

Ultimately, there’s no simple way to calculate when your PMI will be removed because houses appreciate or depreciate in value, which will influence your timeline. Your lender will provide an amortization schedule showing when your loan balance is projected to reach these thresholds based on regular payments alone.

Early removal options include refinancing if rates have dropped or ordering a new appraisal if your home has significantly appreciated. Some borrowers combine extra principal payments with appreciation to reach the 20% equity threshold faster than their normal amortization schedule.

Strategies to Reduce or Avoid PMI

If you’re looking to minimize or eliminate PMI costs, you have several options available to you. Each approach has different financial implications and works better for certain borrower situations:

- Increase down payment to 20% or more: This eliminates PMI entirely and often qualifies you for better interest rates as well. The challenge is having enough cash available while maintaining adequate reserves for emergencies and closing costs.

- Choose lender-paid PMI options (LPMI): LPMI involves your lender paying the PMI premium in exchange for a slightly higher interest rate. This can work well if you plan to stay in the home long-term, but it means you can’t cancel the “PMI” component later like traditional borrower-paid PMI.

- Consider piggyback loans: Also called 80-10-10 financing, this involves taking a first mortgage for 80% of the home’s value, a second mortgage for 10%, and putting 10% down. Other variations include 80-15-5 or 80-20-0 structures, depending on your down payment amount. This strategy avoids PMI on the first mortgage, though you’ll pay interest on both loans and may face higher overall costs.

Making extra principal payments early in your loan can help you reach 20% equity faster, which is one of the most effective strategies for early PMI removal. Even an extra $100-200 per month toward principal can shave years off your PMI timeline, especially when combined with home appreciation. Some borrowers use tax refunds, bonuses, or other windfalls to make larger principal payments specifically to accelerate PMI cancellation.

No PMI Mortgage Options

Some loan programs don’t come with a PMI requirement when you make a down payment of less than 20% the home’s purchase price. These options come with different eligibility requirements and trade-offs worth considering:

- VA loans: VA loans offer 100% financing without PMI. However, you must pay a one-time funding fee.

- No PMI loan: Some lenders offer specialty no PMI mortgage loans that eliminate PMI in exchange for slightly higher interest rates. These can be attractive for borrowers who want to minimize their monthly payments or who plan to move or refinance within a few years.

- USDA loans: USDA loans eliminate PMI and instead charge an upfront fee and an annual fee that can be lower than PMI. These loans can finance 100% of the purchase price for eligible borrowers and properties.

- Non-QM loans: Non-qualified mortgage loans sometimes waive PMI requirements, though these typically come with higher rates and stricter qualification requirements. They can work for borrowers with unique financial situations who don’t fit traditional lending guidelines.

Work With an Experienced Lender

Understanding PMI calculations and alternative options requires expertise that comes from working with experienced mortgage professionals. At Griffin Funding, we help borrowers understand all their options for minimizing or eliminating PMI costs.

Our loan specialists can run scenarios showing how different down payment amounts affect your PMI costs and overall monthly payments throughout the life of your loan. We’ll also explore whether alternative loan programs might better match your financial situation and long-term goals.

Ready to explore your options? Download the Griffin Gold app or get started online today.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Why do I have to pay PMI?

Is it worth putting 20% down to avoid PMI?

Is PMI tax-deductible?

However, the recent One Big Beautiful Bill (OBBB) Act recently reinstated this deduction for 2026, but it’s subject to income qualifications. While tax laws can change, borrowers should not count on PMI deductions when calculating the true cost of their mortgage insurance.

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...