What Is a Barndominium?

KEY TAKEAWAYS

- A barndominium is a hybrid structure that combines residential living with traditional barn space, often using a steel frame.

- These homes are cost-effective, customizable, and ideal for rural living or multi-functional needs.

- The cost to build a barndominium varies widely depending on factors such as location, finishes, materials, and design.

- Financing can be challenging, but options like non-QM loans and home equity lines of credit can help.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformBarndominiums have become increasingly popular across the United States. Blending rural charm with modern functionality, these unique homes offer more than just eye-catching aesthetics.

Whether you’re a DIY enthusiast or a home buyer seeking something unconventional, we break down everything you need to know before building or buying a barndominium.

KEY TAKEAWAYS

- A barndominium is a hybrid structure that combines residential living with traditional barn space, often using a steel frame.

- These homes are cost-effective, customizable, and ideal for rural living or multi-functional needs.

- The cost to build a barndominium varies widely depending on factors such as location, finishes, materials, and design.

- Financing can be challenging, but options like non-QM loans and home equity lines of credit can help.

What Is a Barndominium?

A barndominium (or “barndo”) is a portmanteau of “barn” and “condominium,” coined to describe a building that fuses barn-like utility with residential comfort. Originally developed for ranchers and rural dwellers who wanted to live close to their livestock or equipment, today’s barndominiums are stylish, spacious, and incredibly flexible.

At their core, barndominiums are metal- or steel-framed buildings that house both living quarters and utility areas like workshops, garages, or even small businesses. Think of them as the Swiss Army knife of housing—versatile, efficient, and surprisingly cozy.

These structures have grown beyond their humble beginnings. You can now find luxury barndominiums with vaulted ceilings, designer kitchens, and spa-like bathrooms nestled on wide-open lots.

What Is Considered a Barndominium?

To be considered a barndominium, the structure typically includes:

- A metal or steel frame shell, often pre-fabricated

- An open floor plan, maximizing flexible space

- Dual-purpose layout, combining living space with storage, workshop, or garage

Unlike modular homes or pole barns, barndominiums are designed with residential living in mind from the start. They meet residential building codes and can be fully customized.

Zoning and building codes can significantly impact whether a structure qualifies as a barndominium, particularly in suburban or highly regulated areas. Before building, check your local zoning rules to ensure a barndominium is permitted on your land.

What Is the Average Cost of a Barndominium?

While costs vary, the average price of a barndominium typically ranges between $120 to $200 per square foot, depending on location, labor, materials, and whether it’s a DIY or contractor-led project.

Barndominiums are often less expensive to build than traditional stick-built homes, which typically cost between $150 and $250 per square foot. You may also save on construction time, especially if using pre-fab kits.

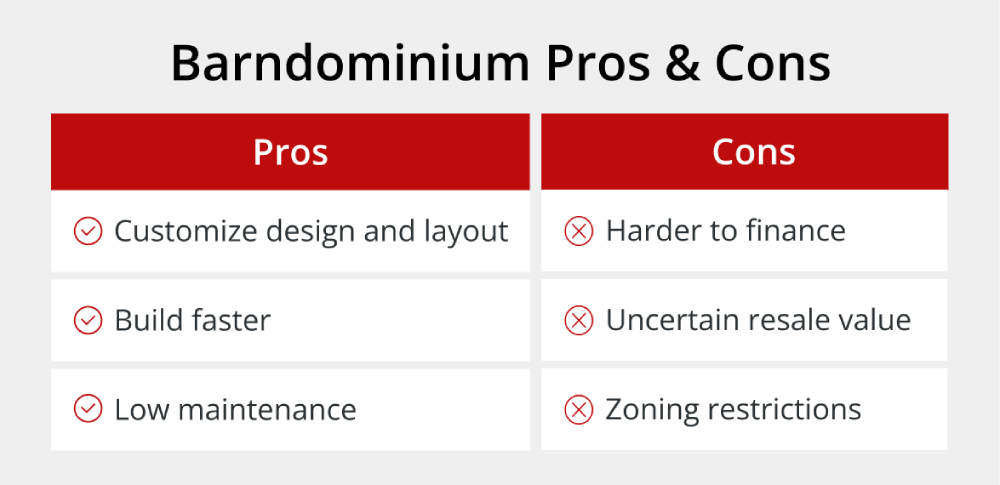

Pros and Cons of Barndominium Living

Barndos are gaining traction for a reason, but they come with tradeoffs.

Pros

- Customization: Easily adjust floor plans to suit your lifestyle. Whether you want a home office, workshop, game room, or an open-concept great room, barndominiums allow for significant design flexibility. This makes them especially appealing for families with evolving needs or creative homeowners seeking a personalized living environment.

- Speed of construction: Barndominiums are often quicker to build than traditional homes, especially when using pre-fabricated steel kits.

- Durability: Since they are steel-framed, barndominiums are known for their longevity. They’re resistant to mold, termites, and rot, and stand up well against severe weather conditions, making them ideal for rural areas with diverse climates.

- Multi-purpose: These structures are perfect for combining different functions under one roof.

- Lower maintenance: With fewer materials susceptible to damage or decay, barndominiums require less exterior upkeep. Metal roofs and siding can last for decades with minimal maintenance, saving time and money in the long run.

Cons

- Zoning hurdles: Not all areas allow barndominiums, particularly in suburban or densely populated areas. Zoning laws may restrict land use or require variances, which can add time and cost.

- Resale ambiguity: Since barndominiums are still somewhat niche, it may be more challenging to determine their resale value or find qualified buyers in the future.

- Insulation challenges: Metal structures don’t insulate as easily as wood-framed homes, which means additional investment in spray foam or other high-performance insulation is often required to maintain comfort.

- Financing issues: Traditional mortgage lenders may be reluctant to fund barndominiums, particularly if comps or completed construction documentation is lacking.

Financing a Barndominium

Financing a barndominium can be trickier than securing a loan for a conventional home, but it’s absolutely possible with the right lender and strategy. Here are a few ways you can secure financing:

- Construction loans: Ideal for buyers starting from scratch, these loans fund the build and convert to permanent financing upon completion.

- Non-QM loans: Perfect for self-employed individuals or borrowers whose income or property type falls outside the scope of traditional underwriting.

- Home equity options: If you already own a home or have a condo mortgage, tapping into your equity through a home equity loan or HELOC can be a smart way to finance the barndominium build.

- Conventional/FHA/VA/USDA loan: All allow barndominiums with no restrictions as long as there are comparable sales and meet minimum property requirements (MPR).

One of the biggest challenges in financing a barndominium is the lack of comparable sales, which traditional lenders rely on for property appraisals. Barndominiums are still relatively niche, and many appraisers have little data to base valuations on. This can lead to complications in securing conventional loans, especially early in the construction process.

Additionally, some lenders may perceive barndominiums as riskier or unconventional investments, which can make them hesitant to approve funding without additional documentation or higher credit requirements.

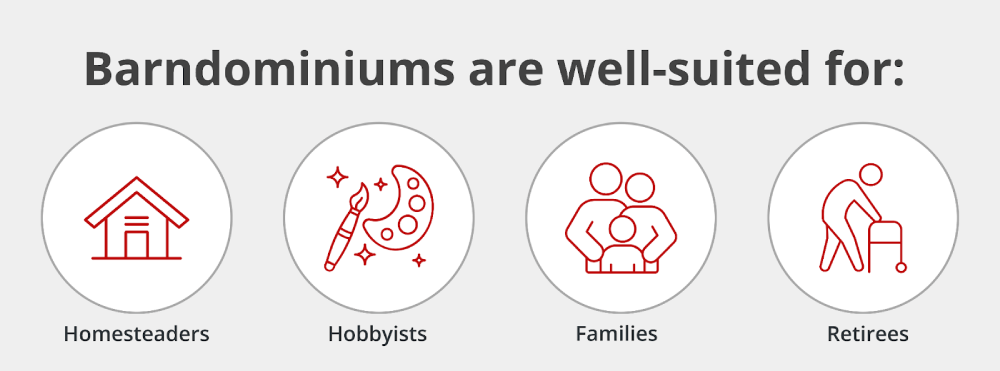

Who Are Barndominiums Best Suited for?

Barndominiums appeal to a diverse group of homeowners, particularly those looking for flexibility and freedom. They’re particularly appealing to rural homeowners who want to live close to land or livestock, as well as DIYers who dream of building a self-sufficient lifestyle. These structures also make ideal spaces for hobbyists and small business owners who need room to work, store equipment, or run a side hustle from home.

Finally, barndominiums can make excellent second homes, offering a multi-functional weekend retreat that doubles as a workshop, event space, or garage.

How to Get Started Building a Barndominium

Here’s a step-by-step roadmap to guide your journey from idea to move-in day.

Step 1: Buy land

Start by identifying land that is zoned for residential and agricultural use. Rural properties are typically the most barndominium-friendly, but it’s always a good idea to verify zoning regulations and any HOA rules.

It’s essential to ensure the site has access to—or the ability to support—utilities like electricity, water, and septic systems. If these services aren’t already available, factor the cost of installing them into your budget.

Step 2: Choose a builder or kit

Next, decide whether you’ll work with a barndominium builder or purchase a pre-fabricated kit. Many builders now specialize in barndominiums and can offer full-service design and construction packages.

If you’re handy or want to cut costs, a pre-fab kit may be an option—just be prepared to manage subcontractors or do some of the work yourself.

Step 3: Secure financing

Once you have a budget and preliminary plans, it’s time to line up financing. Barndominiums don’t always qualify for conventional loans, especially in the early stages or if comps are limited.

Fortunately, non-QM loans offer an alternative path, especially for self-employed borrowers or those with unique financial situations. You can also consider home equity loans if you already own a home.

Step 4: Finalize plans

Work with a licensed architect or designer to create detailed blueprints and floor plans that meet your specific needs and comply with local building codes. Some areas may require engineer-stamped drawings for permit approval. This is also the time to choose finishes, flooring, layout features, and any smart home or energy-efficient upgrades you want to include.

Step 5: Begin construction

With permits secured and financing in place, you’re ready to build. Construction timelines vary, but most barndominiums can be completed within 6 to 12 months. Factors like weather, material availability, and subcontractor scheduling can influence the overall timeline, so build in some buffer time for the unexpected.

Explore Barndominium Financing Options

Griffin Funding offers multiple financing solutions for aspiring barndominium owners, including non-QM loans, home equity lines of credit, and home equity loans. Our team understands the nuances of non-traditional home builds and can help guide you through the mortgage process.

Additionally, check out the Griffin Gold app to manage your finances, streamline your mortgage application, and connect with loan experts.

Get the right financing solution to make your dream of a barndominium come true. Reach out online today and find a mortgage that aligns with your finances and supports your goals.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What is a barndominium house?

A barndominium house is a residential structure built using a metal or steel frame that often combines living space with a garage, workshop, or barn-like area.

Why do lenders hesitate to finance barndominiums?

Because barndominiums are non-traditional, they often lack sufficient comps for appraisals. This makes some banks hesitant to offer loans. Working with specialized lenders experienced in non-QM and unique properties helps you secure financing to make your home-purchasing dream a reality.

Do barndominiums require a building permit?

Yes, building a barndominium generally requires permits, including building permits, zoning permits, and potentially others like septic, electrical, and mechanical permits. It's crucial to check with local authorities in the area as requirements can vary.

Why work with Griffin Funding?

Griffin Funding understands the complexities of financing alternative housing, such as barndominiums. We offer flexible options and personalized service to help you secure funding with confidence.

Recent Posts

Net Operating Income: Definition, Formula, & Examples

What Is Net Operating Income (NOI)? Net operating income measures how much money your investment property gene...

Best DSCR Lenders: Griffin Funding vs Angel Oak vs Kiavi vs Visio vs Lima One vs Easy Street

What to Look for in a DSCR Lender Choosing the best DSCR lender for your unique situation means evaluating sev...

Cash on Cash Return in Real Estate: Definition, Formula, & Examples

What Is Cash on Cash Return? Cash on cash return (CoC) is a metric that measures the annual income you generat...