Net Operating Income: Definition, Formula, & Examples

KEY TAKEAWAYS

- Net operating income measures your property’s profitability by showing income after operating expenses but before debt service.

- The net operating income equation is: Net Operating Income = Gross Rental Income – Operating Expenses.

- Understanding how to calculate net operating income helps you compare properties and make informed investment decisions.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformNet operating income (NOI) represents the true earning power of your investment property. Understanding what net operating income is can help you make smarter investment decisions and more competently manage your portfolio.

What Is Net Operating Income (NOI)?

Net operating income measures how much money your investment property generates after you pay operating expenses but before you make mortgage payments. This metric gives investors, lenders, and appraisers a standardized way to evaluate property performance.

You need to understand what is net operating income because it strips away financing decisions and focuses only on operational profitability. Two investors can own identical properties with different loan terms, but the NOI remains the same because it excludes debt payments.

Lenders don’t approve 1–4 unit DSCR loans off NOI. For lending, DSCR is typically calculated as Gross Rent ÷ PITIA (principal, interest, taxes, insurance, and (if applicable) HOA/MI). In other words, the lender’s DSCR test compares rent to the total mortgage payment and generally does not subtract operating expenses.

By contrast, investors use NOI to measure a property’s operating performance (NOI = Gross Operating Income − Operating Expenses) for things like valuation, cap rates, and comparing deals.

NOI differs from other financial metrics in important ways. Unlike net income, NOI excludes mortgage payments, depreciation, and income taxes. Unlike EBITDA (earnings before interest, taxes, depreciation, and amortization), NOI applies specifically to real estate and focuses on operational performance.

Investors who know how to find net operating income gain a powerful tool for evaluating deals quickly. You can assess whether a property meets your investment criteria by calculating this single number, regardless of how you plan to finance the purchase.

Net Operating Income Formula

The net operating income formula provides a simple calculation that reveals your property’s true earning power:

NOI = Gross Operating Income – Operating Expenses

NOI = Gross Operating Income – Operating Expenses

Gross Operating Income includes all revenue your property generates, such as:

- Monthly rent payments from tenants

- Parking fees

- Laundry and vending machine income

- Pet fees and deposits

- Storage unit rentals

- Late payment fees

Operating Expenses cover the costs of running your property and are essential for calculating accurate net operating income (NOI). These expenses represent the ongoing costs required to maintain and manage the property, not one-time capital improvements or financing costs.

A simple way to remember the most common operating expense categories is the acronym TIMMUR:

- T – Taxes: Property taxes and any state or local assessments.

- I – Insurance: Hazard, liability, and property insurance premiums.

- M – Management: Fees paid to property management companies or on-site staff.

- M – Maintenance: Regular upkeep, cleaning, landscaping, and minor repairs to preserve property condition.

- U – Utilities: Utilities paid by the landlord, such as water, trash, or electricity in common areas.

- R – Repairs: Routine or emergency repairs that keep the property in rentable condition.

Additional operating expenses that fall outside TIMMUR but still affect NOI include:

- HOA or condo fees

- Marketing and advertising costs

- Legal and accounting fees

According to the IRS Publication 527 – Residential Rental Property, these are considered “ordinary and necessary expenses for managing, conserving, or maintaining rental property.” Including all relevant TIMMUR categories in your analysis ensures your NOI accurately reflects operational performance.

The net operating income formula excludes certain expenses, like:

- Mortgage payments (principal and interest)

- Capital expenditures like major renovations

- Depreciation and amortization

- Income taxes

- Owner’s personal expenses

Net Operating Income Example Calculations

Learning how to calculate net operating income becomes clearer when you work through real examples.

Example 1: You own a single-family home that generates the following income and expenses:

- Monthly rent: $2,200

- Annual rental income: $26,400

- Property taxes: $3,600

- Insurance: $1,200

- Maintenance: $1,800

- Property management (10%): $2,640

- HOA fees: $1,200

- Total operating expenses: $10,440

NOI calculation: $26,400 (Gross Operating Income) – $10,440 (Operating Expenses) = $15,960 NOI

Example 2: You purchase a four-unit apartment building with these figures:

- Four units at $1,500/month each: $6,000/month

- Laundry income: $200/month

- Parking fees: $300/month

- Total monthly income: $6,500

- Annual gross operating income: $78,000

- Property taxes: $8,500

- Insurance: $3,200

- Maintenance and repairs: $6,000

- Property management: $7,800

- Utilities (common areas): $2,400

- Marketing: $1,100

- Total operating expenses: $29,000

NOI calculation: $78,000 (Gross Operating Income) – $29,000 (Operating Expenses) = $49,000 NOI

How NOI Is Used in Real Estate Investing

Net operating income serves multiple purposes for both investors and lenders.

For investors, NOI measures the property’s true operating performance. It’s used to:

- Evaluate profitability and determine whether a property generates sufficient income to justify the investment.

- Compare different property types – such as a single-family home, duplex, or small apartment building – because NOI isolates operations from financing. When you build a real estate portfolio, knowing how to find net operating income helps you identify the best opportunities.

- Estimate value using the capitalization rate (Cap Rate), where Value = NOI ÷ Cap Rate.

For lenders, the focus is slightly different. Lenders qualifying DSCR loans do not underwrite using NOI in the same way investors do. Instead, most lenders calculate DSCR as:

DSCR = Gross Monthly Rent ÷ PITIA (Principal, Interest, Taxes, Insurance, and HOA, if applicable)

This version of DSCR compares gross rent to the total monthly mortgage payment, not to NOI. It helps lenders quickly determine whether the property generates enough income to cover its loan obligations. A DSCR of 1.00 or higher typically means the property’s rent covers its PITIA payment, while many lenders prefer a 1.10–1.25 DSCR for approval.

By contrast, investors use NOI-based DSCR calculations when analyzing larger (5+ unit) or commercial properties, where:

DSCR = NOI ÷ Annual Debt Service

That approach incorporates all operating expenses and provides a more complete picture of income coverage and risk.

Understanding both versions is essential: lenders use DSCR for loan qualification, while investors use NOI for valuation, performance, and comparison.

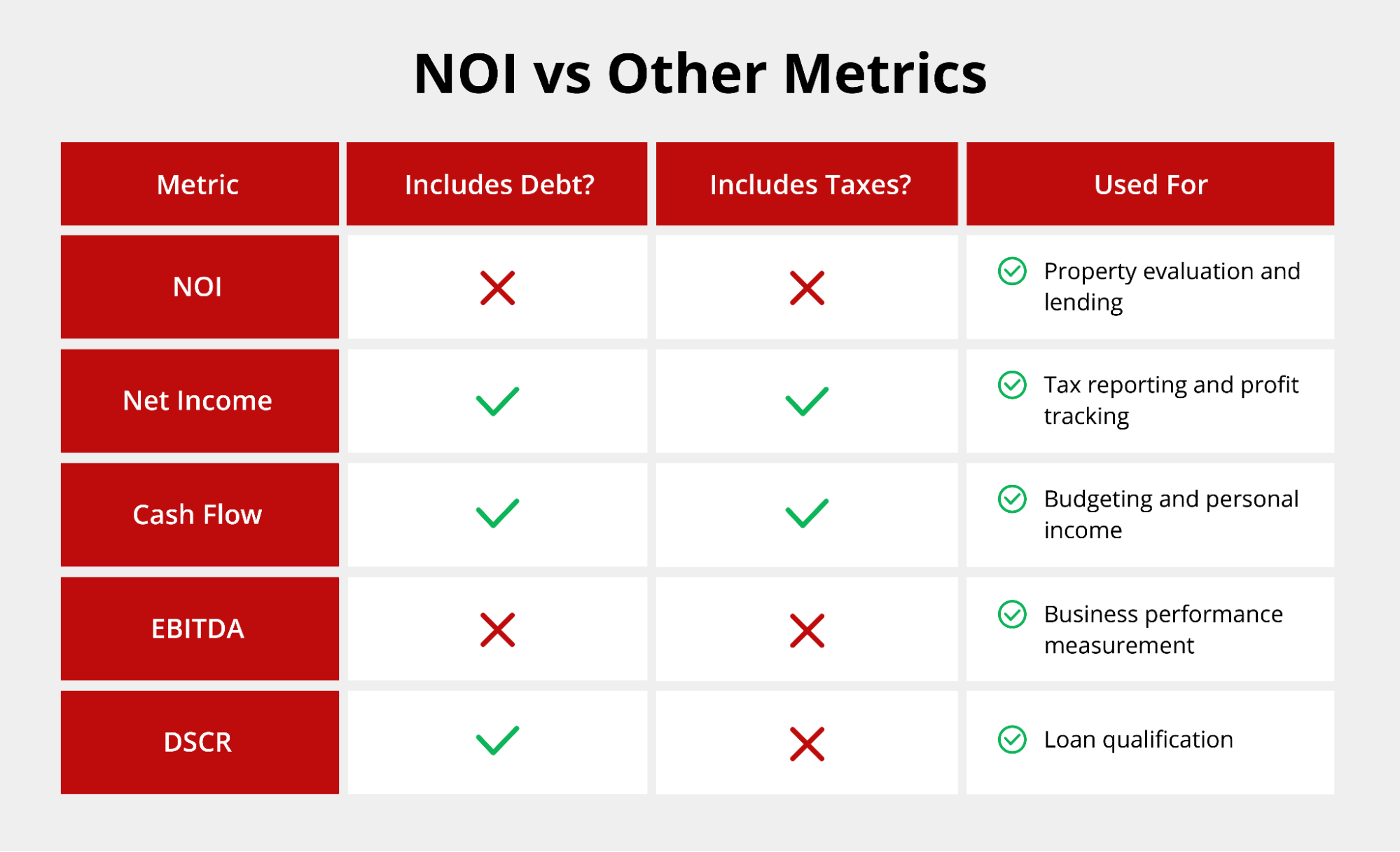

Net Operating Income vs Other Metrics

Understanding what is net operating income requires knowing how it differs from related financial metrics.

- Net operating income vs Net income: Net income represents your final profit after all expenses, including mortgage payments, depreciation, and income taxes. Net operating income stops before these items, focusing only on operational performance. You use net income for tax reporting and understanding your actual profit. You use NOI for property analysis and loan qualification because it isolates operational performance from financing decisions.

- NOI vs Cash flow: Cash flow measures the actual money in your pocket after all expenses, including mortgage payments. Cash flow tells you how much you earn monthly or annually after paying everything. The NOI equation excludes debt service, so NOI typically exceeds cash flow. A property might show strong NOI but negative cash flow if mortgage payments are too high.

- NOI vs EBITDA: EBITDA (earnings before interest, taxes, depreciation, and amortization) applies to businesses generally. NOI serves specifically for real estate and focuses on operational income after direct expenses.

- NOI vs DSCR: While both metrics measure income performance, investors and lenders use them differently:

- Investors calculate NOI (Net Operating Income) to understand a property’s operational profitability, how much income remains after all operating expenses, but before financing costs. They often use NOI to determine value, cap rate, and long-term performance.

- Lenders, on the other hand, use DSCR (debt service coverage ratio) to assess loan repayment ability. Most residential investment lenders calculate DSCR as Gross Rent ÷ PITIA (Principal, Interest, Taxes, Insurance, and HOA if applicable). This approach doesn’t account for detailed operating expenses—it simply gauges whether rental income can cover the total mortgage payment.

To sum it all up:

- Use NOI when evaluating properties before purchase or comparing investment options

- Use net income for tax purposes and tracking actual profit

- Use cash flow for budgeting and determining personal income

- Use DSCR when applying for loans or ensuring debt obligations are covered

- Review how to calculate ROI to understand total investment performance

How to Improve Your Property’s NOI

You can boost NOI by increasing revenue, reducing expenses, or both.

To increase revenue, raise rent strategically. Review market rates annually and adjust rent to match comparable properties. Even small increases compound over time.

Additionally, you can add services to increase your income, including:

- Coin-operated laundry facilities

- Reserved parking spaces

- Pet fees for tenants with animals

- Storage unit rentals

- Vending machines in common areas

To reduce operating expenses, consider the following:

- Energy efficiency upgrades: Installing LED lighting, programmable thermostats, and energy-efficient appliances reduces utility costs.

- Evaluate property management: Compare the costs of hiring a property management company versus managing the property yourself.

- Implement preventive maintenance: Scheduling routine inspections and addressing minor issues protects your investment and keeps operating expenses predictable.

Furthermore, always consider your tax benefits. While property taxes appear in the net operating income equation, exploring bonus depreciation opportunities can improve your overall financial picture through tax savings.

Start Building a Real Estate Investment Portfolio

Knowledge about NOI empowers you to evaluate investment opportunities, secure financing, and maximize profitability. Griffin Funding specializes in helping real estate investors access the capital they need to grow their portfolios. Whether you need investment property loans or DSCR loans, our team understands your unique needs.

Track your investment performance effortlessly with the Griffin Gold app, which helps you monitor property metrics and make informed decisions.

Ready to expand your real estate holdings? Get started online or call us today to discuss your financing options.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What is a good NOI?

What’s the difference between NOI and profit?

- Measures operational performance before mortgage payments

- Excludes debt service, depreciation, and taxes

- Used for property comparison and evaluation

- Shows final earnings after all expenses

- Used for tax reporting and personal income planning

Is net operating income the same as cash flow?

What expenses are excluded from NOI?

- Mortgage payments (principal and interest)

- Capital expenditures

- Depreciation and amortization

- Income taxes

Recent Posts

Net Operating Income: Definition, Formula, & Examples

What Is Net Operating Income (NOI)? Net operating income measures how much money your investment property gene...

Best DSCR Lenders: Griffin Funding vs Angel Oak vs Kiavi vs Visio vs Lima One vs Easy Street

What to Look for in a DSCR Lender Choosing the best DSCR lender for your unique situation means evaluating sev...

Cash on Cash Return in Real Estate: Definition, Formula, & Examples

What Is Cash on Cash Return? Cash on cash return (CoC) is a metric that measures the annual income you generat...