What Is a Lender Credit?

KEY TAKEAWAYS

- A lender credit is money a lender gives you to help cover closing costs.

- In exchange for the credit, you typically agree to a slightly higher mortgage interest rate.

- There is no one-size-fits-all cap on lender credits, as limits vary by loan type and lender policies.

- Lender credits can reduce upfront costs but may increase the total cost of the loan over time.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformWhen you’re getting ready to buy a home or you’re looking to refinance your mortgage, you’re likely to come across a range of new and unfamiliar terms. One thing that often sparks confusion for new buyers is lender credits.

If you’ve ever asked, “What is a lender credit on a mortgage?” or “How can it help with closing costs?” you’re in the right place. In this blog, we’ll break down what lender credits are, how they work, when they make sense, and what to consider before accepting one.

KEY TAKEAWAYS

- A lender credit is money a lender gives you to help cover closing costs.

- In exchange for the credit, you typically agree to a slightly higher mortgage interest rate.

- There is no one-size-fits-all cap on lender credits, as limits vary by loan type and lender policies.

- Lender credits can reduce upfront costs but may increase the total cost of the loan over time.

What Is a Lender Credit?

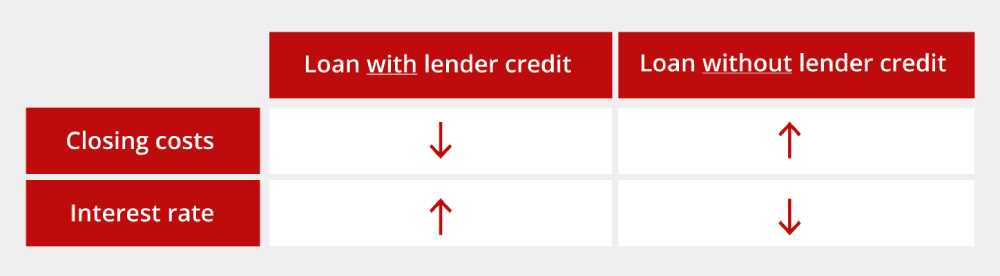

In simple terms, a lender credit is a rebate offered by your mortgage lender to reduce your upfront out-of-pocket costs, specifically your closing costs. It can sound like free money, but there’s a trade-off: you agree to take on a slightly higher mortgage interest rate in exchange.

Think of it this way: rather than paying thousands of dollars in fees at closing, your lender “credits” those costs to you. They then recover that money over time through the interest you’ll pay on your loan.

Lender credits can be applied toward a variety of typical closing costs, helping reduce what you owe upfront when finalizing your home loan. These costs commonly include fees such as title services, property taxes, appraisal fees, and expenses related to mortgage underwriting. Depending on your lender and loan type, the credit may also cover additional costs, such as document preparation or processing fees.

What Is the Maximum Lender Credit for Closing Costs?

Now that you understand what a lender credit is, you might be wondering, what is the maximum lender credit for closing costs?

There isn’t a universal cap, but several factors determine limits:

- Loan type: FHA, VA, and conventional loans each have different restrictions.

- Loan-to-value ratio: A higher LTV may restrict how much credit you can receive.

- Lender and investor guidelines: Some lenders offer more flexibility than others.

Maximum lender credit by loan type

Take a look at the maximum lender credit for closing costs as it relates to different loan types:

- FHA loans: The seller and lender can contribute up to 6% of the home’s value toward closing costs, which includes lender credits.

- VA loans: Lender credits are generally allowed, but the VA limits what veterans can pay out of pocket, making credits especially valuable. The total contribution from interested parties (like lenders or sellers) is capped at 4%.

- Conventional loans: Depending on the down payment, the cap on lender credits and concessions can range from 3% to 9%. For example, if you put less than 10% down, you typically can’t get more than 3% in total concessions.

Pros and Cons of Lender Credits

Lender credits offer a solid strategy to reduce upfront expenses, but they come with trade-offs.

Pros

- Lower upfront costs: Lender credits can dramatically reduce what you owe at the closing table—helpful if you’re short on liquid cash.

- Faster path to homeownership: They can make it easier to buy a home without needing to save for years.

- Free up funds for other expenses: Extra cash can be used for moving costs, renovations, furnishing your home, or establishing an emergency fund.

- Helpful in rising-rate environments: If rates are already high, the bump from a lender credit may not make a big difference in your monthly payment. However, these credits may not be available due to the risk of refinancing the loan when rates drop.

- Short-term savings: For buyers who don’t plan to stay in the home long-term, it can be a strategic trade-off, as the extra interest paid may be minimal over a few years.

Cons

- Higher interest rate: In exchange for the credit, you’ll accept a higher interest rate than if you had paid the closing costs yourself.

- More interest paid: Over a 15- or 30-year loan, the added interest can significantly outweigh upfront savings.

- Smaller refinance benefit: If you decide to refinance later, your starting interest rate may be higher, reducing potential savings.

- Not ideal for long-term homeowners: If you expect to be in the home for the full loan term, buying down your rate may save more money overall.

- Fewer future loan options: In some cases, locking in a higher rate today could impact your ability to qualify for future loans or programs that consider your existing debt obligations.

When to Use a Lender Credit

A lender credit can be a smart move, depending on your financial goals.

Knowing what lender credits are is especially helpful if you’re cash-strapped and need assistance covering closing expenses or if you’re a first-time home buyer looking to maintain liquidity. Refinancers may also find lender credits appealing if they want to minimize out-of-pocket costs during the transaction.

Additionally, buyers entering the market during a rising interest rate environment may use lender credits to get in sooner without tying up extra funds. If you don’t plan to stay in the home long-term, prioritizing lower upfront costs over long-term interest savings can also make sense.

Ultimately, it’s important to run the numbers, as a slightly higher interest rate might still be a worthwhile trade-off if your monthly payment remains within budget.

Alternatives to Lender Credits

Are you unsure if a lender credit is the right option? Depending on your financial situation, one of these alternatives might be a better fit.

For instance, seller concessions allow you to negotiate with the seller to cover some or all of your closing costs, which can be built into the purchase agreement. This is a common tactic in buyer-friendly markets where sellers are more willing to make deals.

Another route is through down payment assistance programs. These are especially beneficial for first-time buyers or those who meet specific income or location-based requirements. These programs can help cover both your down payment and closing costs, which dramatically reduces your need for upfront cash.

If you’re in a position to pay more upfront, consider paying for points. Also known as discount points, this involves paying a fee at closing to reduce your interest rate over the life of the loan. It can be a wise choice for the borrower who plans to stay in their home for many years since the long-term interest savings can outweigh the initial cost.

Get Started on Your Mortgage Journey Today

Understanding the ins and outs of lender credits can give you more control over your home financing strategy. Whether you’re aiming to lower your upfront costs or just curious about your options, having the proper guidance makes all the difference.

Griffin Funding specializes in creating customized lending solutions that align with your financial goals, including the strategic use of lender credits. Explore your options through the Griffin Gold app or get started online today.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What is a lender credit towards closing costs?

A lender credit toward closing costs is money your lender provides to help you cover upfront fees associated with buying a home or refinancing a mortgage. These costs include expenses like the home appraisal, title services, property taxes, and loan origination fees. Essentially, the lender agrees to absorb some or all of these charges on your behalf.

In return for the credit, you agree to a slightly higher interest rate on your mortgage. That means you'll pay more in interest over the life of the loan, but you'll save on the cash needed at closing. This trade-off can be worthwhile if you're short on funds.

Lender credits are particularly helpful for first-time buyers, borrowers in competitive housing markets, or those refinancing who prefer to keep their upfront expenses low.

Can a lender credit exceed closing costs?

No, a lender credit cannot exceed your total allowable closing costs. Lenders can only apply the credit to actual documented costs associated with finalizing the mortgage transaction. For example, if your total closing costs are $6,000, the lender can offer up to $6,000 in credits, but not more.

If the lender credit ends up being more than the closing costs, the excess amount won’t be refunded to you in cash. Mortgage rules prohibit borrowers from receiving a financial windfall from these types of credits, as they’re meant solely to reduce transaction costs, not to serve as cashback at closing.

Are lender credits and discount points the same thing?

No. They’re actually opposites. Lender credits and discount points both impact your mortgage interest rate, but they do so in opposite ways.

Lender credits lower your out-of-pocket costs upfront by increasing your mortgage interest rate. The lender takes the credit over time through higher monthly interest payments.

Discount points require you to pay more upfront in exchange for a lower mortgage interest rate. This option can be beneficial if you plan to stay in your home for many years, since you may end up saving more in long-term interest payments.

Can lender credit be used for down payment?

No, lender credits cannot be used for the down payment on a home purchase. Lender credits are applied toward closing costs.

Can lender credits be used in conjunction with seller credits?

Yes, lender credits can often be used in conjunction with seller credits. You can combine lender and seller credits to maximize affordability.

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...