Bank Statement Loan Document Checklist

KEY TAKEAWAYS

- Bank statement loans let you qualify for a home or investment property loan using 12 to 24 months of consistent bank statements.

- Self-employed borrowers typically need business documentation like a CPA letter, a business license, and proof of operation length.

- Personal identification, credit authorization forms, and property documents are essential parts of your bank statement loan documentation.

- Preparing optional supporting documents can strengthen your application and improve your approval odds.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformIf you’re self-employed and need a mortgage or want to refinance your existing home loan, you’ll run into a common challenge: tax returns that understate actual income due to legitimate business deductions.

Bank statement loans offer an alternative to traditional mortgage loans because they allow you to qualify using alternative documentation. However, the key to a smooth approval process is knowing exactly what bank statement loan documents you’ll need upfront.

This bank statement loan checklist walks you through every document required so you can prepare your mortgage application with confidence and avoid common delays.

KEY TAKEAWAYS

- Bank statement loans let you qualify for a home or investment property loan using 12 to 24 months of consistent bank statements.

- Self-employed borrowers typically need business documentation like a CPA letter, a business license, and proof of operation length.

- Personal identification, credit authorization forms, and property documents are essential parts of your bank statement loan documentation.

- Preparing optional supporting documents can strengthen your application and improve your approval odds.

What Is a Bank Statement Loan?

A bank statement loan is a non-QM mortgage designed for borrowers who can’t easily verify their income through traditional W-2s or tax returns. Instead of relying on documented wages, lenders evaluate your income based on deposits shown in your personal or business bank statements. This makes it an ideal solution for self-employed individuals, independent contractors, and small business owners.

The main difference between bank statement loans and conventional mortgages is how your income is verified. Traditional loans require two years of tax returns and pay stubs, which often understate the true earning power of self-employed borrowers who take advantage of business deductions. Bank statement loans look at your actual cash flow instead, giving a more accurate picture of what you earn.

This loan type has grown significantly in popularity as more Americans work for themselves. According to recent data, over 16 million people in the U.S. are self-employed, and many find traditional lending requirements too restrictive. Self-employed mortgages provide a practical path to homeownership without penalizing entrepreneurial success.

As non-traditional mortgage loans, bank statement loans are structured to accommodate unique financial situations that don’t fit the conventional mold. The main benefits of these loans include:

- No tax return requirements, which means you don’t have to explain away legitimate business deductions.

- More flexibility in income documentation that reflects your actual income rather than adjusted gross income.

- Faster approval timelines since there’s less documentation to review and verify.

- Versatile property types, including primary residences, second homes, and investment properties.

Whether you need financing for a primary residence or investment property loans for rental properties, bank statement loans provide the flexibility to qualify.

For more context on how these loans work in real scenarios, check out these bank statement loan examples.

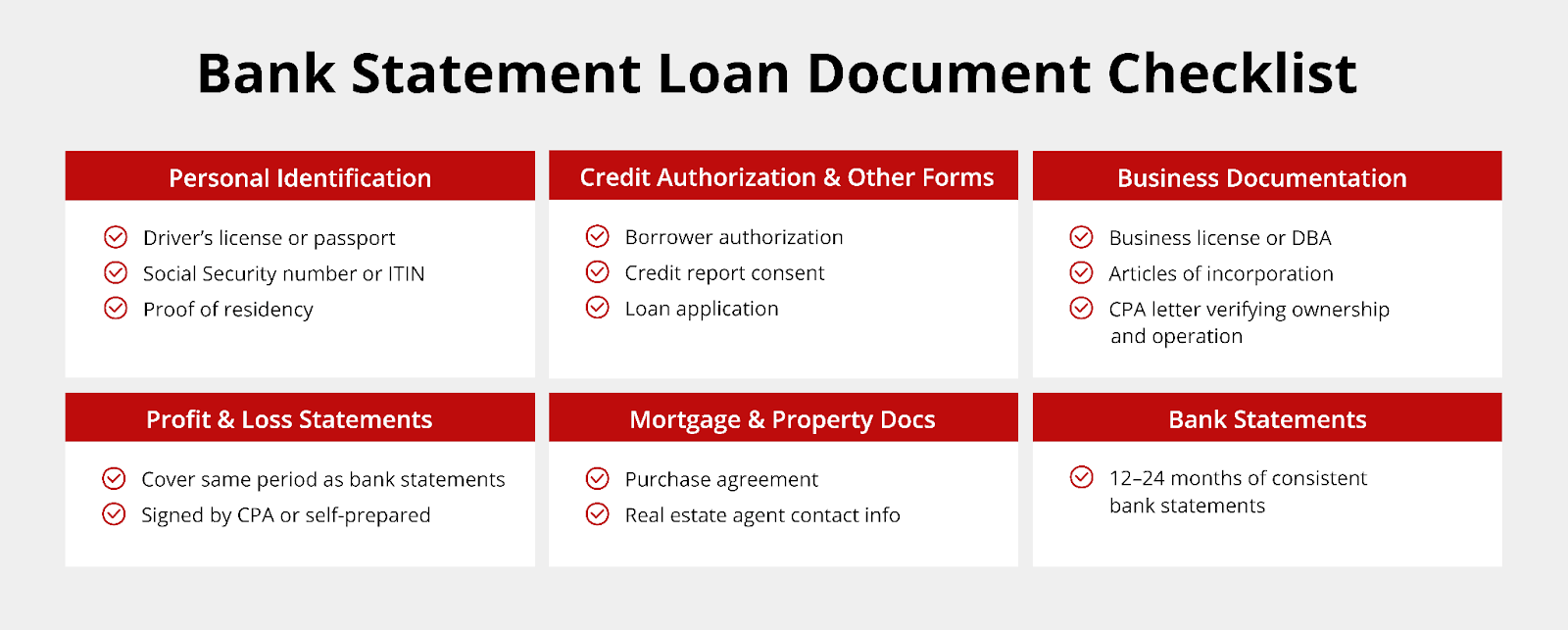

Bank Statement Loan Document Checklist

Use this bank statement loan checklist to see exactly what documentation you’ll need when applying for this type of loan:

Personal Identification Documents

These documents are required to qualify for a mortgage of any type. Lenders need to confirm who you are and that you legally reside where you claim. Here are the identification documents you’ll need for a bank statement loan:

- Government-issued photo ID: Your driver’s license or passport verifies your identity and must be current and unexpired.

- Social Security Number or ITIN: You’ll need to provide your SSN or Individual Taxpayer Identification Number for credit checks and verification.

- Proof of residency: Recent utility bills, lease agreements, or other official documents prove to lenders that you live where you say you do.

Bank Statements

Bank statements show your income patterns and financial stability over an extended period. Here are the bank statement loan documents you’ll need to share with lenders:

- 12 to 24 months of personal or business bank statements: Most lenders require at least one year, though 24 months strengthens your application and may improve your terms.

All statements should come from the same bank account or accounts to show reliable income patterns.

Provide every page of each statement, including pages that appear blank or show minimal activity. Missing pages can delay your approval or raise red flags. To streamline the bank statement loan application process, apply with Griffin Funding — our software allows you to skip manually uploading your bank statements, and instead automatically sync 12-24 months’ worth of bank statements with the click of a button.

Make sure your statements clearly show regular deposits that demonstrate consistent income. Lenders calculate your qualifying income by averaging your total deposits and applying an expense ratio, so it’s important to have accurate records.

Business Documentation

If you’re self-employed, you’ll need to prove your business is legitimate and has been operating for a sufficient length of time. Here are the business documents you’ll need:

- Proof of self-employment: Documentation showing you’ve been self-employed for at least two years gives lenders confidence in your income stability.

- Business license: If possible, you’ll need to share a current, valid business license registered in your name or your company’s name.

- Articles of incorporation or DBA: Provide your legal business formation documents, whether that’s incorporation papers or a “Doing Business As” registration.

- CPA letter: This document, prepared by a certified public accountant, verifies your business ownership and how long you’ve been operating (not always required).

Profit & Loss Statements

Profit and loss statements are not always required, but they do give lenders insight into your business’s financial health and income trends. You can submit P&L statements prepared by your CPA or create them yourself, though both must be signed.

These statements help establish that your earnings are reliable and not subject to wild fluctuations that might make repayment difficult. Even if you prepare your own statements, make sure they’re detailed and accurate. They should cover the same timeframe as your bank statements and reflect the deposits shown in those accounts.

Mortgage and Property Documents

When you’re purchasing or refinancing a property, you’ll need transaction-specific documentation. Here are the documents you’ll need:

- Purchase agreement: The signed contract showing property details and the agreed price for home purchases.

- Real estate agent contact information: Your agent’s name, phone number, and email if you’re working with one.

The purchase agreement and agent details help lenders assess the property value, verify transaction details, and coordinate with other parties involved.

Once you apply for the mortgage, your lender will order an appraisal to determine the property’s current market value, which is critical for both purchases and refinances. You’ll receive a copy of the appraisal report once it’s completed.

The lender will also provide an estimated closing disclosure during the process, followed by a final closing disclosure a few days before closing that outlines your closing costs, loan terms, and cash needed to close. Numbers may shift between the estimated and final versions based on changes to your loan terms, updated property taxes, insurance costs, or other closing adjustments.

Credit Authorization & Other Forms

Standard lending forms allow lenders to access your credit history and process your application properly. Here are the forms you’ll need to complete:

- Signed borrower authorization form: This gives the lender permission to verify the information you’ve provided and access necessary records.

- Credit report consent: You’ll authorize the lender to pull your credit report.

- Loan application: The formal application form captures your personal information, employment details, assets, debts, and the loan amount you’re requesting.

These administrative documents are straightforward but essential. Without proper authorization, lenders can’t move forward with underwriting your loan.

Optional Documents to Strengthen Your Application

While not strictly required, certain supporting documents can improve your chances of approval and help you secure better loan terms. Your lender may ask for these bank statement loan documents:

- Letter of explanation: If you have large deposits that aren’t regular income or gaps in your banking history, a clear written explanation helps underwriters understand your situation.

- Proof of other income sources: Documentation of rental income, investment returns, royalties, or other earnings demonstrates additional financial stability.

- Asset statements: Showing retirement accounts, savings balances, or investment portfolios proves you have reserves beyond your regular income.

- Co-borrower documents: If you’re applying with a spouse or partner, include their identification, income documentation, and credit authorization as well.

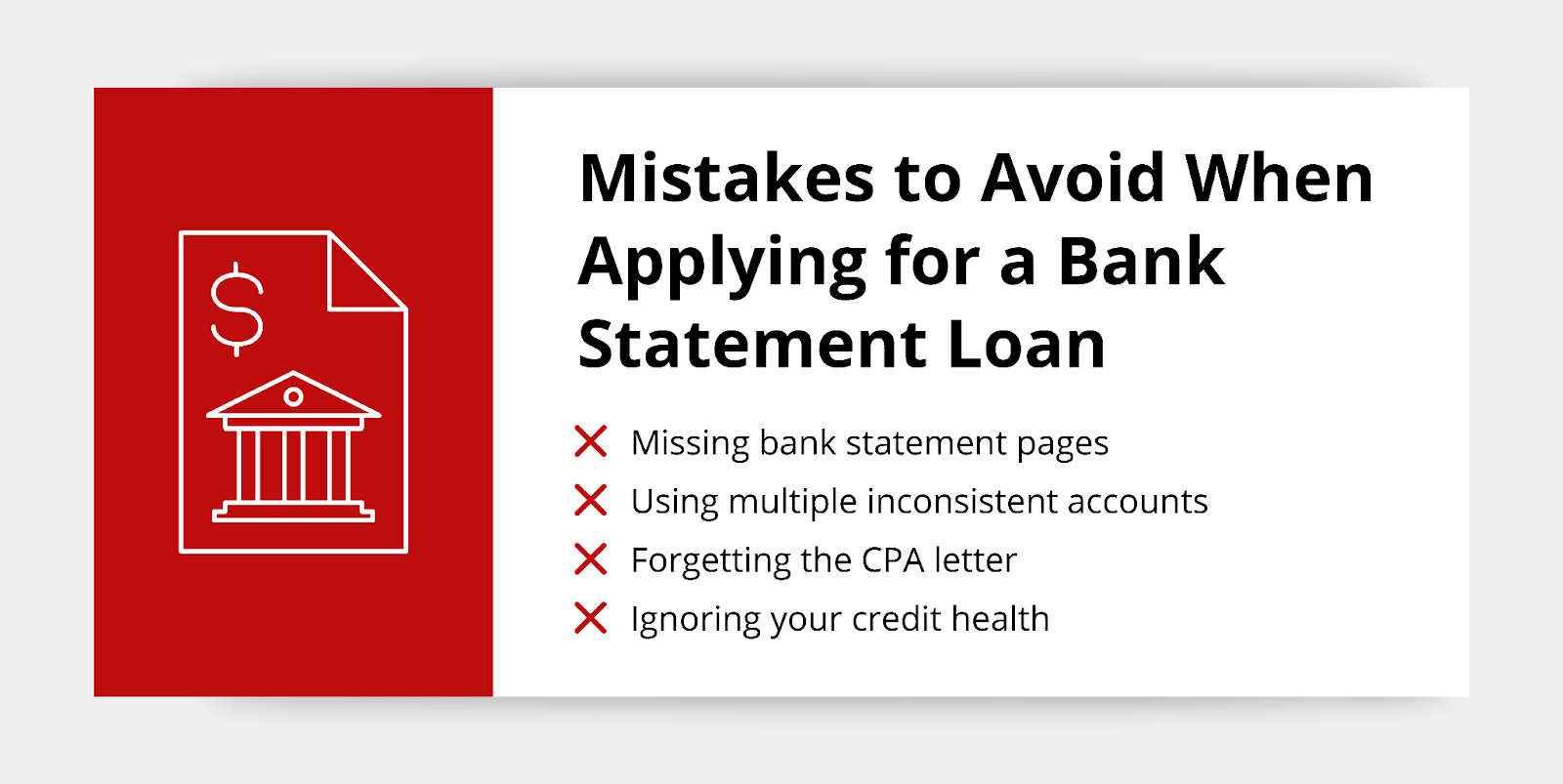

Common Mistakes to Avoid

Many bank statement loan applications get delayed or declined because of preventable errors. Watch out for these frequent pitfalls:

- Submitting incomplete bank statements: Missing even one page from a single month can stall your application while the lender requests additional documentation.

- Using multiple bank accounts without consistency: Switching between different accounts makes it harder for lenders to track your income patterns and may raise concerns about financial instability.

- Forgetting the CPA letter: For business income verification, this document is commonly required (Although not always mandatory). However, many borrowers overlook it until the lender specifically requests it.

- Ignoring credit profile basics: Just because you don’t need tax returns doesn’t mean credit doesn’t matter. Late payments, high debt ratios, and low credit scores can still negatively impact your application.

The best approach is to gather everything upfront and double-check that your documentation tells a complete, consistent story about your financial situation. Before you submit your documents and application, use a bank statement loan calculator or bank statement loan refinance calculator to estimate what you can afford and ensure your income documentation will support that amount.

Partner With Griffin Funding for Your Bank Statement Loan

At Griffin Funding, we understand that self-employed borrowers need flexible financing solutions. Our streamlined bank statement loan document checklist and experienced loan officers make the application process straightforward.

Ready to get started? Download the Griffin Gold app to track your application progress and access your loan documents anytime. Our team specializes in helping entrepreneurs and independent professionals achieve their homeownership goals with confidence.

Get started online today or contact our team to learn more about your financing options.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What documents are required for a bank statement loan?

The main bank statement loan documents you'll need are:

- 12 to 24 months of bank statements

- Government-issued photo ID

- Proof of residency

- Business documentation, such as a business license and a CPA letter

- Profit and loss statements

- Purchase agreement if you're buying a house

- Standard credit authorization forms

Can I use personal and business bank statements to get a loan?

Yes, you can use personal bank statements, business bank statements, or a combination of both. Many self-employed borrowers find that using business account statements provides a clearer picture of their income. However, lenders will accept personal statements as long as they show regular deposits that demonstrate your earning capacity.

Do I need tax returns for a bank statement loan?

Tax returns are not usually required for a bank statement loan. Instead of tax documents that often understate self-employed income due to business deductions, lenders use your actual bank deposits to calculate qualifying income. This makes the process much more accessible for entrepreneurs and independent contractors who write off significant business expenses.

Is it hard to get a bank statement loan?

Bank statement loans aren't necessarily harder to get than traditional mortgages, but they do have different requirements. The process is actually more straightforward for self-employed borrowers since you don't have to explain tax deductions or provide complicated business returns. As long as your bank statement loan documents are complete and accurate, the approval process moves efficiently.

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...