What Is a Home Renovation Loan? Loan Types, Pros, & Cons

KEY TAKEAWAYS

- Home renovation loans provide upfront capital to begin your project without waiting years to save the full amount.

- From government-backed FHA 203(k) loans to personal loans and cash-out refinances, you can choose the financing method that best fits your situation.

- Strategic renovations funded through these loans can boost your property’s market value, potentially offsetting the borrowing costs.

- While some home renovation loans require excellent credit, others offer more flexible qualification criteria for homeowners with different financial profiles.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformWhether you’re planning a kitchen makeover or considering a complete home transformation, funding your renovation project doesn’t have to drain your savings account. A home renovation loan can bridge the gap between your vision and your budget, giving you the flexibility to tackle everything from minor updates to major structural changes.

What Is a Home Renovation Loan?

A home renovation loan is a borrowing option specifically designed to fund home improvement or remodeling projects. These loans provide homeowners with the capital needed to enhance their property, whether they’re planning cosmetic updates like new paint and fixtures or major structural changes such as room additions or complete kitchen overhauls.

Home renovation loans come in several different forms, each with unique features and requirements. Some are personal loans that don’t require collateral, while others are mortgage-based loans that use your home’s equity as security. The flexibility of these financing options means you can find a solution that matches both your project scope and your financial situation.

These loans can cover virtually any type of home improvement project. Small updates like replacing appliances or installing new flooring are just as eligible as major renovations involving structural changes, electrical work, or plumbing updates.

How Do Home Renovation Loans Work?

The process of securing and using a home renovation loan follows a familiar pattern that most borrowers find straightforward. You’ll start by submitting an application that includes details about your financial situation, credit history, and renovation plans. Lenders evaluate this information alongside your ability to repay the loan before making an approval decision.

Once approved, how you receive your funds depends on the type of loan you’ve chosen. Some lenders provide the entire loan amount upfront as a lump sum, giving you immediate access to all the money you need. Others structure disbursements around project milestones, releasing funds in stages as you complete different phases of your renovation. A draw-based approach helps ensure the money goes toward its intended purpose and can provide additional oversight for larger projects.

Interest rates and loan terms vary significantly based on the loan type and your creditworthiness. Personal loans typically carry higher interest rates but offer faster approval and funding. Mortgage-based options usually provide lower rates but involve longer processing times and more stringent qualification requirements. Your credit score helps lenders determine both your eligibility and the interest rate you’ll receive, making it worth checking and potentially improving your credit before applying.

Types of Home Renovation Loans

Not all renovation loans work the same way, and choosing the right type can save you thousands in interest and fees. Here are the main options available to homeowners looking to finance their improvement projects:

- FHA 203(k) Loans: FHA 203(k) loans are government-backed loans that help buyers purchase and renovate a property simultaneously. The loan covers the home’s purchase and renovation costs in a single mortgage, making it an excellent option for buyers interested in fixer-uppers. The FHA backing means more flexible qualification requirements, though the renovation work must meet specific guidelines and use approved contractors.

- Home Equity Loans & HELOCs: These options make use of the equity you’ve built in your home as collateral for the loan. Home equity loans give you a fixed lump sum with predictable monthly payments, while home equity lines of credit (HELOCs) let you borrow against your available credit limit as needed, much like a credit card. Both typically offer lower interest rates than unsecured loans because your home secures the debt.

- Personal loans: Unsecured personal loans don’t rely on collateral, making them accessible to homeowners who haven’t built significant equity or prefer not to risk their property. These loans typically feature faster approval processes and quicker funding, sometimes within days of application. However, the convenience comes at a cost, with higher interest rates than other options.

- Cash-out refinance: With this option, you can refinance for home improvements by replacing your existing mortgage with a larger one and giving you the difference in cash for renovation expenses. It’s most attractive when mortgage rates are favorable, though. This option works best for homeowners with substantial equity and good credit.

Best Home Renovation Loans for Different Needs

Choosing the right renovation financing depends heavily on your specific circumstances and project requirements. For major structural renovations or whole-house remodels, mortgage refinance solutions like cash-out refinancing often provide the lowest interest rates and longest repayment terms. These loans can handle large project budgets while keeping monthly payments manageable.

Smaller projects and quick fixes might be better suited to personal loans or HELOCs. Personal loans offer speed and simplicity, making them ideal when you need funds quickly or when your project budget is relatively modest. HELOCs provide ongoing access to funds, which works well for projects that might expand in scope or for homeowners planning multiple improvement phases over time.

When comparing your options, consider loan amount limits, interest rates, repayment terms, and how quickly you need the funds. Also factor in any restrictions on how you can use the money and whether the lender requires contractor estimates or project oversight.

Some homeowners might benefit from non-QM loans if their financial situation doesn’t fit traditional lending criteria.

How to Get a Home Renovation Loan

Securing a home renovation loan means understanding what lenders expect from borrowers. These steps will increase your chances of getting approved for a renovation loan:

- Determine your renovation budget: Develop a detailed budget that includes materials, labor, permits, and a contingency fund for unexpected expenses. Get contractor estimates and architectural plans when necessary, as these documents strengthen your application and show lenders you’ve done serious planning.

- Check your credit score: Review your credit report early in the process. If your score needs improvement, consider paying down debts before applying.

- Compare lenders and loan options: When researching lender and loan options, consider factors like interest rates, loan amounts, repayment terms, funding speed, and any restrictions on how you can use the money.

- Gather required documentation: Collect necessary paperwork before starting applications, including recent pay stubs, tax returns, bank statements, and details about your current mortgage and other debts. For equity-based loans, you might need a recent home appraisal. Having these documents ready speeds up the application process and demonstrates you’re a serious, organized borrower.

- Apply: Submit applications to your top lender choices, being honest about your financial situation and renovation plans. Most lenders allow online applications, and you can often get pre-approved to understand your borrowing capacity before making final project decisions.

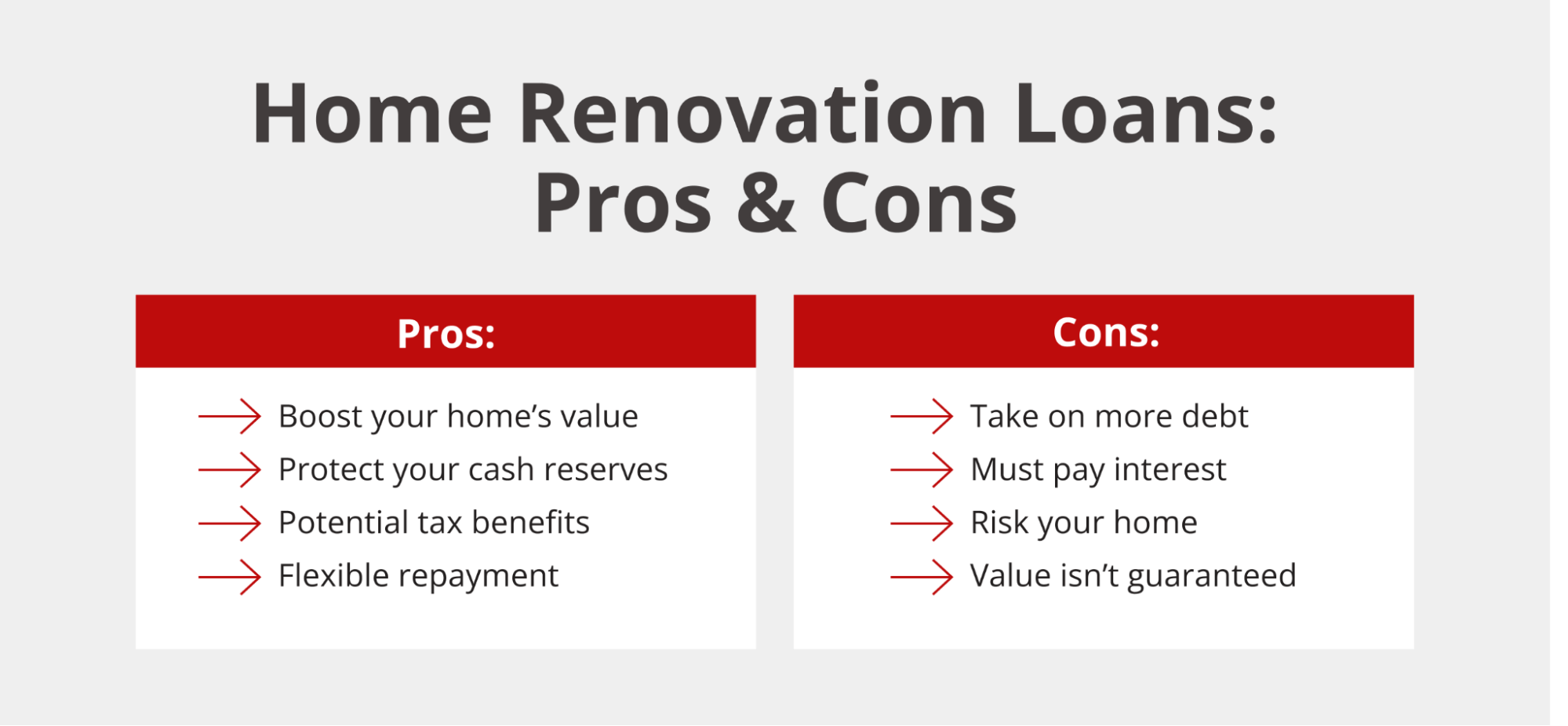

Pros and Cons of Home Renovation Loans

Home renovation loans offer many benefits for homeowners ready to improve their properties, such as:

- Increase home value: Renovations can boost your property’s market value, potentially providing a positive return on investment when you eventually sell.

- Preserve cash reserves: Financing allows you to tackle necessary repairs or desired upgrades without depleting your emergency savings or retirement accounts.

- Tax benefits available: Many renovation projects qualify for tax credits, particularly energy-efficient improvements that may earn federal or state tax benefits. Additionally, interest on some home renovation loans may be tax-deductible.

- Flexible payment terms: Spreading renovation costs over several years through loan payments makes large projects more financially manageable than paying cash up front.

Renovation loans also come with a few notable drawbacks you should consider before applying, including:

- Additional debt burden: You’re taking on extra monthly obligations that could strain your budget if your income changes or unexpected expenses arise.

- Interest costs add up: Borrowing money means paying more than the project’s actual cost, with interest charges increasing your total renovation expense.

- Home at risk: Some loan types use your property as collateral, meaning you could lose your home if you can’t make payments as agreed.

- No guaranteed returns: Market conditions and renovation quality affect whether your improvements actually increase your home’s value as expected, making returns uncertain.

When a Home Renovation Loan Makes Sense

Understanding when to use renovation financing versus paying cash or waiting can help you make the smartest financial decision for your situation. A home renovation loan makes the most sense when:

- Purchasing a fixer-upper: An FHA 203(k) loan allows you to buy in a desirable neighborhood at a lower price point while customizing the home to your preferences, all with a single mortgage payment.

- Facing urgent repairs: Issues like roof replacement, HVAC system updates, or electrical work often can’t be postponed without risking further damage or safety concerns that would cost more to fix later.

- The project will increase home value: Strategic improvements like kitchen remodels, bathroom updates, or adding square footage can boost your property’s market value enough to justify the borrowing costs.

- You have a stable income: If your job is secure and you can comfortably handle the monthly payments, financing allows you to complete projects now rather than waiting years to save up the full amount.

- Interest rates are favorable: Low borrowing costs make financing more attractive, especially for secured loans like cash-out refinancing or home equity loans.

Before choosing loan financing, evaluate alternatives like saving up for the project, tackling some work yourself to reduce costs, or using credit cards for smaller purchases. While credit cards offer convenience for minor expenses, their high interest rates make them unsuitable for large renovation budgets.

RTL loans and hard money loans provide another specialized option for real estate investors who need fast funding for fix-and-flip projects or rental property improvements.

Explore Your Financing Options

Ready to start your renovation project? The right financing can make a difference in how smoothly your renovation project goes and how comfortable you feel with the monthly payments.

Griffin Funding helps homeowners figure out the renovation financing process, giving you personalized advice to pick the right loan for your unique situation. We offer a variety of home renovation and improvement loans, from construction loans to non-QM loans.

Don’t let financing concerns hold back your renovation plans. Download the Griffin Gold app to compare loan options and learn how we can help you bring your vision to life.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

Net Operating Income: Definition, Formula, & Examples

What Is Net Operating Income (NOI)? Net operating income measures how much money your investment property gene...

Best DSCR Lenders: Griffin Funding vs Angel Oak vs Kiavi vs Visio vs Lima One vs Easy Street

What to Look for in a DSCR Lender Choosing the best DSCR lender for your unique situation means evaluating sev...

Cash on Cash Return in Real Estate: Definition, Formula, & Examples

What Is Cash on Cash Return? Cash on cash return (CoC) is a metric that measures the annual income you generat...